Enbridge (ENB) – An ETF-Like Company

I have to admit that it wasn’t my intention to include two midstream stocks in this article, as hard as that may be to believe for some. However, Enbridge deserves a spot, which is why I kicked out my initial idea for this article.

For starters, Enbridge is also a C-Corp, which means it doesn’t issue K-1 forms. It’s also the largest midstream company in North America with a market cap of $100 billion.

It currently yields 6.0%.

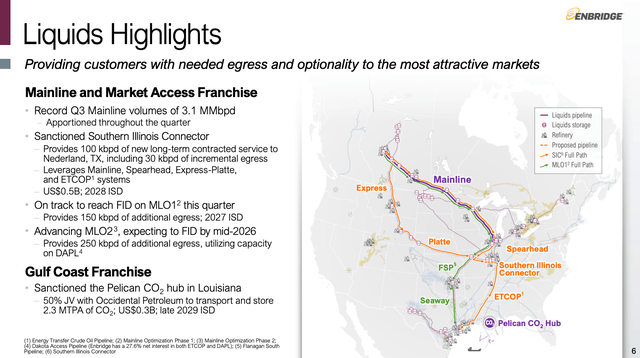

This dividend is protected by a massive infrastructure network, including liquids, gas transmission, storage, and renewable power. Its liquids network, for example, connects major producing areas like the Western Canadian Sedimentary Basin, the Texas Permian, and high-demand areas like the U.S. Gulf Coast.

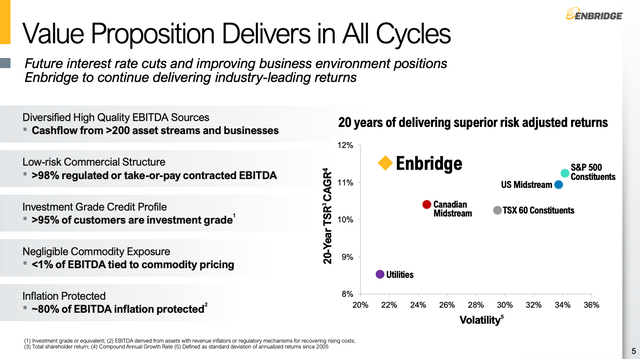

As of 3Q25, it generated roughly 53% of its adjusted EBITDA from liquids. Gas transmission and midstream accounted for 30%. Gas distribution and storage added close to C$600 million in EBITDA (13%). The size and diversification make this company an ETF-like midstream player that enjoys safety from a 98% regulated take-or-pay contract, a customer base that almost entirely consists of companies with investment-grade balance sheets, 80% inflation-protected EBITDA, and less than 1% direct exposure to commodity prices.

On top of safety, Enbridge enjoys strong secular growth from its “essential” operations due to booming data center power demand. These assets are often looking to go behind the meter to get data centers up and running much faster and avoid strains on the local grid. That is bullish for midstream companies.

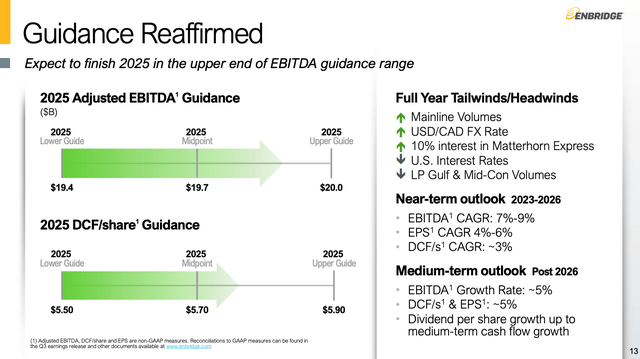

This is one of the reasons why it sees roughly 5% annual EBITDA growth per year after 2026. It expects the same growth rate for its distributable cash flow, its EPS, and its dividend per share. That’s a good deal, as this company yields 6%.

The 6.0% yield and 5.0% growth target alone pave the way for 11.0% annual returns. This excludes acquisitions, major growth projects, and any valuation tailwinds.

Moreover, from a personal point of view, buying Enbridge would make a lot of sense for me once I’m retired. Assuming I’m still in Albania when I retire, I would pay a tax of just 15% on Canadian dividends. That would make ENB a no-brainer for me, especially given its diversification. While I won’t do it, I wouldn’t lose sleep if I had all of my capital in ENB. That’s how I know it’s a company I trust.

Takeaway

To me, the ultimate retirement combo is a mix of stocks that pay big now and can grow.

In this article, I discussed three of them that all yield more than 5.0% and have a clear path to an annual return of 10% to 12% without having to incorporate any wild growth fantasies.

These companies provide income now and a shot at growing your capital for many years, if not decades, to come.

I’m not retired, and I have no plans to retire anytime soon, but knowing that I could buy these, retire, and grow my wealth over time makes me feel a lot safer about my future.

Risks to My Thesis

There are two main risks here. On top of general operational risks, I believe a steep spike in interest rates could pressure both REITs and midstream companies due to the negative impact this has on their cost of capital. It would also give investors a higher risk-free rate, which means they may be less tempted to invest in dividend stocks.

Moreover, although both AM and ENB have almost zero exposure to direct commodity prices, an environment where commodity prices like oil and gas are so subdued that producers cut output could have a negative impact on growth expectations.

Leave a Reply