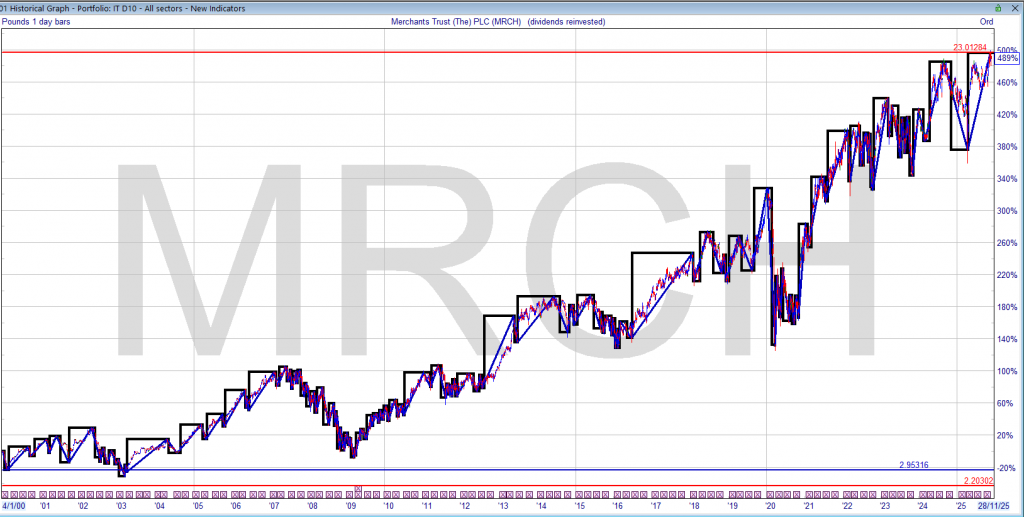

You decided to buy an IT and stick with it thru thick and thin, knowing that there will be plenty of thin. During the thin periods you are getting more shares for your hard earned and therefore one day more dividends.

Your plan was to re-invest the dividends back into the share better if you could add more fuel to the fire but this example is for seed capital only.

If you started with 5k a hefty sum back in the days of yore, your 5k would be worth 50k, you have to allow for inflation and the current yield is 5%.

£2,500 p.a. a yield on your initial investment of 50%.

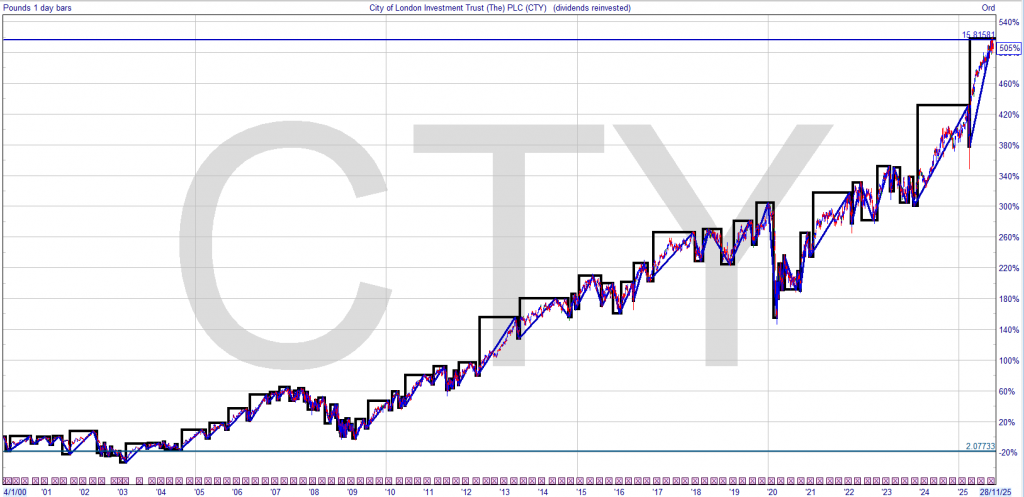

Or you may have chosen CTY or bought both as you wanted to sleep soundly in your bed.

Your investment would be worth 35k and the current yield is 4%.

£1,400 p.a. a yield on your initial investment of 28%.

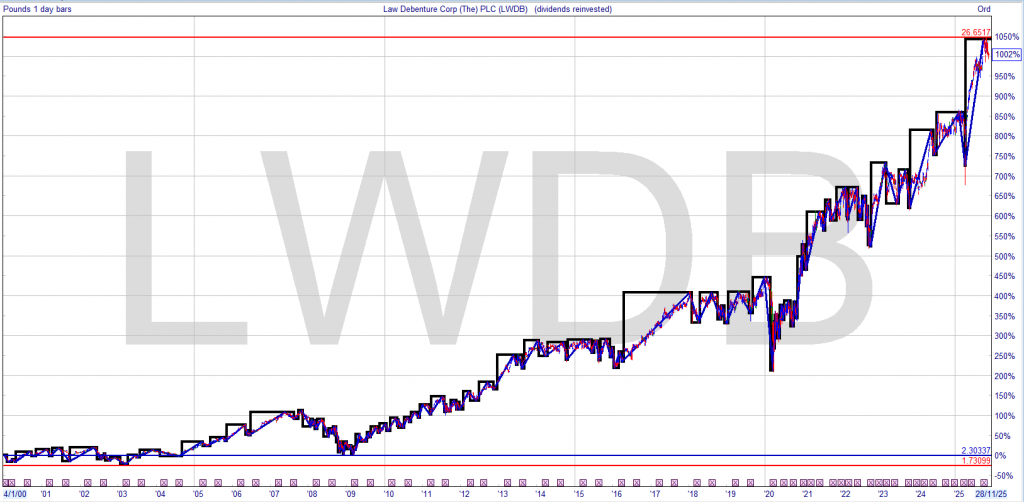

Or you may have chosen LWDB

Your investment would be worth 55k and the current yield is 3.2%

£1,760 p.a. a yield on your initial investment of 32%.

All figures approximations only as prices change constantly.

Leave a Reply