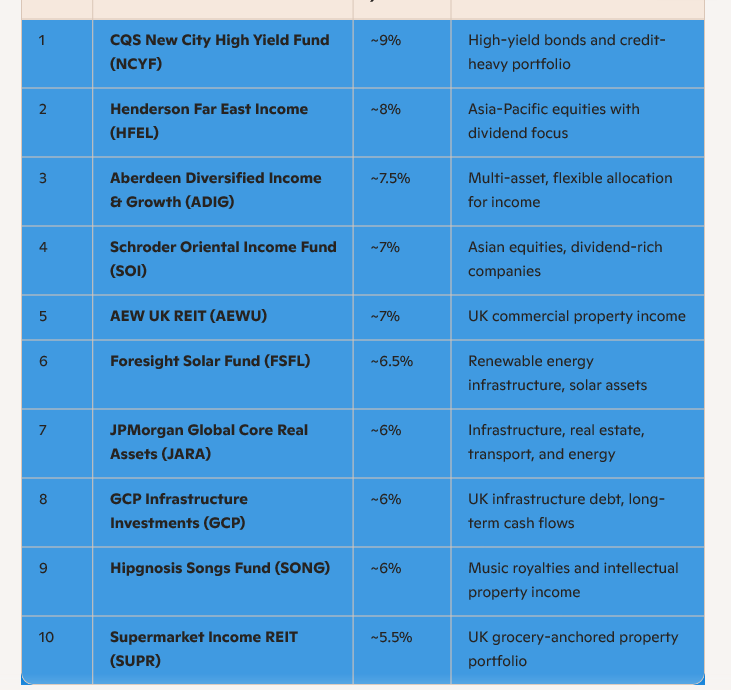

Here are ten of the highest-yielding investment trusts currently available in 2025, offering strong income potential for investors seeking dividends.

🔝 Top 10 High-Yielding Investment Trusts (2025)

📌 Key Insights

- Credit-heavy trusts like NCYF and HFEL deliver the highest yields but carry interest rate and credit risk.

- Property and infrastructure trusts (AEWU, SUPR, GCP, FSFL) provide stable cash flows tied to long-term contracts, though they are sensitive to property valuations and energy prices.

- Asia-Pacific equity income trusts (HFEL, SOI) benefit from dividend-rich markets in Hong Kong, Singapore, and Australia.

- Alternative assets like Hipgnosis Songs Fund show how investment trusts can generate yield from non-traditional sources such as royalties.

⚠️ Risks to Consider

- Leverage: Many high-yield trusts use borrowing to enhance returns, which magnifies both gains and losses.

- NAV erosion: High payouts can sometimes exceed earnings, leading to long-term capital decline.

- Sector concentration: Property and infrastructure trusts are vulnerable to regulatory changes and economic cycles

Given the Snowball’s fascination with cycles of resilience and decline, these high-yield trusts are perfect case studies. They embody the tension between short-term income allure and long-term sustainability. For your creative projects, you could symbolize them as “Yield Sirens”—tempting investors with high payouts but demanding vigilance against hidden risks.

AI generated information contains many errors so even more critical you DYOR.

SONG no longer quoted, double check the yields.

Price divided by the yearly dividends = yield

Example

SUPR 82p target dividend 6.1p = yield 7.5%

No dividends are 100% secure, all though some are more secure than others.

Leave a Reply