What’s your idea of a perfect investment?

It depends on whom you ask, of course. But those looking for market-beating returns, along with superior income over time, will want to own investments that combine:

- Yield

- Growth

- Value

- Safety

Not everything needs to be perfect, but if an investment enjoys a good mixture of these characteristics, it is likely to be a big winner in the long run. Naturally, it is very rare to find such opportunities because if an investment is really that great (without major caveats), it will likely trade at a high valuation and low dividend yield.

Why Become a High Yield Investor?

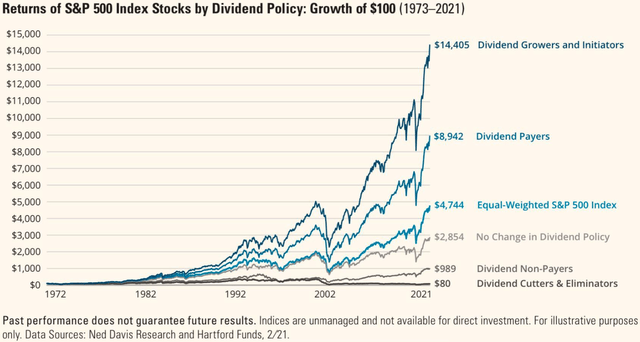

Dividend stocks have historically outperformed non-dividend-paying stocks. Taking this a step further, dividend-growing stocks have also outperformed other dividend stocks.

We believe that earning a steadily growing ~6% yield not only leads to higher returns but also helps you remain patient and disciplined during times of volatility.

However, investors still need to be mindful of risks and balance them against growth expectations. Many high yield investors make the mistake of chasing the highest yield, sacrificing safety and future growth. From our experience, this is almost always a mistake. It is far better to earn a safe and growing 6% yield than a risky and flat 9% yield. In fact, high yields are often the market’s way of signaling that a dividend is at high risk of being reduced or eliminated.

At High Yield Investor, we focus on finding the right balance between safety, growth, yield, and value. Achieving this balance can materially improve your investment results.

Sure, you could invest in a dividend-oriented ETF and be done with it, but you might leave a lot of money on the table. As we explain in our Introductory Course to high yield investing, such ETFs have several flaws. They are heavily exposed to companies paying unsustainable dividends. They also invest in many poorly managed companies with conflicting interests and blindly allocate to challenged sectors like malls, airlines, and movie theaters.

In short, dividend ETFs rely on passive indexing, which is inherently a backward-looking approach to investing. It’s a strategy that focuses on the rear view mirror rather than the road ahead.

Leave a Reply