As this year’s income is assured, it’s time to start to plan for next year’s income. There will be 1k to re-invest at the end of this month, so the 3 Trusts under consideration are BSIF, JLEN, SUPR.

Investment Trust Dividends

As this year’s income is assured, it’s time to start to plan for next year’s income. There will be 1k to re-invest at the end of this month, so the 3 Trusts under consideration are BSIF, JLEN, SUPR.

| j200m fernseherfuchs.com/j200m lucyheap@yahoo.com 114.235.128.8 | sssinstagram Hiya! Quick question that’s completely off topic.Do you know how to make your site mobile friendly? My web site looks weird when viewing from my apple iphone.I’m trying to find a theme or plugin that might be able to resolve this problem.If you have any recommendations, please share. Appreciate it! |

Sorry I can’t help, if anyone can I will update later.

The Fund Monitor

Artemis Alpha and Aurora to merge; Balanced Commercial Property to be acquired by Starwood; Tritax EuroBox to be taken over by Segro; while abrdn UK Smaller Companies Growth to hike dividend by an inflation-busting 9.1%.

Frank Buhagiar

Aurora (ARR) and Artemis Alpha (ATS) are set to become the latest two investment trusts to join forces in the interests of gaining scale. As per ARR’s press release of 02 September 2024, the two funds have agreed to merge with Aurora to be the continuing vehicle. ATS shareholders will be offered a cash option for up to 25% of their shareholding, subject to a 2% discount and an illiquidity discount of 20% on unquoted investments. The tie-up already has the support of shareholders holding 31.6% of ARR and 31.5% of ATS (31.5%). If all goes ahead, the fund will be renamed Aurora UK Alpha.

Liberum: “We think this is a smart combination of portfolios with significant overlap that should benefit from the greater scale it will achieve. We think the combination would be likely to deliver the increased liquidity noted in the deal drivers, with good potential for a higher share price rating too.”

Balanced Commercial Property Agrees Takeover

Balanced Commercial Property (BCPT) to be acquired by private investment firm Starwood Capital Group in a recommended cash offer of 96p per BCPT share. That’s a 21.5% premium to the undisturbed trading price of 79p before the commencement of the strategic review in April. It’s also an 8.7% discount to BCPT’s last reported (unaudited) NAV per share of 105.1p as at 30 June 2024.

BCPT Chairman, Paul Marcuse, “Over the course of the Strategic Review, we have undertaken an open consultation process with shareholders. We note that a significant proportion of the share register expressed to us a clear preference for a liquidity event, either via a sale or a managed wind-down.” Well, shareholders certainly got their liquidity event.

Tritax EuroBox Recommends All Share Offer

Tritax EuroBox (EBOX), as with BCPT above, clearly got the memo, announcing on the very same day that it too had agreed to a takeover, this time by Segro (SGRO). Unlike with BCPT, the deal is to be paid for in SGRO shares not cash – for each EBOX share held, shareholders will receive 0.0765 New SGRO Shares. EBOX shareholders will also receive a 1.05 pence per share dividend. Based on the SGRO closing share price of 880.0 pence as at 3 September 2024, the transaction values each EBOX share at 68.4 pence. That’s a 27% premium to EBOX’s undisturbed share price of 53.8 pence as at 31 May 2024 and a 14% discount to EBOX’s last reported IFRS NAV and EPRA NDV per share of 93.9 cents as at 31 March 2024.

Numis: “The offer is being recommended by the Board; however the absence of significant irrevocable undertakings beyond the Board (0.08% of share cap) does leave the door open for another party to potentially submit a higher counter offer, including Brookfield who currently have an existing PUSU deadline of 26 September.” In other words, watch this space.

Dividend Watch

Finally, after the excitement of the above three deals, some news from the more sedate world of dividends. abrdn UK Smaller Companies Growth (AUSC) is increasing its full-year dividend to 12p per share, 9.1% ahead of 2023’s payout. That’s inflation-busting with room to spare. Who said dividends were more sedate.

Editor Insights

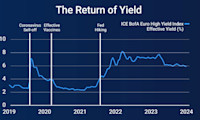

On your marks! With interest rates seemingly on their way down, a chase for yield could be about to begin. According to Invesco Bond Income Plus fund manager Rhys Davies, high-yield bonds sitting on yields of between 7 and 10% could offer a solution.

Frank Buhagiar

In recent years investors haven’t had to work too hard to make a decent return on their cash. Interest rates at levels not seen for decades have meant risk-free assets, such as government bonds and cash, have been offering competitive yields, particularly when compared to the long-run returns generated by riskier asset classes, such as equities. As highlighted in The Financial Times in in 2023, according to the results of a study carried out by Cambridge University’s, Elroy Dimson, world equities (ex-U.S.) generated returns of 5% in the 50 years to 2019. Who needs equities when parking your cash in a government bond can generate near-enough the same level of return?

But with interest rates now coming down in Europe and the UK, and expected to be cut soon in the U.S., government bond yields, which have already fallen to the 4% level in anticipation of lower rates, could move lower still. Alright for those investors who locked in the high yields on offer a year or so back. Not so, for those who didn’t. New investors, it would appear, are now faced with a dilemma – settle for the lower risk-free rates on offer or, in the chase for higher returns, accept the higher level of risk associated with asset classes such as equities. Or are they? For there is a third way. An asset class exists that pays a higher yield than risk-free government bonds, but comes with a lower level of risk compared to equities. The asset class, high-yield bonds.

Certainty of Income and Seniority

High-yield bonds do exactly what they say on the tin – they pay higher interest rates than investment-grade bonds. This way investors are compensated for the extra risk associated with lending to a company with a lower credit rating. A low credit rating is one that is below BBB- from ratings agencies Standard & Poors and Fitch, and below Baa3 from Moody’s.

High-yield bonds have much in common with their investment-grade/government-backed counterparts. And, as Invesco Bond Income Plus (BIPS) fund manager Rhys Davies explains no matter the type of bond, government-backed or high-yield, “a bond is a loan that creates two very important differences versus equities. The first is around income. So, bonds will pay an income through a coupon. That’s a contractual obligation that the company has to pay. Compare that to an equity. Equities will pay an income via a dividend and the company does not have to pay that dividend.” An issuer’s contractual obligation to pay an income, the first difference between corporate bonds and equities which, as Davies puts it, provides “that stability or that certainty of income.”

A second differentiator between bonds and equities is what Davies terms seniority. “So, bonds in a capital structure will rank ahead of equities. That matters should a company get into trouble. In theory, bondholders are able to take the keys, the ownership of a company from the shareholders in that situation.”

Riding High on Yield

Of course, the price paid for certainty of income and seniority over equities is generally lower returns – the classic risk/reward trade-off. I say generally because, according to Davies, the returns on offer from high-yield bonds today are currently higher than they have been for years. As Davies explains, “After the repricing that we saw in bond yields in 2022, we are seeing a lot more yield in the market and especially in the high-yield bond market. So, many high-yield bonds today are paying yields and income of 7%, 8%, 9% even 10% which are levels that are far higher than we have seen for many years.”

Davies goes on to highlight the potential for capital appreciation in today’s bond markets. This is the second component of a bond’s yield, the first being income, and once again, has its origins in the reset of 2022. Bond prices are inversely correlated to yields. Back in 2022, when bond yields moved higher, prices moved lower. So much so that many bonds saw their prices move to below par, par being the level at which they will be redeemed. As bonds approach maturity, prices can therefore be expected to move towards par value, typically 100, thereby generating a capital gain. It is this pull-to-par effect that offers the potential for capital appreciation.

Risk management

The 7-10% yields on offer, just one half of the high-yield bond story though. The other, the extra risk involved, at least when compared with investment-grade bonds. Risk can be managed though. A portfolio, for example, could hold a mix of investment-grade and high-yield bonds to lower the overall level of risk. This is what BIPS does. The fund, which currently offers a 6.8% dividend yield, holds a portfolio of bonds with different credit profiles – as at April 2024, the fund held almost a third of its assets in investment-grade bonds.

Risk can also be managed by ensuring comprehensive due diligence on the issuers is constantly carried out. Gaining a deep understanding of the sectors in which the underlying companies operate, the risks and opportunities they face and critically their key financial metrics, all help manage the risks involved in lending to companies. As BIPS’ Davies explains, “What’s really important to us is looking at the cash profiles of the companies that we are investing in. We need to ensure they are going to be able to afford the interest that they have to pay us on our bonds.” Always important, but especially so in the current high-interest rate environment.

And based on BIPS’ performance over the past five discrete years, a period that included the pandemic as well as the re-emergence of inflation in the developed world, the fund’s focus on risk management has served the fund well in recent years. As the Association of Investment Companies’ graph below shows, BIPS has posted a positive NAV total return in four of the past five discrete years:

Certainly, Winterflood appears to be a fan. In January 2024, the broker wrote “In our view, the managers’ cautious approach is rational, given the uncertainty posed by economic conditions and the oft-cited ‘maturity wall’. Portfolio changes over time have measurably increased income and simultaneously decreased credit risk. Therefore, BIPS may be a suitable vehicle for investors looking to gain exposure to the High Yield market”.

Strike While The Iron Is Hot

BIPS may well be the right vehicle for investors looking to gain exposure to high-yield bonds, but is it the right time to build that exposure? Certainly, more and more investors were upping their weightings in the asset class earlier this year. According to Reuters article, Investors queued up for U.S. high-yield bond funds as rate cut hopes grow, between January and May this year, inflows to U.S. high-yield bond funds totalled $6.1 billion, the highest level seen in three years. Reasons cited, “the allure of higher yields, potential for price appreciation amid anticipated Federal Reserve rate cuts, and diminishing corporate credit risks.”

Now, interest rate cuts in the U.S. have, as yet, not been forthcoming, but this may change soon. The market is currently pricing in a high probability of interest rate cuts at the next Federal Reserve meeting in September – according to Winterflood’s morning note of 9 September “Markets are pricing in a 73% chance of a 25bps cut on 18 September”.

And, as the Reuters article explains, interest rate cuts would be good news for high-yield bonds, “Analysts expect that lower interest rates, stemming from potential Fed rate cuts, would benefit high-yield bond issuers by enhancing liquidity and easing the cash flow constraints that have intensified due to the Federal Reserve’s previous rate hikes.” So, with U.S. interest rates seemingly set to fall, the time could well be right for high-yield bonds.

££££££££££££££££

Yield 6.6% trades at small premium to NAV

Mid Wynd looks forward to a more normalised market environment; Schroder Asian Total Return goes defensive; VH Global Sustainable Energy likes being different; Oakley Capital flies the private equity flag; India Capital Growth thinks execution is key; RTW Biotech expects to be busy; while Schiehallion sees sentiment improving.

Frank Buhagiar

MWY +17.1% share price total return for the year, a tad short of the MSCI All Country World’s +20.1%. NAV per share, a little further behind at +13.9%. Chairman, Russell Napier, puts this down to the concentration of market returns in a handful of US megatechs, aka the Magnificent 7. Nevertheless, positive start for new investment managers Lazard Asset Management. The new team promptly set about rebalancing the portfolio (35 stocks were added, another 35 sold) to bring it into line with their Global Quality Growth strategy. This focuses on “Compounders”, companies “capable of generating consistently high returns on capital and reinvesting in its business to drive future growth.”

In the meantime, the investment managers “are comfortable with the Company’s performance in a short-term market environment that is unusually ‘narrow’ – where a small number of stocks have generated a disproportionate amount of the overall market return.” As for what a “small number of stocks” looks like, less than a quarter of the S&P 500’s constituents beat the MSCI ACWI in H1 2024, the lowest figure since at least 1980. The managers “believe equity markets will broaden. A strategy such as ours, which is focused on financial productivity, should benefit in a more normalised market environment.” Share price added 7p on the day to close at 777p. Market expecting a “more normalised environment” sooner rather than later?

JPMorgan: “In common with every fund invested in global equities that compares its performance to a global market cap weighted index, the impact of Nvidia has been the most material component of relative performance. MWY has no holding in Nvidia. With that context in mind it is perhaps not too surprising to see the start of Lazard’s tenure as manager of MWY as a period of relative NAV underperformance but in our view it is too early to judge the success of the approach within MWY and the manager’s global equity quality growth strategy has a long history of good returns in other funds.”

Schroder Asian Total Return (ATR) Goes Defensive

ATR outperformed over the half year: a +10.1% NAV total return comfortably ahead of the MSCI AC Asia Pacific ex-Japan Index’s +9.5%. The fund’s technology holdings and use of gearing both mentioned in despatches. The strong performance means, on an NAV basis, ATR has beaten the Index over the one, three, five and ten-year periods. A full house!

Sounds like the investment managers are looking to protect that track record. A defensive position has been adopted because “current indicators are now decidedly neutral to cautious with limited scope for material short term positive returns based on historic trading patterns. What does this mean in practice? We have reduced gearing down to 5% and we are now in a modest way adding to capital preservation strategies.” Some of the fund’s technology positions in Taiwan have also been trimmed. “All of this should mean the Company is positioned a little more defensively.” Market liked what it heard – shares tacked on 3p on the day to close at 451p.

Winterflood: “Managers observed that Taiwan market has become ‘frothy’, driven by AI theme, with MSCI Taiwan +30% over H1 2024. Portfolio remains significantly underweight China/Hong Kong (c.17% exposure vs. c.27% benchmark).”

VH Global Sustainable Energy Opportunities’ (GSEO) Differentiated Portfolio

GSEO’s -5% NAV per share decline for the latest half year may have been down to adverse foreign exchange movements, but the longer-term track record remains robust: 8% total annualised NAV return since IPO to June 2024. Dividend looks robust too with the payout fully covered by cash. Chair, Bernard Bulkin, believes “This reflects the Company’s differentiated portfolio, which continues to generate predictable and healthy income to support GSEO’s attractive dividends.” Only half time in terms of the year and in the second half, “focus will be on enhancing the portfolio’s value by completing the construction of existing assets and continuing to create additional value through active management of the operational assets.” Shares ticked a little higher to close at 78p.

Numis: “We recently published a detailed note highlighting potential for attractive total returns from GSEO’s differentiated portfolio, as construction assets complete and asset optimisation strategies are executed”.

Jefferies: “the highly contracted revenue position remains GSEO’s key source of strength, supporting dividend cover and a projected increase in gearing.”

Oakley Capital Investments (OCI) Flies the Private Equity Flag

OCI’s +4% total NAV return per share for the half year would have been 6% had it not been for adverse forex movements. These aside, the underlying strength of the portfolio holdings there for all to see: average year-on-year organic EBITDA growth at the portfolio company level came in at 14%. According to Chair Caroline Foulger, NAV growth has been “driven by higher earnings across a portfolio of tech-enabled, disruptive businesses that have demonstrated an ability to perform regardless of the economic backdrop.” And the Chair believes this “underlines the attractive nature of Private Equity and the outcomes achievable through investing longer-term capital in high-growth, high-potential private businesses, coupled with hands-on management that influences the investment outcome.” All that private equity flag-waving good for a 4p increase in the share price to 503p.

Jefferies “A number of the aggregate portfolio metrics were surprisingly static, but importantly earnings growth remains strong.”

Numis “We think that the future looks bright for OCI and that an estimated discount of c.29% (adjusting for currency), offers an attractive entry point for a high-quality fund.”

India Capital Growth’s (IGC) Double-Digit Return

IGC’s +10.6% NAV total return for the half year, largely in line with the BSE Sensex’s +10.9% but some way off the BSE Midcap’s +26.7%. Despite this, since 2011, the fund has achieved a compound annual growth rate of +15.2%. In their outlook, the investment managers highlight concerns that the valuations for many companies are above historical averages and that the 20%+ annual earnings growth delivered by the corporate sector over the past three years will be hard to repeat given the high earnings base. That said, “the Indian economy is well positioned, with political stability, policy continuity and a favourable macroeconomic environment. Looking ahead, execution is critical.” If the 1.5p results day share price rise to 187p is anything to go by, the market has faith in IGC’s ability to execute.

Winterflood: “Primary detractor was zero weight in state-owned enterprises. Key sector detractor was Financials, while Healthcare and Communication Services contributed.”

RTW Biotech’s (RTW) Busy Half

RTW’s +3% NAV per share return for the half year brings the total gain since the fund’s 2019 admission to +87.7%. By comparison the Russell 2000 Biotech and Nasdaq Biotech are up +1.7% and +4.0% over the half year and +6.5% and +34.6% over the longer time frame. MD, Richard Wong, notes “an intense period of activity for the group, with 14 new core positions initiated, an IPO and a reverse merger.” Sounds like it is only going to get busier, as “The market environment for the biotech sector is improving and the opportunity set for stock picking is encouraging. As we look out to the second half of 2024, we are excited by prospects for the biotech sector and opportunities that the Group’s scale, post-Arix acquisition, presents.” Market containing its excitement for now – shares largely unchanged following the results.

Numis: “In our view, the fund offers an attractive way to access a sector that benefits from numerous tailwinds.”

Schiehallion (MNTN) Sees Sentiment Improving

MNTN’s NAV and share price moved in opposite directions over the half year: NAV down -3.2%, share price up +44.1%. Same goes for NAV and the operating performance of the portfolio companies: portfolio-weighted revenue growth was +41%. Encouraging news on the valuation front. According to the Interim Management Report, “The gradual uptick in private markets activity over the past twelve months have given us opportunities to compare our carrying valuations with external price discovery moments.” Out of 11 price discovery events, MNTN had to revalue its holdings upwards on nine occasions, with a median revaluation of +18%. The two occasions holdings were revalued down, the median revaluation was -2%.

The investment managers “believe the share price appreciation over the last six months hints at an improved sentiment in general towards growth equity in the markets. If so, it is a sentiment we share.” Not much of a surprise to see the shares a smidgeon lower on the back of the results, that 44% share price rise perhaps enough to tempt shareholders to take profits.

Numis: “We believe Schiehallion has an interesting approach and is run by Baillie Gifford who is a well-respected long-term growth investor.”

Fox Squirrel

Dear reader

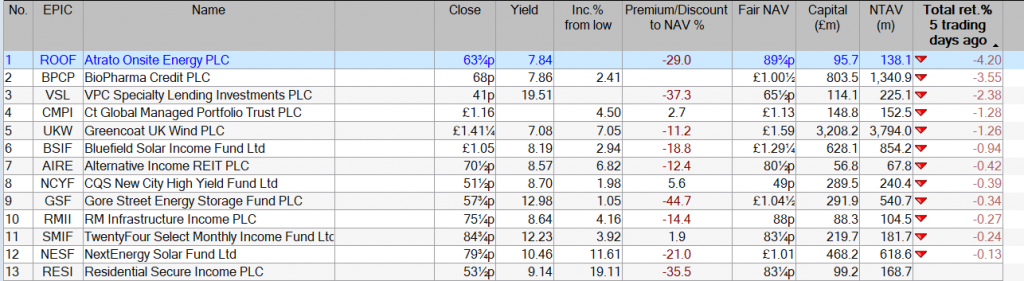

VPC is in a period of wind down. Its dividend on a “headline” basis is one of the strongest on the market at an alleged 19.51% per annum (according to HL).

But is that good value for money? Is it “real” and sustainable? And should existing shareholders hold on, average down, or exit?

For a start, the true dividend is 18.3%. That’s because the dividend is/was/has been 2p per quarter (backed by strong returns on VSL’s loan portfolio) but due to a 0.11p/share B shares capital return this has now been reduced to 1.89p per qtr. 7.56p on a 41.2p ask price is 18.3%.

Still, a chunky old divvy covered by earnings.

For anoraks only.

“The Oak Bloke from The Oak Bloke’s Substack” <theoakbloke@substack.com>

Is it the right time to invest in the UK stock market ?

Story by Harvey Dorset

Currently, UK equities are cheap compared to their foreign counterparts. But with potential takeover activity on the horizon, and growth back on the cards, it appears the tide might be beginning to shift.

In recent years, the UK market has been struggling to keep up with its competitors and has suffered due to its lack of high-quality tech stocks as US-based firms have seen meteoric gains.

As a result, UK equities are considerably cheaper than those in the US or Europe, and at the same time are delivering higher dividends and operating in a faster growing economy.

On the rise: Cheap UK equities could be set to grow in value as the economy stabilises

Richard Hunter, head of markets at Interactive Investor, said: ‘The FTSE 100 has tended to languish over recent years, not least of which was due to the fallout from Brexit and the index’s relatively low exposure to the technology sector, which has latterly been “the” trade which investors chase.

‘However, there are some signs that fortunes could be on the turn.’

Last month, the Bank of England cut interest rates for the first time in 2024 to five per cent and is expected to make further cuts before the year is out.

In comparison, the US has yet to see a rate cut, though this could be on the cards for the looming Fed decision.

The UK has also delivered strong growth in 2024 so far, with GDP having risen by 0.7 per cent in the first quarter and 0.6 per cent in the second, compared to 0.3 per cent and 0.2 per cent growth for the eurozone and 0.4 per cent and 0.7 per cent growth for the US.

‘The signs are the UK economy is set to keep growing,’ Tom Stevenson, investment director at Fidelity, said.

‘In July, the IMF upgraded its forecast for UK growth in 2024 from 0.5 per cent to 0.7 per cent, while sticking with its forecast that the economy will expand by 1.5 per cent next year.

‘Moreover, the UK is now underpinned by several factors including more growth and the actual onset of falling interest rates.

‘That could fuel a further unwinding of the discount that’s been applied to UK shares ever since the Brexit referendum in 2016.’

While the UK market is increasing in value, data from Fidelity shows it remains at a considerable discount.

The UK stock market has a price to earnings ratio of 11.7, far lower than 21.0 for the US and Canada, and 14.1 for Europe (excluding the UK).

Price to earnings ratios indicate the value of a company’s share relative to its earnings.

Often companies with low ratios are considered to be value stocks.

Stevenson said: ‘The UK stock market is no longer trading in absolute bargain territory – but it is pretty close to it.

‘Valuations in the US – even after the hiatus in markets mid-summer – remain close to their recent peaks.’

With UK equities still trading at a marked discount to those elsewhere, they are becoming increasingly attractive prospects for potential buyers.

‘Evidence of the market’s attractive valuation and newfound political stability comes from the number of foreign takeovers we’ve seen so far this year.

‘Indeed, the value of bids for UK companies hit its highest since 2018 earlier this year,’ Stevenson said.

Cyber-security firm Darktrace and packaging company DS Smith have both seen high-profile bids this year, with Rupert Murdoch’s REA group now mulling a bid for Rightmove.

Added to this, the Government has pledged to promote new investment in the UK, both through a £7.3billion national wealth fund, as well as considering reducing regulation and axing stamp duty in order to make the UK a more attractive prospect.

Hunter said: ‘The possibility of luring pension funds back to the UK in a meaningful way is another intriguing possibility which would immediately bolster prospects.’

He added: ‘For the longer term the UK remains an investment destination full of quality and proven names, and while the returns can be lower than some other indices, the potential rewards coming from many well-regarded names is evident and may be increasingly coming to the attention of overseas investors looking for an alternative outlet.

Story by Charlie Keough

Young female business analyst looking at a graph chart while working from home© Provided by The Motley Fool

The main reason I invest is to build my second income. Further down the line when I’m thinking about retirement, I want to have a stream of income that I can rely on to help me enjoy life more. That’s the dream, isn’t it?

Before I started to think about how much I wanted to invest, the first step I’d take would be to open a Stocks and Shares ISA. That’s because I wouldn’t be taxed on any profit I made. From the dividend shares I’d be buying, I’d also be able to keep all of the passive income I received from dividend payments.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

So, I’ve decided I’m going to invest with my ISA. That’s the best way for me to set myself up for success. But what’s next? Well, now comes the most important part. It’s about getting started no matter how much money I have to invest.

But that’s far from the case. How we start doesn’t matter. What’s imperative is that we start as early as possible and over the long run the stock market work its magic. I think £100 a week is a sensible starting amount.

Let me show an example of just how powerful this can be. The stock I’m going to use is Phoenix Group Holdings (LSE: PHNX).It’s an insurance company and a leader in the sector.

Its share price is down 1.8% so far this year. But a falling share price isn’t always a negative. For savvy investors, it means they can snap up bargains while the rest of the market overlooks it.

At its current share price, it has a dividend yield of 10.1%, way above the FTSE 100 average (3.6%). I like Phoenix Holdings because it has a strong balance sheet with plenty of cash spare as well as a rising dividend payout.

Taking my £100 a week and applying it to Phoenix Group’s 10.1% yield ought to see me make slightly over £525 a year in passive income. Not bad.

However, the longer I leave my money in the market, the better chance I have of building my wealth. If I adopt a 30-year investment time frame and reinvest all the dividend payments I receive, at the end of that I’d be making £10,168 a year in second income. I’d have a nest egg worth £106,269.

Investing always comes with risks and the stock market is volatile. There’s no guarantee that Phoenix Group’s yield will stay the same. It could rise or fall. Nevertheless, what this shows is that even investors starting from scratch are able to build a sizeable pot if they give it time.

The post Here’s how investors can build a meaty second income starting from scratch appeared first on The Motley Fool UK.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑