Investment Trust Dividends

Earnings

We continued to see solid corporate earnings from the companies we invest in over the period. Whilst it was not a completely positive picture across all sectors, in aggregate the trusts’ earnings generated a total income of £28.1m. This was 1.1% above the £27.8m generated for the first half of the previous fiscal year. In terms of earnings per share (EPS), issuance of new shares over the equivalent period last year meant that the EPS reduced by 1.7% to 17.1p (2023: 17.4p).

Dividends

The positive earnings picture noted above has given the board confidence to announce an increased Merchants dividend whilst allowing us to continue rebuilding revenue reserves that were partially utilised during the pandemic. As a reminder, at the start of this financial year, revenue reserves per share stood at 18.1p. Not all trusts can or will provide such income support and smoothing, which is why Merchants is one of a handful of companies to be awarded the AIC’s coveted Dividend Hero status from a universe of well over 400 listed companies.

With the final dividend of the 2024 financial year approved by shareholders at the AGM, Merchants has raised its dividend for 42 consecutive years and, with the increased dividend noted in this report, we remain well positioned for the future.

The board has declared a second quarterly dividend for the current financial year of 7.3p per ordinary share, payable on 15 November 2024 to shareholders on the register at close of business on 11 October 2024. A Dividend Reinvestment Plan (‘DRIP’) is available for this dividend for which the relevant Election Date is 25 October 2024 and the ex-dividend date is 10 October 2024. This means that for the first half of the financial year ending January 2025, the aggregated dividend will be 14.5p compared with 14.2p for the same period last year, a 2.1% year-on-year rise.

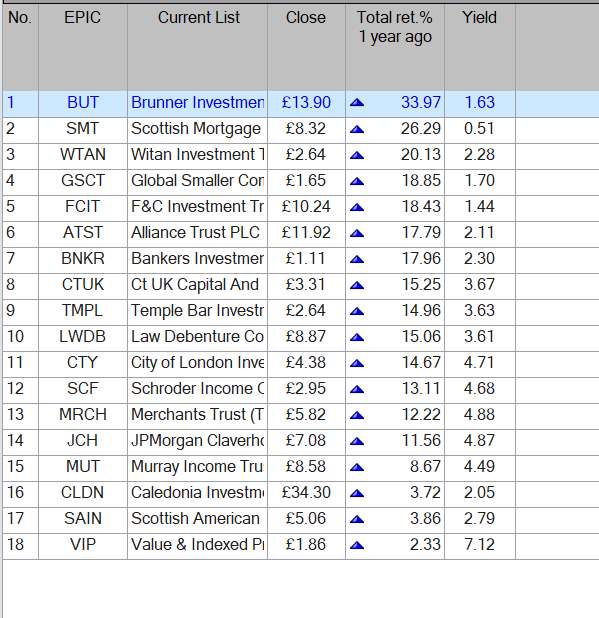

MRCH

£££££££££££££

Advantages of Investment Trusts in a dividend re-investment plan.

Some property trusts and Reits for DYOR. If u particularly like any of the above but the yield is only 6%, u could pair trade it with a higher yielder.

RECI is included although it’s a loan company the loans are secured against property, xd today for 3p.

|

Dividend Wealth Journal: REITs and Interest Rate Cuts, A Double Dipping Opportunity Hey folks, over the weekend I mentioned how dividends can be great for “Double Dipping” when you play them right. In other words, buying a stock that gains value in your portfolio and collecting passive income along the way. I want to follow up with a specific opportunity that could be primed over the next few months for a double dip. With the recent talks and actions around interest rate cuts, the spotlight is once again turning towards Real Estate Investment Trusts (REITs). Lower interest rates often breathe life into the real estate market, making REITs increasingly attractive (and potentially more profitable once again) for investors. Why do lower interest rates matter for REITs? Interest rate cuts have a direct impact on the real estate sector. Lower borrowing costs can lead to an uptick in purchasing and development activities, directly benefiting REITs that hold or manage these properties. As financing becomes cheaper, properties in the portfolios of REITs may increase in value, and their income potential can improve due to higher occupancy rates and rising rents. The infusion of lower rates can turn the REIT market bullish in several ways: Enhanced Property Values: As more investors and businesses find it affordable to finance real estate purchases or expansions, the demand drives property values up. Increased Occupancy and Rent: Lower interest rates generally boost economic activity… This leads to higher demand for both commercial and residential real estate. This increases occupancy rates, allows for rent hikes, and boosts REITs profits. Double Dipping Opportunity With those tailwinds giving REITs an opportunity to gain in underlying value, the next cycle of rate cuts present a unique “double dip” opportunity. But how? •Dividends: REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, offering investors a steady income stream. •Capital Appreciation: As the underlying properties appreciate in value due to increased demand and higher rental incomes, the value of the REITs themselves soar. This scenario allows investors not only to enjoy solid dividends but also to benefit from the appreciation of the stock itself. For dividend investors looking to leverage these benefits, considering REITs in sectors that are most sensitive to interest rate changes, like residential and retail, or those focused on regions with growing economies, might be particularly lucrative for this double dipping strategy. But, as always, the key to capitalizing on these opportunities lies in choosing solid dividends, specifically ones with strong fundamentals, strategic property holdings, and a solid leadership team. As interest rates decrease over the next year and a half, the relationship between interest rates and the real estate markets will grow increasingly important. We haven’t seen a great opportunity for real estate to gain inflows since 2020 when it took off, so now could be another double dip run. — Nate Tucci |

slot5000

sparklinewelders.com/slot5000

janenadel@gmail.com

49.68.108.160

pttogel

Thanks , I’ve recently been looking for information about this

subject for ages and yours is the best I’ve came upon till now.

But, what in regards to the bottom line? Are you positive concerning the supply ?

£££££££££££££££

Yes, there are currently 35 Investment Trusts paying a ‘secure’ yield above 7%, remembering that nothing is ever 100% secure.

7% re-investment is important as it doubles your income in ten years.

There is normally Trusts that the market have sold, for various reasons and u only need one to re-invest in.

The Snowball is currently not buying any new positions but re-investing in the portfolio to increase the income.

If there are no Trusts to buy at 7% or above, the current portfolio shares are trading at a blended discount of 30%, u would have funds to re-invest as well as your income. The income target is secure although u would have to extend the time line.

As the price rises the yield falls and vice versa.

The rules for any new readers, there are only three.

Dividends can be more reliable than share prices as they’re driven by

the companies performance itself and not by the whim of investors.

As part of a total return / reinvestment strategy, this income could be

reinvested into income assets or back into the equity market

depending on the relative valuations.

The emotional benefits of dividend re-investment.

In fact, with this investment strategy you can actually welcome falling share prices.

There seems to be some perverse human characteristic that likes to make easy things difficult.

Warren Buffett

Vanguard’s latest economic and market update, including our outlook for growth, inflation and interest rates.

Shaan Raithatha Senior Economist

The US Federal Reserve (Fed) has cut its federal funds rate for the first time in four years. The move signals the Fed’s confidence that US inflation is slowing, as well as a shift in focus to shore up the weakening US labour market. In kicking off its easing cycle, the US now joins the euro area and UK, where central banks had already begun cutting policy rates.

While the US, euro area and UK are seeing varying degrees of economic health, China may struggle to meet its growth target given lacklustre domestic demand. A strong, timely policy response will be required.

The Fed cut its policy interest rate by 50 basis points (bps)1 but did so in the context of economic resilience rather than concerns about a material slowdown.

The Fed’s decision, announced on 18 September, marked a strong start to its easing cycle. The 50-bps reduction in the federal funds rate indicates a target range of 4.75%-5%. The Fed had resisted cuts at previous meetings, which allowed monetary policymakers to see more evidence of slowing inflation and gave them the confidence to cut by 50 bps rather than 25 bps.

At the midpoint of the year, GDP growth was tracking largely in line with Vanguard’s 2% outlook for 2024. The US economy grew more in the second quarter than previously thought, with real GDP rising by an annualised 3%. Strong consumer spending contributed to the growth.

The pace of headline inflation, as measured by the consumer price index (CPI), slowed again in the year to August to 2.5% compared with 2.9% in the year to July. Core CPI, which excludes volatile food and energy prices, rose by 3.2% in the year to August, little changed from July.

Recent data suggest softening in the labour market. There was a second consecutive month of below-consensus job growth, coupled with a recent pattern of downward revisions to already-announced totals. We expect job growth continuing to slow amid moderating economic activity, with the unemployment rate ending the year marginally above current levels (4.2% in August).

The euro area is growing after stagnation in 2023. We expect steady—but not spectacular—growth in 2024 as restrictive monetary and fiscal policy constrain activity.

The European Central Bank (ECB) announced a 25-bps cut to its policy rate on 12 September. The decrease in the deposit facility rate, to 3.5%, was the second cut of a cycle that began in June with a similar 25-bps cut. Vanguard does not expect a further cut at the ECB’s October meeting, although we anticipate the easing cycle will resume with a 25-bps cut in December, followed by a quarterly cadence of 25-bps reductions in 2025.

The euro area economy grew again in the second quarter, with real GDP rising by 0.2% compared with the first quarter. This was despite an unexpected drag from Germany, where a rebound in the manufacturing sector remains elusive.

The pace of headline inflation slowed in August, driven by a drop in energy prices. Headline inflation slowed to 2.2% in the year to August—the slowest in three years—compared with 2.6% in the year to July. Core inflation, which excludes volatile food, energy, alcohol and tobacco prices, slowed marginally in August; however, services inflation remained sticky.

The unemployment rate returned to a record low of 6.4% on a seasonally adjusted basis in July, falling from 6.5% in June. We foresee little change to the unemployment rate into year-end.

In the UK, the Bank of England (BoE) held rates steady at 5% in September after initially cutting in August. We expect rate cuts to resume in the fourth quarter and believe rates will end the year at 4.75%.

The BoE’s decision to keep rates unchanged reflects that risks to resurgent inflation remain, although services inflation, pay growth and GDP data have all undershot expectations since the bank’s last meeting.

GDP growth increased by 0.6% in the second quarter compared with the first. We expect the UK economy to moderate in the second half the year, growing by 1.2% for all of 2024.

The pace of headline inflation held steady at 2.2% in the year to August. Meanwhile, core CPI, which excludes volatile food, energy, alcohol and tobacco prices, jumped to 3.6% in the year to August, compared with 3.3% in the year to July. Vanguard expects core inflation to end 2024 around 2.8% and to hit the BoE’s 2% target by the second half of 2025.

Wage growth cooled to its slowest pace in more than two years in the May-July period, even as the unemployment rate fell to 4.1% and job vacancies decreased for a 26th consecutive reading during that period. We foresee the unemployment rate ending 2024 in the 4%-4.5% range.

Sluggish domestic demand has put China’s 2024 growth target of 5% at risk. Fiscal policy in the form of increased government loan issuance in August provides hope, but more of the same will likely be required in the months ahead.

Government loan issuance totalled 900 billion yuan in August, a significant ramp up compared with the 260 billion yuan issued in July. In order for the government to hit its 5% growth target for 2024, this is the type of timely policy response that will be required. On the monetary policy side, we expect the start of the Fed’s rate-cutting cycle could give the People’s Bank of China (PBoC) room to cut as well.

GDP grew by only 0.7% in the second quarter compared with the first and by 4.7% compared with the second quarter last year. Weaker-than-expected retail sales and industrial production figures suggest that China’s growth momentum slowed in August.

The pace of inflation, as measured by consumer prices, rose 0.6% in the year to August, below expectations and well below the 3% inflation target set by the PBoC. We expect inflation in 2024 to be mild, with headline inflation of 0.8% and core inflation, which excludes volatile food and energy prices, of just 1.0%.

The unemployment rate rose to 5.3% in August from 5.2% in July. Vanguard expects that rate to remain around current levels for the rest of the year.

The points above represent the house view of the Vanguard Investment Strategy Group’s (ISG’s) global economics and markets team as at 19 September 2024.

Vanguard has updated its 10-year annualised outlooks for broad asset class returns through the most recent running of the Vanguard Capital Markets Model® (VCMM), based on data as at 30 June 2024.

Our 10-year annualised nominal return projections, expressed for local investors in local currencies, are as follows2.

SUPR’s current yield is

It’s likely they will continue to pay a gently increasing dividend but could be taken over but as the discount to NAV is 17%. U would then have to buy another IT with the profits but u can only control what u can control.

If the price rises the yield falls, so u may decide to re-invest the dividends elsewhere or even better spend them in your local Supermarket.

In twelve years time, most probably less, u have received all your cash back and now have a share yielding income at zero cost.

The holy grail of investing, not dependent on a rising market. If markets fall u could re-invest the dividends back into SUPR to earn even more income.

Other Trusts are available so not a recommendation to buy but as always best to DYOR.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑