Can regular investment in income stocks be the rocket fuel for someone’s dreams of building wealth? Christopher Ruane explains why it may be.

Posted by Christopher Ruane

Published 2 February

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Every week, FTSE 100 income stocks pay out well over a billion pounds on average to shareholders as dividends.

That is just the FTSE 100. Lots of smaller British companies also pay out hefty amounts in dividends.

So, could someone aim to build serious wealth over the long term simply by investing in carefully chosen UK income stocks?

I think the answer is yes, for three main reasons.

A trio of wealth creation levers

The first reason is the benefit of long-term regular investment.

Even with relatively modest amounts, drip feeding money into an investment over the long term can mean things soon add up.

A second factor is how much the dividends can add on top of the money invested. Dividends are never guaranteed, but they can be substantial.

If they last, then someone who buys one share in a company today could potentially be earning dividends from it for decades – perhaps as long as they live, if they hang onto it.

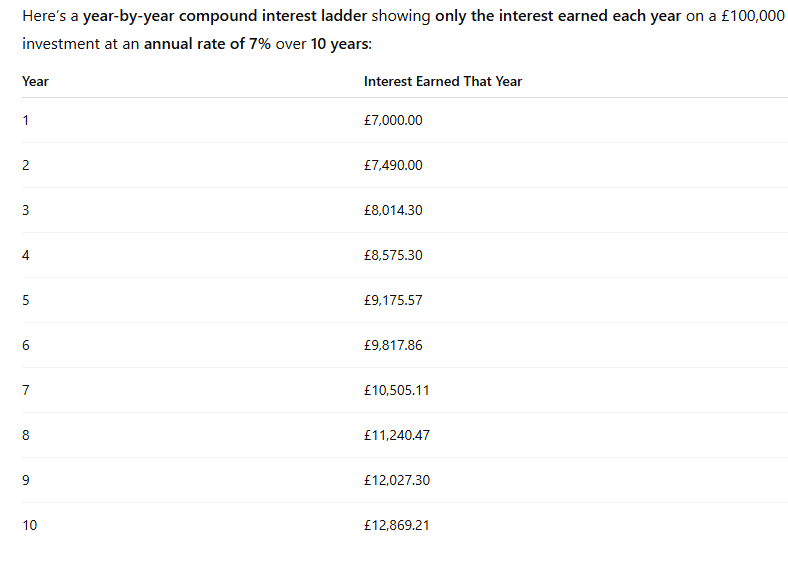

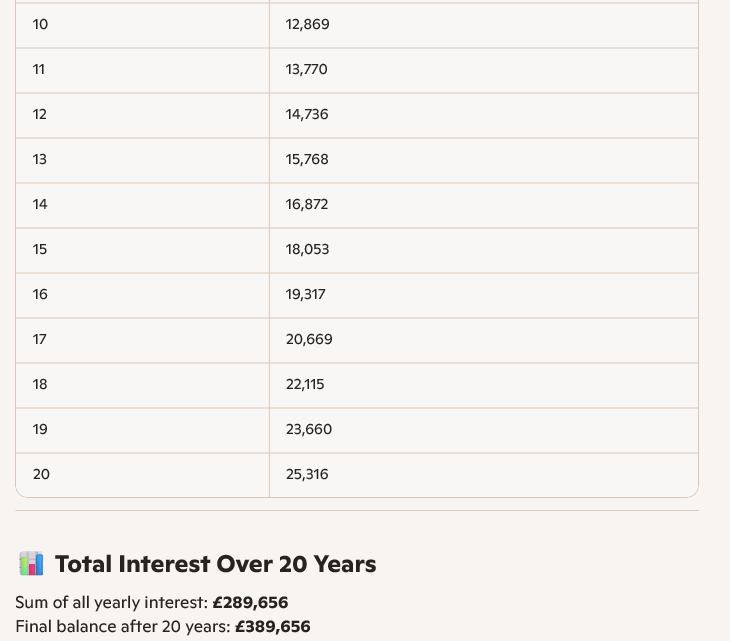

A third factor is what is known as compounding. That means dividends being reinvested and so in turn earning more dividends.

Billionaire Warren Buffett compares an income stock compounding to pushing a snowball downhill. As it rolls, the snowball gets exponentially larger because snow picks up more snow and so on. In the stock market, that snow can be dividend income!

Over a long period of 20 years, you may not be able to re-invest the dividends at 7% but with compounding and with the table the interest is only added at the end of the year, where your dividends will be buying more dividends every month.

It all adds up – sometimes to a lot!

As an example, say someone starts with nothing today then invests £500 a month and compounds their portfolio at 5% a month.

5% is well above the current FTSE 100 yield of 2.9%, but there are plenty of blue-chip UK income stocks that offer a yield of 5% or higher.

At the end of the 35-year period, the portfolio should be worth over £554,000.

So the investor would be over half way to becoming a millionaire, on the back of investing £500 a month.

Leave a Reply