Infrastructure: income at a discount

ii

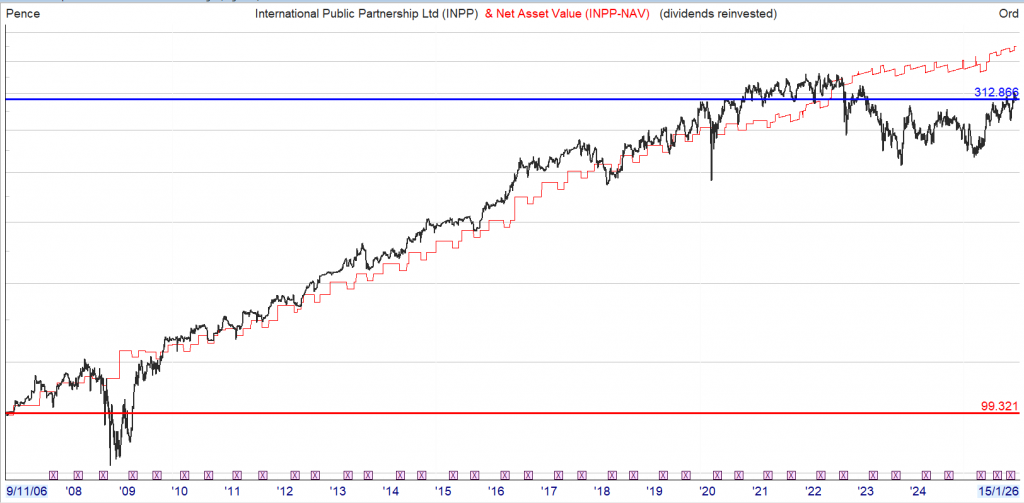

Capital Gearing initiated a position in International Public Partnerships Ord

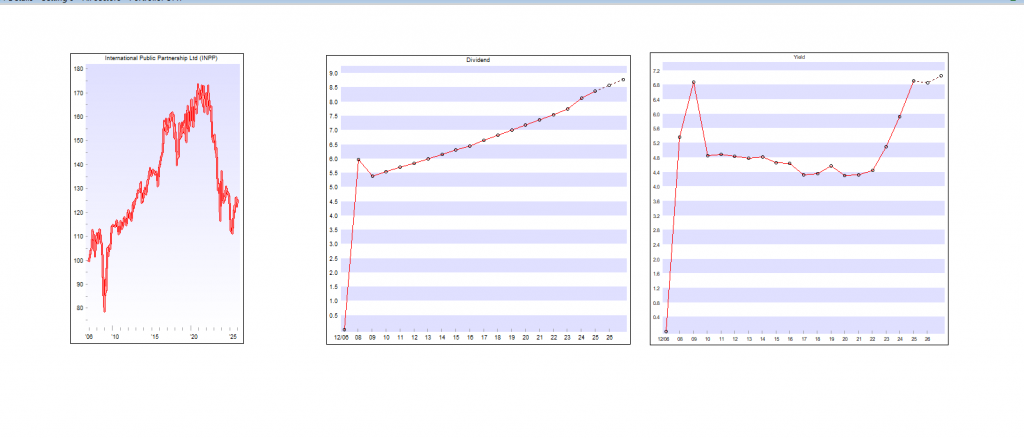

0.32% in 2018 and added significantly to it in 2025. The portfolio of infrastructure projects includes train leasing, offshore power cables and London’s new “super sewer”. INPP yields around 7%. Its discount is -16%.

“These assets are mostly in the UK and have highly predictable, long-term cash flows, typically with an element of inflation linking,” says Laing.

Laing adds: “These private assets are hard to value, so discounts should be taken with a pinch of salt, however INPP has sold £345 million of assets, or 13% of the portfolio, to third parties at or above NAV, giving some hard evidence of pricing.”

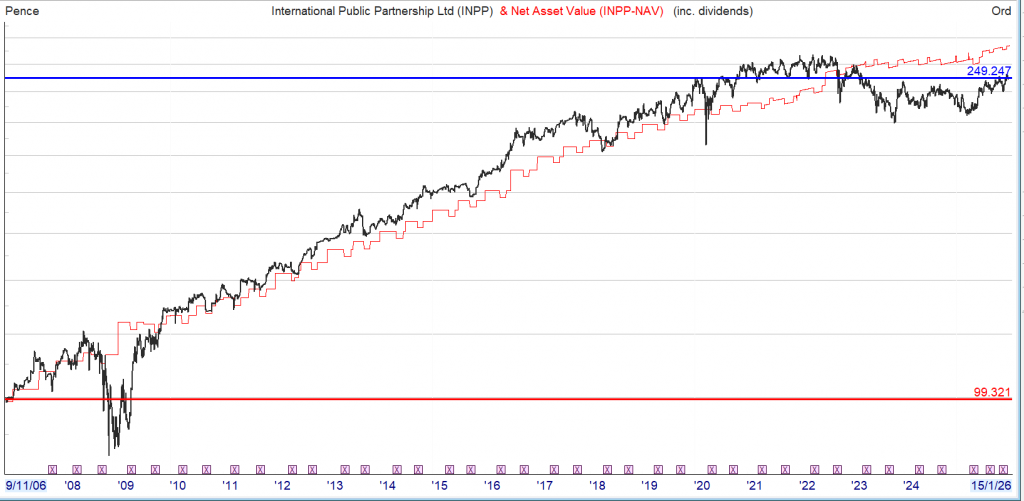

The same chart but with dividends re-invested into your Snowball

Not been a great investment for the last 5 years but has returned reliable dividends for re-investment.

Leave a Reply