GREENCOAT UK WIND PLC

RO Indexation, Net Asset Value and Dividend Policy

| Updated Net Asset Value / Net Asset Value per share | £2,882.4 million / 133.5 pence |

Renewables Obligation Indexation Consultation

The UK Government has now published the result of its consultation on changes to the inflation indexation of the Renewables Obligation (“RO”) scheme.

From 1 April 2026, the RO scheme will now be indexed at the Consumer Price Index (“CPI“) rather than the Retail Price Index (“RPI“).

Updated Net Asset Value

In light of the consultation outcome, the Company announces that its unaudited Net Asset Value as of 31 December 2025, updated solely for changes to the RO scheme, would be £2,882.4 million (133.5 pence per share). This represents a reduction of 2.6 pence per share, which is in line with the previous guidance provided on 11 November 2025 and having reflected the outturn of 2025 CPI.

An updated December 2025 Factsheet is available on the Company’s website, http://www.greencoat-ukwind.com.

Dividend Policy and 2026 Dividend Target

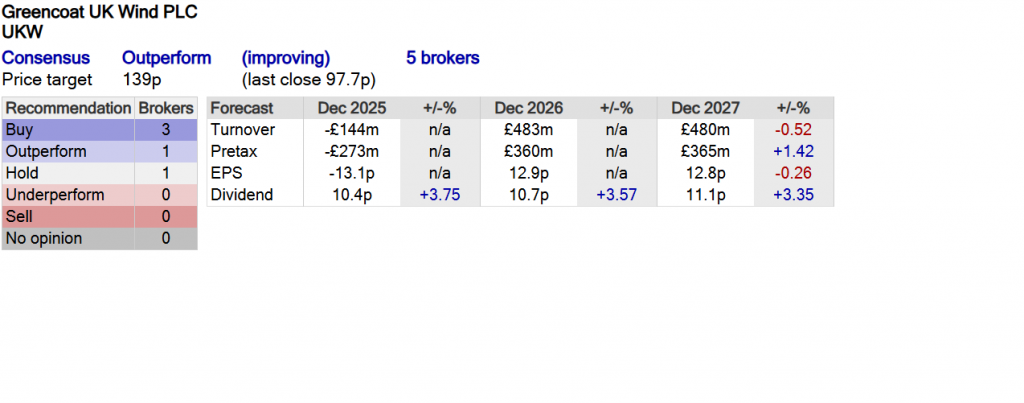

The Company has been reviewing its dividend policy in line with the range of potential outcomes from the RO Indexation Consultation. The Company has, for 12 consecutive years, increased its dividend by RPI or better, from a 6 pence dividend per share at IPO to 10.35 pence in respect of 2025. Dividend progression has been underpinned by strong cashflow generation.

The principal instrument from which the Company derives explicit RPI cashflow linkage is the RO scheme, which will now be indexed to CPI. The Company’s Contracts for Differences instruments also have explicit CPI linkage. The Board has therefore determined that its dividend policy will now be to aim to provide shareholders with an annual dividend that increases in line with CPI inflation.

Accordingly, the Company announces an increase in the target dividend for 2026 to 10.7 pence per share in line with CPI for December 2025 of 3.4%. The Company’s forward looking dividend cover expectations remain robust and are substantially unchanged.

For the avoidance of doubt, the quarterly interim dividend of 2.59 pence per share with respect to the quarter ended 31 December 2025 remains unchanged.

Some times its a pain in the ass to read what blog owners wrote but this website is really user pleasant! .