4 Best Value And Growth Stocks (Yes, They Can Coexist)

Oct. 30, 2025 8:00 AM ETGARP, GRFS, BAM, INCY, HRTG, CCSI, BAM:CA

Steven Cress, Quant Team

SA Quant Strategist

Summary

- The current market is all about momentum, but investors don’t need to buy overpriced high-growth stocks to participate in gains.

- If you dig deep enough, you can find undervalued stocks with growth potential in both the short term and the long run.

- Across varied sectors like healthcare, technology, and finance, as well as non-U.S. countries with growth potential, a select group of stocks can combine those qualities.

- The four companies highlighted here have a common thread: Quant Strong Buys that are reasonably priced relative to earnings potential, yet positioned in industries with room to expand.

- I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.

GARP Wins vs Mega-Cap Growth

After years of easy money and growth-at-any-price investing, the market’s mood is bound to shift, and now is a good time to look for more reasonable valuations. With inflation still above comfortable levels, and U.S. economic growth expected to flatline (from 1.9% this year to 1.8% in 2026), investors are wise to begin looking for companies that can grow earnings without depending on a booming economy. This doesn’t mean sell all your growth stocks. It means focusing on reasonably valued businesses with solid balance sheets, consistent cash flow, and clear growth drivers.

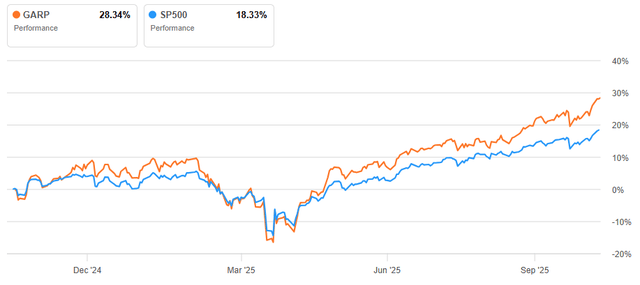

When looking at “growth-at-a-reasonable-price” stocks, we can see how selecting companies with a lower PEG compared to the S&P 500 can still outperform, and this trend may continue as the high-growth, mega-cap names finally begin to lose momentum. Here we measure these stocks by the iShares MSCI USA Quality GARP ETF (GARP) and compare to the cap-weighted S&P 500:

GARP vs S&P 500: 1-Year Performance

Across sectors as varied as healthcare, technology, and finance, as well as non-U.S. countries with growth potential, a select group of stocks now combines those qualities:

- Proven revenue growth

- Credible earnings momentum

- Share prices that haven’t yet caught up to their potential

Capturing growth and value is why I’ve selected four standouts that can coexist, even in a cautious market.

How I Chose the Best Value and Growth Stocks

The current market is all about momentum, but investors don’t need to buy overpriced high-growth stocks to participate in gains. If you dig deep enough, you can find undervalued stocks with growth potential in both the short term and the long run.

The leading selection criterion was valuation and the secondary was growth, both of which placed emphasis on forward potential. So, these stocks tend to be more tilted toward value than a traditional GARP selection. I eliminated microcaps and placed preference on sectors and industries that can thrive in a growing economy with slowing momentum.

1. Grifols, S.A. (GRFS)

- Market Capitalization: $8.06B

- Quant Rating: Strong Buy

- Quant Sector Ranking (as of 10/29/2025): 32 out of 976

- Quant Industry Ranking (as of 10/29/2025): 16 out of 474

- Sector: Health Care

- Industry: Biotechnology

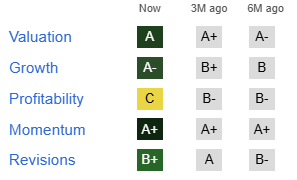

Grifols is a global healthcare company based in Spain that specializes in plasma-derived medicines used to treat immune deficiencies and bleeding disorders. After years of heavy investment, the company is now refocusing on profitability and paying down debt. For investors, that transition could unlock meaningful value, as the stock trades at a discount to historical averages, even as demand for its therapies remains steady.

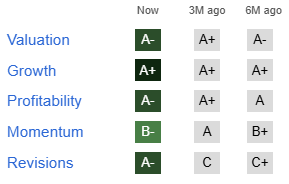

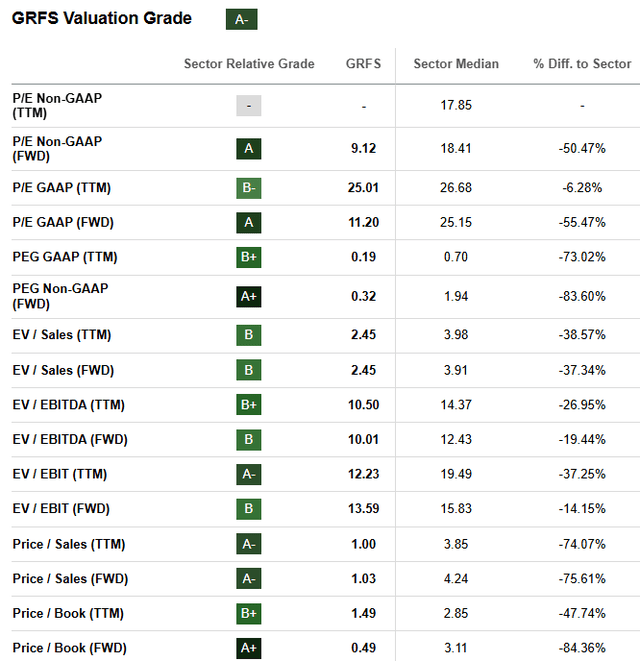

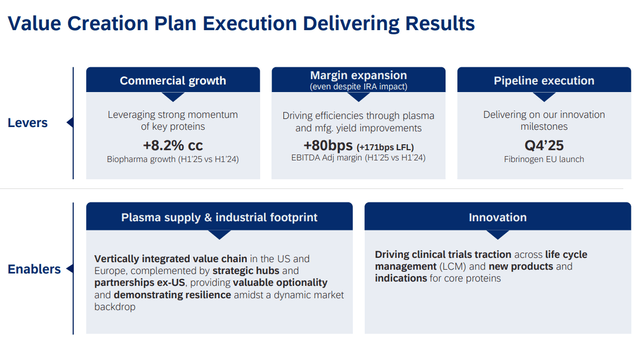

Grifols’ A- valuation grade is supported by the 9.12 P/E ratio, which is half that of the sector median, and its 0.49 forward Price/Book ratio, coming in at a fraction of the 3.11 peer metric. My favorite value metric, forward PEG, is 0.32, which is significantly more attractive than the peer median of 1.94. The growth side of Grifols’ value story is told by their focus on solid FCF and its impressive, peer-beating EBITDA increase, expected at 14.54%. The value-plus-growth story can continue as the company continues to plan value creation and deliver results with commercial growth, margin expansion, and pipeline execution.

Note that GRFS has been rumored to be a potential takeover target by Brookfield (BAM). A previous bid was rejected by Grifols management, who denied media reports that it was in talks with the private equity fund for another takeover bid.

Grifols’ valuation is attractive, with a potential upside driven by EPS growth and market expansion in plasma-derived products. In an environment of moderate inflation and slower global growth, Grifols’ pricing power and defensive healthcare qualities stand out, making GRFS a classic “growth at a discount” opportunity.

2. Incyte Corporation (INCY)

- Market Capitalization: $17.90B

- Quant Rating: Strong Buy

- Quant Sector Ranking (as of 10/29/2025): 22 out of 976

- Quant Industry Ranking (as of 10/29/2025): 11 out of 474

- Sector: Health Care

- Industry: Biotechnology

Incyte is a mid-size U.S. biopharmaceutical company best known for its cancer and autoimmune treatments, including the blockbuster drug Jakafi. The firm has a strong track record of research success and continues to expand its pipeline into dermatology and rare diseases. Despite that growth outlook, the stock trades at a valuation below many biotech peers, giving investors an entry point into a profitable, cash-generating innovator.

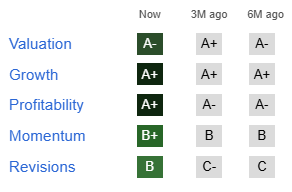

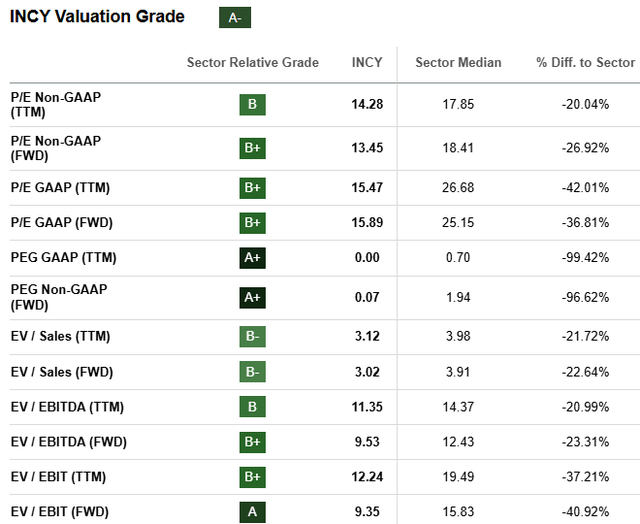

INCY’s A- valuation grade is supported by its forward P/E of 15.89, which compares to 25.15 for the sector, while key value and growth metric, PEG, is an extremely attractive 0.07, which is a fraction of the sector’s 1.94.

Digging into the growth side, INCY’s forward EBITDA growth is expected at 37.70% while its EPS forward long-term (3-5y CAGR) growth rate is estimated at over 200%, primarily supported by its strong pipeline. CEO William Meury stated in this week’s quarterly earnings call that Incyte delivered a strong quarter and highlighted, “The fundamentals around Jakafi, Opzelura and our hem/onc business, Niktimvo and Monjuvi namely remains strong.”

Incyte’s diverse lineup and steady revenue base help buffer against potential economic weakness, while its upcoming drug launches can drive growth through 2026.

3. Heritage Insurance Holdings, Inc. (HRTG)

- Market Capitalization: $690.06

- Quant Rating: Strong Buy

- Quant Sector Ranking (as of 10/29/2025): 7 out of 686

- Quant Industry Ranking (as of 10/29/2025): 1 out of 53

- Sector: Financials

- Industry: Property and Casualty Insurance

Heritage Insurance is a Florida-based property and casualty focused on homeowners and small commercial coverage across several southeastern states. Insurance isn’t exciting like Stellar Stocks Flying High on AI, but in today’s market, HRTG combines two things investors seek: low valuation and rising profits. Above-average interest rates allow insurers to earn more on their investment portfolios, and Heritage has been improving investment results amid a slow hurricane season followed by several challenging ones. HRTG trades at a single-digit P/E ratio while earnings have the potential to grow into 2026.

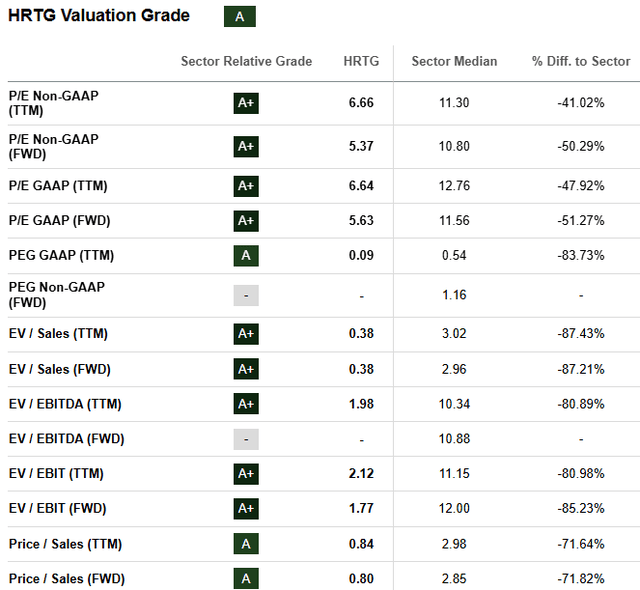

As you can see in the chart, HRTG’s forward P/E of 5.63 is about half that of the sector median, while the growth/value metric, PEG, is outstanding at 0.09, which is a fraction of the sector median’s 0.54. On the growth side, HRTG’s forward EBIT of 42.51% is expected to come from a combination of decreasing overhead and an increasing customer base. At its Q2 earnings call, CEO Ernesto Jose Garateix emphasized the successful implementation of strategic initiatives, citing rate adequacy, managed exposure, and enhanced underwriting discipline as key drivers of earnings power. He said, “We are at an inflection point in our business, where we expect our personal lines policies in-force to slowly increase through the second half of this year as our new business production continues to ramp up.”

For investors who appreciate steady returns without overpaying, HRTG fits the bill: a value stock with solid fundamentals and limited sensitivity to slow or moderate economic growth.

4. Consensus Cloud Solutions, Inc. (CCSI)

- Market Capitalization: $515.42M

- Quant Rating: Strong Buy

- Quant Sector Ranking (as of 10/29/2025): 25 out of 540

- Quant Industry Ranking (as of 10/29/2025): 6 out of 182

- Sector: Information Technology

- Industry: Application Software

Consensus Cloud Solutions provides secure digital document and data exchange services, primarily for health care and financial institutions. Its software helps organizations move away from paper-based processes while meeting strict privacy and compliance requirements. The company’s recurring revenue model generates consistent cash flow, yet CCSI trades at a valuation far below typical software peers. That disconnect creates an appealing setup for investors: modest risk, recurring revenue, and a path to gradual growth.

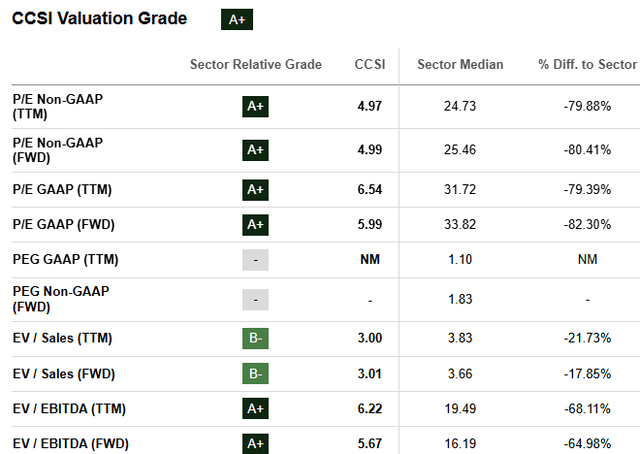

CCSI’s stellar valuation grade starts at its low forward P/E of 4.99, which is less than 20% the size of the sector median’s 25.46. The low P/E is in part due to its below-average forward EPS earnings of 5.96%, but CCSI’s standout growth metric is its outstanding working capital position that has jumped 760% year-over-year, signifying solid liquidity and stability. These metrics, combined with its mission-critical services, make CCSI more of a strong value play with moderate growth potential in the tech space.

Conclusion: Best Value and Growth Stocks to Balance Risk and Return

In an economic and market climate where investors expect slower growth, sticky inflation, and potentially declining sentiment, finding a balance between value and growth may have never been so important. The four companies highlighted here have a common thread: Quant Strong Buys that are reasonably priced relative to earnings potential, yet positioned in industries with room to expand. Whether through healthcare innovation (GRFS and INCY), insurance profitability (HRTG), and digital transformation (CCSI), they offer investors a path to future growth without overpaying for it. In the months and year ahead, disciplined stock selection may take leadership from market momentum, potentially making the difference between steady gains and short-term disappointment.

Pair trading with the Snowball, is where you split your stake between a growth stock and a higher yielding share. In case, maybe just maybe your growth stock is a clunker.

If not you could use any capital gain from your growth stock and the income from your higher yielder to add to your Snowball or use the income to add to your growth stock, dependant on Mr. Market.

Leave a Reply