The past 12 months were all about value stocks. We look at the managers getting ahead of the market

Ten funds beating the FTSE this year

Published on February 6, 2026

by Val Cipriani

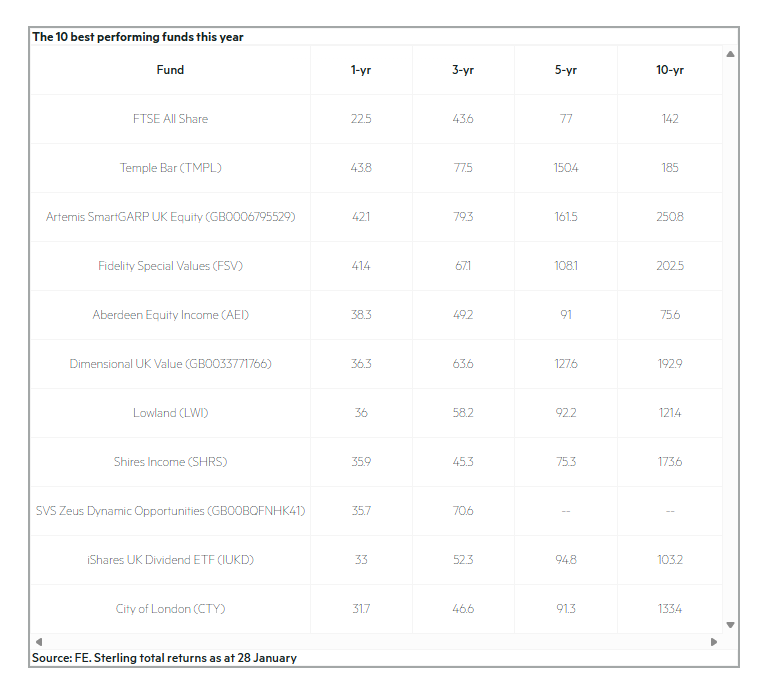

After a long malaise, it’s been a buoyant period for UK stocks, with the FTSE All-Share index returning 22.5 per cent in the 12 months to 28 January. One might have assumed such a strong result would be hard to beat for fund managers, but in fact a decent number of active funds comfortably outpaced the index.

The table below lists the 10 best performing funds over the period, spanning the UK All Companies and UK Equity Income sectors across both funds and investment trusts (using Investment Association sectors for the first and Association of Investment Companies sectors for the second; there are 302 funds in total across the four sectors). This is a short timeframe, but it is interesting to see which strategies have worked well in the current market.

The 10 best performing funds this year

Six out of the 10 funds in the list are investment trusts. While stock picking will have been a crucial driver of outperformance, gearing is likely to have helped too – trusts have the ability to borrow to invest, which can give them a real boost in rising markets (and exacerbate losses during downturns). The trusts in the table all deploy gearing to various degrees, with Shires Income (SHRS) currently the most geared at 14 per cent of the portfolio.

Some of these trusts also saw their discounts narrow meaningfully in the past year, as net asset value (NAV) performance helped stimulate demand – as at the end of 2024, Fidelity Special Values (FSV) was trading on an 8 per cent discount to NAV, Temple Bar (TMPL) on 6.6 per cent and Lowland (LWI) on 11.7 per cent. Fast forward to 29 January this year, and the first two are trading at around NAV, while Lowland is on a 6.5 per cent discount.

The list also includes one exchange traded fund (ETF), the iShares UK Dividend ETF (IUKD). Not all ETFs are included in the Investment Association sectors, so including any in our table is arguably a little partial. We have kept this one in because it is not just a broad market ETF – instead it tracks “the top 50 stocks by one-year forecast dividend yield”, with weightings determined by yield levels rather than market capitalisation. Its presence in the list also indicates that the top dividend-paying stocks delivered some of the best total returns over the past year.

Leave a Reply