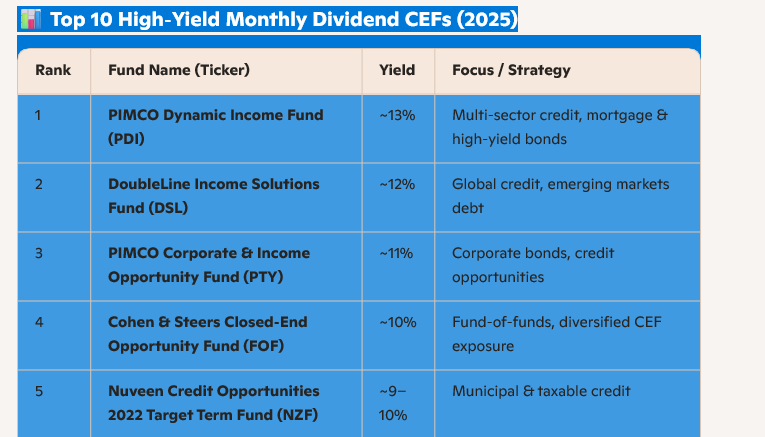

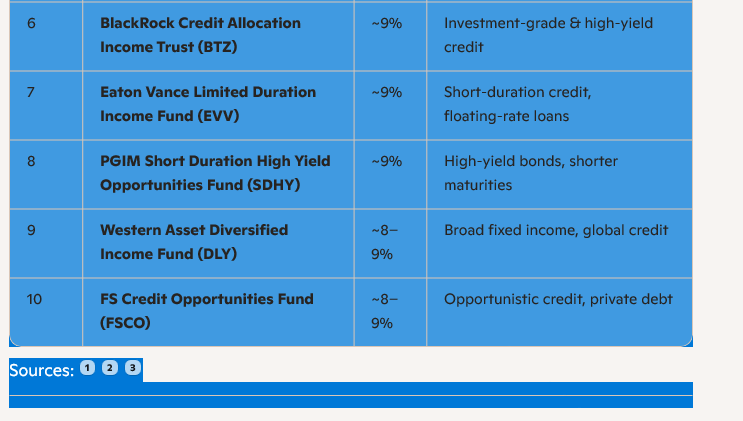

Here are ten of the highest-yielding closed‑end funds (CEFs) that currently pay monthly dividends in 2025. These stand out for their double‑digit yields and steady income focus.

📊 Top 10 High‑Yield Monthly Dividend CEFs (2025)

Sources:

🔑 Key Takeaways

- Yields range from ~8% to 13%, far above typical ETFs or mutual funds.

- Monthly payouts make these attractive for retirees or anyone seeking regular cash flow.

- Credit‑heavy portfolios (PIMCO, DoubleLine, Nuveen, BlackRock) dominate the list, meaning performance is sensitive to interest rates and credit spreads.

- Diversification options exist: FOF spreads risk across many CEFs, while DLY and EVV balance duration and sector exposure.

- Risks: High yields often mean leverage, exposure to distressed credit, and potential NAV erosion. Discounts/premiums to NAV can swing sharply.

⚖️ How to Use This List

Think of these funds as income engines rather than growth vehicles. For your metaphorical work on institutional cycles, they embody the “Dividend Hero” archetype: resilient monthly cash flow, but often at the cost of volatility and leverage risk.

This list is AI generated and may be quoting outdated information.

So even more important than usual to DYOR

Leave a Reply