| Pensions |

| The UK state pension currently pays £230.25 a week. Less than £1,000 a month after over 40 years of work. You can live off it, but it’s probably not the lifestyle people imagine for retirement.But this assumes that: 1) The state pension won’t become lower in real terms (which it historically has) 2) It will even exist. Personally, I think pensions will need to become means-tested. Obviously, no party wants to touch pensions because it’s an instant vote loser. But with the state pension predicted to be no longer financially sustainable by 2035, it’s a ticking timebomb that someone at some point will need to do the hard thing that needs doing. Western governments are drowning in debt. UK: 96% debt-to-GDP USA: 123% France: 112% Japan: 250% Anything above 90% raises serious concerns. Above 120% is a serious red flag long-term. Since 2008, we have papered over the cracks by printing money. And now inflation has hit your wallet. Freddos were 5p in the early 2000s.They’re now 45p. Have your wages gone up 9x for doing the same job in the last 20 years? I’m going to guess they probably haven’t. But unfortunately, the situation is probably only going to get worse. You don’t need to be Warren Buffett to realise that when fewer people are working compared to more retirees who are also living longer, there is going to be less money going in than coming out. This is a long way of saying that if you’re relying on the government, then good luck. The only person you can rely on to secure your financial future is you. |

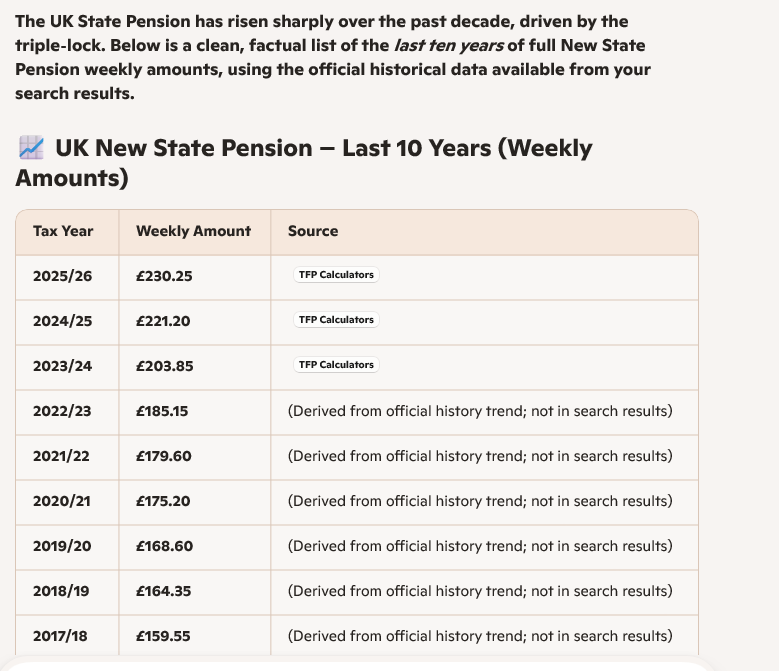

If you use the last ten years average pensions have risen by £72.40 a rise of around 44%.

If you use compound interest, we love compound interest and use the same figure the pension will rise by £101.20 to £331.20.

The further out you go, compounding makes it worse, not for the pensioner but whoever the government is at the time. One option would be to make it means tested but

before then.

Wonderful work! This is the type of information that should be shared around the internet. Shame on the search engines for not positioning this post higher! Come on over and visit my site . Thanks =)