I’ve bought for the Snowball 1445 shares in NESF for 1k, this should add to the Snowball another £110.00 p.a.

All baby steps.

Investment Trust Dividends

I’ve bought for the Snowball 1445 shares in NESF for 1k, this should add to the Snowball another £110.00 p.a.

All baby steps.

Thinking of opening or rebalancing a Stocks and Shares ISA this April? Consider diversifying into these two promising US growth stocks.

Posted by Mark Hartley

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. .

The past two months haven’t been kind to US growth stocks, as trade tariff turmoil sent many into freefall. Automakers and banks were among the worst hit, with Chrysler owner Stellantis losing 10% in a single day in March.

Now analysts are eyeing a recovery following news that the Trump administration may ease tariffs this week. The result could be great news for stocks that had a tough start to the year and are now trading at a discount.

For UK investors looking to add some diversity to their ISA this April, here are two promising US growth stocks to consider.

The ride-hailing and food delivery platform Uber (NYSE: UBER) is more often in the news for controversy than its stock performance. Yet despite several security issues — including data breaches and safety concerns — it remains the most popular ride-hailing app in the world.

Founded in 2009 and headquartered in San Francisco, its operations span across the Americas, Europe, the Middle East, Africa and the Asia Pacific.

The stock’s currently trading around $76, up 180% after five years of volatile price action. Investors who caught the $20 low in mid-2022 would have almost quadrupled their investment by now.

But several ongoing risks threaten continued volatility. Regulatory challenges are a key issue, with some regions attempting to ban the app on grounds of unfair competition. It also faces stiff competition from a plethora of lower-priced rivals like Bolt.

By adding additional revenue streams like food and freight delivery, Uber has successfully expanded its business. Adding to this is its recent partnerships with autonomous vehicle companies like Waymo, positioning it to benefit from the robo-taxi market.

Analysts expect revenue to reach $50bn by the end of 2025, with an average 12-month price target of $90.

Dell Technologies

Dell‘s (NYSE: DELL) a well-recognised name in the tech world, providing a broad range of IT products and services. The multinational tech giant sells everything from personal computers and servers to storage systems and networking products. Its varied customer base includes individual consumers, small businesses and large enterprises.

The stock currently trades at around $100 a share, up 410% in the past five years. Lately, performance has been underwhelming, with the stock down 44% from its May 2024 all-time high of $180.

Despite moderate revenue growth, it has struggled recently with declining profit margins. This has been attributed to the high costs associated with artificial intelligence (AI) server components like Nvidia GPUs. Competition from other major players in the AI-server market is also threatening its market share and profitability.

In its fiscal fourth quarter ended January, Dell reported an 18% increase in adjusted earnings of $2.68 per share and a 7% revenue increase to $23.93bn. This surpassed earnings expectations but fell short of sales projections.

Demand for AI infrastructure has been a key driver of growth recently, with Dell enjoying significant interest in its servers and networking segment. Reports indicate the company’s AI server backlog is around $9bn.

The growth’s reflected in its annual cash dividend, which climbed 18% this year, supported by a $10bn share buyback programme. These developments reinforce the company’s commitment to returning value to shareholders.

Analysts are overwhelmingly optimistic about the stock, expecting an average 36.5% increase in the coming 12 months.

Of course, there are plenty of other passive income opportunities to explore. And these may be even more lucrative:

How to generate income with fixed-interest investments

Story by Max King

How to generate income with fixed-interest investments

© Getty Images

With UK interest rates down to 4.5% and likely to fall further, it is becoming increasingly difficult to earn more than 4% from a deposit account. Inside a cash ISA, there is no tax to pay on interest income, but the chancellor is reported to be keen to chip away at the £50 billion locked up in them, ostensibly to encourage investors to shift into risk-taking assets, but more probably to generate extra tax revenue. What are the alternatives?

There are plenty of conventional investment trusts, especially those investing in UK shares, yielding over 4%, but many investors will not want the stock market risk. For them, Stifel, an investment bank and brokerage, has compiled a list of 33 relatively liquid “alternative funds” yielding between 4% and 15%, generated from what should be more predictable streams of income.

“A cynic would argue that these yields indicate the market is expecting many dividends to be cut,” it points out, “but many of these high yields have arisen due to sharp falls in share prices over the past year”, which is not exactly reassuring for those wanting to avoid risk to their capital.

“However, those now trading on wide discounts to net asset value [NAV] should have more upside than downside,” especially as “many of the funds have set modestly increased dividend targets for 2025 and projected dividend covers, based on revenues after deducting expenses, typically ranging from 1.1 times to 1.3 times.”

The leading investment trusts.

These include a number of funds investing in fixed interest, including the £300 million CQS New City High Yield Fund (LSE: NCYF), trading on a 6% premium to NAV and yielding 8.7%. It invests in high-yielding corporate bonds, which implies high risk, but the manager, Ian Francis, has delivered strong returns for 17 years by focusing on capital preservation, helped by an experienced team of analysts at Manulife CQS, the management company.

Strong performance (11% over one year, 25% over three and 42% over five), and the consequent premium to NAV, has enabled the fund to grow through share issuance (£13.3 million in the last year), although this has always been conservative to prevent the size of the fund swamping the opportunities.

Dividends have risen every year for 16 years, although the rate of increase has slowed to a snail’s pace in the last five years. Most importantly, the fund succeeded in generating positive returns in the last half of 2024, a difficult time for bonds generally, suggesting that it will continue to do so even if ten-year gilt yields head up to 5%.

TwentyFour Income Fund (LSE: TFIF) and TwentyFour Select Monthly Income (LSE: SMIF) have also performed well. TFIF, with £845 million of assets, has returned 15% over one year, 32% over three and 49% over five, while SMIF (£240 million of assets) has returned 17%, 28% and 40%. Their shares trade on a small discount and small premium to NAV respectively and yield 9.1% and 8.5%.

The key to TwentyFour’s success, says manager George Curtis, is “avoiding the accidents”. The investment-trust structure means that “managers are not forced to sell at times of crisis” and “enables us to take advantage of the premium return from illiquidity by investing in less liquid securities”. But the golden rule is “getting your money back by minimising defaults”.

TFIF doesn’t invest in bonds, but in “a diversified portfolio of predominantly UK and European asset backed securities”. Nearly half of the portfolio is in “mortgage backed securities”, mostly residential. Banks package together a large number of mortgages and then turn the package into tradable securities, injecting bank debt to raise returns. The top tier is prioritised in a return of capital while lower tiers are progressively riskier, but have higher coupons.

TFIF also invests in securities based on car loans, consumer loans and “collaterised loan obligations” (nearly 40% of the portfolio), which uses the same process to turn bank loans to companies into tradable securities. About 20% of the portfolio is “investment grade” (lower risk), 46% sub-investment grade (higher-risk, but above junk) and 33% is not rated, which means there is no independent review of the riskiness of the securities.

Around 36% of SMIF’s portfolio is invested in asset-backed securities, but most of it is in “subordinated” bank and insurance-company debt, meaning that it is a lower priority for repayment than other types of debt, thereby providing banks and insurance companies with an additional buffer to share capital in the event of a crisis. Slightly more of its portfolio (30%) is made up of investment-grade debt; 60% consists of sub-investment grade (but above junk) paper and 10% is “not rated”.

While TFIF invests in floating-rate debt and so has no exposure to changes in interest rates, SMIF invests in fixed-rate securities, but with short lives – nearly 90% repay within five years. This all sounds risky, but Curtis points out that the balance sheets of banks and insurance companies are “very strong”, while yields have tightened, “but are still well above those in 2021”. In the personal sector, “unemployment and divorce are the key factors behind defaults”. He notes that “economies have been resilient to higher rates and defaults have remained low. Interest rates in the UK are expected to flatten out at 4%, so it should be pretty easy to maintain 8% returns”.

Less risk, lower returns

Those who are more risk-averse can still earn 8.9% from the £140 million M&G Credit Income Investment Trust (LSE: MGCI), although a portfolio yield to maturity of 7.8% means that it dips into capital to pay the dividend. Like TwentyFour, it invests in “private, semi-liquid assets, mostly held until maturity”, but at least 70% of its portfolio has to be investment grade (the current proportion is 77%). The trust is seeking to raise another £30 million.

MGCI’s lower risk means that its returns have also been lower; 8% over one year, 20% over three and 28% over five. The returns from the Invesco Bond Income Plus Trust (£350 million of net assets) at 9%, 14% and 24% are lower still, as is the yield of 6.8%, but it invests in a “very liquid” portfolio of listed bonds, which reduces the complexity of the portfolio, if not the risk: 70% of the portfolio comprises sub-investment grade paper.

As with the other funds, investing in a portfolio of seemingly low-quality bonds and credit has turned out not to have been nearly as risky as might have been expected. The global financial crisis of 2008-2009 was a shock to the credit-rating agencies who have learned to be a lot more cautious in their assessment of risk – just as the issuers of bonds and loan securities (and, behind them, people and businesses) have learned to be far more prudent.

The result has been that just as government bonds came to be, and probably still are, systematically overvalued, nominally higher-risk fixed-interest investments have been, and remain, undervalued.

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by M&G Credit Income. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

MGCI’s high yield and strong returns have led to a premium rating…

Overview

M&G Credit Income (MGCI) is a highly flexible fixed-income fund which delivers a very high yield without taking the credit risk, duration risk, or gearing that is usually used to achieve this. The historic yield is 8.2% at the time of writing, achieved from a portfolio of investment-grade quality on average, a duration below one, and no Gearing.

Manager Adam English invests across public and private debt markets, aiming to deliver an attractive yield with low NAV volatility. In recent months he has been reducing credit risk in the portfolio, taking the view that it is not being fairly compensated. He is parking funds in liquid ABS funds of high credit quality and looking for opportunities to reinvest in attractively priced assets.

Currently, the private assets pipeline looks particularly promising, and it may be that is where Adam looks to boost the yield and take on more risk as the year progresses . Private assets are usually only accessible to institutional investors and offer high yields for those able to do the research required to invest. MGCI brings these opportunities to the retail market, facilitated by the expansive credit teams at M&G.

MGCI has delivered strong returns in the last two years and met its Dividend target of SONIA plus 400bps. This has contributed to a premium rating and the board has struggled to issue enough shares to keep a lid on it. A recently completed placing and retail offer saw demand for an additional 6.5m shares which listed this week, or around 4% of the share capital before the raise.

Analyst’s View

We think MGCI is an attractive long-term holding for an income-seeking investor. A yield around full four percentage points higher than the base rate and therefore the typical cash rate is likely to be very good whatever that base rate is. Whilst spreads can vary over time, this is on average likely to be the sort of yield available from high yield, whilst it is achieved with a portfolio of much higher credit quality which should keep losses to default and credit events to a minimum. Meanwhile, the volatility of the NAV should be lower thanks to the low credit risk and very low duration. Investors do forego the potential for sharp capital returns in higher-yielding bonds or those with higher duration when the relevant conditions apply, but we think this is an easy sacrifice for the income investor who will most likely be more worried about limiting the potential for capital losses.

Currently, the picture for fixed income is mixed. We are expecting modest rate cuts in the UK and EU over the year which should boost prices and be good for the affordability of corporates with debt. However, these cuts are expected due to a weakening of the economy which means inflation is slowly falling and rate cuts may be needed to stimulate activity. These factors are all bad for credit. Adam’s relatively cautious stance makes sense in this environment, in our view, and it is notable that he can go defensive whilst still yielding just under 8% on his portfolio.

Cash for re-investment tomorrow, most probably into NESF.

Current yield 12.3%.

Note: the yield you receive will be the blended yield of your buying price, so with NESF the current yield for the Snowball is 10%, which will gently increase when/if the new shares are purchased.

Over the past 12 months, the prices of these FTSE 250 renewable energy stocks have fallen 4%-10%. Our writer looks at what’s going on.

Posted by James Beard

BSIF FSFL

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

Despite the heightened interest in renewables, since March 2020, the FTSE 250’s three solar energy funds have under-performed the wider market. As a result, they now trade at a significant discount to their net asset values And their yields are all close to — or in excess of — double figures.

Difficult times

The directors of Foresight Solar Fund (LSE:FSFL) are particularly frustrated at the failure (as they would see it) of investors to recognise the underlying value of its assets. They are now considering various strategic options and recently said: “The Board is of the view that consolidation is likely to be a major feature in the sector in the year ahead.”

Some of the sector’s recent problems can be blamed on a relatively low level of irradiation. In 2024, Foresight said the UK experienced the lowest number of hours of sunshine since 2013, which meant its portfolio generated 7% less electricity than budgeted.

To try and mitigate against volatile earnings, the fund has hedged 88% of anticipated revenues for 2025 at a price of £86/MWh. As for 2026, 69% of expected income has been fixed at the same price.

Borrowing costs also appear to be weighing on the solar industry.

At 31 December 2024, Bluefield Solar Income Fund had total debts of £566m. That’s 6% more than its current market cap (£534m). I think it’s fair to say that interest rates haven’t fallen as quickly as most would have expected. This means the fund’s borrowing costs are higher than anticipated. And this makes the return from solar assets less attractive than anticipated, contributing to its shares trading at a discount.

Bluefield’s directors say “something needs to change” and have launched a “Perception Study with many of the larger shareholders, to assess their views and reflect on the way forward”.

Currently, NextEnergy Solar Fund trades at the biggest discount.

But on the positive side, its falling share price means the stock’s now yielding 12.4%. Since listing in 2014, it’s increased its dividend every year. Of course, there are no guarantees when it comes to payouts. However, these types of funds generally have steady and predictable payouts. The long-term nature of their contracts and their ability to hedge future prices gives them a greater certainty over their income than businesses that are dependent on more conventional markets where consumers tastes can change at short notice.

| Metric | Foresight Solar Fund | Bluefield Solar Income Fund | NextEnergy Solar Fund |

|---|---|---|---|

| Current share price (pence) | 79.7 | 90.2 | 67.8 |

| Discount to net asset value (%) | 29.1 | 28.4 | 30.8 |

| Dividend – last 12 months (pence) | 8.0 | 8.8 | 8.4 |

| Yield (%) | 10.0 | 9.8 | 12.4 |

| Group debt (£m) | 272 | 566 | 333 |

| Market cap (£m) | 444 | 534 | 388 |

Source: London Stock Exchange / company reports

Valuing unquoted assets, like solar farms, is subjective. Small changes to modelling assumptions can lead to large variations in valuations. However, even allowing for a large margin of error, the current discounts on these three funds seem excessive to me.

But it does appear as though the sector has fallen out of favour with investors. A combination of higher power prices and lower interest rates is probably what’s needed to get their share prices moving in the right direction. And there’s no guarantee that this will happen. However, as long as they are aware of these risks, income investors could consider all three for the generous yields that are currently on offer.

Income Portfolio

| Fund | Ticker | Allocation | initial price | current price | gain |

| JPMorgan Global Growth and Income | JGGI | 20% | 4.88 | 6.02 | 23.36 |

| Murray International | MYI | 20% | 2.37 | 2.62 | 10.55 |

| North American Income | NAIT | 10% | 2.64 | 3.38 | 28.03 |

| Ecofin Global Utilities | EGL | 10% | 1.52 | 1.78 | 17.11 |

| Invesco Bond Income Plus | BIPS | 10% | 1.62 | 1.71 | 5.56 |

| BioPharma Credit | BPCR | 10% | 0.828 | 0.858 | 3.62 |

| HICL | HICL | 10% | 1.3 | 1.11 | -14.62 |

| TwentyFour Income | TFIF | 10% | 1.01 | 1.066 | 5.54 |

These three bits of nonsense are often trotted out to investors aiming for passive income from an ISA. Now they’re all squashed.

Posted by

Alan Oscroft

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Passive income from stocks and shares sounds great, right? But so many naysayers trot out all the reasons why it will only ever be a pipe dream.

I can’t cover all their claims. But today I want to stomp on a few common ones.

Some passive income ideas might indeed cost big money to set up. Rental real estate is a common one, but that means having enough cash for a property or taking out a big mortgage. Actually, even that might not be true, and I’ll come back to it.

The stock market’s just for well-healed investors, yes ? Well, no. I’ve just done a quick online search. And I see with a Stocks and Shares ISA from AJ Bell, we can invest as little as £25 monthly or make a one-off £250 transfer. That’s not unusual and it’s not a recommendation, it’s just the very first one I found.

Other ISA platforms are similar. As well as costing very little to get started, they’re easy to open. The more we can invest, the better we’re likely to do. But we really can start with modest amounts of money.

The thought of putting our money into a company that goes bust is scary. It can happen, but we can greatly reduce the risk.

All we need to do is consider shares in a stock market tracker, like the iShares Core FTSE 100 UCITS ETF

Myth 3: It takes talent

Stock market investing has long been shrouded in mystery. We have to understand all sorts of big words and do complicated financial sums to have a clue, don’t we? Well, that myth has also been shattered these days. I think it’s pretty clear that investing in a simple tracker fund doesn’t require egg-head brains.

Considering investment trusts, which spread out cash using specified strategies is a common next move. Want income from UK dividend stocks? Look for one that does that. No genius required. Oh, remember that thing about real estate income? There are investment trusts that do that too.

And there’s a bonus — the more we widen our investing horizons, the smarter we can get at it.

Patria Private Equity and Foresight Solar have increased their dividends for 10 consecutive years.

News editor, Trustnet

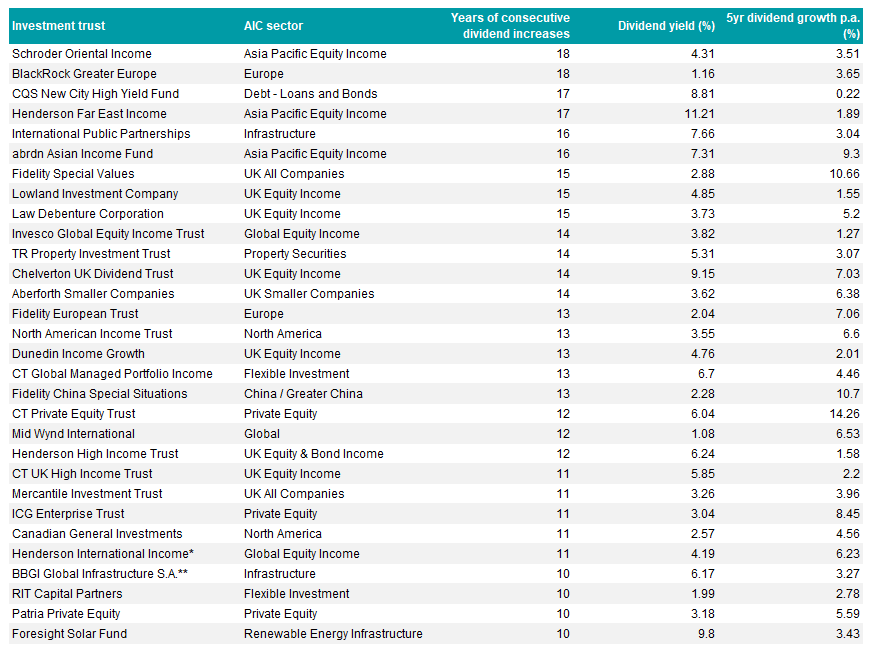

Patria Private Equity and Foresight Solar have joined the Association of Investment Companies’ (AIC) list of next generation dividend heroes – trusts that have grown their annual dividends for 10 or more consecutive years but fewer than 20.

Schroder Oriental Income and BlackRock Greater Europe lead the 30-strong list with 18 years of growing payouts. In two years’ time, they will qualify to join the ranks of the full-fledged dividend heroes.

Hot on their heels are CQS New City High Yield and Henderson Far East Income, with 17 years of unbroken dividend increases, followed by International Public Partnerships and abrdn Asian Income Fund, with 16 years.

The next generation of investment trust dividend heroes

Source: Association of Investment Companies, Morningstar. Data as at 20 Mar 2025. *A merger between Henderson International Income and JPMorgan Global Growth & Income has been proposed. **A cash offer for BBGI Global Infrastructure S.A has been proposed.

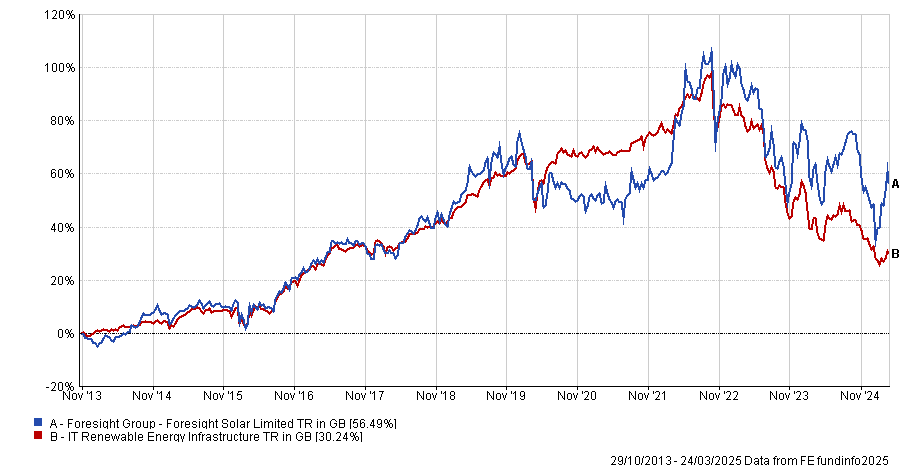

Foresight Solar has a 9.8% yield – the second-highest amongst the next generation dividend heroes – and over the past five years it has grown its dividend by an average 3.4% per annum. Since Foresight Solar listed in 2013, its dividend has grown by 35% (including the 2025 target).

Lead fund manager Ross Driver said: “Our operational portfolio will continue to produce steady, reliable income from the sale of electricity to the grid. We have a dedicated team to monitor and manage our solar farm assets and ensure they’re producing in the most efficient way.”

The trust has delivered solid long-term performance but made an 11.4% loss over three years to 24 March 2025 in total return terms. The whole IT Renewable Energy Infrastructure sector has struggled during the past three years due to higher interest rates and selling pressure, with an average loss of 28%.

Performance of trust vs sector since inception

Source: FE Analytics

“Our strategy has evolved to adjust to the new post-pandemic reality of higher interest rates,” Driver said.

“To amplify returns, we’re building a development pipeline of solar and battery storage projects that allows us to deliver an additional element of growth on top of the regular income provided by the operational portfolio – improving performance over time.”

Foresight Solar had a market capitalisation of £435m as at 31 December 2024 and was trading on a 31.4% discount to its net asset value of £634m.

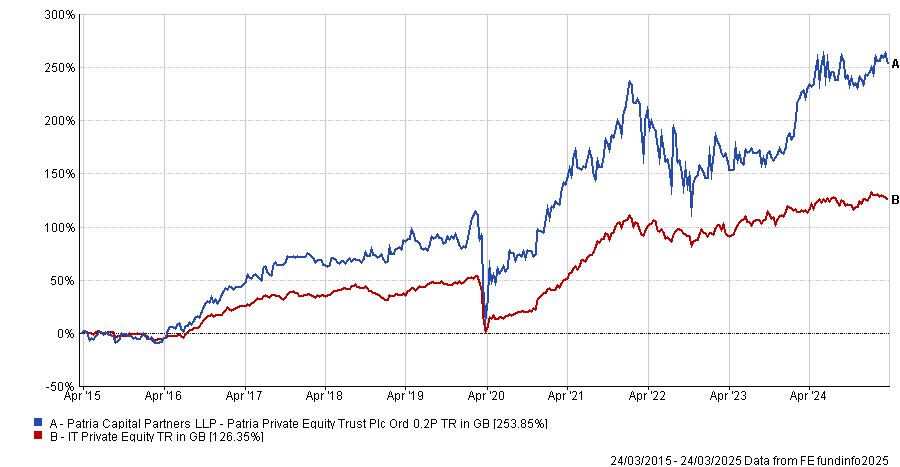

The other new entrant, Patria Private Equity Trust (PPET), was run by Aberdeen until it sold its European private equity business to Patria Investments last year. The trust allocates to mid-market private equity funds run by external managers and also invests directly in private companies, alongside these managers.

It has a market cap of £828m and a 3.2% dividend yield, and was trading on a discount of 29.9% as of 24 March 2025. PPET is the third-best performer in the IT Private Equity sector over 10 years.

Performance of trust vs sector over 10yrs

Source: FE Analytics

Lead fund manager Alan Gauld said: “Historically, there has been a debate over whether private equity trusts should be purely about capital growth or not. However, the board of PPET has consistently prioritised returning cash to shareholders. Having a consistent dividend policy has helped build trust with PPET’s shareholders.

“PPET’s portfolio is well diversified and generates a consistent cash yield, usually around 20% of opening NAV per year. As such, this allows PPET to comfortably support a growing dividend. The board’s strategy in recent times has been to at least maintain the value of the dividend in real terms. This has resulted in 5% growth in dividend in 2024 and 11% growth in 2023.”

More than half of the 30 next generation dividend heroes have yields above 4%, which illustrates the advantages of investment trusts for income seekers, said Annabel Brodie-Smith, communications director of the AIC.

“Investment trusts are able to smooth dividends over time because they can hold back income from their portfolio and use this to boost dividends in leaner years. They can also pay income out of their capital profits and their structure is particularly suitable for high yielding hard-to-sell assets, such as infrastructure and property,” she said.

Matt Ennion, head of investment fund research at Quilter Cheviot Investment Management, said the key thing for investors to watch out for is whether the dividend is a natural output of a trust’s investment strategy. A sustainable, growing dividend that is well covered is a good thing for investors, especially if the trust can maintain the dividend through downturns such as the Covid pandemic.

However, the potential problem with getting onto the dividend hero list is when a trust becomes desperate to keep growing its payout and potentially has to use capital to increase its dividend, he warned.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑