Five Reasons Why Investors are Rediscovering Dividend Stocks

15 January 2026

Martijn Rozemuller CEO – Europe

Amid all of the attention given to AI and the big US tech stocks, the fact that some investors have been quietly rediscovering high dividend stocks is less appreciated. They’re going back to basics, favoring big companies that pay high dividends year after year, providing investors with income that can be reinvested for capital gains.

Take our VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF (TDIV). In 2025, inflows helped quadruple its size – from USD 1.2 billion at the beginning of the year to USD 4.8 billion as of the year-end.*

The question, though, is why did investors flock to high dividend stocks during the year and what does it say about their views on equity markets in 2026 ? In my opinion, dividend stock investing has five main attractions.

Performance History – VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF

| 2021 | 2022 | 2023 | 2024 | 2025 | |

| ETF | 26.94 | 15.77 | 11.76 | 16.00 | 23.78 |

| MSDMDLGE (Index) | 27.24 | 16.58 | 12.56 | 16.71 | 24.72 |

Source: VanEck. Past performance does not predict future results. Calendar year as of December 31st, 2025.

1. Dividend Payers Tend to Be More Resilient

In uncertain times, the solidity of big companies paying high dividends is more appealing than ever. They have profits backed by strong cash-flows that underpin dividends, even through moderate economic downturns. Their commitment to maintaining, or even growing, annual dividend payments makes them disciplined about the internal projects they spend capital on. These strong fundamentals help explain why dividend strategies can perform comparatively well in both rising and volatile markets, although this is not assured. 2025 illustrated this well, with the TDIV ETF proving less volatile than world markets, represented by the MSCI World Index, following the announcement of US tariffs in April 2025 (see chart). It is worth noting that every situation is unique and past performance does not predict future returns.

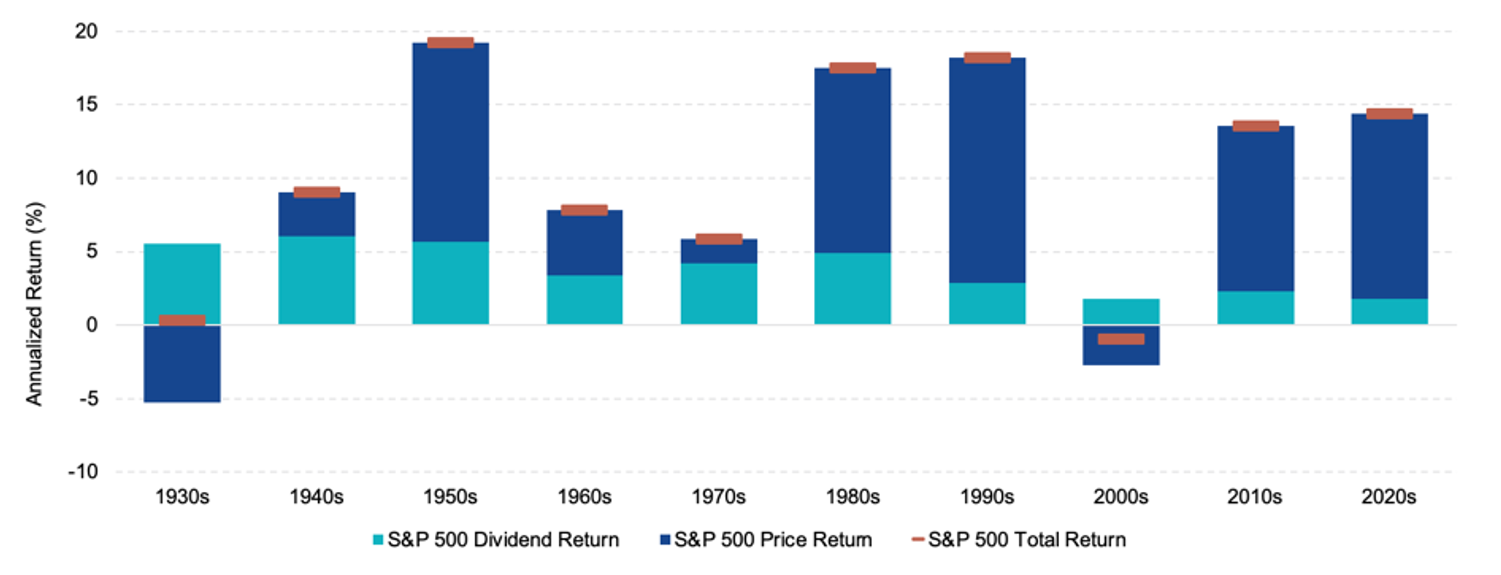

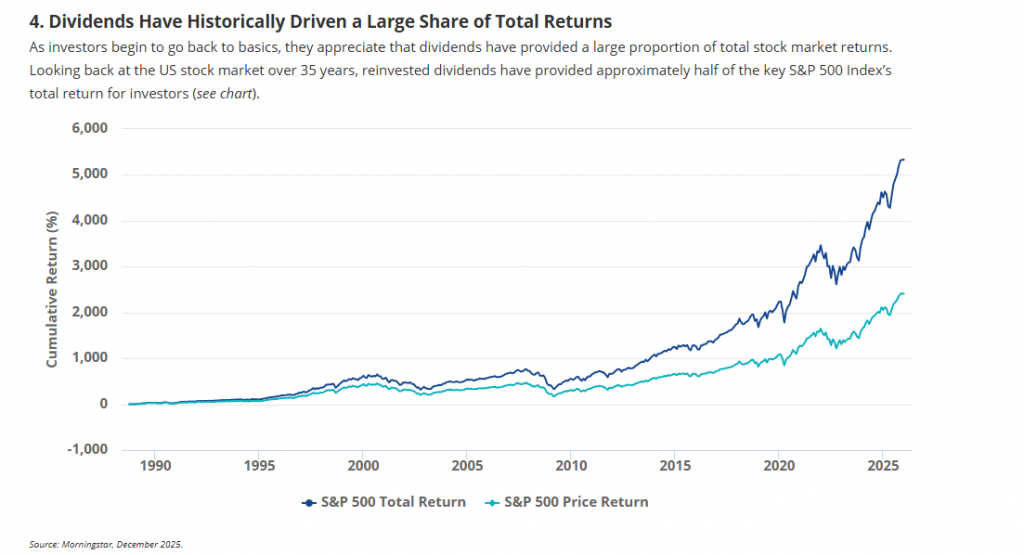

2. Dividends Help Manage Volatility Without Leaving Equities

For investors who are nervous about the outlook but do not want to sell, dividend stocks may be the answer. As 2025 shows, they can provide resilience in volatile markets. Our research indicates that dividends have underpinned stock returns over the past 80 years, especially when inflation has spiked higher as it did in the 1940s and 1970s (see chart).

Dividends Are Key In Periods of Muted Returns | Dividend Contribution to S&P 500 Total Return / 1/1/1930 – 30/06/2025

Source: Morningstar, June 2025.

3. Higher-for-Longer Rates Have Changed Investor Priorities

After years of low interest rates when investors prized ‘growth at any price’, they once again value cash returns. In the 2010s, exceptionally low rates around zero encouraged investors to put a premium on growth companies in sectors like technology that offered the prospect of high future earnings growth. But with European Central Bank short-term interest rates around 2%, some investors now prefer the tangible returns of high dividends. Even if rates do fall somewhat from here, it appears that investor expectations have shifted.

5. Stability in an AI-Driven Market

Lastly, dividend stocks offer the likelihood of greater stability at a time when some investors are nervous that AI stocks might be in a bubble. If for any reason that bubble should burst, the type of well-known stocks in a high dividend ETF are backed by well known, solid companies that have stood the test of time. For instance, the top 10 holdings in our TDIV ETF are large well-known companies from a variety of sectors such as Exxon Mobil, Nestle and Roche (see below).

| Top 10 Holdings (%) as of 31 Dec 2025 | Total Holdings : 100 | |||

| HOLDING NAME | Ticker | Shares | Market Value (EUR) | % of Net Assets |

| EXXON MOBIL CORP | XOM US | 2,344,575 | 240,236,730 | 5.03 |

| VERIZON COMMUNICATIONS INC | VZ US | 6,008,577 | 208,377,734 | 4.36 |

| NESTLE SA | NESN SW | 2,175,450 | 184,097,351 | 3.85 |

| PFIZER INC | PFE US | 8,176,829 | 173,360,253 | 3.63 |

| ROCHE HOLDING AG | ROG SW | 458,275 | 161,647,043 | 3.38 |

| SHELL PLC | SHEL LN | 4,850,408 | 152,206,223 | 3.18 |

| TOTALENERGIES SE | TTE FP | 2,503,659 | 139,178,404 | 2.91 |

| PEPSICO INC | PEP US | 1,128,960 | 137,960,974 | 2.89 |

| ALLIANZ SE | ALV GR | 347,254 | 135,602,687 | 2.84 |

| NOVO NORDISK A/S | NOVOB DC | 2,670,969 | 116,311,223 | 2.43 |

| Top 10 Total (%) | 34.49 |

These are not recommendations to buy or to sell any security. Securities and holdings may vary.Due to certain corporate actions, the holdings may contain shares with a very small weighting. In addition, more shares may be included in the portfolio than in the normal composition. During the review, these shares normally fall from the index.

Source: VanEck, December 2025.

Key risks to consider alongside these five attractions:

Although dividend stocks may appear attractive for their perceived resilience and income potential, dividends are never assured and can be reduced or suspended, while share prices can still decline significantly. A high-dividend approach may also underperform broader equity markets – particularly during growth-led rallies – and may entail greater exposure to certain sectors or countries, which can amplify the impact of sector- or region-specific setbacks. Returns can be further influenced by currency fluctuations and changes in interest rates. As with any ETF, investors should also take into account product-specific risks, including tracking difference.

Leave a Reply