SCF has outperformed the index over the long term and boasts a premium yield to the market.

Sue Noffke has been the lead manager of Schroder Income Growth (SCF) since July 2011 and focuses on achieving two main objectives – providing real income growth, meaning it exceeds the rate of inflation, and growth in investors’ capital. Sue and her team invest predominantly in UK stocks, ensuring that the portfolio blends companies that have sustainably high yields with lower-yielding companies offering much stronger future growth prospects. Each company also needs to showcase traits the team deem desirable, such as healthy finances, proven management or a strong competitive advantage others in the industry may struggle to compete with . The team are stock pickers at heart, valuing the importance of fundamental, bottom-up analysis and placing a strong emphasis on exploiting market inefficiencies, whereby a company, which in their view has strong fundamentals, has been valued inappropriately by the market.

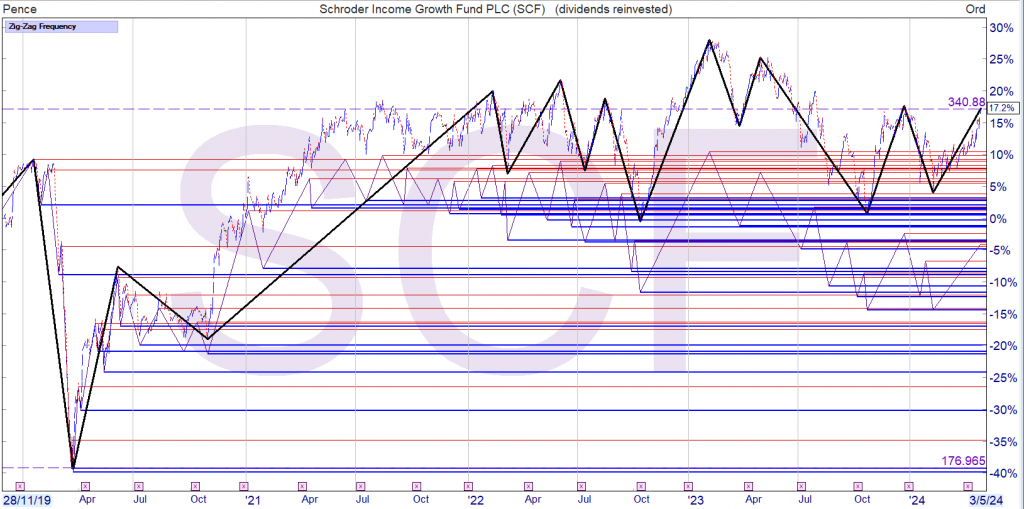

Under Sue’s tenure, this strategy has proved effective, comfortably outperforming the index, buoyed by strong stock selection in small- and medium-sized companies, the latter in particular. Over the last 12 months, however, SCF has lagged the index, largely down to its bias towards these companies. They are tied more closely to the prospects of the UK economy, so the adverse investor sentiment associated with weak economic issues led to valuations falling as a result, although as sentiment has improved since October, performance has picked up a little .

SCF boasts a premium Dividend yield to the market, and over its latest financial year increased dividends by 4.6%. The board has increased dividends for 28 consecutive years and feature on the AIC ‘Dividend Heroes’ list. At the time of writing SCF is trading at a wider Discount to both its five-year and AIC sector average, though this has narrowed meaningfully since October, owing largely to the bounce back in the FTSE 250.

£££££££££££

U want to include some growth Trusts in your portfolio but also wish to earn some dividends to re-invest in the market when it is weak.

The current blog portfolio plan is to earn a yield of 7%, which when compounded doubles your income in ten years, whatever the markets do in between.

Using SCF as the working example, it currently yields 5%, so u would have to pair trade it with another Trust yielding around 9%. If after doing your own research and u like a Trust that yields less, that’s ok, belt and braces GRS but GR.

If u had re-invested the dividends and without using a high risk strategy, u could have doubled your hard earned. Once it doubles u could take out your stake and try to do it all over again.

This piece of writing will assist the internet visitors for building up new webpage

or even a weblog from start to end.

Every weekend i used to pay a quick visit this site,

because i want enjoyment, as this this web page conations genuinely fastidious funny material too.