Reits are back – here’s how to take advantage

Published on July 4, 2025

by Val Cipriani

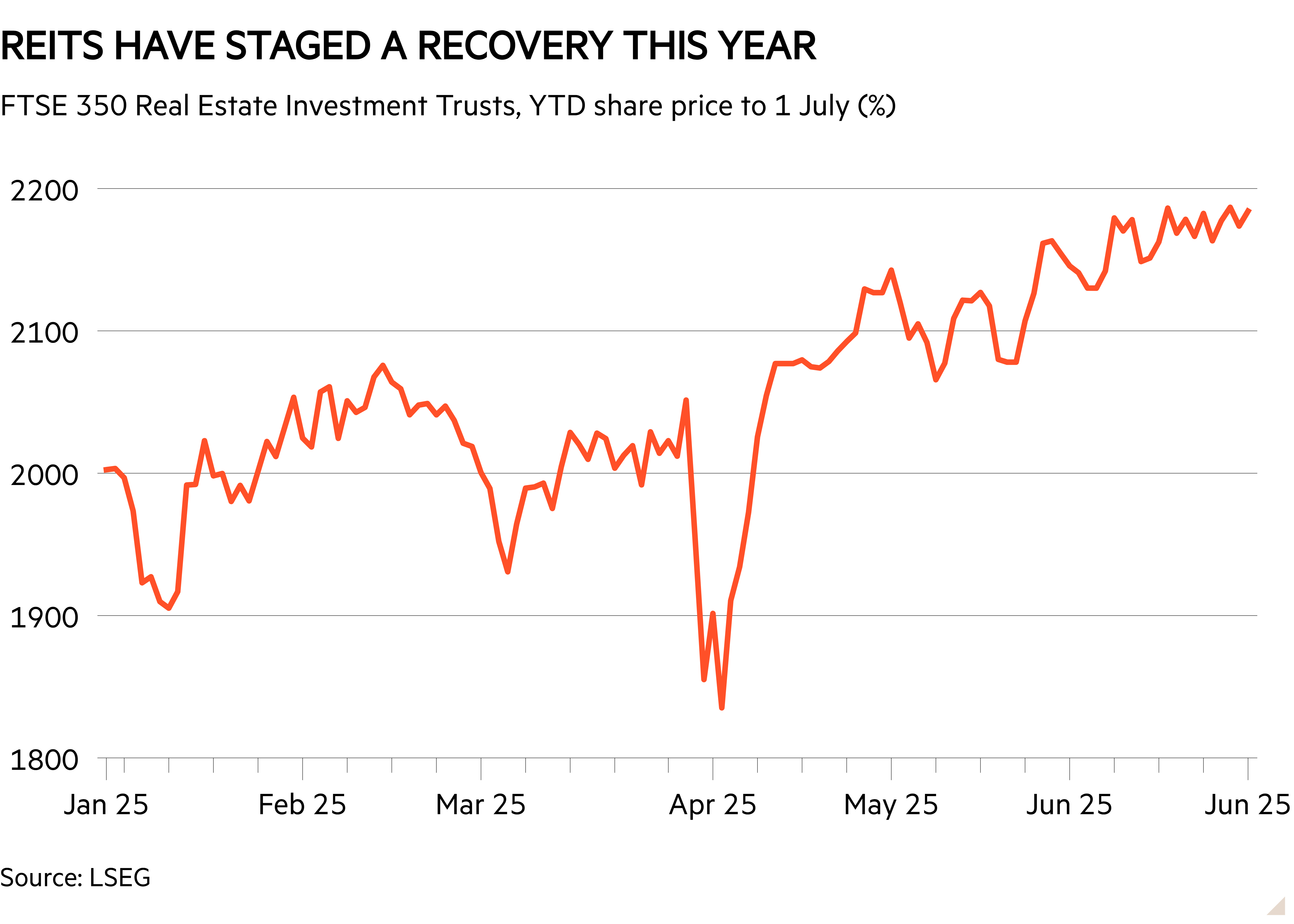

After three fairly abysmal years, real estate investment trusts are having a solid 2025 – the FTSE 350 Real Estate Investment Trusts index returned 11 per cent between the start of the year and 25 June.

But with interest rates only coming down at a snail’s pace, a flurry of corporate activity has done some of the heavy lifting for the sector.

Last week, Warehouse Reit’s (WHR) board recommended an offer from rival Tritax Big Box (BBOX), higher than the previously announced offer from Blackstone; in June, PRS Reit (PRSR) said it received a cash proposal from real estate investment management firm Long Harbour. And this is just the latest news.

Investors are being left with fewer options, particularly if they wish to access specialist areas of the sector.

Eating and being eaten

Nobody seems shocked that M&A is happening at pace. The UK-listed property sector has often been criticised for being too fragmented, and higher interest rates and shares trading at a discount to net asset value (NAV) have provided a catalyst for consolidation and dealmaking.

In theory, a consolidated sector is not automatically a smaller one, at least in terms of sheer asset value. Some think that listed buyers are actually better positioned than private equity buyers, as demonstrated by the bidding wars for Assura (AGR) and Warehouse Reit.

“Borrowing costs are so elevated that private equity funds, which typically use more debt than Reits for acquisitions, are now at a disadvantage,” says Edoardo Gili, senior analyst at Green Street. “Perhaps counter-intuitively, we therefore expect the Reit market to keep growing, as long as borrowing rates remain high in the UK.”

Some of the biggest Reits, particularly LondonMetric (LMP) and partly Tritax Big Box, are showing an “entrepreneurial” mindset, demonstrating focus and ambition to scale up. This is a pretty new approach in the UK market,” says John Moore, wealth manager at RBC Brewin Dolphin. The other big players in the sector might have to take note or risk being left behind.

Analysts also agree that there is more corporate activity to come. “There are too many small-scale and inefficient Reits in the UK that should be consolidated within broader companies,” says Gili.

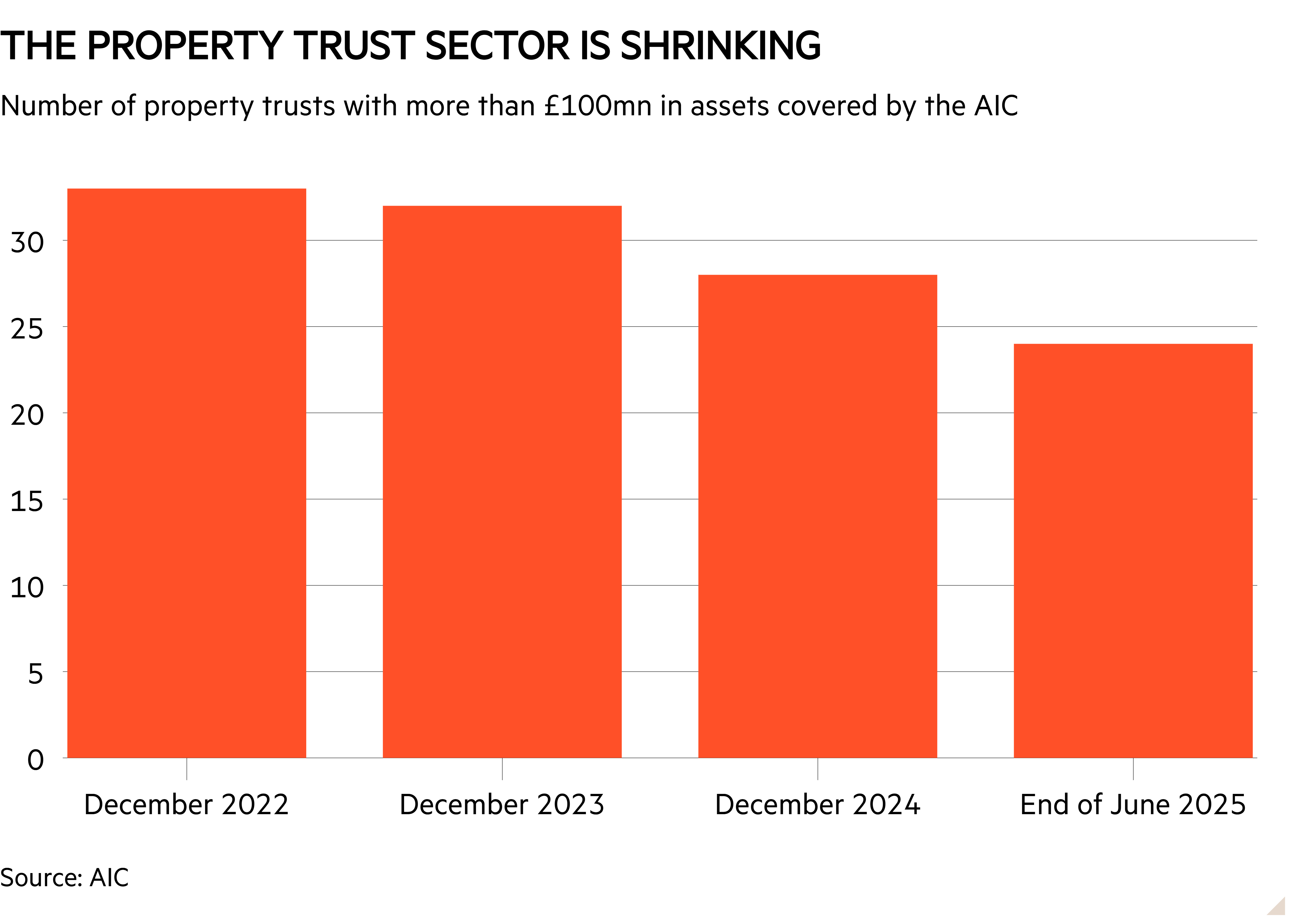

On this note, it is worth keeping in mind that there are technically two types of Reits: trading companies such as LondonMetric, which are under the FCA listing category of “equity shares”, and those such as Tritax that list as “closed-ended investment funds”, and as such are covered by the Association of Investment Companies.

Most of the biggest players in the sector, including the giant Segro (SGRO), are in the first group, while the second category has been shrinking fast, as the chart below shows.

Cost disclosure rules, which campaigners argue have been contributing to discounts across the investment trust sector, would apply to the second group but not the first.

Meanwhile, private equity buyers are by no means out of the picture. Richard Williams, property analyst at QuotedData, notes that discounts still look wide – for example, as of 25 June, the average was 15 per cent for the AIC UK commercial property sector, and 11 per cent for the residential sector.

“With share prices where they are, there remains ample opportunity for private equity to bag more portfolios on the cheap and reap the benefits of the valuation uplifts to come at the expense of shareholders,” he says.

Read more from Investors’ Chronicle

Leave a Reply