ANNUITY

You could use your hard earned to buy an annuity.

Canada Life figures show the 65-year-old with a £100,000 pension pot could buy an annuity linked to the retail price index (RPI) that would generate a starting annual income of £3,896. That’s up from £2,195 in the New Year following a 77% spike in rates this year.

Oct 22.

That could be what you could receive, could be more or could be less. One huge gamble so it’s not for this blog.

TOTAL RETURN

The 4% Rule.

Depends on luck when you retire, what Mr. Market would offer you.

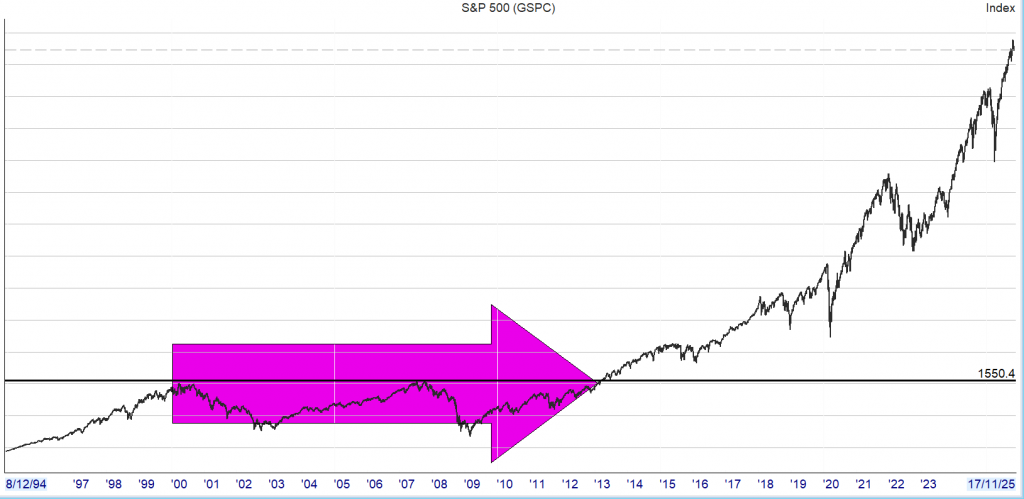

If you buy an S&P tracker and can choose when to sell you will not lose any of your money, again down to luck when you want to retire.

One option would be to transfer some of you hard earned into Bonds but as recent history proves that can be one way of ruining your retirement.

Ditto Pension lifestyling.

You have no way of planning as the final amount is the known unknown.

DIVIDEND RE-INVESTING.

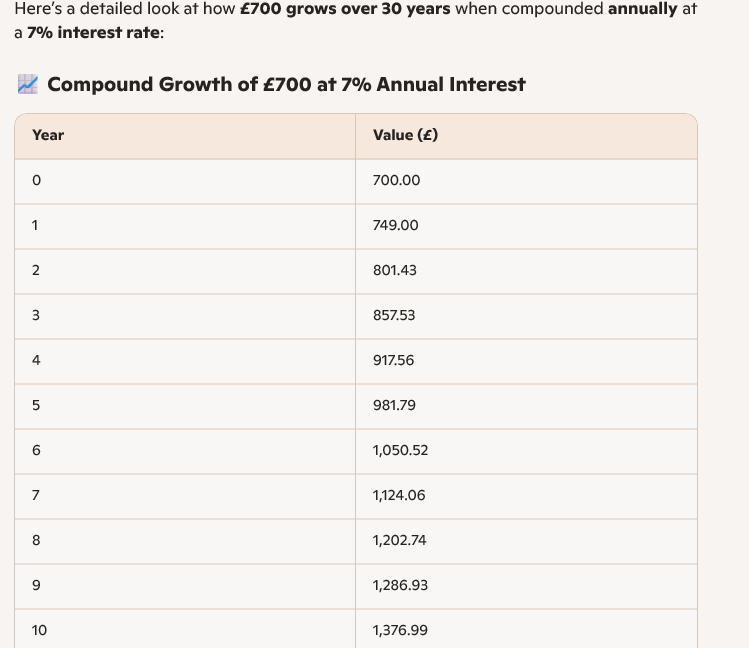

You can plan ahead, although to arrive at your final destination, you would need to monitor your plan and tweak it as you journey along.

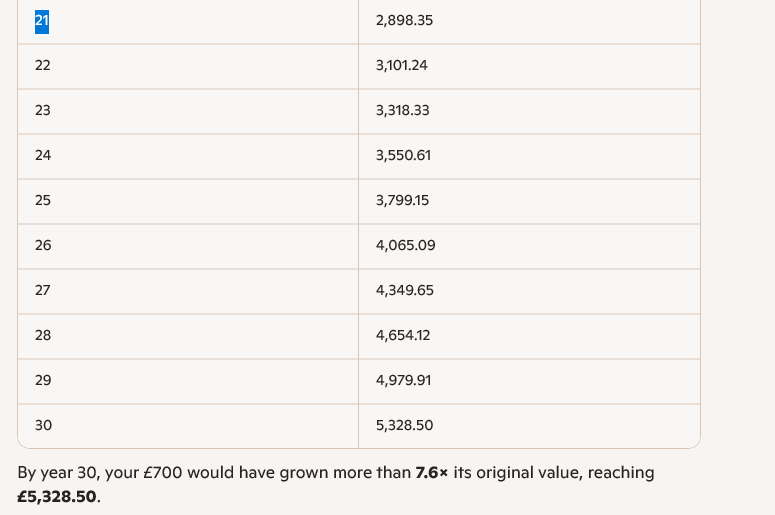

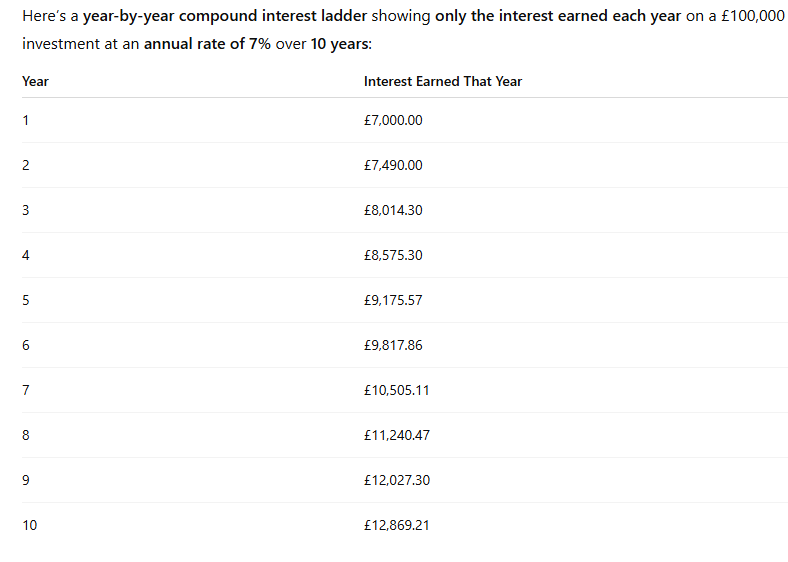

Note how the largest gains are made in the final years, that’s why Lifestyling can be such a bad choice.

On a 100k investment income of 53%, you need to allow for inflation.

The Snowball has a TR comparison share VWRP.

The current comparisons

The Snowball income for 2025 £11,800. The fcast for 2026 is £9,175.57

The ten year plan is currently 2 years ahead of the final total thanks in part to the largesse of Mr. Market.

Comparison share VWRP current value £149,299.00 Not too shabby, when the markets correct you could possible include some for your Snowball.

Using the 4% rule it would currently provide an income of £5,971.00

It is assumed the gap between the two options, will continue to widen.

Leave a Reply