Posted by Zaven Boyrazian, CFA

Published 6 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The higher interest rate environment is putting a lot of pressure on these debt-ridden businesses. But with rates steadily falling, and many continuing to generate stable cash flows, dividends are still being put in investor pockets.

The combination of dividends with lower share prices has steadily pushed yields higher over the last couple of years. As such, some yields are now starting to climb beyond 8% !

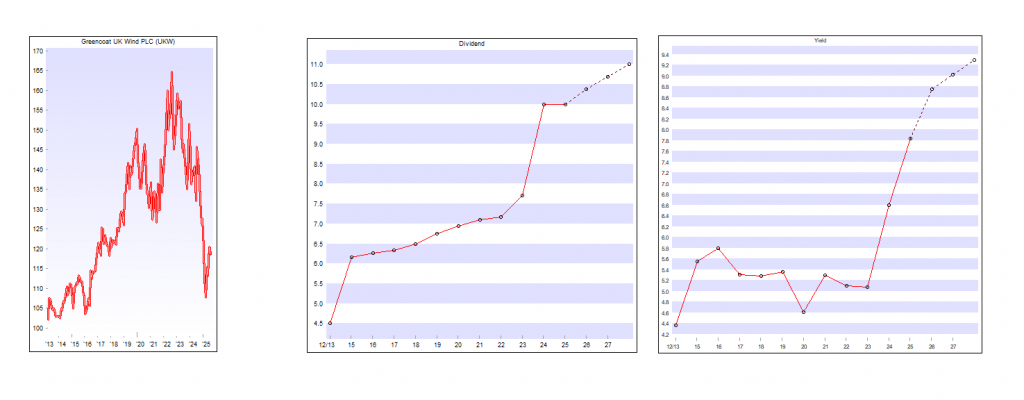

Greencoat UK Wind‘s (LSE:UKW) a prime example of this, with its payout now stretching beyond 8.5%. That’s a little lower than a few months ago, but it’s still the highest level seen in over a decade. And based on current guidance, dividends, even at this massive yield, are set to grow even further in the coming years.

Greencoat manages a portfolio of onshore and offshore wind farms throughout Britain. Instead of collecting rent, it sells clean electricity to the national grid. And since energy’s in constant demand, it enjoys a relatively stable cash flow to fund shareholder payouts.

However, with so much profit being paid out, these businesses are often almost entirely dependent on external financing. As such, they tend to be highly leveraged enterprises. That was fine for most of the last 15 years. But when interest rates started climbing again, high debt burdens proved quite troublesome.

Leave a Reply