Watch List

Funds on the Watch List this week include: SMT, CRS, TENT, SSIT, IVPB, PHI, RCP, FGT, PIN, ROOF, LXI, LMP

Welcome to this week’s Watch List where you’ll find golden nuggets on trust discounts, dividends, tips and lots more…

By

Frank Buhagiar

15 Jan, 2024

BARGAIN BASEMENT

Discount Watch: three

Our estimate of the number of investment companies whose discounts hit 12-month highs over the course of the week ended Friday 12 January 2024 – the same total as the previous TWO weeks.

Only one of last week’s names on the list this time round: JPEL Private Equity (JPEL) from private equity. That leaves two newbies: Digital 9 Infrastructure (DGI9) from infrastructure; and Finsbury Growth & Income (FGT) from UK equity income.

ON THE MOVE

Monthly Mover Watch: something of a shake up

At Winterflood’s list of top-five monthly movers in the investment company space this week. New top performer and two new names to report. Top of the tree, one of last week’s names – Seraphim Space (SSIT) with a 30.6% share price gain. The space investor put out its monthly shareholder letter this week which highlighted how “SSIT saw a 12-month share price decline of c.30%, while its NAV fell by only 7.1% in FY23 (to end-June 2023), shielded in part by the downside protection embedded in its investments via preference shares and only one down round out of 11 funding rounds completed by SSIT’s portfolio companies in FY23.” Share price playing catch-up it seems.

Next up, newbie HydrogenOne Capital Growth (HGEN) in second – shares up 21.6% on the month without a news release in sight. Put this one down to the positive effect of lower yields then or could there be a whiff of corporate activity in the air? HGEN has a sub £100m market cap after all and it’s not as if there hasn’t been any corporate activity in the renewables sector recently. Look no further than fifth-placed Triple Point Energy Transition (TENT) – shares up 18.3% on the month on the back of the mid-December announcement: Proposed Orderly Realisation of Assets.

That just leaves two names to mention – Invesco Select Balanced (IVPB) and Crystal Amber (CRS) in joint third courtesy of both shares being up 18.7%. IVPB going through a restructuring of its own. As revealed in the suitably titled 14 December announcement, Restructuring Proposals, the Board is proposing to consolidate various share classes including Balanced “…into the Global Share Class…The Consolidation would result in the Company having net assets of approximately £182 million…As compared with any of the Company’s current share classes individually, the Board believes this should increase the appeal to investors and would be expected to have a beneficial impact on liquidity, and potentially on the discount of the enlarged Global Share Class.” Crystal Amber (CRS) meanwhile continues to benefit from its ongoing share buyback programme.

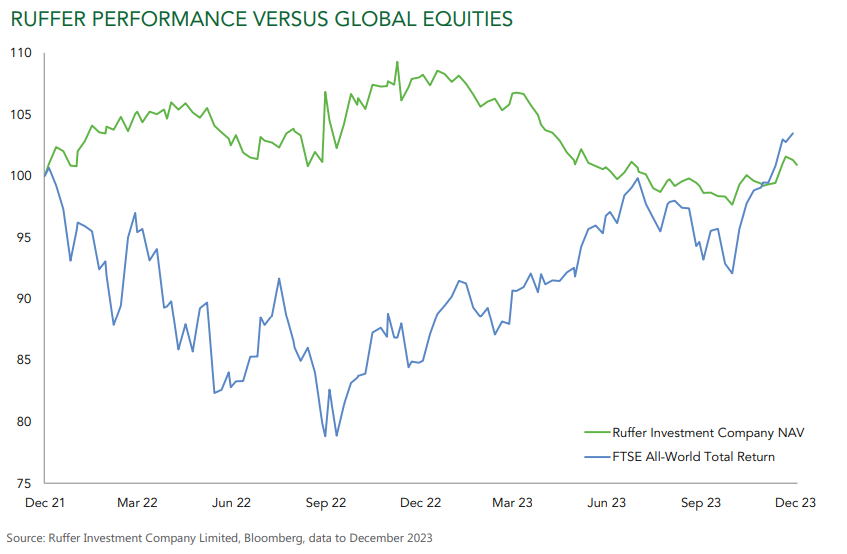

Scottish Mortgage Watch: +2.9%

Scottish Mortgage’s (SMT) monthly share price gain as at Friday 12 January 2024 – a reduction on last week’s +4.2%. NAV held up better – up +1.3% on the month compared to +1.6% previously; while the wider global IT sector finished the week up 2.6%, having been up +3.9% seven days earlier.

THE CORPORATE BOX

Insider Watch: 25,000

The number of Finsbury Growth & Income (FGT) shares acquired by Nick Train: “The Company has been notified that on 9 January 2024, Nick Train purchased 25,000 Ordinary Shares of £0.25 each in the Company (‘Ordinary Shares’) at an average price of 838.40 pence per share. As a result of the transaction, Mr Train now holds interests in a total of 5,312,243 Ordinary Shares, representing an aggregate 2.7% of the Company’s issued share capital.”

Combination Watch: LondonMetric (LMP) and LXi REIT (LXI)

Announced “…they have reached agreement on the terms of a recommended all-share merger pursuant to which LondonMetric will acquire the entire issued and to be issued ordinary share capital of LXi…by means of a scheme of arrangement under Part 26 of the Companies Act. Under the terms of the Merger, each LXi Shareholder will be entitled to receive: for each LXi Share held: 0.55 New LondonMetric Shares…”

Comment from LMP Chief Executive Andrew Jones: “This is a compelling transaction which creates the UK’s leading triple net lease REIT and underscores our ambitions to leverage our management platform and access exciting new opportunities across the UK real estate market. The deal gives us access to a very well let triple net portfolio of key operating assets and brings together two highly complementary investment approaches that embrace the qualities of income compounding. The combined £6.2 billion portfolio will have no legacy assets, full occupancy, high occupier contentment and exceptional income longevity with a high certainty of growth – both organically and contractually.”

Borrowings Watch: Pantheon International (PIN)

Announced “…a private placement of $150m…of loan notes (‘the Notes’)…structured over different maturities of 5, 7 and 10 years, resulting in a weighted average maturity of 6.9 years. The Notes were three times oversubscribed at the pricing point and purchased by five North American institutional investors. When considered alongside the existing £500m equivalent multi-currency revolving credit facility (‘Loan Facility’), the issuance of the Notes means that PIP now has access to an even more diverse supply of liquidity from high quality counterparties…”

The company went on to say that the “As at 11 January 2024, the Company had £20m of net available cash and drawings of £136m under the Loan Facility. Proceeds from…the Notes will be used to partially repay and convert…drawings into longer term funding at a blended US Dollar coupon of 6.4945%. This blended coupon is lower than the all-in interest cost currently payable on the Loan Facility. Following the issuance of the Notes, PIP’s net debt to NAV will remain conservative and unchanged at 5%. The Company expects to finance its new investments and meet its unfunded commitments principally from the cash that continues to be generated by the Company’s portfolio and from short-term utilisations under the Loan Facility.”

Dividend Watch: 10% The amount by which Atrato Onsite Energy (ROOF) proposes to increase its full year dividend by: “…in line with the progressive dividend policy set out at IPO, the Board has increased the target dividend from 5 pence to 5.5 pence per Ordinary Share for FY24, an increase of 10%. The highly contracted nature of our portfolio means the Company’s 12-month forward-looking dividend cover is expected to be in excess of 1.3x.”

MEDIA CITY

Tip Watch #1: Now is not the time to jump ship at Rothschild investment trust

So says The Times’ Tempus Column. The Rothschild investment trust is of course RIT Capital Partners (RCP). So, why would investors consider jumping ship? Because, as Tempus writes: “It’s all change at RIT Capital Partners…First, Ron Tabbouche, the chief investment officer of the RIT-owned fund manager that runs the portfolio, left in November; now, Francesco Goedhuis, the chief executive, is going, because of a family illness. The new broom is Maggie Fanari, at present the head of high-conviction investments at the Ontario Teachers Pension Plan. Well, not that much of a new broom. She has sat on the RIT board as a non-executive director for the past four years. She arrives as a full-timer in March.”

Because of this, Tempus thinks: “It doesn’t sound like the appointment will signal any big change in RIT’s investment philosophy, one that has shifted already since its heyday under Lord (Jacob) Rothschild, when an emphasis on capital preservation was combined with an opportunistic approach to markets and stock selection. The very long-run annual return of 10.7 per cent remains impressive to this day. RIT has turned £10,000 at its launch in 1988 to £345,000 in 2024.”

Having said that “…recent years have been disappointing. RIT has underperformed over one, three and five years and the shares languish at a 25.6 per cent discount to net assets…The big concern is that RIT has pushed very heavily into unlisted company investments, with 39.8 per cent of its portfolio allotted to private equity. The jury is still out on whether it has picked enough successes to offset the inevitable duds and whether it is valuing these unlisted assets conservatively enough…The next year or so will help to establish the wisdom, or folly, of RIT’s private equity foray. Fanari has bags to prove, but, with a bit of luck and a receptive flotation season, she could significantly narrow that yawning discount. This is a case where there is not enough reason to buy the shares, but just enough hope not to sell.”

Tip Watch #2: A compelling comeback play – courtesy of Baillie Gifford

Guess the Baillie Gifford fund the Investors’ Chronicle is talking about in the above article. Scottish Mortgage? No. Keystone Positive Change? That’s another non! Over to the Chronicle for the big reveal: “With a market capitalisation of around £500mn, Asia-focused Pacific Horizon (PHI) is a minnow compared with the biggest Baillie Gifford trusts…It has done plenty to warrant attention, however.” That’s because: “Pacific Horizon was one of the best-performing investment trusts of 2020 thanks to its focus on internet companies such as China giants Tencent (HK:700) and Alibaba (HK:9988) that blossomed during lockdown. Impressively, the portfolio also fared well in 2021, a difficult year for Asian markets, thanks to a well-timed pivot that saw the team drastically reduce exposure to China and focus more heavily on India just before the former embarked on a big regulatory crackdown.”

But as the article explains: “…the fund subsequently struggled to escape the impact of higher interest rates, meaning shareholders had to stomach a paper loss of more than 30 per cent in 2022, as well as a modest hit last year. With the shares recently trading on a discount of around 10 per cent to the net asset value (NAV) of the underlying portfolio, investors who believe growth investing will come good again can still point to this name as one of the many bargain buys available in the investment trust space.” The tipster does note that: “The fund comes with some of the usual selling points and drawbacks of Baillie Gifford vehicles. The investment managers favour companies with good structural growth stories and very high risk/reward profiles…that can at least double their share prices over five years, with most of the progress stemming from earnings growth.” While, “…the portfolio often bears little resemblance to the MSCI AC Asia ex-Japan index, which many investment teams in the region use as a comparator.”

The Chronicle concludes by saying: “The trust is clearly not immune to threats. Growth stocks could fall out of favour again, or face diminished returns due to higher rates. China could still have some nasty surprises up its sleeve. But Pacific Horizon remains a dedicated play on the region’s potential growth stars with a very tempting valuation.”