Investment Trust Dividends

Shift from offices to logistics and residential helps this trust thrive

Anthony Leatham

26 June 2025

Questor is The Telegraph’s stock-picking column, helping you decode the markets and offering insights on where to invest.

As with so many other asset classes, the real estate market took fright in 2022. In just two months, the index tracking real estate equity trends fell sharply, down 33pc between August and October of that year.

While it has since staged a recovery, up 45pc from its lows, the sector has been on a volatile journey.

However, in spite of the macro-economic headwinds of recent years, we see an important positive inflexion point for pan-European listed real estate – and know how investors can profit from it.

TR Property Investment Trust offers access to a portfolio of UK and European real estate securities, as well as investments in the bricks-and-mortar properties themselves.

The trust has focused solely on property investing for more than 40 years and aims to pay investors an income while compounding their capital growth.

It is managed by a highly experienced team led by Marcus Phayre-Mudge and, under his stewardship, the trust has consistently outperformed its market benchmark with about 2pc annualised outperformance over the past five years.

Marcus Phayre-Mudge brings a wealth of experience and a disciplined investment approach. His focus on bottom-up analysis and stock selection, combined with a deep understanding of macroeconomic trends, has enabled the trust to navigate volatile markets effectively.

The manager’s emphasis on balance sheet strength, dividend sustainability, and management quality helps to ensure that the portfolio remains resilient even during periods of economic uncertainty and, importantly, captures the market rebound.

The portfolio is diversified across geographies and sectors, with significant allocations to logistics, residential, shopping centres and office properties.

As of the end of May 2025, the trust’s largest were to the UK, France, and Sweden. Top holdings include Vonovia, a specialist in German residential and one of the largest real estate companies in continental Europe by market capitalisation; TAG Immobilien, a residential company, with a portfolio of about €6.5bn (£5.5bn) split between Germany and Poland; and Picton Property Income, a diversified UK Reit with a weighting towards UK industrial. This reflects a strategic tilt towards high-quality, income-generating assets with strong fundamentals.

The trust’s physical property portfolio, though a smaller component at about 5pc of net asset value (Nav), provides additional diversification and income stability.

In our view, what sets this company apart is its active management style and the ability to adapt to changing market conditions.

The trust has demonstrated a strong track record of identifying undervalued opportunities and capitalising on structural trends such as urbanisation, e-commerce and demographic shifts.

Its flexible mandate and the closed-end structure allow it to adjust sector and geographic exposures dynamically, enhancing its ability to generate outperformance. In addition, “animal spirits” have returned to the market over the past few years, and the trust is well-placed to be a beneficiary of this phase in the property cycle.

Recent portfolio activity includes selective additions to logistics and residential names, reflecting the manager’s confidence in these sectors’ long-term prospects. The trust also reduced exposure to office assets in weaker locations, aligning the portfolio with evolving tenant preferences and hybrid working trends.

Looking ahead, potential catalysts include a stabilisation in interest rates, improving rental growth and continued consolidation within the pan-European property sector.

The trust has a long-standing commitment to delivering income to shareholders. For the year to the end of March 2025, it declared a total dividend of 15.9p per share, representing a 1.3pc increase from the previous year.

It currently yields 4.7pc and this dividend has grown every year since 1996 (excluding 2010 where it was held unchanged) and boasts an annual dividend growth rate of 8pc over the last decade.

In terms of valuations, the trust is trading at a discount to net asset value, currently about 9pc, which we think presents an attractive entry point for investors.

As market sentiment improves, there is scope for this discount to narrow, providing additional upside. The valuation of the pan-European property equity market has bounced off its post-global financial crisis discount levels but, even though Navs are rising, the ratings are still dislocated.

Listed real estate share prices continue to be driven by interest rates and movements in the yield curve, and in Britain, a pick-up in transaction activity points to some green shoots of recovery, as well as much-needed price discovery.

In this column’s view, there is an attractive valuation opportunity in listed real estate. Merger and acquisition activity will probably remain elevated and the market is likely to continue rewarding the winning sub-sectors and quality growth companies, but dispersion is also likely to remain high. At the risk of stating the obvious, the outlook should only improve further if the future path of interest rates is downward.

Questor says: buy

Ticker: TRY

Share price at close: £3.37

The strong recent performance of Ecofin Global Utilities and Infrastructure Trust (EGL) has continued into 2025. Despite market volatility, manager Jean-Hugues de Lamaze delivered 7.1% NAV total return growth for the six months to 31 May. This was well ahead of the two most relevant utilities and infrastructure indices, as well as UK equities, and only a little behind global equities as measured by the MSCI World Index. At 12.3%, share price total return performance was even better, as EGL’s discount narrowed – a very welcome development for shareholders.

This strong recent performance has been generated through a tactical focus on networks, environmental services and transportation infrastructure as a diversifier. These themes are visible throughout the portfolio, the latter notably in the recent purchase of two airport operators. We believe that EGL offers investors exposure to an attractive portfolio of assets, underwritten by powerful underlying drivers, particularly the growth in demand for energy.

EGL seeks to provide a high, secure dividend yield and to realise long‐term growth, while taking care to preserve shareholders’ capital. It invests principally in the equity of utility and infrastructure companies in Europe, North America, and other developed OECD countries.

| Year ended | Share price total return (%) | NAV total return (%) | MSCI World Utilities total return (%) | S&P Global Infra total return (%) | MSCI World total return (%) |

|---|---|---|---|---|---|

| 31/05/21 | 19.7 | 15.8 | 1.0 | 6.8 | 22.9 |

| 31/05/22 | 28.0 | 26.8 | 22.5 | 26.4 | 8.4 |

| 31/05/23 | (5.2) | (5.1) | (6.9) | (5.4) | 5.2 |

| 31/05/24 | (6.9) | 7.7 | 9.8 | 8.4 | 20.5 |

| 31/05/25 | 21.0 | 12.9 | 11.0 | 13.8 | 7.8 |

Source: Morningstar, Marten & Co

2024 was a very strong year, largely driven by data centre demand due to the AI revolution.

2024 was a positive year for the utilities and infrastructure sectors, largely driven by the US. A strong theme was surging demand for data centres, due to the ongoing take-off of AI, which is highly energy-intensive. The beginning of this theme was arguably the purchase by Amazon Web Services (AWS) of Talen Energy’s Cumulus Data Centre campus in Pennsylvania for $650m. This deal was followed by other mega-deals and a significant re-rating of companies such as Vistra (in EGL’s top 10 – see page 8) and Constellation Energy that stood to benefit from the trend.

The Talen deal was also emblematic in that the data centre’s energy source was the Susquehanna Nuclear Power Plant; use of nuclear energy helps companies like AWS meets their sustainability goals. Nuclear is the only energy source that is both carbon-free and base load – that is, providing a minimum level of continuous supply to ensure the grid can meet constant needs, regardless of variations in overall usage (one of the drawbacks of renewables is that they are, in contrast, intermittent).

We have therefore seen nuclear energy make a dramatic comeback in the US, from being perceived as a technology of the past to being front-and-centre of efforts to meet rising power demand in a sustainable manner. President Biden’s signature Inflation Reduction Act (IRA) significantly boosted the sector through a combination of financial incentives, market stabilisation measures and support for new technologies, helping both existing nuclear power plants and the development of next-generation reactors. In the UK, we have seen the recent government announcement of £14.2bn of public money to build the new Sizewell C nuclear plant.

The first quarter of 2025 saw something of a mean reversion, with retracements in the share prices of those names that had benefitted from the dominant themes of 2024. A key catalyst was the arrival of DeepSeek, a Chinese competitor to US large language models (LLMs) that surprised the market by seemingly matching the performance of the likes of ChatGPT, while using a much lower level of energy. This called into some doubt the assumed future demand for AI data centres, with the need to power them, and the likes of Vistra saw subsequent share price falls of around 25%.

Despite these struggles in the US, European utilities and infrastructure companies at last saw some positive share price performance. Previously, in many cases even multi-year double-digit EPS returns did little to boost shareholder returns. However, for example, E.ON and RWE (both top 10 holdings for EGL) returned 20% and 16% respectively over the quarter. This was helpful for EGL, which, as discussed on page 6, has been increasing European exposure for several months, such that it is now the portfolio’s largest geographic allocation.

Source: Bloomberg, Marten & Co

Thus far in Q2 the positive trend in Europe has continued. However, this time positivity has simultaneously been seen in the US. Vistra, for example, has clawed back all its earlier losses to stand at a higher level than it began the year.

Jean-Hugues puts this turnaround down to the general positive sentiment in the market. Equities (along with currencies and bonds) experienced significant turmoil in the aftermath of President Trump’s “Liberation Day” reciprocal tariff announcements on 2 April. However, his subsequent 90-day pause, followed by the US Court of International Trade’s ruling that many of his announced levies were illegal, has seen equities rebound almost as quickly as they fell, with the S&P 500 now well above its Liberation Day level; a rising tide has lifted all boats.

Energy demand in the OECD has been flat for a quarter of a century, but that is changing.

The past 25 years has been characterised by flat energy consumption in the OECD, the organisation of developed world countries, and indeed falling demand in the UK and Europe. However, there is now a clear upward trend across the Western world, and particularly in the US. There are three principal drivers:

EGL’s manager comments that the underlying growth in demand has been masked by gains from increasing energy efficiency. However, with many of the easier opportunities now exploited, the scope for further efficiency gains is much more limited. At the same time, it is relatively difficult to add new generation capacity, so the transmission and transportation of power is now the vital factor, and new capacity needs to be interconnected. This is very positive for EGL’s portfolio, where transmission and transportation are key themes.

Against this backdrop, companies are benefitting from more predictable contracts. Conventional power generation, typically highly dependent on commodity price fluctuations, has previously accounted for as much as 50% of operating profits, but now a level of 10% is more typical. Those companies that are able to adapt their business model for the energy transition are therefore being rewarded with much more predictable cashflows.

Other recent geopolitical and macroeconomic developments have also been positive for EGL’s universe of companies, albeit in a less direct way. The general increase in defence budgets across the West, driven by Russian aggression and pressure from the Trump administration, will lead to more demand for electricity, and also relevant technological gains. The recent commitment from Friedrich Merz, the new German Chancellor, of €600bn of new infrastructure spending should also have positive spillover effects, particularly for the likes of Vinci (a current Top 10 holding).

The Spanish blackout should act as a wake-up call to governments about the critical importance of energy infrastructure.

On 28 April, Spain and Portugal (along with parts of southern France) were hit with an unprecedented blackout. Spain’s electrical grid experienced the loss of 15 gigawatt (GW) of power, or 60% of its total supply, with immense disruption to transport, telecommunications, healthcare and other sectors. Although the exact cause is still unclear, the blackout highlighted the extreme vulnerability of Spanish connectivity, with only one direct link to France, effectively making it an energy island.

EGL’s manager thinks that the incident should serve to focus the attention of governments and regulators, and act as a wake-up call for the need to incentivise investment in energy network infrastructure, and not just in Spain. The risk of further blackouts is significant. In Germany, wind power is the largest source of electricity production, at 31% of the total. Production is centred in the north of the country, but the south dominates economic activity, so maintaining transmission infrastructure is critical. In the UK, the National Grid warns of the risk of blackouts in winter, and there is also a similar risk in some parts of the US. Jean-Hugues believes that this increased attention should be positive for many of the companies in which EGL invests.

In the past year, the five big infrastructure-focused private equity managers (KKR, Brookfield, Macquarie, Blackstone and BlackRock) have raised more than $100bn of fresh capital, which they will seek to deploy. Jean-Hugues views this as part of a broader trend that has seen private equity paying some of its highest-ever premiums for infrastructure assets. In February, Innergex, a Canadian-headquartered hydro, wind and solar company, was acquired by CDPQ for $10bn at a 58% premium to its previous close. Jean-Hugues says that a deal premium of around 50% is currently typical, against an historic norm around 20-25%.

This all bodes well for investors in listed infrastructure such as EGL, both in terms of the potential for bids for some of its investments, and for the general upward pressure such transactions should have on the prices of listed companies in the sector.

EGL has continued to increase its exposure to Europe at the expense of the US.

There has been a continuation of the shift in EGL’s geographic allocation highlighted in our last note in December. As shown in Figures 2 and 3, the exposure to continental Europe has continued to increase at the expense of North America. Historically, Jean-Hugues’s starting point has been to have a broadly equal split between these two largest geographies within the portfolio, to ensure exposure to all the important themes, and to avoid concentration risk. However, along with market moves in the early months of 2025, when many of the portfolio’s European holdings rallied, the shift also reflects his relative convictions about the two markets.

The US faces major headwinds from the second presidency of Donald Trump, specifically his likely changes to the IRA, which has provided funding for grid modernisation and electrification alongside other incentives. At the same time, Europe had depressed valuations, with numerous companies reporting strong results but not seeing their share prices respond accordingly.

Source: Ecofin Global Utilities and Infrastructure Trust

Source: Ecofin Global Utilities and Infrastructure Trust

The changes to sector allocation, shown in Figures 4 and 5, have been relatively modest since December. The small decrease in renewables and nuclear was due to the sale of NextEra Energy, and the reduction in regulated utilities was due to the sale of Edison International (see below). The new airport purchases saw the transportation allocation increase. These portfolio changes are explored in more detail on pages 8-10.

Source: Ecofin Global Utilities and Infrastructure Trust

Source: Ecofin Global Utilities and Infrastructure Trust

EGL’s investment policy allows gearing of up to 25% and Jean-Hugues uses this flexibly. The level at any one time reflects his current level of conviction. It rose to around 15% at the end of 2024 as opportunities were identified for new purchases and adding to a number of key holdings, both on the grounds of valuation and fundamentals. As of 31 May 2025, net gearing was 15.4%. This provides ample margin to the 25% maximum should a future market event throw up particular opportunities.

EGL has calculated that an impressive average of 170bps of alpha are generated each year for shareholders through gearing; this has remained the case even with the rise in the cost of debt.

Since our last note in December, National Grid has been replaced as the largest holding in the portfolio by E.ON (previously third-largest). RWE is newly in the top 10, replacing NextEra Energy, which was sold. Readers interested in other names in the top 10 should see our previous notes (see page 18 for a list of these).

| Holding | Sector | Country | Allocation 31 May 2025 (%) | Allocation 30 November 2024 (%) | Percentage point change |

|---|---|---|---|---|---|

| E.ON | Integrated utilities | Germany | 5.3 | 4.3 | 1.0 |

| National Grid | Networks/Regulated | UK | 4.8 | 4.7 | 0.1 |

| Vinci | Transportation infrastructure | France | 4.6 | 3.8 | 0.8 |

| Enel | Integrated utilities | Italy | 4.3 | 3.7 | 0.6 |

| Vistra | Integrated utilities | US | 4.2 | 4.6 | (0.4) |

| ENAV | Transportation | Italy | 3.8 | 3.5 | 0.3 |

| Veolia Environnement | Environmental services | France | 3.6 | 3.9 | (0.3) |

| RWE | Integrated utilities | Germany | 3.6 | 3.5 | 0.1 |

| SSE | Integrated utilities | UK | 3.5 | 3.7 | (0.2) |

| Constellation Energy | Nuclear | US | 3.4 | 3.5 | (0.1) |

| Total of top 10 | 41.1 | 39.9 | 1.2 |

Source: Ecofin Global Utilities and Infrastructure Trust, Marten & Co

Source: Bloomberg

RWE is a Germany-based energy generation and trading company with global operations. Historically a coal-heavy utility, it has transformed itself into a clean energy leader. It has a particular focus on onshore and offshore wind, with an installed capacity of 3.3GW at the end of 2024. An additional 4.4GW is under construction, including projects in the UK (Sofia), Denmark (Thor) and the Netherlands (OranjeWind). The company’s flexible generation division is responsible for around a third of EBITDA, through gas, hydro and biomass plants. These are assets that can specifically ramp electricity production up or down quickly in response to changes in demand and supply.

RWE does still have exposure to coal (“phase-out technologies”) but aims to exit the sector entirely by 2030. This is being done in conjunction with the German state; in 2023 the government received an exemption from the EU’s state aid rules to pay RWE €2.6bn for the closure of lignite-powered energy plants in the Rhine region. The company’s nuclear exposure was phased out in 2023, as it was across Germany as a whole.

Jean-Hugues sees RWE as a particularly attractive way to play the looming tightness in the German power generation market, caused by grid infrastructure challenges, delays in transitional energy projects and reduced dispatchable power capacity (caused in part by the country’s move away from coal and nuclear). Its most recent corporate results reaffirmed its full-year outlook, despite some short-term softness in earnings on weak wind conditions.

There have been three notable additions to the portfolio since our last note in December. Two are European airport operators, reflecting Jean-Hugues’s confidence in Europe (and a desire to diversify the portfolio), while the third is a Canadian renewable energy producer that has limited exposure to the US.

Source: Bloomberg

Spanish-headquartered Aena is one of the leading global airport operators, handling nearly 370m passengers in 2024. This investment reflects a conviction in the resilience of Spanish tourism – particularly mass tourism – as the company owns the majority (46) of the country’s airports.

Aena also has some international assets. It owns a 51% stake in the UK’s Luton Airport, the majority ownership in six airports in Brazil and further interests in Mexico, Columbia and Jamaica. There is, however, no US exposure, which Jean-Hugues views as positive in the current environment. The stock offers very strong earnings growth while trading at a substantial discount to its historic valuation.

Source: Bloomberg

Swiss-listed Flughafen owns and operates Zurich Airport, the largest airport in Switzerland and 12th-largest in Europe. Outside the country, it operates airports in Brazil and won the bid to build and operate Noida International Airport in India, for 40 years from its opening, which is expected to occur later in 2025.

Flughafen’s strong balance sheet, less cyclical traffic and exposure to the solid Swiss economy make it a high-quality, defensive purchase. With the opening of Noida, the company’s investment programme should normalise, leading to a sharp increase in free cash flow yield generation, which should allow much higher dividend payments in future.

Source: Bloomberg

Canadian company Brookfield Renewable Partners is one of the world’s largest developers and producers of clean energy. Its portfolio consists of hydroelectric, wind and solar distributed energy and sustainable solutions across five continents.

EGL has previously held the company, but the position was sold several years ago, largely on valuation grounds, after a strong run of performance. However, following a period of share price retrenchment during the last quarter of 2024 and the beginning of this year, Jean-Hugues has reinitiated a position. He says that Brookfield gives EGL international renewables exposure but with minimal exposure to the US (and none to US offshore), noting that Brookfield’s hydroelectric assets are particularly attractive as they are both clean and can provide baseload power.

Jean-Hugues sees significant upside in Brookfield, citing strong development margins and long-term tailwinds from the global power supply-demand imbalance. He believes these factors give Brookfield a long growth runway that is not yet priced into the company’s shares.

Source: Bloomberg

Headquartered in Chicago, Exelon is the largest regulated utility in the US, serving over 10 million customers through six major subsidiaries in the Midwest and on the East Coast. Since spinning off its generation business in 2022, it has focused on electricity and natural gas distribution.

The company is investing heavily in grid modernisation, with the aims of increasing resilience and automation, enabling a higher share of renewable generation and the increasing demands of electrification. This includes rolling out advanced metering infrastructure, which allows real-time monitoring and billing, and working with local municipalities and states to expand electric vehicle charging networks.

As a regulated, defensive holding, Exelon performed well during the market volatility of early 2025. Recent quarterly results beat expectations on both revenue and earnings, and full-year guidance was reaffirmed.

Recent exits from the portfolio have included NextEra Energy and Edison International.

NextEra’s unit XPLR Infrastructure announced it was suspending its dividend for an indefinite period; Jean-Hugues feels that paying dividends reflects a degree of maturity in a company’s operation, and saw this as a strong signal to sell.

Southern California Edison (SCE), a subsidiary of Edison International, faced severe exposure to the early 2025 California wildfires – particularly the Eaton and Hurst fires around Los Angeles. Jean-Hugues felt that the full costs of this were difficult to quantify and that this represented a significant level of idiosyncratic risk that was not appropriate for EGL’s portfolio. He decided to exit the position promptly.

Source: Morningstar, Marten & Co

| 3 months(%) | 6 months (%) | 1 year (%) | 3 years(%) | 5 years(%) | From launch1 | Volatility2(%) | |

|---|---|---|---|---|---|---|---|

| EGL NAV | 9.0 | 7.1 | 12.9 | 15.4 | 69.6 | 132.2 | 15.8 |

| EGL share price | 14.3 | 12.3 | 21.0 | 6.9 | 63.8 | 174.5 | 23.2 |

| MSCI World Utilities | 2.0 | 0.1 | 11.0 | 13.5 | 40.4 | 84.4 | 14.3 |

| S&P Global Infrastructure | 2.9 | 1.5 | 13.8 | 16.7 | 57.6 | 72.9 | 14.3 |

| MSCI World | (4.5) | (3.4) | 7.8 | 36.8 | 82.2 | 162.2 | 13.6 |

| MSCI UK | 0.8 | 7.8 | 9.7 | 29.0 | 76.7 | 79.5 | 17.1 |

Source: Morningstar, Marten & Co. Note 1) EGL was launched on 26 September 2016. Note 2) Volatility is the annualised standard deviation of daily returns over five years.

Up-to-date information on EGL is available on the QuotedData website.

Recent performance from EGL – particularly visible in the three- and six-month periods in Figure 13 – is very encouraging. As shown in Figure 13, one-year NAV performance of 12.9%, as well as being strong in absolute terms, was ahead of both UK and global equities, as measured by the MSCI UK and MSCI World indices, respectively. Shareholders have benefitted even more, with a share price total return of 21.0% over the last 12 months, reflecting a marked narrowing of the discount during the period (see Figure 15 on page 13).

The chart in Figure 12 shows that EGL’s NAV has outperformed both the wider utilities and infrastructure indices over the last five years. This illustrates the benefit of skilled active management in these sectors, with Jean-Hugues able to identify and exploit market inefficiencies. This is even more apparent in Figure 13, which shows very strong outperformance of both EGL’s NAV and share price since its launch in September 2016.

| Strengths | Weaknesses |

|---|---|

| Good NAV and share price performance over both the short and long term. | Although fundamentally a bottom-up fund, EGL is subject to market sentiment towards its particular sectors. |

| Strong record of increasing dividends and commitment from the board for further increases at least in line with inflation. | |

| Opportunities | Threats |

| Structural increase in energy demand from the AI revolution, which largely needs to be met by companies in EGL’s universe. | The course of the development of AI is uncertain, with potential surprises such as the emergence of DeepSeek, that uses much less energy than other LLMs. |

| A renewed focus on the opportunities presented by nuclear power. | A single safety incident in the nuclear industry could undermine support. |

| Still trades at mid-single digit discount to NAV and has been known to trade at a sustained premium rating when market conditions are right. | Potential discount widening, in response to poor performance and/or poorer sentiment towards the utilities and infrastructure sectors. |

Source: Marten & Co

EGL has traded at a discount over the past year, within a 9.6% range.

Over the 12-month period ended 31 May 2025, EGL’s shares have traded between a 16.0% and 6.4% discount to NAV. The average over that period was an 11.6% discount. As of publishing, EGL was trading at a 10.2% discount, and it is encouraging to note the recent narrowing. There is the potential for this to close further if market conditions are broadly favourable, most obviously if interest rates and inflation are low and stable, and if AI continues to gain traction, with the associated increase in demand for energy to power it. EGL regularly traded at a premium to NAV as recently as the middle of 2023. Conversely, rising interest rates would clearly be negative for the premium/discount position, as would any setback in the development of AI or, more precisely, any reassessment of the likely future energy needs of the technology, as happened with the emergence of DeepSeek.

Source: Morningstar, Marten & Co

After a period of share issuance while the trust was at a premium, the company has consistently bought back shares since it moved to a sustained discount in the middle of 2023, per Figure 16. Over the 12 months to the end of May 2025, these repurchases totalled just under 5 million shares.

Source: Marten & Co

Both quarterly dividend payments for 2025 so far have been for 2.125p per share, 3.7% higher than their 2024 equivalents.

As well as realising capital growth, EGL’s stated aim is to increase dividends at least in line with inflation. Gearing and reserves can be used to augment the portfolio yield if necessary, and the dividend has tended to be uncovered in recent years. For example, in 2024, dividend per share was 8.1p on revenue earnings of 7.2p. Despite this the reserves position remains very healthy, at £95m as of 31 March 2025, which equates to 89p per share.

The trend of recent years of steadily increasing dividend payouts has continued, with the first two quarterly payments in 2025, each of 2.125p, being 3.7% higher than their equivalents in 2024. Based on the latest share price, the current yield is 3.9%. Although lower than at the time of our last note in December, this is a reflection of EGL’s strong share price performance since then. We remain confident that the target yield will be met, with EGL’s investment income growth remaining strong.

Source: Ecofin Global Utilities and Infrastructure Trust

Further information regarding EGL can be found on the manager’s website:

Ecofin Global Utilities and Infrastructure Trust Plc is a UK investment trust listed on the main market of the London Stock Exchange (LSE). The trust invests globally in the equity and equity-related securities of companies operating in the utility and other economic infrastructure sectors. EGL is designed for investors who are looking for a high level of income, would like to see that income grow, and wish to preserve their capital and have the prospect of some capital growth as well.

On 1 October 2024, Redwheel completed the purchase of the assets of Ecofin Advisors, the investment manager of EGL. The Ecofin team has relocated to Redwheel’s offices, but there are otherwise no changes to the investment strategy, process or Ecofin brand. Also effective from 1 October, the investment management fee was reduced to 0.9% p.a. of NAV on the first £200mn; 0.75% above £200m and up to £400m; and 0.6% thereafter.

Reflecting its capital preservation objective, EGL does not invest in start-ups, small businesses or illiquid securities, as these may involve significant technological or business risk. Instead, it invests primarily in businesses in developed markets, which have “defensive growth” characteristics: a beta less than the market average; dividend yield greater than the market average; forward-looking EPS growth; and strong cash-flow generation.

It also operates with a strict definition of utilities and infrastructure, as follows:

EGL does not invest in telecommunications companies or companies that own or operate social infrastructure assets funded by the public sector (for example, schools, hospitals or prisons).

EGL does not have a formal benchmark and is not constructed with reference to any index.

EGL does not have a formal benchmark, and its portfolio is not constructed with reference to an index. However, for the purposes of comparison, the MSCI World Utilities Index and the S&P Global Infrastructure Index are the global indices deemed the most appropriate by the manager. The company also supplies data for the MSCI World Index and the All-Share Index in its own literature for general interest. We consider the MSCI World Utilities to be the most relevant – although it should be noted that this index has a strong bias towards US companies and excludes transportation services and some environmental services that EGL invests in.

| Aspect | Bull case | Bear case |

|---|---|---|

| Performance | Strong relative and absolute performance. EGL is well positioned for this to continue, as it is invested in structural growth areas; albeit many of its investments also have defensive qualities. | Performance is negatively impacted in periods of higher inflation and interest rates, due to the very long-term revenue streams of the companies invested in, and in some cases their relatively high levels of debt. However, revenues should catch up in such an environment, albeit with a time lag. |

| Dividends | Strong track record of increases, which the board are committed to continuing. | Increases potentially not sustainable if conditions change. The current dividend is uncovered by revenues (by 0.9p per share in 2024), but there are ample distributable reserves (89p per share). |

| Outlook | Structural increase in energy demand looks set to continue. Despite some recent change in political rhetoric, much of this is still likely to be met by nuclear and renewables. | Any global slowdown puts pressure on politicians to scale back climate commitments, to the detriment of the renewables sector. AI is also a new and rapidly evolving technology that is ripe for disruption, e.g. DeepSeek. |

| Discount | EGL still trades at a discount which could narrow further and potentially move to a premium rating, where it has been in the past for a sustained period. This could come about from inflation and interest rates subsiding and from beneficial long-term structural growth themes within clean power generation, particularly for AI. | The discount could widen significantly due to circumstances beyond EGL’s control, as happened in mid-2023. This could be caused by higher interest rates or any newsflow perceived as negative for the underlying assets. |

Source: Marten & Co

Brett Owens, Chief Investment Strategist

Updated: June 25, 2025

Let’s talk about oil and gold dividends. Whether or not the new peace in the Middle East holds, there are some high-quality dividends worth owning anytime. These generous payers (up to 8%!) provide peace of mind just in case the geopolitical Jenga set gets knocked loose again.

We’ll start with crude, which had rallied to one-year highs. I was originally going to advise not chasing the “Strait of Hormuz” oil rally. Futures indicated (and still do) that lower prices are likely ahead. January 2026 still trades cheaper—suggesting temporary disruption at worst.

Back at home, you’ve probably heard (not least from me, often) that President Trump wants a lower Fed Funds Rate! To achieve this, he and Treasury Secretary Scott Bessent are targeting lower oil (“drill baby, drill”) so that inflation continues to cool and the Fed can ease.

Given policymakers’ penchant for deregulation and drilling, it’s best to sidestep the producers here. We have done well owning Exxon Mobil (XOM) in the past but the time to buy the stock is when oil prices are likely to rise. Exxon has grinded sideways since we sold it from our Contrarian Income Report portfolio.

Let’s consider Kinder Morgan (KMI) and its 4.2% yield instead. Kinder funds its dividend by “collecting tolls” on its 79,000 miles of pipelines. Crude oil and most notably natural gas flow through Kinder’s North America pipelines. As long as energy moves, the cash flows.

A huge 40% of US natural gas flows through Kinder’s systems to 139 company-owned terminals storing petroleum products, chemicals and renewables. With market share like this, Kinder can raise its pricing regularly and therefore boost dividends often too.

When the company was founded back in 1997 (or “back in the 1900s” as my kids say) by Richard Kinder and William Morgan, they structured it as a master limited partnership (MLP). MLPs issue K-1 forms at tax time, which can be a bit of a headache. Instead of forcing shareholders into a lifetime of tax-time headaches, Kinder converted into a simpler corporation in 2014.

Corporations issue a traditional 1099, which is easier for accountants and users of tax software. This move made Kinder more popular and awarded it a perennially higher valuation.

For those of us who prefer lower valuations (and higher yields), Alerian MLP ETF (AMLP) is an elite 8% dividend play. Alerian buys MLPs and packages them into one fund, consolidating messy K-1s into a neat 1099 at tax time—a “cheat code” for easy 8% energy dividends.

These are salad days for Alerian, too. The fund has raised its dividend for three straight quarters!

Let’s move on to gold, the “barbarous relic” that investors buy when they feel nervous. We contrarians are bullish because:

US Debt Levels Have Doubled in 10 Years

Creditors will be paid back, because the US owns the global printing press. But they will ultimately receive depreciated dollars due to some “monetization” of this massive debt load.

The US dollar is already eroding, falling 28% versus gold year-to-date. Twenty-eight percent! A shiny sign of capital flowing into assets immune to central bank printing.

VanEck Gold Miners ETF (GDX) is a one-click way to play higher gold and lower oil prices. Energy is the main cost input for gold miners. Profit margins will expand from here if gold stays high and oil slumps.

A high-quality discounted alternative is GAMCO Global Gold, Natural Resources & Income Trust (GGN), a closed-end fund trading at a 2% discount to its net asset value. About half of the fund’s portfolio sits in mining stocks—both gold and non-gold plays like iron miner Rio Tinto (RIO). Thanks to the deal we can snag these stocks for 98 cents on the dollar.

GGN pays a steady 3-cent monthly dividend (8% annualized), giving investors income stability with upside potential.

Annuity rates hit a record for the decade – is now a good time to buy an annuity?

Annuity rates have increased 10% since May 2024, part of an upward trend, while sales of the pension product are also soaring. Should you buy an annuity?

By Ruth Emery

Annuity rates have surged above 7.7%, the highest point of the decade. The figures, for May 2025, mark a 10% increase on a year ago, in an ongoing upward trend of annuity rates.

This marks a significant recovery from July 2020 when rates were just 4.71%, reflecting a 64% increase since then.

An annuity is an insurance product that delivers a guaranteed income for life in exchange for a pension pot.

A healthy 65-year old with a £100,000 pension pot could now expect to receive approximately £7,720 a year, according to the data from Standard Life’s annuity tracker.

The tool said a healthy 65-year-old man who bought an annuity in May 2025 at a rate of 7.72% could expect a total lifetime income of £155,180. For a woman of the same age, the expected income was £172,940.

Meanwhile, a healthy 70-year-old who bought an annuity in June 2025, could expect a rate of 8.54%. For a man, this would provide a total lifetime income of £136,680 while a woman could expect to receive £153,770.

Pete Cowell, head of annuities at Standard Life, said the surge in annuity rates offers retirees “one of the strongest opportunities yet for securing a guaranteed income in retirement”. He added: “This uplift has been driven by higher long-term interest rates.

“While the recent upward trend has been steady, it feels unlikely annuity rates will fall back to historic lows. Interest in annuities is likely to remain strong, particularly given the anticipated changes to inheritance tax in 2027, which may prompt more people to consider annuities as part of their retirement planning.”

Annuity rates are closely linked to government bond (gilt) yields, which surged to their highest level since 2008 in January. At the end of June 2025, yields on ten-year gilts are currently around 4.4%, a bit lower than where they were throughout January on either side of the gilt yield crisis that sent yields to record highs.

Annuity rates are closely linked to government bond (gilt) yields, which surged to their highest level since 2008 in January.

Gilt yields are affected by interest rates; the rise in interest rates over the past few years has been good news for annuity incomes. Hargreaves Lansdown notes that the rate for a 65-year-old with a £100,000 pension hit £7,586 after the mini-Budget in 2022.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, says it’s a “reversal of fortune for a market that many thought had been all but killed off by a combination of rock-bottom interest rates and the Freedom and Choice reforms” in 2015, when then chancellor George Osborne said retirees didn’t need to buy an annuity anymore.

She adds: “Rising interest rates have seen incomes climb in recent years and people’s interest has risen along with them. The Association of British Insurers (ABI) recently hailed 2024 as a bumper year for annuities with sales of £7 billion. It’s a momentum that will continue into 2025 as people mull the best option for securing a guaranteed income in retirement.”

Indeed, annuity sales jumped 24% last year, and hit a 10-year high, according to the ABI. The most common age to purchase an annuity continued to be aged 65, making up 20% of all sales.

Six providers offer annuities to new customers, and last year 69% of annuity buyers switched – taking an annuity from a different provider to the one they held their pension savings with – compared to 64% in 2023.

Shopping around for an annuity can get you a better deal compared to staying with your current pension provider.

Pete Cowell, head of annuities at Standard Life, comments: “Annuity rates have continued to improve, offering retirees even stronger total incomes.

“Looking ahead, we expect annuity rates, as well as the demand for these types of products, to remain strong, especially with pensions being brought into scope for inheritance tax from 2027. Wealthier savers may be encouraged to access more of their pensions, with annuities becoming an increasingly attractive way of doing so.”

However, it’s possible that annuity rates might fall this year, especially if interest rates are cut again. Annuity rates drifted downwards last year following two interest rate reductions, but then soared during the gilt turmoil in January.

The Bank of England voted to cut the base rate from 5.25% to 5% last August, its first cut in more than four years. In November, rates were trimmed again to 4.75%. In February, the Bank reduced the base rate to 4.5%.

The Bank of England last cut its base rate in May, reducing it from 4.5% to 4.25%. This was the fourth time the base rate was reduced since August 2024.

But, even if annuity rates do fall, sales could get a further boost due to last year’s Autumn Budget announcement that pension pots will be liable for inheritance tax from April 2027.

“This will remove many people’s rationale for using income drawdown as they used it to pass the pension down generations tax-efficiently rather than draw an income from it. As they revisit their retirement income plans, many may opt to secure a guaranteed income through an annuity instead,” comments Morrissey.

If you’re thinking of buying an annuity, we look at the outlook for annuity rates, and what you can do to ensure you get the best deal.

Will annuity rates fall?

The outlook for annuity rates this year depends on what happens to gilt yields. If yields stay high, or soar further, we could see an increase to annuity rates.

But, if interest rates fall, gilt yields may follow suit, which will negatively impact annuity rates.

Holly Tomlinson, financial planner at the wealth manager Quilter, comments: “Annuity rates are closely tied to government bond yields, which can be influenced by changes in interest rates. A reduction in the base rate may lead to lower bond yields, potentially resulting in less favourable annuity rates for retirees.”

However, Morrissey points out that “we aren’t expecting the Bank of England to cut interest rates anywhere near as quickly as they raised them”.

According to Lily Megson, policy director at the financial adviser My Pension Expert, the base rate is expected to continue to fall this year, “meaning that some pension planners consider now to be the best time to lock in an annuity product”.

Is an annuity right for me?

Just because rates are high at the moment and represent good value, that doesn’t necessarily mean an annuity is the right retirement strategy for you.

Using your pension pot to buy an annuity is an irreversible decision, so you need to think carefully before making your mind up and should seek financial advice if you are unsure. You can find an independent adviser at Unbiased or VouchedFor.

According to the ABI, more annuity purchases occurred after taking financial advice in 2024, with 36% of buyers taking advice beforehand compared to 29% in 2023.

Some people may prefer to keep their pension pot in drawdown. This is when you keep part of your pot invested (where it will hopefully continue to grow), while withdrawing cash flexibly as and when you need it.

FCA data shows that pensions drawdown is the most popular option among retirees. Almost 280,000 people opted for drawdown in 2023/24, versus about 82,000 annuity purchases.

However, as previously mentioned, this could change as pension pots become liable for inheritance tax. Experts predict that savers may stop preserving their pensions to pass on to beneficiaries tax-free, and instead look at buying a guaranteed income with their pension.

Swapping a pension for an annuity means you get rid of your pension, reducing the size of your estate and any potential inheritance tax bill.

Another benefit of buying an annuity is the peace of mind it gives you. An annuity will pay out an income until you die, so there is no worry that you could run out of money during retirement.

Stephen Lowe, group communications director at the retirement firm Just Group, notes: “I think in today’s environment many people are seeing current annuity rates as sufficient to meet their retirement objectives and a good time to lock in. Along with other sources of guaranteed income such as the state pension, it provides peace of mind that there will always be an ongoing income to cover day-to-day bills.”

A potential downside with annuities is that, unless you choose a joint-life annuity, when you die, the income dies with you. So, if you only live a few years after you purchase the product, you won’t have received much money from your pension.

Some people may prefer to do a combination of the two approaches. You could use part of your pot to buy a guaranteed income, while leaving the rest invested so that you can draw on it as and when you need.

It’s also worth mentioning that there are different types of annuities on the market. Some are linked to inflation, while others pay a fixed amount each year.

Joint-life annuities continue to pay an income to a beneficiary (such as a spouse or civil partner) after you die, while others do not.

You can buy an annuity at any time in retirement, so you could leave it until you are older – especially as the older you are, the higher the annual income.

Purchasing an annuity earlier in retirement typically results in higher overall income. However, annuity rates tend to increase with age, meaning those who choose to buy an annuity later in retirement are likely to benefit from better rates.

As of May 2025, rates for a healthy 60-year-old were 7.01% compared to 8.54% for a healthy 70-year-old. This results in an annual income of £7,010 for a 60-year-old versus the £8,540 a healthy 70-year-old may expect to receive on a £100,000 pension pot – a difference of £1,530, according to Standard Life.

Clare Moffat, pensions expert at Royal London, comments: “The most suitable option will depend on an individual’s needs and while annuities aren’t for everyone, there are scenarios where they could be beneficial, so they should be considered as part of the retirement planning process.

“Many want complete flexibility with their retirement income, which explains the popularity of drawdown, while for others, buying an annuity offers them the comfort of a guaranteed income. For those people initially opting for income drawdown, that may not be the final decision. As people get older, some are keen to introduce a form of guarantee, so a happy medium for many is an annuity to cover basic living costs, providing comfort and reassurance, while leaving the rest invested for extra flexibility.”

Shopping around for an annuity

As well as considering what type of annuity is right for you (if any), you should do your homework to ensure you get the best rate.

“Different providers offer different rates and not searching the market can leave you thousands of pounds worse off over the course of your retirement,” Morrissey says.

Almost a third of retirees fail to shop around for the best annuity deal, instead sticking with their pension provider, according to the ABI figures.

Using a comparison site is a good starting point, Morrissey adds, but reminds retirees that there’s more to consider than the annual income alone.

“Single-life annuities offer higher incomes than joint-life ones but the joint-life one will offer an income to your spouse should you die first,” she points out.

Similarly, an inflation-linked annuity will generally offer a lower starting income than a level annuity, but if you live long enough (and inflation is high), you might end up getting more from the inflation-linked product.

Finally, Morrissey recommends giving all of your health details – including whether you smoke or drink – as this information feeds into the insurer’s calculations and can result in you getting an enhanced annuity, which pays a higher rate of income.

This marks a significant recovery from July 2020 when rates were just 4.71%, reflecting a 64% increase since then.

Do you really want to gamble with your future ?

TR over 1 year 25%, as the price rises the yield falls.

Yields 7.2%, so still a hold for the portfolio, maybe with a floor of 6% where reluctantly it might be sold.

Zacks Equity Research

Wed, June 25

Strange but true: seniors fear death less than running out of money in retirement.

And unfortunately, even retirees who have built a nest egg have good reason to be concerned – with the traditional approaches to retirement planning, income may no longer cover expenses. That means retirees are dipping into principal to make ends meet, setting up a race against time between dwindling investment balances and longer lifespans.

In the past, investors going into retirement could invest in bonds and count on attractive yields to produce steady, reliable income streams to fund a predictable retirement. 10-year Treasury bond rates in the late 1990s hovered around 6.50%, whereas the current rate is much lower.

While this yield reduction may not seem drastic, it adds up: for a $1 million investment in 10-year Treasuries, the rate drop means a difference in yield of more than $1 million.

And lower bond yields aren’t the only potential problem seniors are facing. Today’s retirees aren’t feeling as secure as they once did about Social Security, either. Benefit checks will still be coming for the foreseeable future, but based on current estimates, Social Security funds will run out of money in 2035.

So what’s a retiree to do? You could cut your expenses to the bone, and take the risk that your Social Security checks don’t shrink. Or you could find an alternative investment that provides a steady, higher-rate income stream to replace dwindling bond yields.

As we see it, dividend-paying stocks from generally low-risk, top notch companies are a brilliant way to create steady and solid income streams to supplant low risk, low yielding Treasury and fixed-income alternatives.

Look for stocks that have paid steady, increasing dividends for years (or decades), and have not cut their dividends even during recessions.

Dear reader,

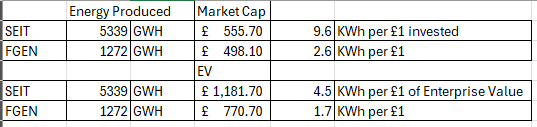

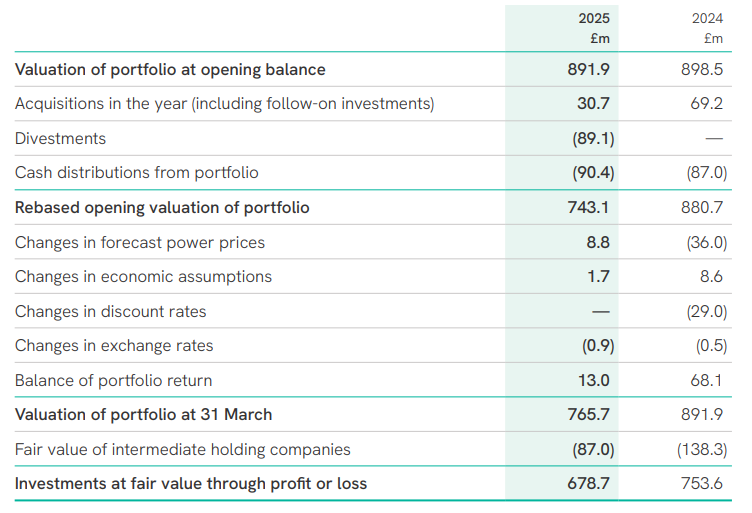

I looked at FGEN last November and a few readers asked me to look again given its annual results release for the year to 31/3/25.

FGEN’s portfolio now comprises 40 assets across the UK and Europe, diversified across renewable energy generation (73% by value), sustainable resource management (17%), and other energy infrastructure (10%). Key holdings include the Cramlington biomass plant, the Rjukan aquaculture facility in Norway, and wind, solar, and anaerobic digestion projects in the UK.

FGEN’s net asset value (NAV) per share declined by 6.3% over the reporting period, from 113.6p to 106.5p. This was partly the write off off its investment in hydrogen platform HH2E – and otherwise good old discount rates.

I wrote yesterday about how fellow IT SEIT is at a 9.6% discount rate. FGEN is at a slightly higher 9.7% rate. The rate appears very high even for comparable assets (e.g. Gore Street BESS are 7%-9% vs 10.3% here.

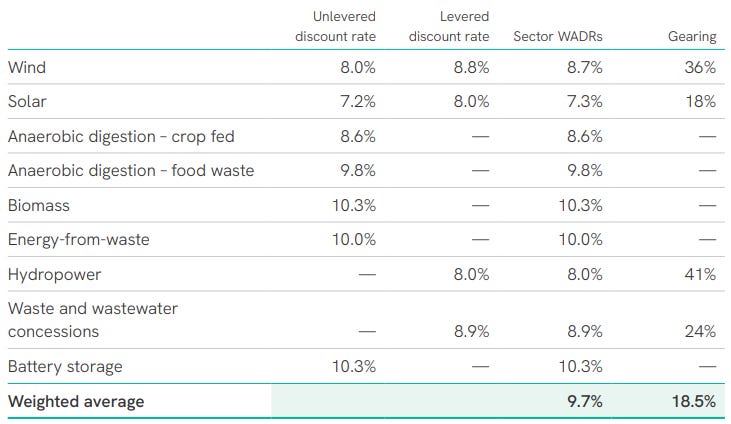

The discount rate is made up of the following rates:

An increase in the discount rate of 0.5% would result in a downward movement in the portfolio valuation of £17.2 million (2.7 pence per share) compared to an uplift in value of £18.0 million (2.8 pence per share) if discount rates were reduced by the same amount.

So compared to NESF’s 8% rate FGEN would gain £61.2m to be at 8% too.

1.27 TWh is 50% more than NESF but still sits below SEIT.

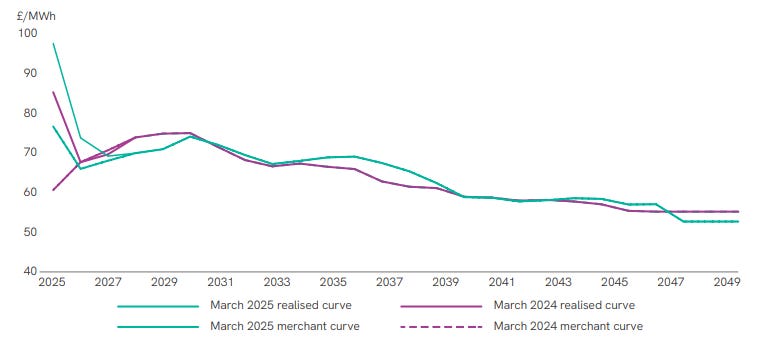

Power curves once again are, based on the forecasts of 3 experts due to be dropping away in the years ahead even though the 2024 power curve forecast for 2025 was well below the current 2025 rate (incorrect by about £15/MWh). If these experts can’t even forecast 1 year ahead accurately how much credence should you give to 5 years or 10 years?

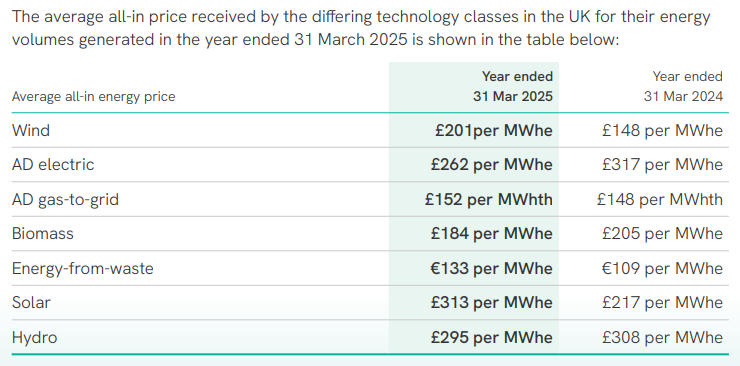

Of course the power curve also bears little resemblance to the energy prices FGEN quote in their investment manager’s report:

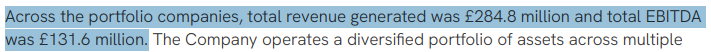

Now this is interesting since an FY25 EBITDA of £131.6m for FGEN compares very favourably to a SEIT’s EBITDA of just £86m. Favourably to the £678.7m NAV closing value.

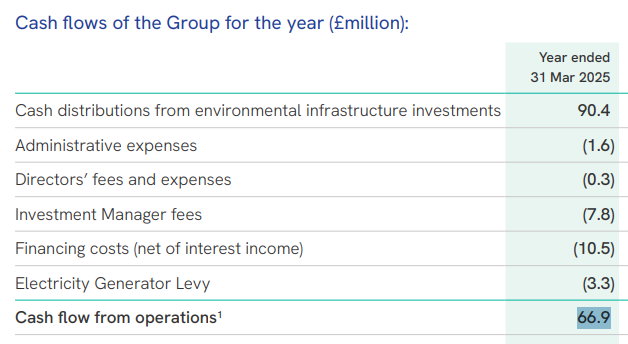

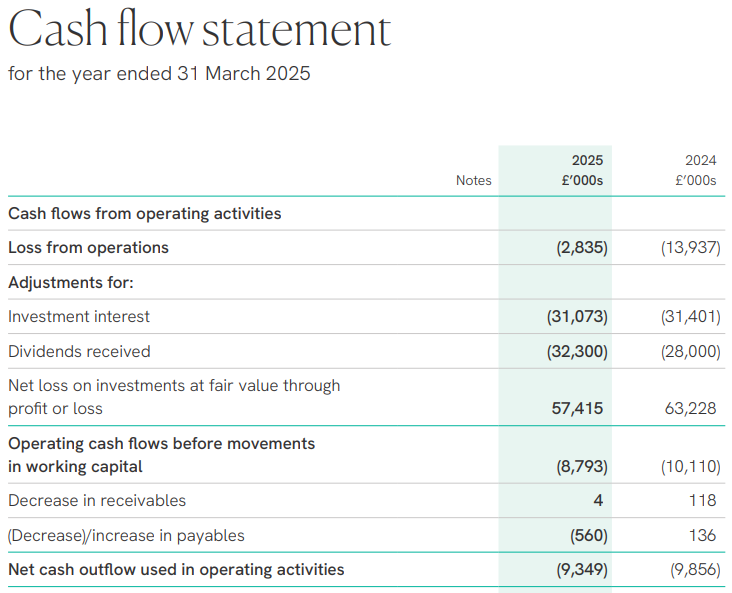

So how are cash distributions so different to EBITDA? £90.4m of what might be approximated to be free cash flow (and is much lower than SEIT’s) nets to £66.9m as what appears to be a better proxy to the “real” returns for FGEN.

It mirrors the £63.4m of interest and dividends that FGEN earned as below.

I suspect the answer to this riddle is the EBITDA was £131.6m and FGEN own half those portfolio companies. It’s pretty frustrating to not just be given facts in a consistent manner.

Of course the statutory result was a loss due to a £57.4m fair value loss. We are told this is due to a power price forecast contraction and future cash flows. Well you know what I think of that.

Judging by the 92% operational and 8% in construction there isn’t much still to complete, but a review of the actual assets under construction reveals a vast array of big ticket items (e.g. a 0.75GW interconnector). Again a riddle, but the answer must be FGEN is taking a minority ownership. Perhaps even just 2%-5%.

Of course a 2.1% dividend increase for FY26 to 7.96p per share and covered 1.32x by operating cashflow. FGEN has delivered consistent annual dividend growth over numerous years.

On top of dividends there were also NAV-accretive share buybacks and a £1.3m gain from asset disposals. The NAV total return was +0.6%. During the year, the company completed £88.6m of asset disposals (equivalent to approximately 10% of its portfolio), all at or above carrying value. The proceeds were used to repay floating rate debt and fund a £30m share buyback programme, of which £24.3m had been deployed by the end of March. Gearing was reduced to 28.7% from 31.2%, maintaining FGEN’s position among the least leveraged funds in the sector.

FGEN’s strategic review concluded a refocused strategy centred on proactive asset management and disciplined capital allocation would best serve shareholders. Quelle surprise.

FGEN say they will prioritise new investments in core environmental infrastructure sectors – including renewables, energy storage, and sustainable resource management – that offer long-term, stable, inflation-linked revenues. Investments in higher-risk growth assets will be limited. It intends to monetise existing positions in platforms such as the Glasshouse, Rjukan, and CNG Fuels when they reach maturity and can command premium valuations. The portfolio will instead focus on income-generative assets and value enhancement at operational sites.

Investment manager’s fees change from 1 October 2025, where the base management fee will be calculated on a blended metric of 50% NAV and 50% market capitalisation (capped at NAV), replacing the previous NAV-only basis.

I am trying not to say meh. Oops just said it.

FGEN has a 10% yield, and the share price is up from a 66p low to 80p a share but there’s still a 31% discount to NAV. The discount rate and the power price assumptions make that 106.5p very likely to be understated. There are various assets coming on line in FY26 too. FGEN have said they are going to stick to their knitting with inflation-linked returns.

I’m just not convinced that there’s any great upside here. The investment manager manages to say a lot and presents well but leaves me not feeling excited. I previously said that FGEN is “a decent way to earn solid dividends and where the margin of safety appears higher than the market perceives.” I still believe that that’s true. Even more so today.

So FGEN appears a trusty plodder but not an Arabian thoroughbred. What horse do you want in your portfolio?

Regards

The Oak Bloke

Disclaimers:

This is not advice – make your own investment decisions.

Micro cap and Nano cap holdings, even FTSE250 companies like SEIT, might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”

Stephen Wright thinks two FTSE 250 REITs looking to merge could be an interesting opportunity for investors looking for passive income to consider.

Posted by Stephen Wright

Published 25 June

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

After falling almost 5% in a day, Primary Health Properties (LSE:PHP) has slipped back to 99p. But the FTSE 250 real estate investment trust (REIT) has had some potentially big news.

It looks as though the firm has managed to hijack KKR’s takeover of fellow healthcare REIT Assura (LSE:AGR). And the result could be a very interesting stock for passive income investors.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

There has been a lot of interest in UK REITs over the last few months. As well as Assura, Care REIT, Warehouse REIT, and Urban Logistics REIT have all been attracting attention.

After a short bidding war, Assura announced it intended to accept a best-and-last offer of £1.7bn from a consortium led by US investment firm KKR. But it’s now switched courses.

Officially, the preferred offer from Primary Health Properties values the company at £1.8bn. There are, however, a couple of things to keep an eye on.

The deal involves merging the two companies to create a much bigger healthcare REIT. And Assura shareholders are set to receive the following (for each share they currently own):

The firm currently has a market value of £1.62bn – around 10% below the proposed takeover price. But the final value of the deal depends on what happens to the Primary Health Properties share price.

With that in mind, I’m not looking for a quick win based on the deal going through. But I am interested in the combined company as a potential long-term passive income opportunity.

In their current forms, Assura and Primary Health Properties are very similar businesses. Both make money by owning and leasing portfolios of healthcare properties – notably GP surgeries.

There’s a slight difference in terms of the balance of state (mostly NHS) and private tenants. But combining the two clearly offers some benefits of scale for shareholders.

The similarities between the two businesses mean they also have similar risk profiles. Both use their reliable income stream to operate with unusually high debt levels. Assura and Primary Health Properties both have net debt levels roughly equal to their entire market value. That’s something investors need to factor into their calculations.

Both stocks currently have dividend yields of around 7%. So even if the combined company has to issue shares to pay off some of its debt, investors might still hope for a good return.

An aging population and the UK government’s desire to use private healthcare to try and reduce NHS waiting times should both be benefits. As a result, I think this is an interesting opportunity.

I’ve owned shares in both Primary Health Properties and Assura in the past, but I’ve since sold both. Looking back, I think that was probably a mistake. The merger of the two companies could well be my chance to get back in. But I have a clear preference for which stock I prefer at this stage.

There’s still a risk the deal doesn’t go through. And in that situation, I expect both share prices to go back to where they were before the latest news. That means up (slightly) for Primary Health Properties and down (slightly) for Assura. So to cover that possibility, I think I prefer the former.

The Snowball has profits in

Assura of £2,925.00 and PHP £2,281.00, which now re-invested back into the Snowball will accelerate the planned timescale.

One to watch ?

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑