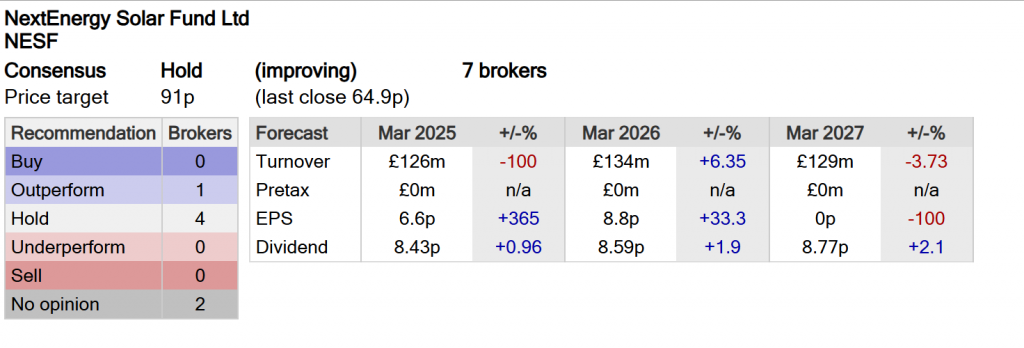

You would like to add a high yielding IT to your portfolio but are concerned about the risk.

Let’s use NESF as the working example but as always best to DYOR

Whilst no dividend is 100% safe, you think the divided is fairly secure.

The recommended yield for the Snowball is 7% as this doubles every ten years when re-invested at or above 7%.

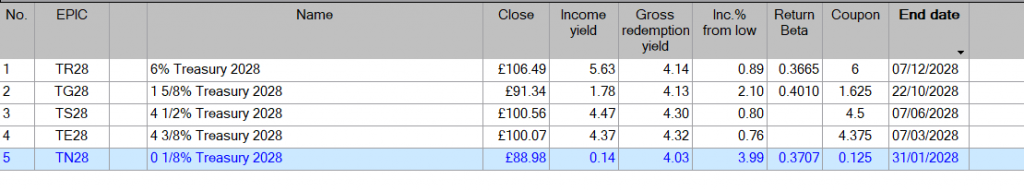

To lessen the risk you could pair trade it by buying a Government Gilt.

If held inside a tax free wrapper, the yield would be around 4%, making a blended yield of 9%, with a lower risk profile.

If held outside a tax free wrapper TN28 would return £100 on the 31/01/28

There would be tax to pay on the coupon if you exceeded your yearly allowance, and it wouldn’t give you cash to re-invest in the Snowball.

Gilts bought at around £100, the capital is guaranteed if held to maturity.

This is not advice but for educational purposes only.

Leave a Reply