DYOR as this years leaders may be next years laggards.

Investment Trust Dividends

DYOR as this years leaders may be next years laggards.

The holy grail of investing a Trust that pays u a dividend and sits in your account at nix, nada, nothing, if u took out your stake and re-invested it in a higher yielder.

Dividends earned but not re-invested in back into JGGI. A trust to consider if u are in the accumulation stage, if/when Mr. Market gives u the chance to buy. To grow your Snowball it would have to be pair traded with a higher yielder.

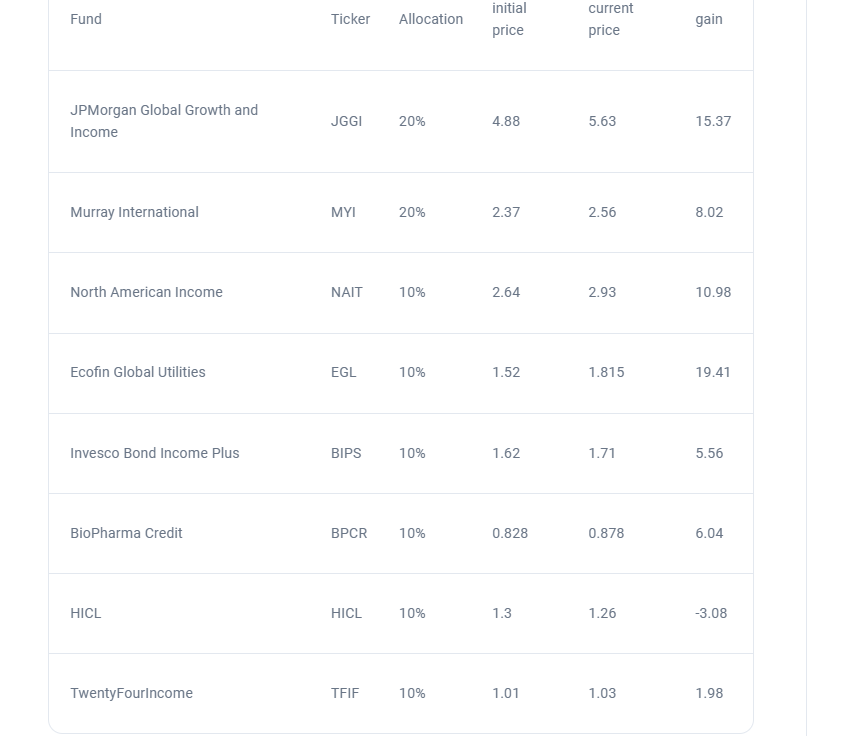

The Income portfolio, there were fewer big movers as the model portfolio advanced to a price return of 8.77% since its launch in mid-November of last year – dividends paid will have added at least another 2.5% to that price return. Yet again, the star performer was the global utilities and infrastructure fund Ecofin Global, which has been up 8% over the last month and 19% since the model portfolio launched. Ecofin. It helped that interest rates and 10-year bond yields rose in April, as did listed infrastructure stocks led by utilities, with low valuations and solid earnings reports. The fund reports that the global utility index and EGL’s NAV have now outperformed the MSCI World Index over three months, almost entirely owing to US constituents of the portfolio “which are beginning to be recognised as future beneficiaries of the datacentre and AI power needs” become obvious to investors. This defensive fund is now up 21% over the last six months.

20 investment companies made it onto the AIC’s list of this year, two more than 12 months ago. But based on number of years of growth, level of dividend yield and 5-yr dividend growth rate, which comes out top?

By Frank Buhagiar

Back in Q1 2024, the Association of Investment Companies (AIC) published its latest list of Dividend Heroes – those investment companies that have increased their annual payouts for at least 20 consecutive years. No mean feat considering the last two decades have seen a pandemic, a financial crash and a European sovereign debt crisis. While all funds on the list are to be commended, to continue to qualify as a Dividend Hero and maintain a track record of 20 plus years of growth, a trust, in theory, only has to raise its payout by the smallest of margins. And then again, if a Hero’s dividend yield is relatively small, how valuable is it to investors looking for income to help tackle the cost-of-living squeeze? We thought we’d repeat the exercise we carried out last year and look to identify which fund is the definitive Dividend Hero.

The Heroes

First, the AIC’s latest list of Dividend Heroes:

| Investment Trust | AIC Sector | Number of Consecutive Years Dividend Increased | Dividend Yield (%) | 5-year Annualised Dividend Growth Rate (%) |

|---|---|---|---|---|

| City of London | UK Equity Income | 57 | 5.12 | 2.58 |

| Bankers | Global | 57 | 2.31 | 5.36 |

| Alliance | Global | 57 | 2.10 | 13.20 |

| Caledonia Investments | Flexible Investment | 56 | 2.06 | 3.41 |

| The Global Smaller Companies | Global Smaller Cos. | 53 | 1.50 | 9.82 |

| F&C Investment Trust | Global | 53 | 1.50 | 5.97 |

| Brunner | Global | 52 | 1.78 | 4.58 |

| JPMorgan Claverhouse | UK Equity Income | 51 | 5.18 | 4.64 |

| Murray Income | UK Equity Income | 50 | 4.57 | 2.43 |

| Scottish American | Global Equity Inc | 50 | 2.83 | 4.16 |

| Witan | Global | 49 | 2.48 | 5.14 |

| Merchants | UK Equity Income | 41 | 5.24 | 2.16 |

| Scottish Mortgage | Global | 41 | 0.52 | 5.96 |

| Value and Indexed Property Inc | Property – UK Com | 36 | 7.13 | 2.50 |

| CT UK Capital & Income | UK Equity Income | 30 | 3.90 | 2.10 |

| Schroder Income Growth | UK Equity Income | 28 | 5.21 | 3.18 |

| abrdn Equity Income | UK Equity Income | 23 | 8.42 | 3.50 |

| Athelney Trust | UK Smaller Cos. | 21 | 5.37 | 1.49 |

| BlackRock Smaller Companies | UK Smaller Cos. | 20 | 2.95 | 9.00 |

| Henderson Smaller Companies | UK Smaller Cos. | 20 | 3.29 | 4.36 |

Source: theaic.co.uk / Morningstar. Correct at 08/03/24.

A Couple of Observations

The list has grown. Twelve months ago, 18 funds made it onto the list. Fast forward a year and the complement of Heroes now stands at 20, courtesy of new entries BlackRock Smaller Companies and Henderson Smaller Companies.

With seven names, the UK equity income sector is the largest contributor to the list and half of the Heroes have now raised their dividends each year for half a century or more.

We have our heroes. Now, to rank them.

20 investment companies made it onto the AIC’s list of Dividend Heroes this year, two more than 12 months ago. But based on number of years of growth, level of dividend yield and 5-yr dividend growth rate, which comes out top?

By Frank Buhagiar

Degrees of Heroism

Quick refresh of the ranking process. Heroes are something of a mixed bag. Some trusts have notched up 50 plus years of dividend growth but have relatively small yields. Then there are those that boast higher yields but have shorter track records of consecutive annual dividend growth. There are also those trusts that have relatively small yields but above average dividend growth rates. Begs the question, which is more valuable – longevity, level of payout, or growth rate?

For the purposes of this exercise, equal weightings are attached to the three right-hand columns on the AIC list – ‘Number of consecutive years dividend increased’; ‘Dividend yield (%)’; and ‘5-year annualised dividend growth rate (%)’.

In terms of the scoring system itself: the higher the number of years of consecutive dividend increases, dividend yield and 5-year annualised dividend growth rate, the higher the trust scores. The trusts are ranked based on their relative standing in each of the three columns with the highest ranking ascribed 20 points (20 trusts in the pool). For example, the two newbies, BlackRock Smaller Companies and Henderson Smaller Companies receive the lowest points in the longevity category as they have ‘only’ increased their payouts for 20 consecutive years. City of London, Bankers and Alliance have the longest track records and so collect the full 20 points on offer.

The trust with the highest score wins the day and we have the ‘Hero of Heroes’.

The Scores

The table below includes the AIC’s original list with the results of the scoring system in brackets:

| Investment Trust | AIC Sector | Number of Consecutive Years Dividend Increased | Dividend Yield (%) | 5-year Annualised Dividend Growth Rate (%) |

|---|---|---|---|---|

| City of London | UK Equity Income | 57 (20) | 5.12 (14) | 2.58 (6) |

| Bankers | Global | 57 (20) | 2.31 (7) | 5.36 (15) |

| Alliance | Global | 57 (20) | 2.10 (6) | 13.20 (20) |

| Caledonia Investments | Flexible Investment | 56 (17) | 2.06 (5) | 3.41 (8) |

| The Global Smaller Companies | Global Smaller Cos. | 53 (16) | 1.50 (3) | 9.82 (19) |

| F&C Investment Trust | Global | 53 (16) | 1.50 (3) | 5.97 (17) |

| Brunner | Global | 52 (14) | 1.78 (4) | 4.58 (12) |

| JPMorgan Claverhouse | UK Equity Income | 51 (13) | 5.18 (15) | 4.64 (13) |

| Murray Income | UK Equity Income | 50 (12) | 4.57 (13) | 2.43 (4) |

| Scottish American | Global Equity Inc | 50 (12) | 2.83 (9) | 4.16 (10) |

| Witan | Global | 49 (10) | 2.48 (8) | 5.14 (14) |

| Merchants | UK Equity Income | 41 (9) | 5.24 (17) | 2.16 (3) |

| Scottish Mortgage | Global | 41 (9) | 0.52 (1) | 5.96 (16) |

| Value and Indexed Property Inc | Property – UK Com | 36 (7) | 7.13 (19) | 2.50 (5) |

| CT UK Capital & Income | UK Equity Income | 30 (6) | 3.90 (12) | 2.10 (2) |

| Schroder Income Growth | UK Equity Income | 28 (5) | 5.21 (16) | 3.18 (7) |

| abrdn Equity Income | UK Equity Income | 23 (4) | 8.42 (20) | 3.50 (9) |

| Athelney Trust | UK Smaller Cos. | 21 (3) | 5.37 (18) | 1.49 (1) |

| BlackRock Smaller Companies | UK Smaller Cos. | 20 (2) | 2.95 (10) | 9.00 (18) |

| Henderson Smaller Companies | UK Smaller Cos. | 20 (2) | 3.29 (11) | 4.36 (11) |

The Final Table

With scores totted up:

| Investment Trust | Number of Consecutive Years Dividend Increased | Dividend Yield (%) | 5-year Annualised Dividend Growth Rate (%) | Overall Score |

|---|---|---|---|---|

| City of London | 20 | 14 | 6 | 40 |

| Bankers | 20 | 7 | 15 | 42 |

| Alliance | 20 | 6 | 20 | 46 |

| Caledonia Investments | 17 | 5 | 8 | 30 |

| The Global Smaller Companies | 16 | 3 | 19 | 38 |

| F&C Investment Trust | 16 | 3 | 17 | 36 |

| Brunner | 14 | 4 | 12 | 30 |

| JPMorgan Claverhouse | 13 | 15 | 13 | 41 |

| Murray Income | 12 | 13 | 4 | 29 |

| Scottish American | 12 | 9 | 10 | 31 |

| Witan | 10 | 8 | 14 | 32 |

| Merchants | 9 | 17 | 3 | 29 |

| Scottish Mortgage | 9 | 1 | 16 | 26 |

| Value and Indexed Property Inc | 7 | 19 | 5 | 31 |

| CT UK Capital & Income | 6 | 12 | 2 | 20 |

| Schroder Income Growth | 5 | 16 | 7 | 28 |

| abrdn Equity Income | 4 | 20 | 9 | 33 |

| Athelney Trust | 3 | 18 | 1 | 22 |

| BlackRock Smaller Companies | 1 | 10 | 18 | 29 |

| Henderson Smaller Companies | 1 | 11 | 11 | 23 |

A Quick Reordering

And we have a final table of heroes ranked in terms of heroism with last year’s scores/rankings in brackets:

| Investment trust | Score | Ranking | ||

|---|---|---|---|---|

| Alliance | 46 (43) | 1 (1) | ||

| Bankers | 42 (35) | 2 (4) | ||

| JPMorgan Claverhouse | 41 (39) | 3 (2) | ||

| City of London | 40 (38) | 4 (3) | ||

| The Global Smaller Companies | 38 (33) | 5 (6) | ||

| F&C Investment Trust | 36 (29) | 6 (9) | ||

| abrdn Equity Income | 33 (35) | 7 (5) | ||

| Witan | 32 (32) | 8 (8) | ||

| Scottish American | 31 (29) | 9 (10) | ||

| Value and Indexed Property Inc | 31 (27) | 10 (12) | ||

| Caledonia Investments | 30 (27) | 11 (11) | ||

| Brunner | 30 (32) | 12 (7) | ||

| Murray Income | 29 (23) | 13 (14) | ||

| Merchants | 29 (24) | 14 (13) | ||

| BlackRock Smaller Companies | 29 (-) | 15 (-) | ||

| Schroder Income Growth | 28 (22) | 16 (15) | ||

| Scottish Mortgage | 26 (17) | 17 (18) | ||

| Henderson Smaller Companies | 23 (-) | 18 (-) | ||

| Athelney Trust | 22 (17) | 19 (16) | ||

| CT UK Capital & Income | 20 (17) | 20 (17) |

The Definitive Dividend Hero

For the second year in a row, Alliancesits atop of the tree. Bankers jumps two places to second from fourth last year. JPMorgan Claverhouse and City of London both drop one place to third and fourth respectively. Mention in dispatches goes to Scottish Mortgage for the largest points increase – 17 to 26. Ditto for biggest climb up the rankings, F&C Investment Trust from ninth to sixth. And for strongest newcomer BlackRock Smaller Companies in 15th place.

Of course, all the funds that make it on to the AIC’s list are heroes. Sadly, only one can be the winner and that’s Alliance, whom we sat down with for an update earlier this month.

Which shareholders are being paid to wait for a lasting recovery in income stocks thanks to an 8.3% dividend yield? And UK small and medium-sized company valuations “remain incredibly attractive” according to one Chairman, but who said it? Find out in this week’s round-up.

By Frank Buhagiar

BlackRock Smaller Companies’ (BRSC) one inescapable truth

BRSCoutperformed its benchmark during the full year despite reporting a -3.6% decline in NAV per share for the year. That’s because the Deutsche Numis Smaller Companies plus AIM Index (excluding Investment Companies) fared worse, ending the period down -5.8%. As for share price total return, this almost finished the year in positive territory (-0.8%). Relative performance stacks up over the longer-term too. According to Chairman Ronald Gould’s full-year statement, £1,000 invested in BRSCon 28 February 2006 would have grown in value by +421.5% in NAV terms by 29 February 2024. That compares to just +150.7% had that £1,000 been instead invested in the ‘UK open-ended income sector median’.

What’s more, since year end the fund has recovered lost ground despite ‘continued and significant market volatility’ – NAV (as at 8 May 2024) is up +8.0%, once again beating the benchmark’s +7.8%. A thumbs up then for the strategy to weight the portfolio towards companies with well capitalised balance sheets and entrepreneurial management teams that are able to rapidly adapt their businesses to the shifting market dynamics. For those searching for the one inescapable truth, the investment managers have the answer – UK small and medium-sized company valuations remain incredibly attractive. Perhaps should have made it clear the one inescapable truth related to financial markets in this instance. The search for the truth goes on.

JPMorgan: “BRSC has underperformed the index TR since late 2021 but has partially reversed that underperformance in the past year. BRSC, like most of its peers, has a growth style bias which likely has been a significant factor in performance. We feel our Neutral recommendation for BRSC remains fair.”

abrdn Equity Income’s (AEI) dependable income

AEI’s NAV total return of +1.6% for the half year fell short of the FTSE All-Share Index’s +6.9%. Chair Sarika Patel puts the underperformance down to income stocks being overlooked in favour of growth companies during the latest half year. Encouragingly, towards the end of the period, a noticeable shift towards value names was observed which coincided with a recovery in our relative performance. Helpfully, investors are being paid to wait for a lasting recovery in income stocks – as at 31 March 2024, the shares were offering a dividend yield of 8.3%. And according to Patel, the yield is based around dependable income, always useful as a high proportion of the total return generated by UK equities over time has come from dividends.

In his outlook statement Portfolio Manager, Thomas Moore, managed to fit in a weather forecast, “we are now increasingly confident that the clouds that have existed for some time are now dissipating, with many of our holdings now delivering on the investment thesis we originally anticipated at the time of purchase.” Here’s to blues skies and sunnier days ahead.

Winterflood: “Largest sector exposures at period-end were Financials (36% of portfolio value), Energy (16%) and Industrials (11%). Net gearing at period-end was 12.5% (30 September 2023: 11.3%). Manager has re-focused portfolio positioning towards stocks where he sees potential for combination of dividend yield, dividend growth and valuation re-rating.”

Polar Capital Global Healthcare (PCGH) expecting more of the same

PCGH posted a double-digit NAV per share return for the latest half-year period. The +16.55% return for the six months under review easily beat the +9.56% clocked by the MSCI ACWI/Healthcare Index (total return in sterling with dividends reinvested). That means NAV per share is now up +95.3% since the fund was restructured in June 2017, once again comfortably ahead of the benchmark’s +81.88%. In their half-year review, the investment managers cite strong stock selection as the reason for the latest bout of outperformance.

And the investment managers are expecting more of the same. They believe the sector’s key growth drivers including innovation, emerging markets and artificial intelligence along with rising demand will continue to drive revenue and earnings growth, along with outperformance, in the years ahead.

Winterflood: “Discount narrowed slightly from 7.7% to 6.7%. Outperformance driven by stock selection. Over the period, exposure to healthcare facilities was reduced to take profits, while biotechnology exposure was increased.”

Baillie Gifford European Growth (BGEU) waiting for the love to return to Europe

BGEUput in a strong showing over the half year – NAV total return came in at +20.2% compared to a still impressive +14.9% from the FTSE Europe ex UK Index (sterling). The share price beat the index too, rising +18.5%. The Interim Management Report admits that, as with other growth investors, rapidly rising inflation and interest rates have been painful. But the managers have been proactive, getting rid of weak companies and capitalising on low valuations to pick up competitively advantaged ones. They’ve also taken the opportunity to add to long-term winners that are currently facing challenges, albeit temporary ones.

The investment managers think there’s more to come too. In their view Europe is unloved and because of that there is the chance to pick up resilient companies offering significant long-term upside on sale. According to the investment managers ,“it feels like a better time to be a long-term European growth investor than it has for several years.” Just need Europe to start feeling the love now.

Numis: “The fund provides exposure to fast-growing European companies, and also benefits from opportunities to invest in unquoted assets through the Baillie Gifford network, with a maximum allocation of 20% (currently c.10%). Style headwinds have dampened medium-term performance, and since Baillie Gifford took over management the fund has produced NAV total returns of 32.8% (6.5% pa), compared with 43.3% (8.2% pa) for the index.”

IF the current market strength continues, one way of trading would be to buy a 250 tracker. XMCX pays a variable yield of around 4% so if u wanted to lesson the risk u would need to pair trade it with a higher yielder, maybe property as the current values are nearer their low from their high. But as always best to DYOR as there are still plenty of other Trusts trading at above market yields.

FTSE 250 frenzy

Experts say these stocks can help Brits cash in as UK markets soar.

Story by Anne Ashworth

Suddenly, the UK’s economic mood is brighter – cheerful, even. Following what one analyst called a ‘resounding rebound’ in first-quarter output, global banks have raised their projections for the outlook.

This index is full of British businesses ‘trading at material discounts to their global peers’, as Simon Doherty, head of managed portfolio services at Quilter Cheviot, puts it.

The view that some of these companies may be ripe for takeover is gaining currency – thanks to the £34billion bid battle for mining giant Anglo American.

This appears to have highlighted the value of much cheaper, smaller businesses – without political baggage.

Flying the flag: The FTSE 250 is full of British businesses ‘trading at material discounts to their global peers’© Provided by This Is Money

There are many of these opportunities, companies that have been ‘hiding in plain sight’, according to Thomas Moore, manager of the Abrdn Equity Income Trust.

Stuart Clark, of Quilter Investors, highlights the FTSE 250’s rich mix of constituents. He says: ‘The index contains companies that have fallen on tougher times. But they own great assets or intellectual property which would be attractive to larger-sized competitors. The index also contains smaller companies that are successfully growing and would be appealing to larger firms that wish to accelerate their expansion.’

It’s kind of kept us in that Goldilocks place.

The FTSE 250 enthusiasm has been further fuelled by this month’s bid for engineering group John Wood. Its Lebanese suitor Sidara offered premium of 25pc above John Wood’s share price. This approach was rebuffed, but Sidara may return with a more generous figure.

Last month, cybersecurity group Darktrace was snapped up by the Chicago private equity firm Thoma Bravo, in a deal seen as foreshadowing more FTSE 250 ‘acquisition activity’.

The expectation that more promising UK plc players will succumb to overseas predators is disheartening.

But not all FTSE 250 names will face this fate and here are the routes to make the most of what seems to be their brighter future.

FTSE 250 frenzy: Experts say these stocks can help Brits cash in as UK markets soar© Provided by This Is Money

She says: ‘Moonpig has 65-70 per cent share of the UK and the Netherlands markets.’ This business, established in 2000, takes its name from founder Nick Jenkins’s hated schooldays nickname. Shares have risen by 16pc over the past year to 156p, but remain 63 per cent below their level of three years ago. Analysts at Deutsche have set a target of 180p.

Bell likes Rotork’s solid levels of growth and strong profit margins. She adds: ‘The company is built on an ethos of continual innovation, quality and reliability.’

Rotork shares are up 8pc this year to 336p, with some analysts now targeting 430p. Alexandra Jackson, manager of the Rathbone UK Opportunities fund, lists two of the potential winners in property.

‘This sector should be in the vanguard if rates are cut this summer,’ she says.

‘Sirius Real Estate owns business parks in Germany and the UK. The company is skilled at converting sub-optimal and under-utilised space for which there is strong demand.

.

‘Sirius has now delivered its 10th consecutive year of rent roll growth of 5 per cent-plus.’

Thanks to these attributes, the consensus of analysts rate Sirius Real Estate a ‘buy’.

Grainger is the UK’s largest private landlord and also the largest name in build-to-rent developments. Jackson likes its low-risk business model, its balance sheet that can withstand a 50 per cent fall in house prices, and its plan to double earnings per share by 2026. Again, analysts rate Grainger as a buy.

Moore’s property pick is OneSavings Bank, the UK’s biggest professional buy-to-let lender which is also benefiting from the nation’s increased dependence on the private rental sector.

The simplest way to get broad exposure to the index is via a tracker fund such as the Vanguard FTSE 250 ETF (exchange traded fund). But if you are looking for a longer-term option, Quilter Cheviot’s Doherty points to the Janus Henderson UK Smaller Companies fund.

He says: ‘This fund invests in the likes of Bellway, the housebuilder, and Mitchells & Butlers, the pub operator. These businesses should do well as the UK emerges from recession, interest rates are reduced – and consumer confidence returns following the cost of living crisis.’

Let’s hope for such an outcome.

15 May 2024

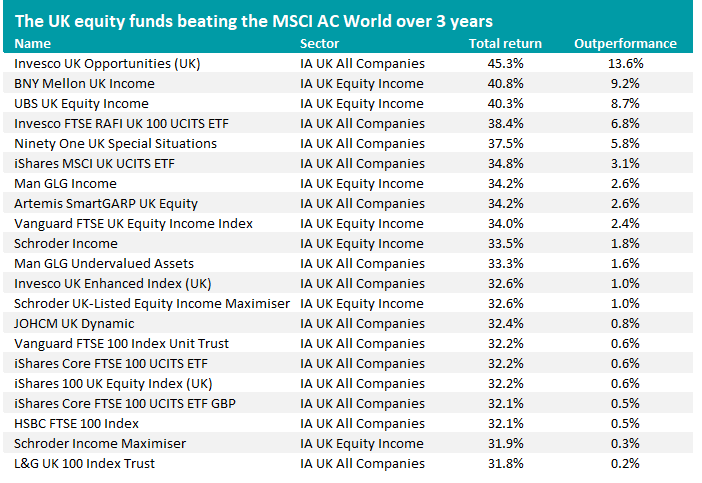

FE Analytics shows that 21 UK funds have outperformed the MSCI AC World index over three years.

By Gary Jackson

Head of editorial, FE fundinfo

The global equity market has been powered higher by surging US stocks but research by Trustnet shows a handful of UK funds are outperforming them over the past three years.

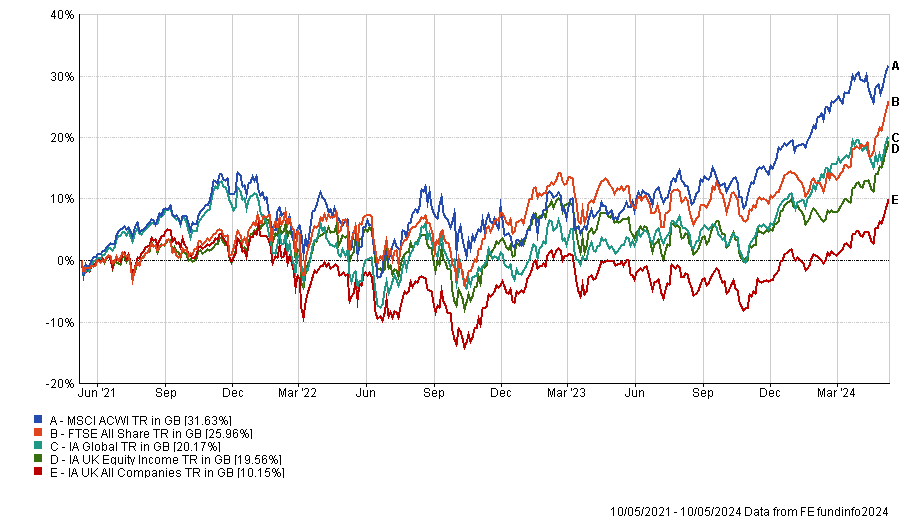

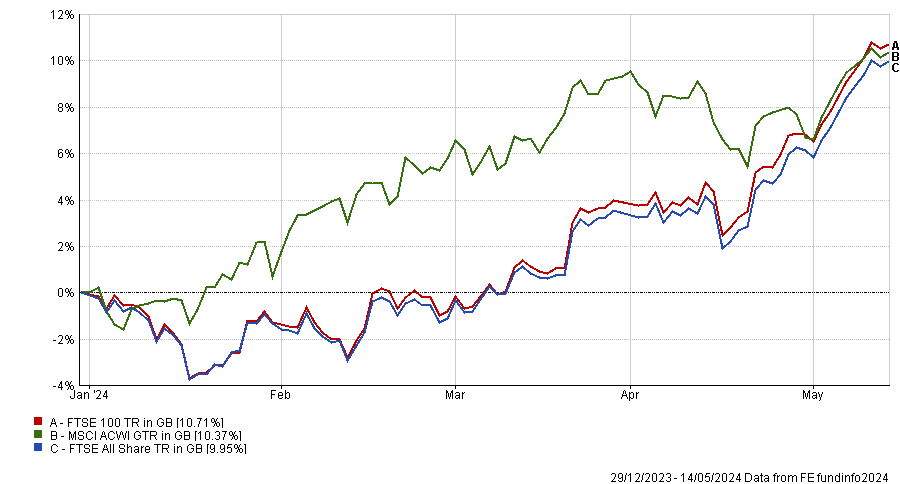

UK equities have been out of favour among investors for an extended period and, as the chart below shows, the FTSE All Share has underperformed the MSCI AC World index over the past three years (although this has started to narrow more recently).

For active managers, beating global equities – with its high weighting to the efficient US market – is no mean feat. The average fund in the IA Global sector is more than 10 percentage points behind the MSCI AC World (its most common benchmark) while the IA UK Equity Income and IA UK All Companies sectors are also nowhere near the index.

Performance of sectors and indices over 3yrs

Source: FE Analytics

However, there are some funds in the two main UK equity sectors that have made a higher return than the global stock market over this period: FE Analytics shows that 21 out of the 300 funds with a sufficient track record – or 7% – have done this.

Martin Walker and Bethany Shard’s Invesco UK Opportunities fund has made the highest three-year return, posting a gain of 45.3% and beating the MSCI AC World index by 13.6 percentage points in the process.

The £1.3bn fund has a value approach with Walker and Shard looking for companies with attractive earnings potential that isn’t recognised by the rest of the market. This tends to lead them to UK large-caps with strong international businesses; among the fund’s top holdings are the likes of Shell, BP, AstraZeneca, Unilever and Imperial Brands.

In their latest update, the managers said: “Despite the caution engendered by macro views, we remain optimistic at the medium- to long-term outlook for UK equities – particularly on a relative basis – as the value factor increases in importance. We expect an increased focus on cash generation in UK equities and the low starting point for valuation will combine to overcome inertia in relative performance.

“We believe that over the next 10 years, in an environment of higher interest rates and higher inflation than we have experienced since the global financial crisis, value as a factor will be more important. An environment that is different calls for equity exposure that is different. And sector exposures in the UK are very different to other global equity markets. The FTSE All Share index offers low correlation to US markets, but still has scale, breadth and depth of companies.”

Signs of these can be seen in the below table, which shows the 21 IA UK All Companies and IA UK Equity Income funds that have made a higher return than the MSCI AC World over the past three years.

Source: FE Analytics. Total return in sterling between 10 May 2021 and 10 May 2024

Many of the funds in the above table take a value approach to investing with Man GLG Income, BNY Mellon UK Income, Man GLG Undervalued Assets, Schroder Income, JOHCM UK Dynamic, Ninety One UK Special Situations and UBS UK Equity Income being among them.

Although value investing has continued to underperform growth in 2024 – the MSCI AC World Growth index is up 11.8% while MSCI AC World Value gained 8.9% – the UK stock market has been catching up with its international peers.

The FTSE 100 has reached a record high, as investors overcome the aversion that has been in place since 2016 and take another look at UK stocks – and UK value is outperforming UK growth.

The recent outperformance of the UK is apparent when we look at the number of funds outperforming the MSCI AC World index since the start of the year: 69, or 22% of the 311 with a long enough track record.

This compares with just one fund beating global equities on a five-year view (Artemis UK Select).

Matt Britzman, equity analyst at Hargreaves Lansdown, said: “Investors are finally starting to look at UK businesses and see reasons to be optimistic. The Bank of England held rates steady earlier in the week but hinted at rate cuts to come. Meanwhile, economic growth came in better than expected, but crucially not too much better to drive up fears it could cause inflation to spike. This comes on the cusp of major UK banks reporting over the past couple of weeks and there was a huge array of optimism from management teams around the outlook for the UK.

“Many will look at this run and assume it has no legs, UK investors have been beaten down too many times in the past. UK bulls will argue it’s been long overdue, with the market suffering from a hefty valuation discount to global peers for some time.”

UK equities hit an all-time high this week but there’s plenty of petrol in the tank to continue fuelling this rally.

By Emma Wallis

News editor, Trustnet

The UK equity market hit fresh highs this week and while no-one wants to get in at the top of any market, there are many reasons to believe that this rally might only just be getting started.

With the benefit of hindsight, we would all have boosted our domestic equity holdings months ago, but some investment professionals think now still seems like a relatively opportune moment to get in on the action.

While many catalysts have converged to produce the recent rally (including an improvement in economic data, imminent rate cuts and voracious share buybacks) there are plenty more irons in the fire yet to make an impact.

FTSE 100 and FTSE All Share vs MSCI ACWI, year-to-date

Source: FE Analytics

One factor that could really move the dial would be inflows.

As Artemis Income’s Nick Shenton pointed out, the UK stock market has “been making all-time highs on a total return basis for a while [but] it’s not doing so from an extended position where it’s widely owned or the shares don’t [offer] value. We think it bodes quite well that it’s starting to make all-time highs without the aid of international investors coming back to the UK market, or even domestic investors”.

Meanwhile, private investors continue to pull money out of UK equity funds, channelling it instead into passively-managed global and US equity funds. Asset managers are bullish about the prospects for US large-cap stocks and European equities but not the poor old UK. Even wealth managers such as Coutts are turning their back on the UK – at precisely the wrong time, in my view.

The UK government is doing its best to stem the tide of outflows, launching the British ISA which is not expected to move the needle massively, but is a step in the right direction. It proves there is political will to take action to support the stock market, which is why Man Group’s Henry Dixon called the British ISA announcement in the spring Budget “a faint line in the sand moment”.

Jack Barrat, who co-manages Man GLG Undervalued Assets with Dixon, said the chancellor’s call for UK pension funds to disclose their allocations to domestic equities should give the stock market more “sunlight” and “greater attention”.

If the government were to go one step further and abolish stamp duty, that could encourage investors back into the stock market.

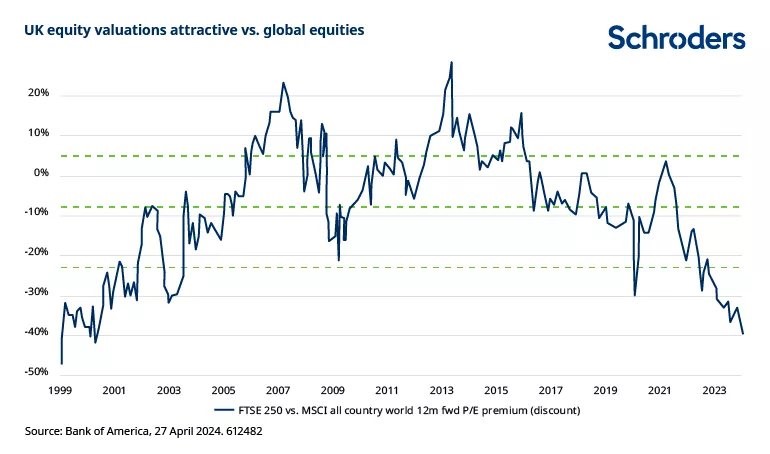

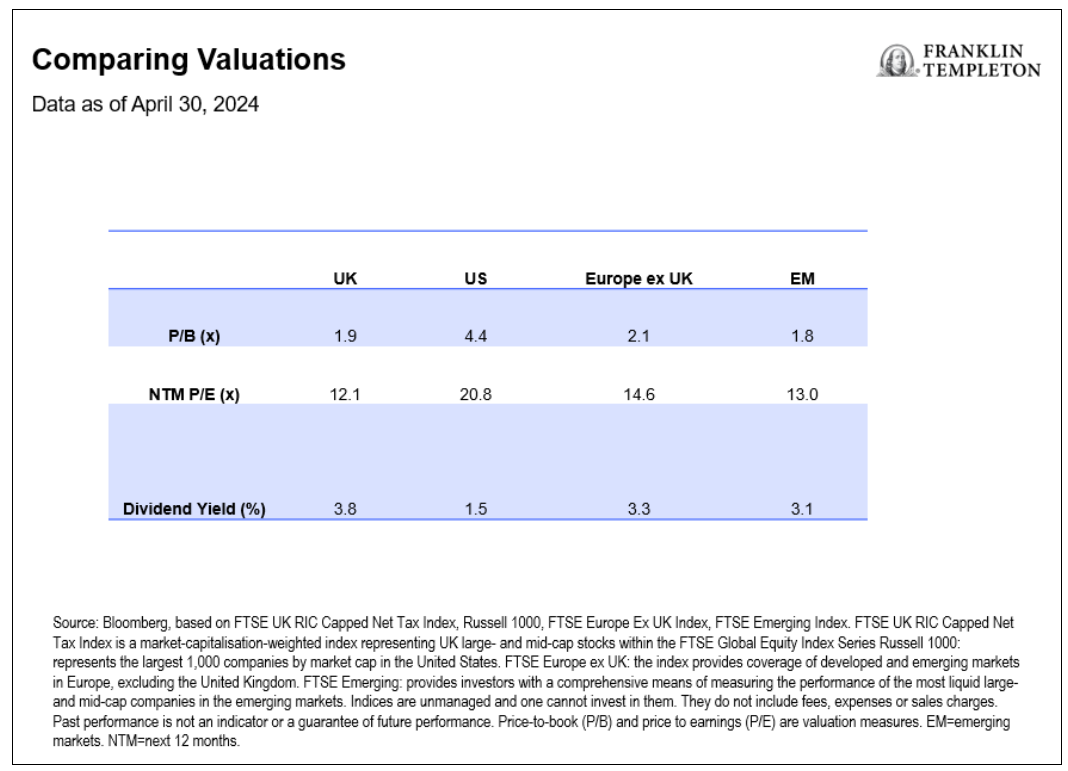

Valuations remain attractive despite this year’s gains, as the chart below shows.

Marcus Weyerer, senior ETF investment strategist, EMEA at Franklin Templeton, said: “With a price-to-book ratio of less than 2.0, UK equities are currently trading at a discount of more than 50% compared to US equities. Additionally, in terms of forward price-to-earnings, they are closely aligned with emerging market levels. Furthermore, the UK has long been considered a haven for income investors, and it currently boasts a dividend yield of 3.8%.”

Cheap valuations in a cheap currency have sparked a “frenzy” of merger and acquisition (M&A) activity, according to James Lowen, manager of JOHCM UK Equity Income. 5 of his 60 holdings have been approached by bidders this year alone.

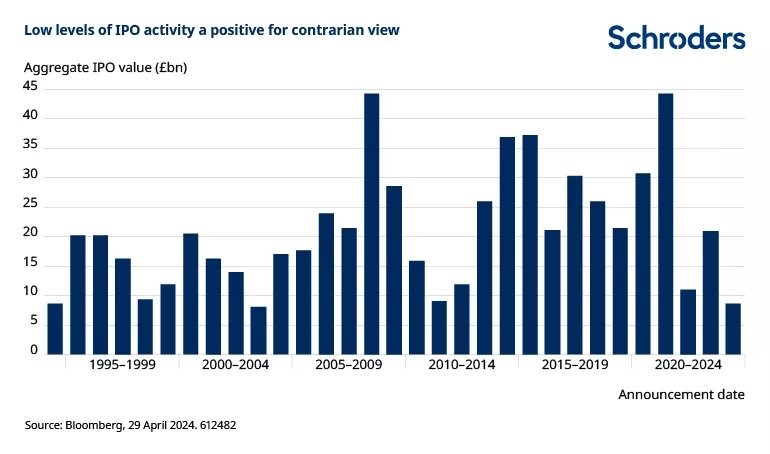

There has been a dearth of initial public offerings (IPOs) but if valuations were to surge, British companies might become more confident about going public here.

And if valuations better reflected what public companies are worth, management teams might be less eager to move their listings to the US.

A pickup in IPOs would create a virtuous circle, according to Graham Ashby, a UK all-cap fund manager at Schroders. “History clearly shows that increased UK IPO activity typically corresponds with a short-term peak in the equity market – witness the high levels of IPO activity in 2008 and 2021, compared with current depressed levels,” he said.

Meanwhile, companies themselves are cognisant of the value in their own cheap shares, so have been buying them back in droves. Buybacks – along with companies being taken out by foreign acquirers or moving their listings abroad – are gradually shrinking the size of the UK equity market.

Ashby observed that “less supply when demand may be set to increase” could eventually drive up prices. Quoting Warren Buffett’s maxim of being greedy when others are fearful, he concluded: “It may be time to get greedy.”

The overall cheapness of the UK market masks the fact that some of the UK’s largest stocks already appear expensive, Lowen warned. The seven “expensive defensives” (AstraZeneca, GSK, Diageo, Unilever, LSEG, British American Tobacco and RELX) look overvalued and comprise a fifth of the FTSE 100, which represents “a big danger lurking under the surface” for passive investors.

Other areas such as banks, insurers, miners and small-caps offer greater opportunities. That is why Lowen believes actively-managed strategies that can deviate away from the FTSE 100 index’s largest names would be a better way to play the UK recovery.

Five funds even outperformed the MSCI ACWI by more than 5% (Invesco UK Opportunities, BNY Mellon UK Income, UBS UK Equity Income, Invesco FTSE RAFI UK 100 UCITS ETF and Ninety One UK Special Situations).

This is no mean feat, dominated as the global index is by the US, which has outperformed the UK mightily.

If these fund managers can surpass global equities during a period where the UK has been a laggard, what might they be capable of at the helm of a more buoyant opportunity set?

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑