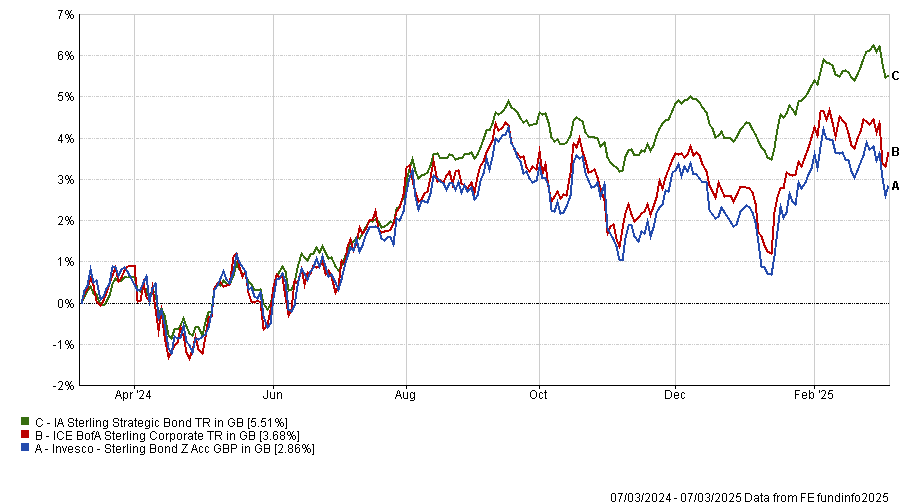

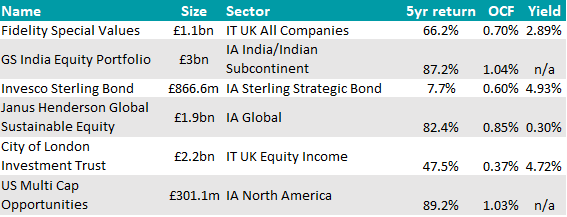

Interactive investor’s six ISA picks for all tastes

11 March 2025

The platform suggests six funds in six different sectors.

By Matteo Anelli

Senior reporter, Trustnet

Some investors can stomach risk in search of the best returns while others will want to protect their cash while eking out reasonable gains. Then there are those in the middle, who want the best of both worlds. Each investor has different needs and different fund-shaped holes in their portfolios to fill.

As such, below, the analysts team at interactive investor shares its top ISA picks across different investment styles, including growth, income and sustainable options – with the reminder that the end of the tax year on 6 April coincides with the reset date of the £20,000 ISA allowance, which will be lost unless put to use before then.

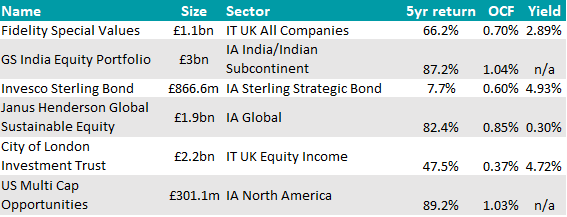

The risk-on option

We begin with an adventurous pick from senior investment analyst Alex Watts, who chose the Neuberger Berman US Multi-Cap Opportunities fund. This should appeal to investors who find the concentration of the US market disconcerting and are looking to capitalise on opportunities beyond the small set of ‘Magnificent Seven’ names running the market.

Although manager Richard Nackenson does invest in Microsoft (5.4%), Apple (4.8%) and Amazon (3.4%), the portfolio’s 45 holdings are chosen independently of any index, with an emphasis on cashflow and capital allocation decisions.

This approach has put the fund in the third quartile of the IA North America peers over the past 10, five and three years, but it has improved over the past 12 months when it rose to the second quartile with an 11.1% return.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“The fund is unconstrained in being able to seek opportunities from large and mega-caps down to small-caps. While still able and willing to selectively invest in mega-cap stocks, the portfolio also houses businesses of varying scale and from a diverse and differentiated set of sectors to capitalise on the breadth of the US market,” Watts said.

“The manager doesn’t have to conform to any one investment style. Rather, the portfolio comprises stocks defined as special situations, opportunistic or classic, making for a fairly stylistically neutral portfolio and a differentiated exposure compared with the fund’s S&P 500 benchmark.”

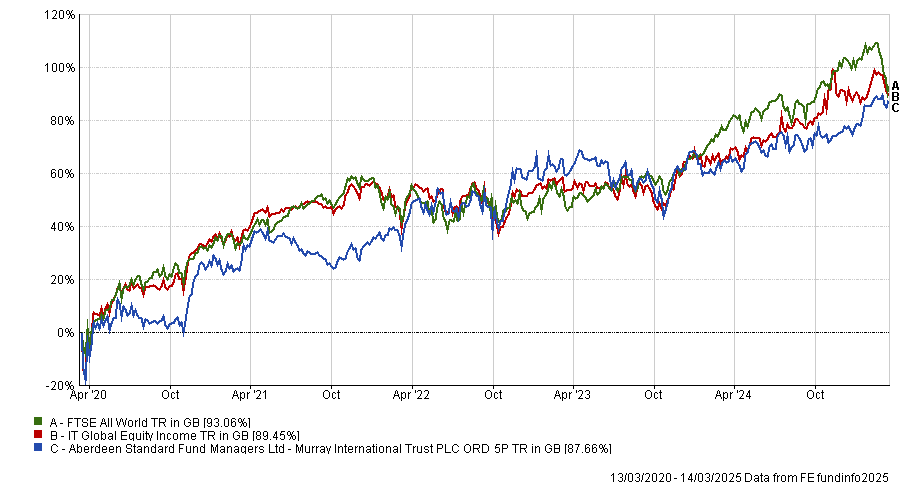

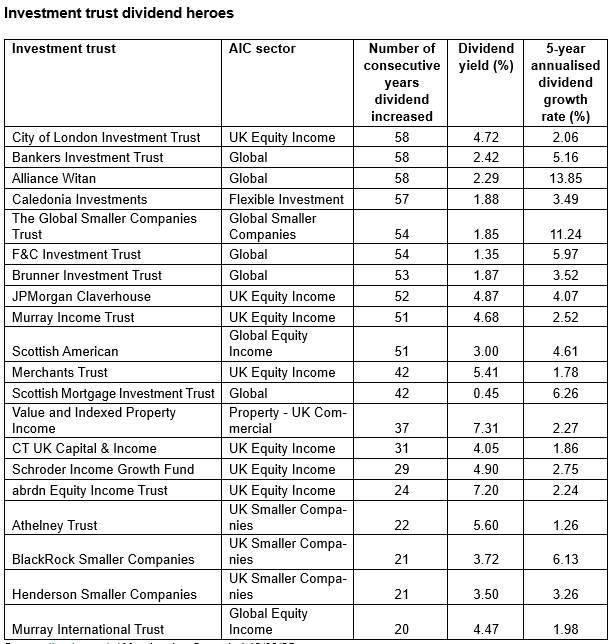

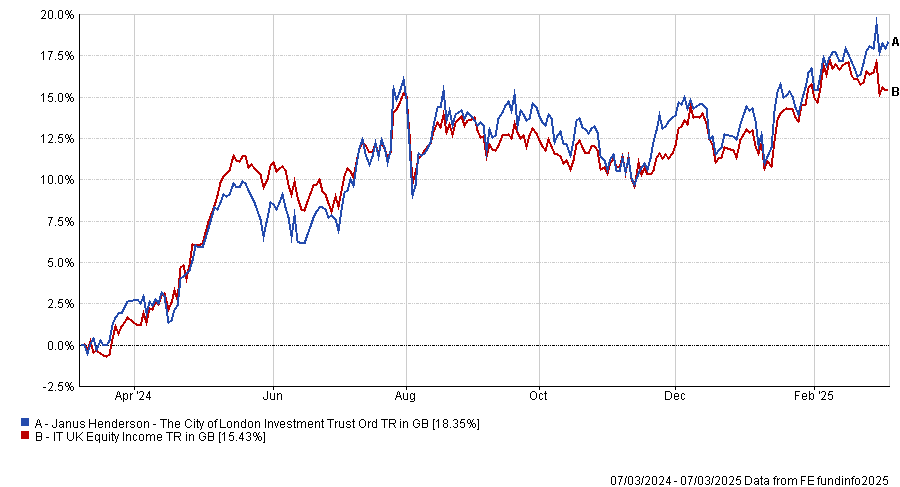

For income seekers

Fund analyst Tom Bigley picked City of London, an investment trust conservatively run by Janus Henderson’s Job Curtis, who aims to provide long-term growth in income and capital by mainly investing in FTSE 100 companies.

Bigley mainly liked Curtis’ approach, focusing on well-managed companies that commit to their dividends. This has helped the trust to consistently increase its dividend every year since 1966. The current yield is 4.72%.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“Curtis is a cautious, mildly contrarian investor who doesn’t ignore the macro picture, but primarily focuses on bottom-up analysis. Cash generation and physical assets are important elements, but the primary focus is dividend yield as a measure of value,” Bigley said.

“The use of reserves demonstrates the benefit of the investment trust structure to smooth income volatility over time,” he continued. “Over the long term, returns have been solid, but arguably a bigger attraction is that the trust is a consistent dividend payer.”

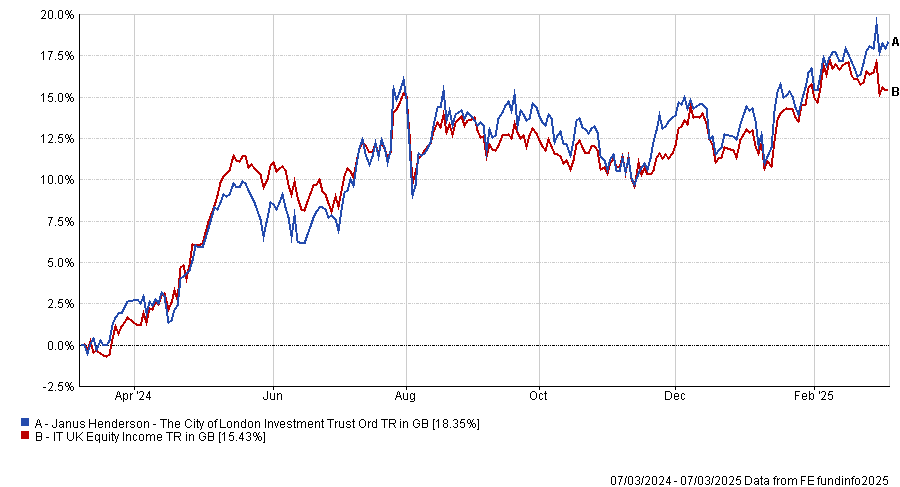

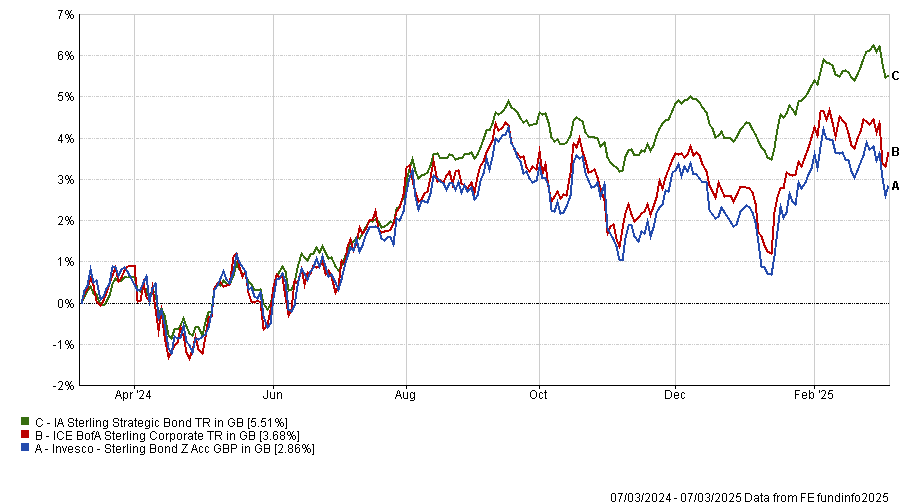

For fixed-income exposure

Geopolitical tension, persistent inflation and concerns regarding government spending across developed economies all have contributed to government and corporate bond yields remaining high in 2025.

Investors who wish to take advantage of the attractive income on offer in the UK may consider the Invesco Sterling Bond fund, recommended by Watts.

It has been managed by FE fundinfo Alpha Manager Michael Matthews since 2006, with Tom Hemmant joining him as co-manager in November 2023. They invest heavily in bonds issued within the financials sector, with around 40% of the portfolio held in bonds issued by banks and insurers, then followed by utilities and telecoms.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“The team invests flexibly across sterling investment grade bonds but can also allocate to some bonds below investment grade, including subordinated debt. The managers look both at the fundamentals underlying an issuing company and take a top-down view to guide positioning,” Watts said.

“The fund’s yield of around 4.8% is attractive and Matthews’ approach has been well proven, with total returns over the long-run being impressive versus both peer group and the fund’s benchmark.”

For fans of the domestic market

Despite lagging for many years, UK equities have made an “impressive” start to 2025, Bigley said. If they continue to display some resilience, an allocation to the UK “could stand to benefit investors”.

Cheap companies due a change in fortune are the remit of the Fidelity Special Values Investment Trust, managed by Alpha Manager Alex Wright and co-manager Jonathan Winton.

They invest in companies trading at lower multiples where the market is yet to realise their potential, a bias that makes the FTSE 250 Wright’s main hunting ground. Currently, the allocation to small and mid-cap stocks is just over two-thirds of the portfolio.

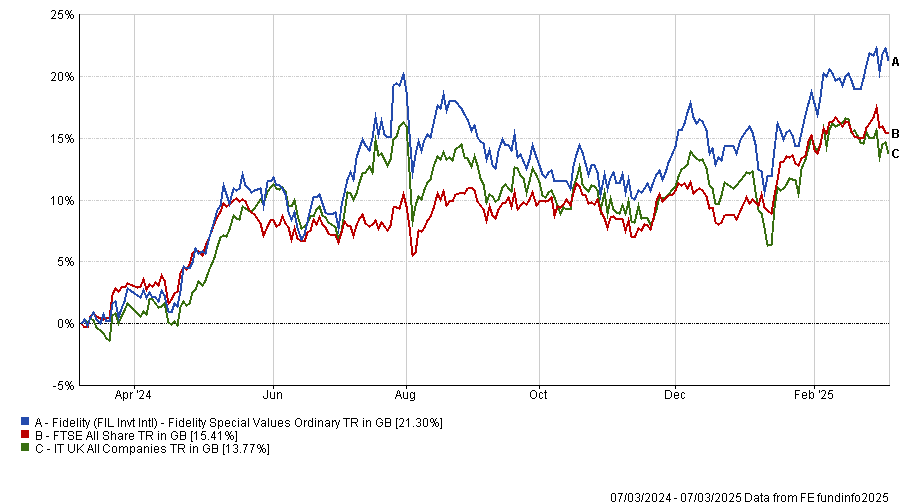

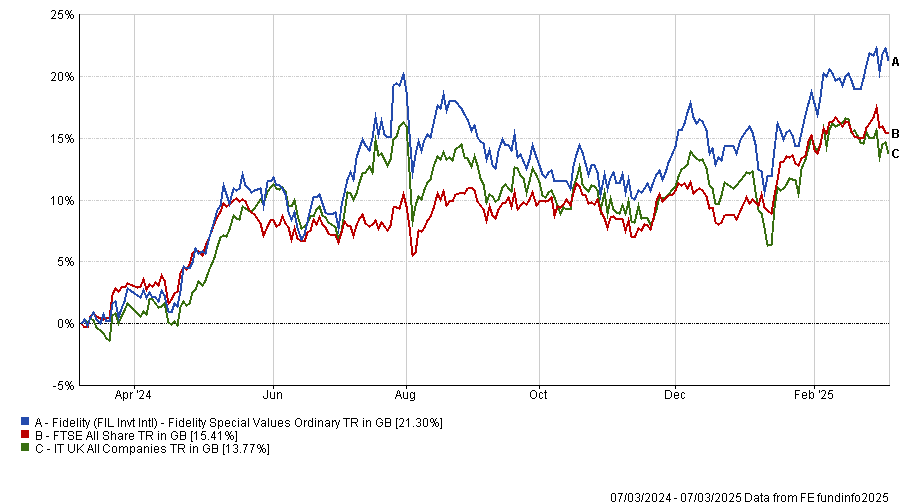

Performance of fund against index and sector over 1yr

Source: FE Analytics

Performance-wise, the fund has been at the head of the five-strong IT UK All Companies sector across all main timeframes but, despite its strong track record, it is trading on a discount of more than 6%, which Bigly said is an attractive entry point to investors.

In emerging markets, India is the winner

Bigley preferred India over China in emerging markets as, over the past decade, the Indian economy and stock market have seen substantial growth, although it has pulled back in recent months.

The analyst’s pick in the sector was the Goldman Sachs India Equity Portfolio, a “well-diversified, multi-cap portfolio” with a bias towards the small and mid-cap space. The vehicle is “a good way to gain exposure to the region” and to benefit from the “highly experienced” Alpha Manager Hiren Dasani, who favours businesses with strong competitive advantages and low or decreasing competition.

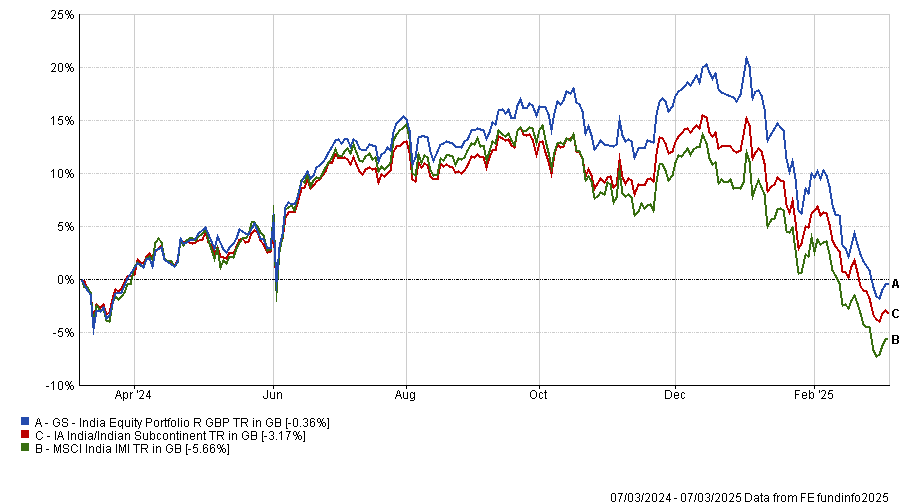

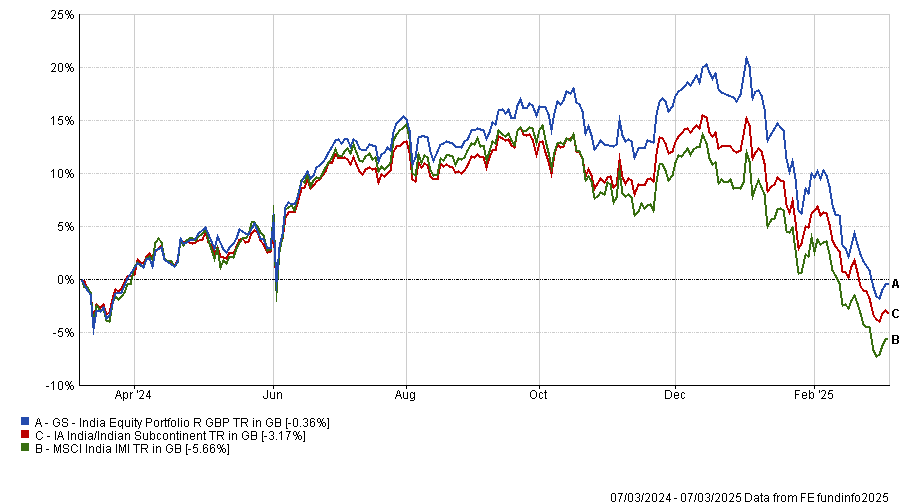

This philosophy delivered strong performance consistently, outperforming the MSCI India IMI index in four of the past five calendar years as well as over five and 10 years.

Performance of fund against index and sector over 1yr

Source: FE Analytics

One key selling point for Bigley was company meetings, which are “a crucial part of the process”. He said: “The fund management team’s ability to meet companies on the ground in India differentiates it from many competitors”.

The sustainable option

Managed by Hamish Chamberlayne with a “disciplined” investment process and sustainability focus, the Janus Henderson Global Sustainable Equity is a “compelling” choice for investors looking to expand their core global equity exposure, said Bigley.

The fund aims to provide capital growth over the long term by investing in companies whose products and services contribute to positive environmental or social change. The portfolio of 50 to 70 stocks employs a growth-at-a-reasonable-price (GARP) strategy and is expected to show persistent biases to growth and mid-cap stocks relative to mainstream indices and, at the sector level, to favour technology and industrials.

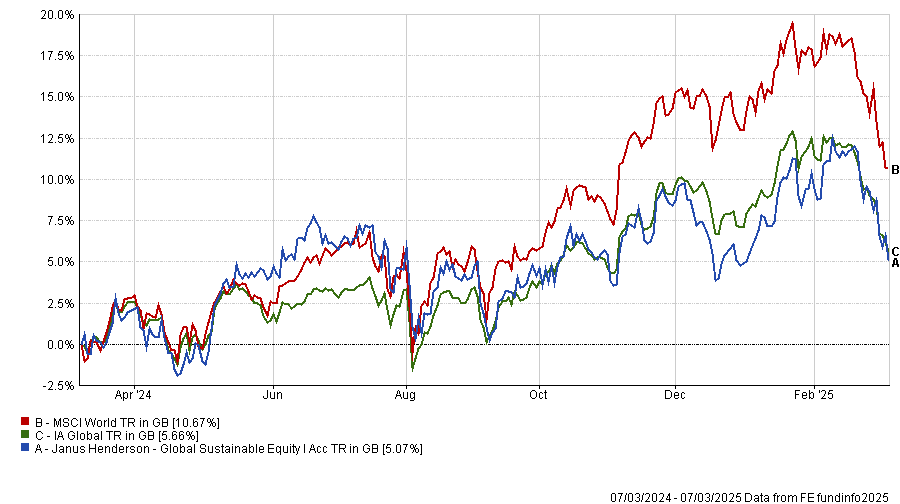

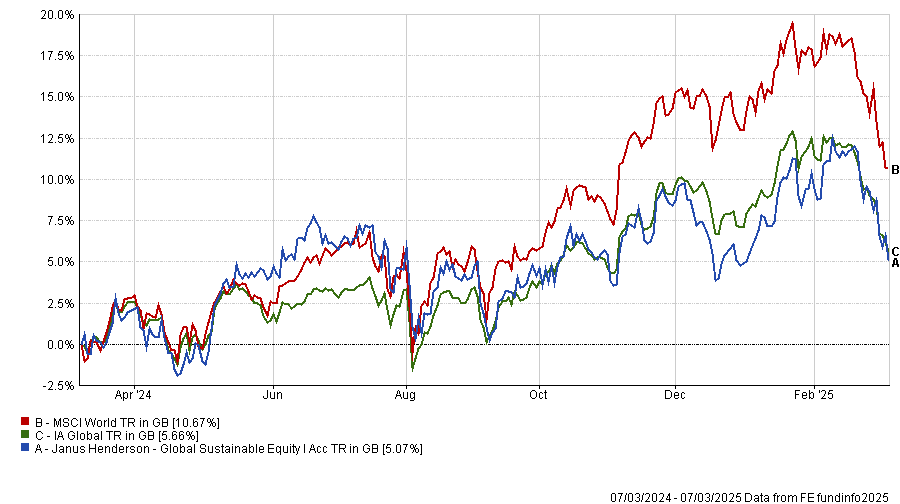

Like many environmental, sustainability and governance (ESG)-focused investments, it has suffered in recent years but the longer-term track record is strong, with top-quartile returns over 10 years and second-quartile performance over half a decade.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“Sustainability is central to the process. For a company to be considered eligible at least 50% of their revenues is required to be aligned with the team’s 10 positive impact themes, which are mapped to the UN Sustainable Development Goals,” said Bigley. “This results in a subset of companies with long-term compounding characteristics and support from structural growth drivers.”

Source: FE Analytics