Sequoia Economic Infrastructure Income Fund Limited

(“SEQI” or the “Company”)

Monthly NAV and portfolio update

The NAV per share for SEQI, the specialist investor in economic infrastructure debt, increased to 92.46 pence per share from the prior month’s NAV per share of 92.05 pence, (being the 31 March 2024 cum-income NAV of 93.77 less the dividend of 1.71875 pence per share declared in respect of the quarter ended 31 March 2024 and payable on 23 May 2024), representing an increase of 0.41 pence per share.

As the Company is approximately 100% currency-hedged, it does not expect to realise any material FX gains or losses over the life of its investments. However, the Company’s NAV may include unrealised short-term FX gains or losses, driven by differences in the valuation methodologies of its FX hedges and the underlying investments – such movements will typically reverse over time.

Investment Policy amendment

The current Investment Policy mandates at least 50% of the portfolio (net of interest rate hedging, if any) should be in floating rate investments. Given the current outlook for policy rates in the main markets that the Company operates in, the Company has adjusted the Investment Policy to target up to 60% of its portfolio (net of hedging) in fixed rate investments (and therefore no less than 40% in floating rate investments). This will have the practical effect of locking in current interest rates, and therefore protecting the Company’s income should rates fall.

Market Summary

During April 2024, central banks across the UK, US and Eurozone maintained policy rates at 5.25%, 5.50% and 4.00%, respectively. Government bond yields trended upward during the same period, by 0.5% in the UK and US, and 0.3% in the Eurozone, which reflected a realignment in market expectations of fewer rate reductions by the end of the year (either one or two). The most recent data on CPI inflation shows a downward trend in the UK and Eurozone, from 3.4% and 2.6% in February 2024, to 3.2% and 2.4% in March 2024 respectively. In the US, where figures have been released for April 2024, CPI inflation declined to 3.4%, from 3.5% in March 2024. CPI inflation is expected to return to close to the 2% target by the end of the year across all three regions, mainly due to the unwinding of energy-related base effects.

The Investment Adviser expects abating inflation to provide a foundation for steadier credit markets, highlighting that the long-term outlook on inflation and base rates points towards a beneficial tailwind to the Company’s NAV, as falling rates would typically increase asset valuations. The changes to the Investment Policy provide the opportunity to lock in higher rates in a falling interest rate environment.

Share buybacks

The Company bought back 12,791,719 of its ordinary shares at an average purchase price of 81.15 pence per share in April 2024. The Company first started buying shares back in July 2022 and has bought back 155,546,443 ordinary shares as of 30 April 2024 with the buyback continuing into May 2024. This share repurchase activity continues to contribute positively to NAV accretion while investing in its own diversified portfolio. The rate at which SEQI buys back shares will vary depending on various factors, including the level of our share price discount to NAV.

On 26 April 2024, the Company cancelled 154,046,443 ordinary shares of no par value in the capital of the Company which had previously been bought back.

Portfolio update

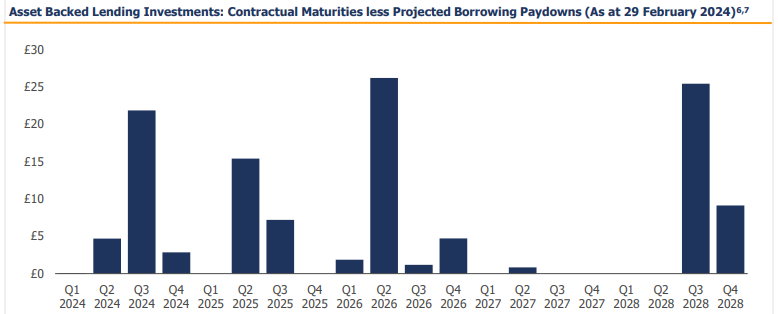

The Company currently has strong liquidity, with cash of £94.34 million, compared to undrawn investment commitments of £65.73 million. The Company’s revolving credit facility (RCF) of £325 million is also undrawn. The Company’s policy in the current environment is to operate with little or no leverage, but the RCF can be used to manage the potential misalignment of new investments versus the repayment of existing investments.

As at 30 April 2024, 58.7% of the portfolio comprised of senior secured loans and 50.7% remained in defensive sectors (Renewables, Digitalisation, Utility and Accommodation). The Company’s invested portfolio consisted of 53 private debt investments and 2 infrastructure bonds, diversified across 8 sectors and 30 sub-sectors. It had an annualised yield-to-maturity (or yield-to-worst in the case of callable bonds) of 10.10% and a cash yield of 7.90% (excluding deposit accounts). The weighted average portfolio life remains short and is approximately 3.8 years. This short duration means that as loans mature, the Company can take advantage of higher yields in the current interest rate environment.

Private debt investments represented 96.8% of the total portfolio, allowing the Company to capture illiquidity yield premiums. The Company’s invested portfolio currently consists of 42.2%[1] floating rate investments and remains geographically diversified with 53.2% located across the USA, 24.5% in the UK, 22.2% in Europe, and 0.1% in Australia/New Zealand. As at 30 April 2024, the positive effect of pull-to-par is estimated to be worth approximately 4.2p per share over the course of the life of the Company’s investments.

The portfolio remains highly diversified by sector and size, with the average loan representing about 1.6% of the total portfolio and the largest 4.4% of NAV as at 30 April 2024.

At month end, approximately 100% of the Company’s NAV consisted of either Sterling assets or was hedged into Sterling. The Company has adequate liquidity to cover margin calls, if any, on its hedging book.

Settled investments in April 2024

SEQI continues to carefully scrutinise new investment opportunities in a disciplined manner alongside other uses of proceeds such as share buybacks and ensuring it has adequate liquidity on its RCF. Aside from these uses of capital, the Company invested in an additional Senior loan for $0.8 million to Sunrun Safe Harbor Holdco LLC, a manufacturer of solar energy equipment in the USA.

No significant investments (exceeding £0.5 million) sold or repaid in April 2024