When the recent dividends are applied to the Snowballt later today, I am going to buy another 1k of ORIT, bringing the total to ‘ a half a position’.

Investment Trust Dividends

When the recent dividends are applied to the Snowballt later today, I am going to buy another 1k of ORIT, bringing the total to ‘ a half a position’.

AERS Aquila European Renewables.

AERS is winding down and therefore the dividend yield has fell, so it leaves the watch list today.

Michael Foster, Investment Strategist

Updated: September 29, 2025

Small caps are (finally!) back, but most people are in the dark about how to tap them for serious dividends. But there is a proven way to do that—one that puts a rich 7.1% payout squarely on the table for us.

Everyone has missed this one. We’re going to dive into it today.

The main reason I hate to see people ignore small caps—especially now—is that, well, their time has come.

Small Caps Have Lagged for Years—And They’re Due for a Bounce

As you can see, It’s been a solid decade of small-caps delivering, well, small profits to investors. But it’s time for the script to flip. In fact, it’s already happening:

Small Caps See a Summer Bounce

After years of being dusted by big caps, small caps are matching them point for point this year—even pulling ahead, going by the performance of the benchmark iShares Russell 2000 ETF (IWM) in orange above, over the last three months.

I see that continuing.

For one, small firms tend to have close, personal relationships with clients, keeping their loyalty—and small firms’ sales along with it—strong. Moreover, they tend to be domestic, so they directly profit from the US economy’s strength (which we discussed in last Thursday’s article) and get a hedge from global headaches (including on trade), too.

But What About the Dividends?

Of course, there are drawbacks to buying these “small fry”: For one, unless the company is near where you live, say, or factors into your work life, you probably don’t know much about it. That’s unlike, say, big caps like Microsoft (MSFT), which get loads of analyst and media coverage.

Another, of course, is the dividends. Many small caps are earlier in their growth process—and if they’re lucky, on their way to becoming tomorrow’s large caps. Unfortunately, this means many can’t afford to both fund that growth and pay dividends.

This is why, for the most part at my CEF Insider service, we’ve focused on closed-end funds (CEFs) that hold large caps and high-yield bonds. Not only have they delivered bigger gains than small caps, but they’ve been handing us high, steady dividends, too.

You get a sense of that when you compare the average CEF yield—8.3%—with the payout on the small-cap benchmark iShares Russell 2000 ETF (IWM): a mere 1%.

Still, every rule has its exception.

When it comes to small caps, that exception is a CEF called the Royce Small-Cap Trust (RVT). This fund (in orange below) has closely tracked small caps, but with a twist: It “translates” small cap gains into dividends—7.1% payouts, to be exact.

RVT Turns Small Cap Gains Into Dividend Cash

The power of a fund like RVT is in its structure: the managers at Royce Investment Partners invest in many different small caps—488, to be exact.

Its three top holdings are IES Holdings (IESC), Assured Guaranty (AGO) and SEI Investments (SEIC). Note this chart:

Top Holding Explodes, 2 Others Gain

IESC (in blue above) installs electrical and technology systems for businesses and had $2.9 billion of sales in its latest fiscal year. Revenue soared 16% in the latest quarter on strong data-center growth (no surprise there). Meantime over at financial firm SEIC (in orange), EPS jumped 70% and revenue jumped 8% in the latest quarter, driven in part by higher interest in alternative investments.

As for financial-insurer AGO (in purple), the firm saw net income rise 32% in the last quarter as municipalities continued rolling out bonds at a record pace.

All of these stocks’ gains are pushing up RVT’s net asset value (NAV, or the value of its underlying portfolio), putting a lift under its share price. Royce’s job is to take profits on its winners and use its gains to buy up-and-comers and maintain its 7.1% dividend.

Now, to be sure, RVT’s dividend does float a little. That’s because it has a mandate to pay dividends at a yearly rate of 7% of the average of the last four quarters of NAV (calculated at quarter-end). So if NAV rises, payouts do, too.

I like this payout strategy because it means the fund is not bound to a fixed payout and has flexibility to reinvest gains in other opportunities where it sees them. And even with that flexibility, RVT’s dividend has been remarkably consistent (and even up modestly) over the last five years:

Source: Income Calendar

Moreover, RVT is still available at a 9.2% discount to NAV. That markdown has momentum, too, up from double digits in late August.

RVT Is Cheap, With a Discount Trend We Like

Given that RVT’s discount shrunk below 6% in January, before tariff fears sent it plunging in the spring, we still have potential for upside on a closing discount here.

The bottom line is that RVT has been doing a good job of “translating” small cap gains into 7% dividends for a long time. That’s why, as small cap momentum ramps up, we see the fund as a good one in which to slowly build a position.

Thursday 2 October

Aquila Energy Efficiency Trust PLC ex-dividend date

CT Private Equity Trust PLC ex-dividend date

European Opportunities Trust PLC ex-dividend date

F&C Investment Trust PLC ex-dividend date

Invesco Asia Dragon Trust PLC ex-dividend date

Law Debenture Corp PLC ex-dividend date

Manchester & London Investment Trust PLC ex-dividend date

Murray International Trust PLC ex-dividend date

North American Income Trust PLC ex-dividend date

Pantheon Infrastructure PLC ex-dividend date

Petershill Partners PLC ex-dividend date

Real Estate Investors PLC ex-dividend date

RIT Capital Partners PLC ex-dividend date

Schroder European Real Estate Investment Trust PLC ex-dividend date

Schroder Japan Trust PLC ex-dividend date

Shires Income PLC ex-dividend date

STS Global Income & Growth Trust PLC ex-dividend date

UIL Ltd ex-dividend date

Value & Indexed Property Income Trust PLC ex-dividend date

Let’s start with what you can’t control.

TR plan.

If your plan is to take out an annuity, it’s out of your control as you do not what rate you will be offered when your retire. It could be.

Canada Life figures show the 65-year-old with a £100,000 pension pot could buy an annuity linked to the retail price index (RPI) that would generate a starting annual income of £3,896. That’s up from £2,195 in the New Year following a 77% spike in rates this year.

Oct 22

It could be more or it could be less, a huge gamble which will effect the rest of your life.

Using the 4% rule, recent studies state that 4% may be too high but we will go with the figure. Again you can’t control the final amount you will have in your portfolio.

Latest comparison if your plan is for the tail and not the body, you fail by the month with a dividend re-investment plan.

The snowball

2025 Income £9,120.00

Dividend total for the quarter ending 30 Sep £9,794.00. Do not scale to reach an end of year figure as it includes a special dividend from VPC.

Comparison share VWRP £145,534. Not too shabby but a ‘pension’ of £5,821 using the 4% rule. The figure could be higher at the end of the year or it could be lower.

Millions of Britons have almost nothing saved, but that doesn’t mean they can’t start working towards a life-changing second income from today.

Posted by

Dr. James Fox

Published 29 September

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

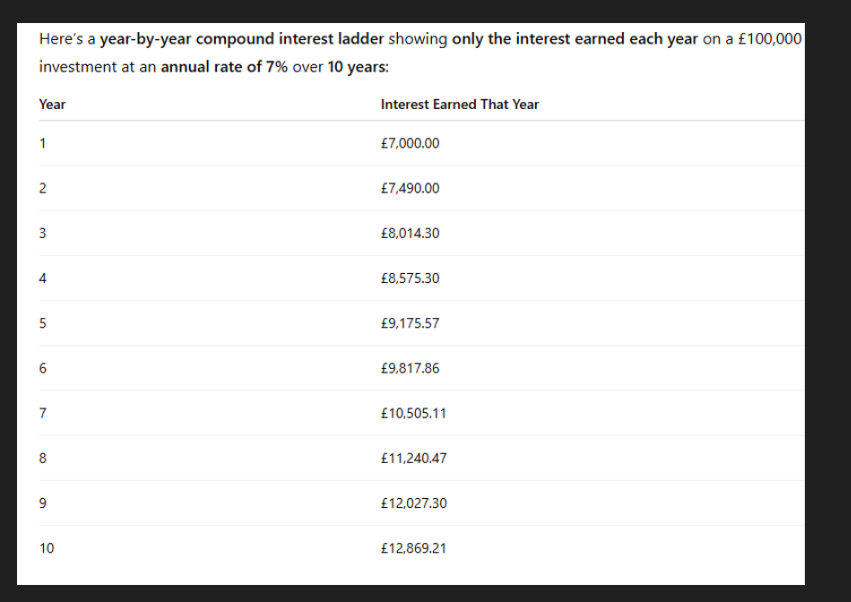

Many people assume that without a large pot of cash already saved, the dream of generating a second income from investing is out of reach. But the reality is that even starting from almost nothing, a disciplined approach can still build a meaningful income stream over time.

The key lies in consistency. Let’s imagine a new investor can put aside just £250 a month into a Stocks and Shares ISA. That’s £3,000 a year. If those funds are invested in a diversified portfolio that generates an average annual return of 7%, the portfolio could grow to around £125,000 after 20 years.

At that point, drawing a 5% income from the portfolio would provide more than £6,000 a year. While it may not replace a salary, it represents a valuable supplementary income stream, particularly in retirement.

Of course, the more we contribute and the more successful we are at investing, the larger the end figure. Indeed, £500 a month in contributions could build a pot in excess of £250,000 in the same timeframe, potentially generating over £12,000 annually at a 5% withdrawal rate.

The strategy isn’t about chasing quick wins, but about harnessing compounding. There are risks, of course. Stock markets are volatile, and returns are never guaranteed. But history shows that patient, regular investing has rewarded those who stick with it.

Even if starting with almost nothing, consistency and discipline can transform modest monthly contributions into a powerful second income portfolio over the long term

Brett Owens, Chief Investment Strategist

Updated: September 26, 2025

The Fed has finally cut rates, and if the “dot plot” is any indication, it won’t be the last. This is fuel for real estate investment trusts (REITs)—they thrive when borrowing costs fall and their fat dividends shine next to shrinking bond yields.

Today we can lock in payouts between 6% and 13% from landlords set to surge as Powell’s long-awaited pivot plays out.

Why do REITs rally as rates fall? These stocks act as “bond proxies” that move alongside bonds and opposite rates. Here is a major REIT ETF plotted against the 10-year Treasury yield. As you can see, when the important rate zigs, the REIT benchmark zags:

REITs Zig When Rates Zag

Rate cuts don’t always hit the 10-year overnight. But the direction is now clear—and history shows that REITs rally once the bond market adjusts. So, let’s look at a lineup of landlords yielding up to 13.3% that are ready to ride Powell’s pivot higher.

We’ll start with Healthpeak Properties (DOC, 6.5% dividend yield). Healthpeak owns 702 properties across outpatient medical, labs and senior housing. This blend has weighed on 2025 results because labs have been weak. However this “property patient” has perked up since August, when a sad jobs report foreshadowed the September rate cut.

In other words, the Fed is driving this rebound:

Healthpeak: Riding High on Rates Over Fundamentals

Broadstone Net Lease (BNL, 6.3% dividend yield) specializes in single-tenant commercial properties. Currently, its portfolio is made up of 766 properties in 44 states and four Canadian provinces, leased out to a whopping 205 tenants representing more than 50 industries.

Its blend looks a lot different than it did even a year or two ago—Broadstone has been actively shedding healthcare properties, which made up roughly 20% of annualized based rent back in 2024 but now accounts for less than 4% of ABR. Today, industrial makes up roughly 60% of ABR, retail accounts for more than 30%, and office buildings drive most of the remainder.

Broadstone deals in “net leases,” where tenants cover taxes, insurance and maintenance costs. BNL just collects rent. Those long-term leases, with built-in 2% rent escalators, deliver the steady cash flows we want from a landlord.

I said more than a year ago that although its transformation might weigh on earnings in the short term, “the renewed portfolio focus is a benefit to BNL.” At the time, insiders thought so too.

All of us were right.

But Broadstone’s Success Is Missing One Critical Component

Broadstone’s doing a lot that we can like. It looks like it’s handling the bankruptcies of tenants At Home and Claire’s in stride. Management expects that its burgeoning build-to-suit pipeline will reach its $500 million end-of-year goal.

But it’d be nice to see BNL share the wealth. The company recently updated its full-year guidance for adjusted funds from operations (AFFO), expecting $1.48 to $1.50 per share. It’s on track to pay $1.16. BNL could easily boost its dividend. Management just hasn’t shared the wealth yet.

Global Net Lease (GNL, 9.4% dividend yield) is another commercial net-lease operator, and it has a significant international bent.

GNL’s 911-property portfolio spans 10 countries. North American operations (U.S. and Canada) account for 70% of straight-line rents; eight European companies account for the remaining 30%. The average remaining lease term isn’t as long as Broadstone’s, at just over six years, but it does utilize rent escalators, which are on 88% of leases.

Global Net Lease has also been busy trying to improve its operations. It recently completed the $1.8 billion sale of its multitenant retail portfolio, which improved overall occupancy and improved its annualized net operating income (NOI) margin. It has been buying back stock. And it has been rapidly deleveraging—GNL has shed $2 billion in net debt in roughly a year. During the company’s most recent earnings call, CEO Michael Weil noted that “S&P Global upgraded our corporate credit rating to BB+ from BB and raised our issuer level rating on our unsecured notes to investment-grade BBB- from BB+.”

The stock has been doing exactly what we’d expect in the midst of that kind of turnaround, beating the pants off the real estate sector year-to-date.

But There’s Still a Big Black Mark We Need to Talk About

GNL’s past payout cuts weren’t by choice—they were survival. Dividend coverage looks fine today, but only if cash flow keeps climbing.

A couple “hybrid” REITs—Armada Hoffler Properties (AHH, 7.7% dividend yield) and Brandywine Realty Trust (BDN, 13.3% dividend yield) are benefiting from a one-two punch: declining rates and return-to-office mandates.

But both cut payouts this year and their balance sheets leave no margin for error:

2 Big Yields, But 2 Very Recent Distribution Cuts

Armada Hoffler kicked off 2025 with weak guidance and a quick dividend cut. It’s still on pace for a significant drop in FFO, and its guidance hasn’t changed, but the most recent quarter saw at least a few green shoots, including a slight improvement in same-store cash NOI growth.

Brandywine, while a hybrid REIT, is much heavier in office influence. BDN owns 63 properties representing ~11.8 million rentable square feet, and office space accounts for just less than 90% of each (56 properties representing ~10.4 million rentable square feet).

Joint ventures have been Brandywine’s Achilles’ heel of late; some of its development deals force BDN to recognize numerous costs until the projects become profitable, and that has resulted in significant downward revisions to FFO estimates. Relief could be on the way, though, as several JVs could be recapitalized in coming quarters. Brandywine also secured a massive deal with Nvidia (NVDA), which will occupy nearly 100,000 square feet in BDN’s One Uptown development in Austin.

But let’s keep a really close eye on the dividend. The payout was 107% of FFO through the first half of 2025, and full-year FFO are expected to just barely pay for the dividend. If Brandywine runs into liquidity issues, that 13%-plus yield could be a rug-pull just waiting to happen.

This year’s fcast is for year 5 of the plan and the fcast for 2026 is year 6 of the plan.

For those luckily enough to have longer to compound your dividends, at a yield of 7% your income doubles every ten years, so the long term target would be 25k. A yield of 25% for you ‘pension’. Remember to allow for inflation.

Sep. 26, 2025 7:30 AM ET OKE, GTY, VICI, PEP

Leo Nelissen

Investing Group

The other day, someone told me something like, “Why do you spend so much time discussing retirement investments? You’re never going to retire, anyway!”

It’s a fair question, for a number of reasons. The first one is that, as I have written in a few articles, I am indeed not ever planning on retiring.

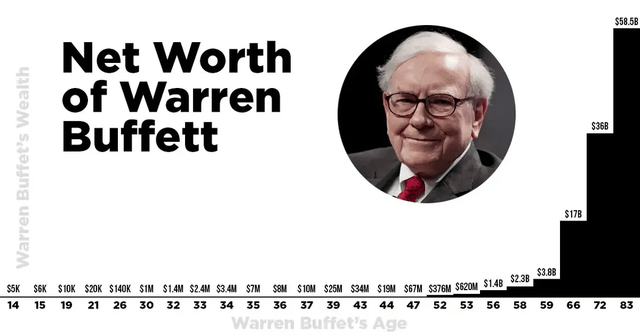

Although I have no idea what the future holds when it comes to AI disruption, my health, and other circumstances, I would love to do what Buffett and so many others do, which is work until it’s no longer humanly possible. After all, my work is based on writing research on a computer. I’m not a construction worker or a Texas roughneck. That’s a huge difference.

Even Maurice Greenberg, the 100-year-old who landed on D-Day in France during the Second World War, fought in the Korean War, and became the successor of AIG founder Cornelius Vander Starr, still works. Roughly ten years ago, he made a big comeback with a multi-billion-dollar insurance takeover. He was 90 at the time.

Obviously, I’m not comparing myself to people like Buffett and Greenberg. All I’m saying is that I’m a workaholic. I haven’t had a trip (some call it “vacation”) in more than a decade where I did not spend every day working on a project, article, or similar endeavour.

The other reason I am not a huge fan of talking about my own retirement is motivation. Striving for the goal of financial independence is a great thing, don’t get me wrong. It eases some anxiety, as I will soon be able to stop working if I decide to, technically speaking.

However, on top of the fact that I would do exactly what I am doing right now if I suddenly got really wealthy, I also believe that not having a safety net is better for progress. Personally, I have never been more productive than in the years after I completely wrecked my trading portfolio while being in college. Back then, I traded leveraged bonds. It went really well until it didn’t, and the countermove destroyed my stop losses, leaving me with a hole that took me at least a year to fill.

The good news is that it caused me to rethink my entire strategy and work hard to become a better investor. It led to everything I am doing now.

Ok. That’s enough about me.

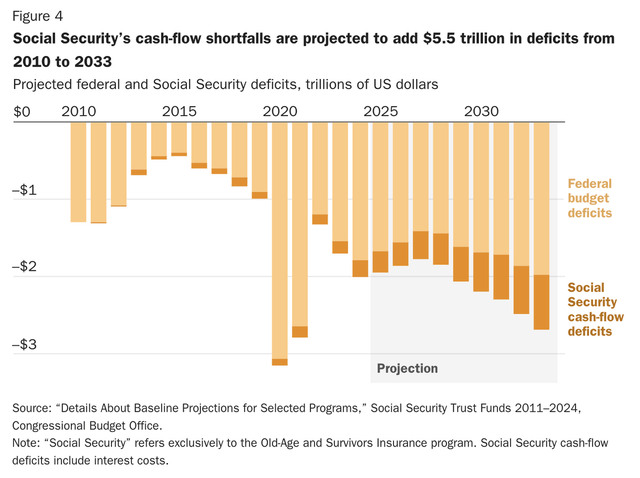

The reason I promised readers to focus more on retirement stocks is based on my belief that owning higher-yielding value stocks, in general, is a good idea, and because retirement planning is critical, given increasing pressure on Social Security, as I wrote this month.

Essentially, Social Security cash flows have become a disaster since the Great Financial Crisis, with increasing deficits and funding requirements, which could lead to cuts down the road and changes like delayed retirements and other regulatory changes.

As the CATO Institute wrote in its warning report, it may be important for people to take more control of their own retirement. As I am someone who is expected to get close to zero from my country’s Social Security and other pension plans, I could not agree more with that.

What if, instead of replacing earnings in old age regardless of need, Social Security was a basic safety net? And what if, instead of relying so heavily on a government program for income in retirement, Americans could own and control more of their own retirement savings, with Social Security acting as a poverty backstop? This reimagined Social Security system would be far from ideal but substantially better than the current unsustainable system. – CATO Institute

In this article, I’ll focus on that and present a few investments that I trust so much, I could make them the core of my retirement portfolio.

So, let’s dive in!

I’m not a financial advisor. And even if I were, I could not give you personal advice, as this article is read by a huge range of different investors. Some are multi-millionaires with second and third homes. Others are barely making ends meet and investing as much as they can to somewhat improve their cash flows. Meanwhile, others have lived paycheck to paycheck their entire lives, while others have enjoyed big tailwinds like inheritances.

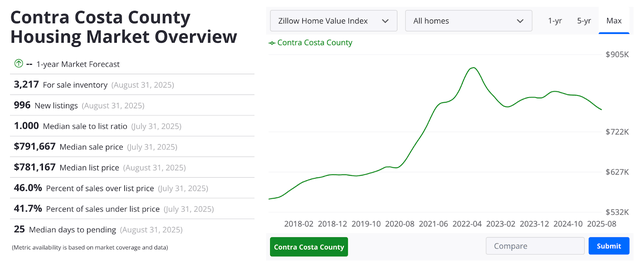

For example, if you inherit a home in Contra Costa County, California, you would likely look at a windfall of close to $800,000, based on the average home price in that region, as we can see below.

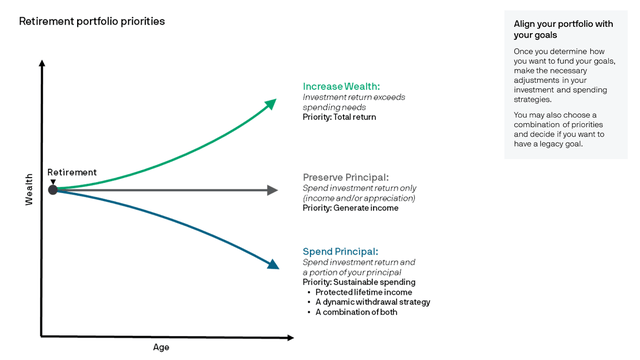

That’s why even during retirement, some can increase their wealth, others manage to keep it steady by generating enough cash flow, while others have to sell assets to cover expenses.

Anyway, my point is that everyone has different needs, which makes this topic so complex.

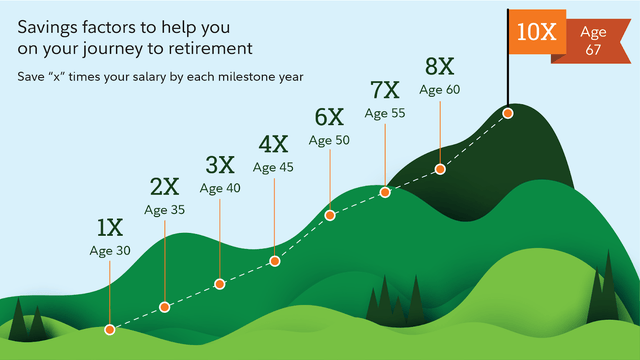

That’s why Fidelity made a roadmap. It all starts by asking how much money you need.

Fidelity says we should try to follow the 10x, which suggests we need to save 10x the salary we expect to make before we start retirement. If you make $80,000 a year, that number is $800,000. If you make $120,000, that number is (you guessed it), $1.2 million.

Now, the tricky part is that we need to incorporate wage growth and inflation. If you’re a 20-year-old college student reading this, you’ll have to factor in close to 50 years of inflation and wage growth. Just imagine what the average income will be in the year 2075 and how high your annual expenses could be. A million dollars by then won’t get you far.

Heck, depending on where you live right now, a million isn’t much either. While a million dollars makes you a king in countries like Albania, a 5-7% yield on that amount makes you lower-middle-class in areas like the San Francisco Bay Area (let’s stick with that example).

Here are some costs to keep in mind (based on Fidelity findings):

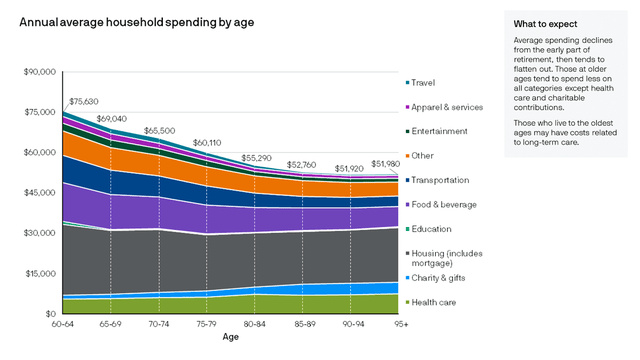

As we can see below, healthcare is one of the few costs that will rise as we get older. Meanwhile, other costs like travel, entertainment, transportation, and food decline.

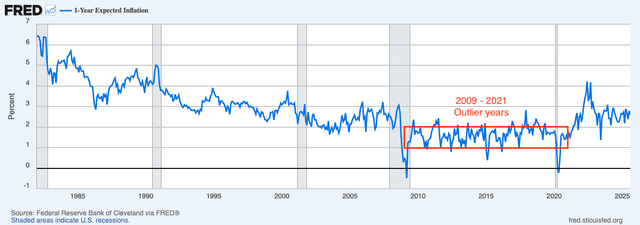

To show you how big a deal small inflation changes are, let’s use the inflation calculator.

The purchasing power of $100,000 in 2025 equals $122,000 after 10 years based on 2% inflation. A 3% inflation rate brings that number to $134,000. That’s a 10% difference.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑