Investment Trust Dividends

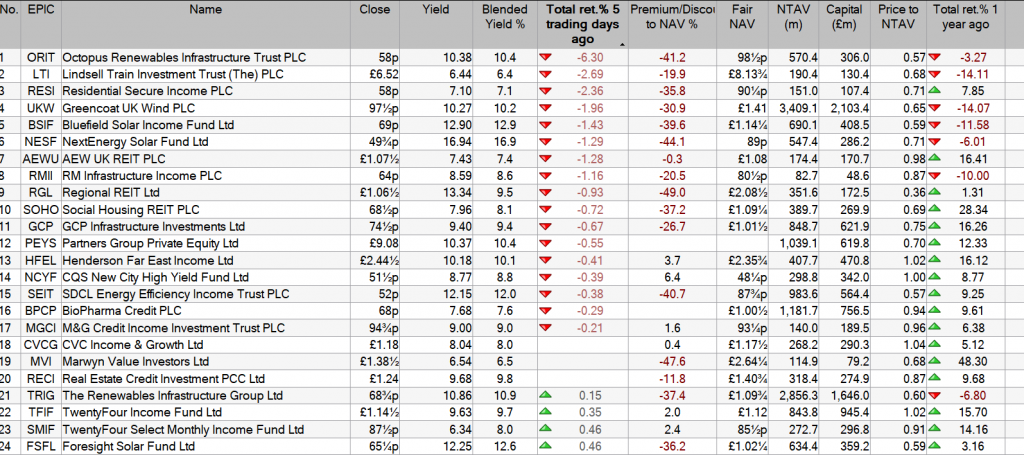

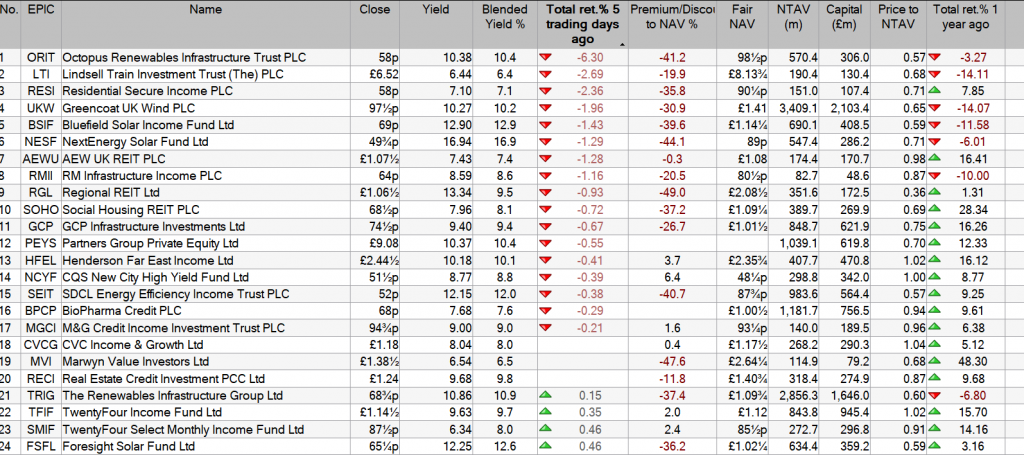

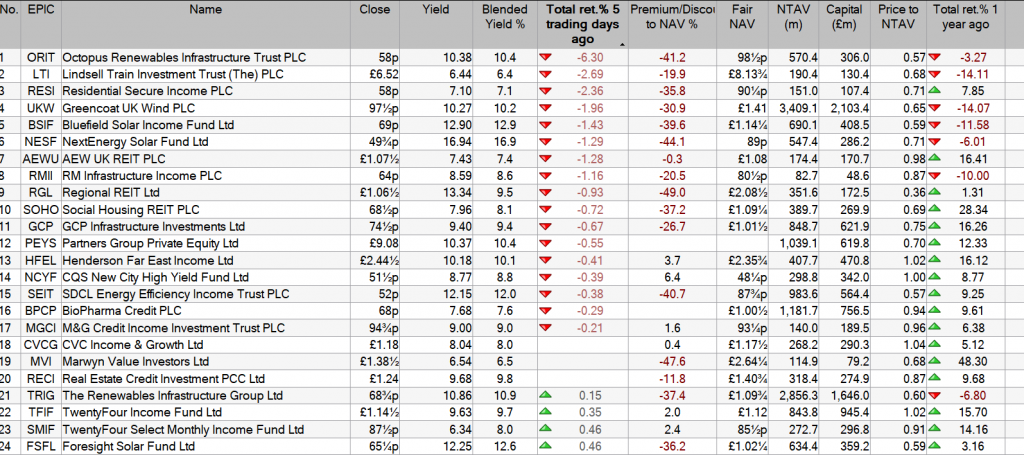

The current plan for the Snowball

The progress to date.

Dividends received.

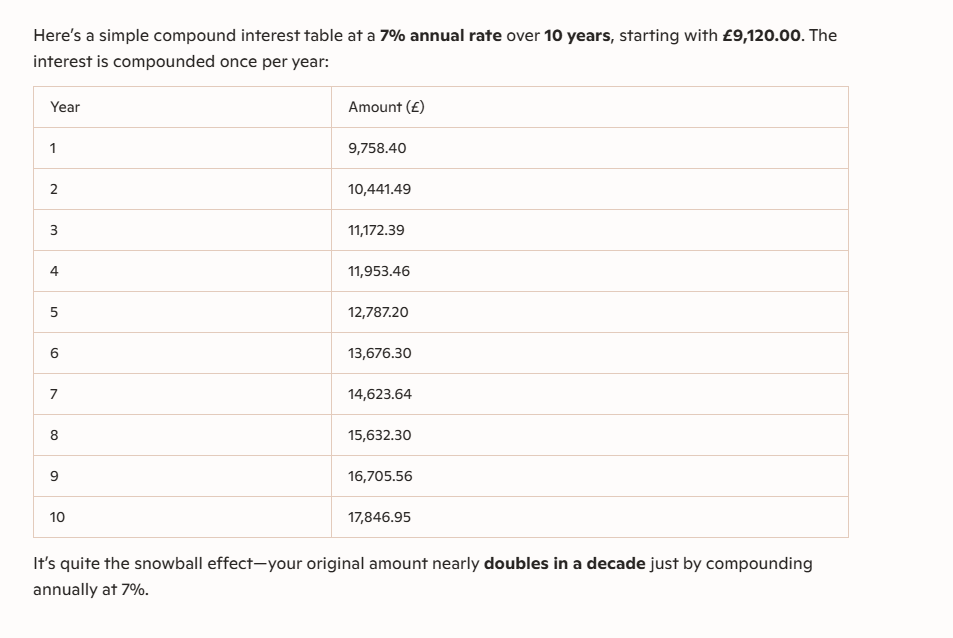

2023 £9,422

2024 £10,796

2025 £11,914

2026 Target 10k

With an end destination of a yield of 18% and you retain all of your hard earned.

Sorry boys and girls it’s much more boring than Naval gazing.

The first attempt at forecasting the first quarter dividends

£3,607.00.

Do not scale to reach a year end figure as the figure includes some dividends harvested in January but it should mean the Snowball is on target to earn 10k plus in dividends, all to be re-invested.

Last year will go down as a golden 12 months for investors in listed commodities funds, but shareholders in a variety of emerging market, technology and recovery plays also have cause to celebrate.

As precious metals and copper soared to all-time highs in 2025, data from the Association of Investment Companies (AIC) shows that the seven London-listed funds in the Commodities and Natural Resources sector generated an average 61.5% share price return in 2025.

That put the group way ahead of the next best investment trust sectors of China, Global Emerging Markets, Growth Capital and Technology which returned between 30% and 39% on average.

“It’s always good to understand which sectors and trusts have done best over the short term but investment is all about the long term. Building a diversified portfolio which meets your investment needs is the priority,” AIC communications director Annabel Brodie-Smith reminded investors.

Top of the commodities sector was Golden Prospect Precious Metals (GPM), a £93m investment company run by Keith Watson and Robert Crayfourd at Manulife Investment Management. Its shares soared 165% on the back of a huge rebound in the shares of gold miners as bullion advanced 65% in response to the geopolitical and economic uncertainty exacerbated by US tariffs.

That made GPM easily the top-performing investment company in the UK last year (see table below), 38 percentage points ahead of the next best performer with a return that was 13 times greater than the average 12% made by investment trusts in 2025.

It was a stellar year for Watson and Crayfourd as the £129m CQS Natural Resources Growth & Income (CYN) they also run more than doubled. It achieved a 102% total return to shareholders from a broader portfolio of miners to rank it fourth in our list of top 10 risers. As a result, the company is broadly the same size it was before it had to buy back nearly 46% of its shares in July as part of a tender offer to get activist hedge fund Saba Capital off its back.

Shareholders in £1.6bn BlackRock World Mining (BRWM), the UK’s largest listed commodities fund, won’t be complaining either after it recorded an impressive 74% return. As with CYN, this was fuelled by gold and an intense demand for raw materials required to support the global roll-out of infrastructure, renewable energy and artificial intelligence.

| Investment companies | Total shareholder return % | Net asset value (NAV) total return % | Premium (- discount) % |

|---|---|---|---|

| Golden Prospect Precious Metals | 165 | 165 | -18 |

| DP Aircraft I | 127 | NA | -30 |

| Seraphim Space | 121 | 27 | -0.4 |

| CQS Natural Resources Growth & Income | 102 | 91 | 2 |

| BlackRock World Mining | 74 | 74 | -6 |

| Gresham House Energy Storage | 72 | 6 | -32 |

| Marwyn Value Investors | 63 | 37 | -47 |

| Molten Ventures | 58 | 7** | -30 |

| Fidelity Emerging Markets | 56 | 51 | -8 |

| RTW Biotech Opportunities | 55 | 42 | -16 |

Source: Association of Investment Companies and Winterflood. ** Gross portfolio return 12 months to 30 September.

A recovery in China’s stock market and a dollar deliberately weakened by President Trump’s trade policy swung momentum back towards emerging markets. Fidelity Emerging Markets (FEML) led the rebound in its sector with a 56% shareholder return. Most of this was generated by the 51% underlying growth in its investments, with a slight narrowing in the gap between its share price and net asset value (NAV) also helping. The shares ended the year at an 8% discount below NAV.

Elsewhere, a range of funds made decisive bids for the sunny uplands after a tough few years.

Second-placed DP Aircraft 1 (DPA) flew 127% higher after re-leasing its two Boeing 787-8 planes from Thai Airways to LOT Polish Airlines. However, that marks only a partial recovery for the specialist dollar-based investment company. At 14 cents today, the shares are a fifth of their value before the 2020 Covid pandemic sent the aviation sector into a tailspin.

Seraphim Space (SSIT) provides a better view in third place. The world’s first listed space technology fund made 121% for shareholders last year. With the shares yesterday rallying with other defence-related stocks following the US overthrow of Venezuela’s president at the weekend, SSIT has now surpassed the early peak it reached shortly after launch in 2021 with shares up 37% since flotation.

It’s a similar story for RTW Biotech Opportunities (RTW) which is closing in on its 2021 peak after advancing 55% last year as shares in drug developers rallied from record lows in response to falling interest rates and an upsurge in bids and takeovers.

Gresham House Energy Storage (GRID) has more to do to recoup shareholder losses from 2023 and 2024 but the 72% share price recovery last year represents a good start for the battery fund’s three-year turnaround plan.

Congrats if you had one or two of the above.

| Investment companies | Total shareholder return % | Net asset value (NAV) total return % | Premium (- discount) % |

|---|---|---|---|

| Lindsell Train | -14 | -12 | -21 |

| Augmentum Fintech | -15 | -3 | -43 |

| JPMorgan US Smaller Companies | -15 | -11 | -7 |

| Greencoat UK Wind | -16 | 0 | -30 |

| Bluefield Solar Income | -19 | -3 | -40 |

| Ecofin US Renewables Infra ($) | -34 | -9 | -50 |

| Hydrogen Capital Growth | -37 | -60 | -60 |

| ICG-Longbow Senior Secured UK Property Debt -39 | -37 | -37 | -29 |

| Aquila Euro Renewables (€) | -41 | -27 | -38 |

| Digital 9 Infrastructure | -69 | -5 | -82 |

Source: Association of Investment Companies and Winterflood.

Turning to the 10 worst-performing investment companies last year, it’s worth noting that the bottom five are all in managed wind-down. Tired of poor, or disappointing, returns exacerbated by wide discounts, shareholders in DGI9, AERI, LBOW, HGEN and RNEW have voted for their assets to be sold and the companies liquidated.

The pressure on renewables funds is evident with half of our list of big fallers investing in forms of clean energy. High-yielding Bluefield Solar Income (BSIF) slid 19% last year and looks likely to exit the stock market with a strategic review launched in November after shareholders objected to a proposed merger with its fund manager.

I wonder if the top three in our list of fallers could do better this year? Lindsell Train (LTI), the top decliner, fell 14% with the dividend included. Even including pay-outs, the shares are down 43% over five years which reflects the trust’s exposure to fund manager Nick Train’s previously successful, but out-of-favour investment approach, and its large stake in the fund firm he runs with Michael Lindsell that has suffered outflows and falls in assets under management. But is the doom and gloom priced in with the shares stuck on 21% discount? Certainly the stock has significantly derated from the 100% premium it stood on in 2021.

Poor sentiment continues to undermine Augmentum Fintech (AUGM) with the shares off 15% last year despite Winterflood data showing its portfolio of unquoted financial services companies proved stable, if unexciting, in 2025. Having avoided the big write-downs that have afflicted some other early-stage investors, AUGM has delivered a 34% underlying return in the past five years and yet its shares have dropped by a third to languish on a 43% discount. That valuation gap looks unsustainable. Something could happen to close it. Perhaps it’s already happening as the shares have rallied since early December when the company said £125m of its investments were effectively valued at nil by its share price.

Lastly, will JPMorgan US Smaller Companies (JUSC) catch a break in 2026 after its 15% decline last year? Donald Trump’s re-election in late 2024 prompted a value-style rally that left this former top-performing small-cap growth investor out in the cold, and badly lagging the market’s rebound since “Liberation Day” last April. With the company actively buying back shares, the discount has stayed relatively narrow at 7% so there isn’t a valuation gap to exploit as such, just a hunch that the market could swing back in its direction.

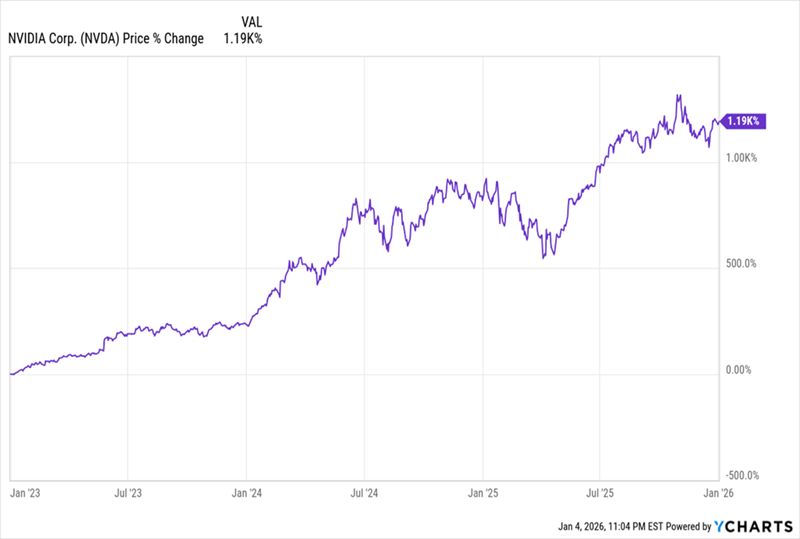

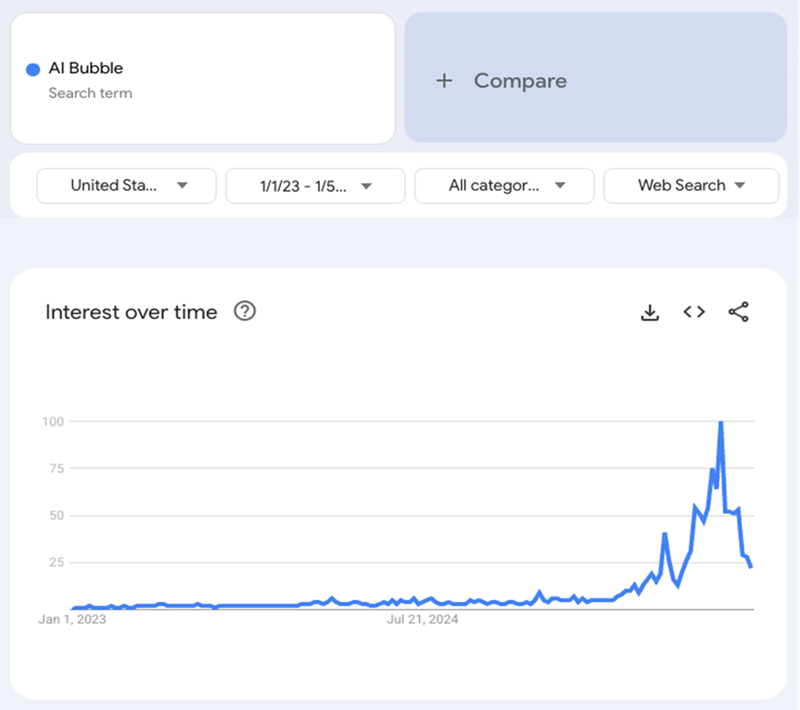

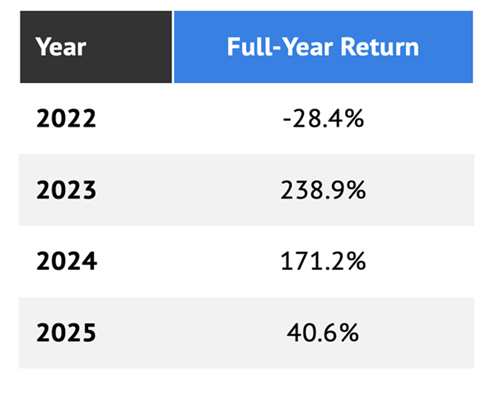

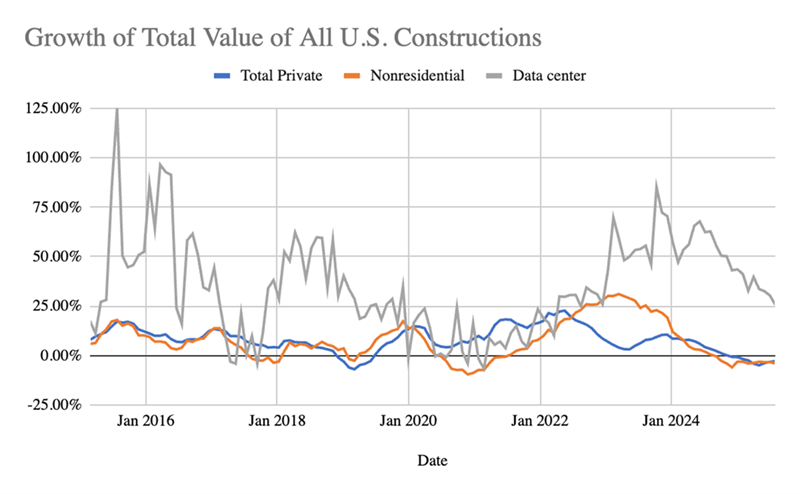

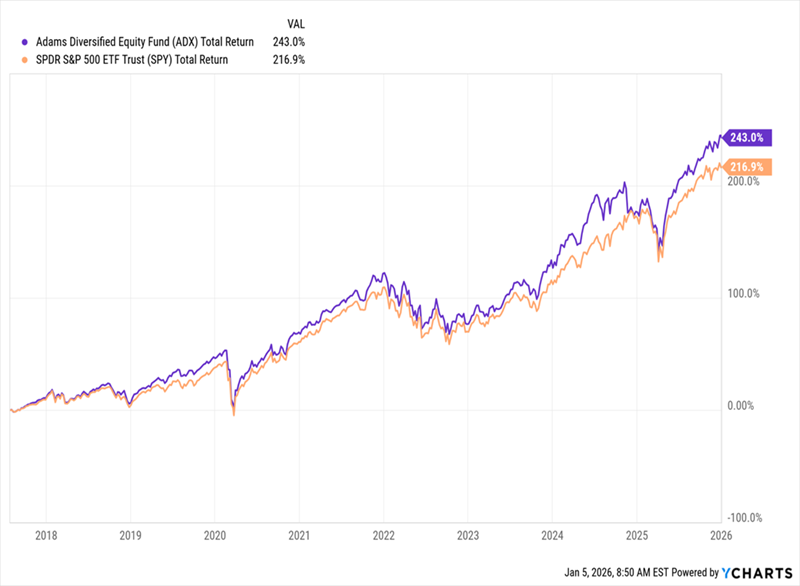

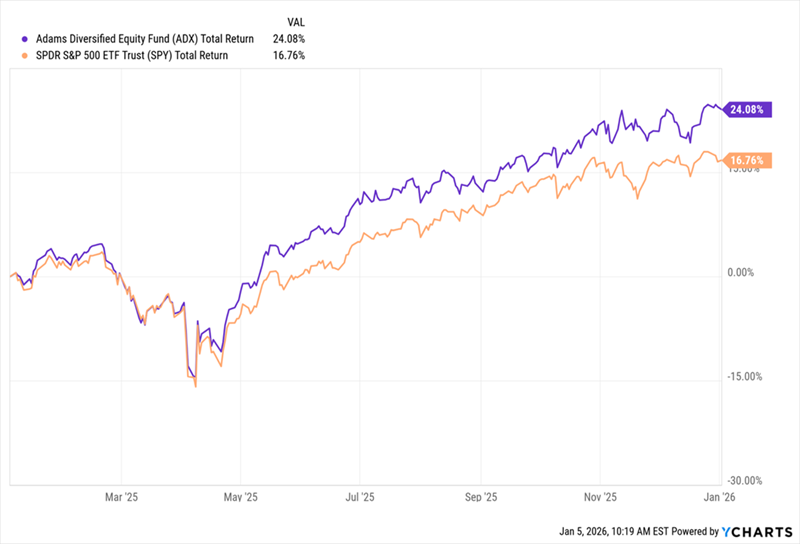

My Plan for 7.9% Dividends From the AI Boom (Hint: It Began in 1854) by Michael Foster, Investment Strategist The run that AI poster child NVIDIA (NVDA) has been on these last few years is truly incredible. That’s not news, of course. But what matters now is whether investors are overpaying for that growth – in both NVIDIA and AI as a whole. NVIDIA’s Monstrous Run  Once a chipmaker known for appealing mainly to gamers, NVIDIA started to climb in 2023, thanks to a new technology only a few people really understood at the time: generative AI. Then, as AI spread in 2024, hopes – and NVIDIA’s stock – soared. That was followed by more fears of a bubble in AI. As with NVIDIA’s share price, a chart is the best way to do these worries justice: The Bubble in Worries About an AI Bubble  There’s so much discussion of an AI bubble now that we seem to be in a bubble of talking about bubbles! That’s why some advisors are saying that this AI bubble talk is a distraction. I’d agree, as we can’t even be sure this is a bubble – and I’d argue it’s not. To see why I’m saying this, we need to look no further than NVIDIA shares. Consider this table of their performance in the last four years.  Here I’ve broken out NVDA’s per-year returns since 2022, a year in which the stock plunged alongside all of tech. Note how its biggest year was in 2023, and that its gains have been moderating since? If this were really a bubble, you’d expect yearly gains to keep building and building until they hit a wall. That’s not the case here. In fact, I’d argue that we’re seeing a massively undervalued company becoming a fairly valued one. To really unpack this, let’s look at how much investors are paying for NVIDIA’s earnings. We’ll do that by looking at the stock’s price-to-earnings (P/E) ratio (in purple below). As you can see, it roughly matches that of “boring” big-box retailer Costco (COST)! Is NVIDIA Really Worth as Much as …Costco?  I think you’ll agree that Costco, with its membership-driven revenue, is a pretty reliable revenue generator. This shows that investors are starting to see NVIDIA the same way. Note also that NVIDIA’s P/E ratio trailed that of Costco for most of 2025. In other words, this is not a bubbly valuation. And in fact, none of the “Magnificent 7” stocks sport higher valuations than Costco right now. That is, except for Tesla (TSLA), which in many ways lives in its own little world. To be sure, some aspects of the AI space do look bubbly, like the 700 seed-stage rounds that attracted $10 million or more in 2025. This shows that venture capitalists are indeed making some outrageous bets here. But that’s not a sign of a bubble. In fact, I heard the same worries about VC over investment in the early 2010s (if you don’t remember Juicero, it was a great example of VC silliness), when I worked on Wall Street. The market powered higher anyway. But what about all the infrastructure investments we hear about, especially around data centers? One report says we saw about a 30% growth rate in data-center spending in the middle of 2025, to about $40 billion on an annualized basis, and the Fed estimates about $41.2 billion. But both sources also cite rapid growth in building back in 2023 and 2024, so the 2025 rate actually moderated compared to 2024. If we look at total private construction of non-residential properties, as provided by the Census Bureau, a similar story appears.  Source: US Census Bureau, CEF Insider Source: US Census Bureau, CEF InsiderHere we can see spending growth on data-center construction (gray line) far outpacing all non residential spending (orange line) and overall private-sector spending (blue) in late 2023 and 2024. That was actually the case in the late 2010s, as well. In fact, data-center spending looks like it’s simply going back to where it was pre-pandemic. It’s also worth noting that the growth rate has been slowing since peaking in late 2023, much like NVIDIA’s stock-price growth has been moderating since then, too. In other words, this is clearly not a bubble – if anything, the bubbly numbers looked most alarming in late 2023. How I’m Playing the AI “Non-Bubble” So what’s the best approach for us here? For one, the data says this market is not acting irrationally. On the contrary, valuations suggest a mature market, and our best play is to remain fully invested and diversified. Most people would go with an index fund like the SPDR S&P 500 ETF (SPY) in a situation like this. But we want dividends, and SPY’s sad 1% yield just won’t cut it. In this market, while we wait for AI to continue its spread through the US economy, getting a big slice of our return in cash dividends is key. That’s why we prefer a closed-end fund (CEF) like the Adams Diversified Equity Fund (ADX), a long-time holding of my CEF Insider service. ADX is a proven long-term wealth generator, both in the form of dividends and capital gains. Since we bought the 7.9%-yielding fund in July 2017, it’s returned 243% in gains and dividends, as of this writing, soundly beating the S&P 500. “Dividend-Powered” ADX Beats the Market in the Long Term …  That’s thanks to management’s stock-picking skills (ADX holds NVIDIA, along with many other top S&P 500 stocks). Their acumen stems from ADX’s long institutional memory: The fund traces its roots back to 1854 – yes, the mid-nineteenth century. And then there’s that income stream, responsible for a big slice of the fund’s total return: ADX’s 7.9% yield is roughly seven times that of the typical S&P 500 stock (note that ADX’s payouts do flex somewhat, based on its portfolio performance). The odd thing about CEFs like ADX is that when investors judge their performance, they tend to only look at price returns, not total returns (including dividends), as we discussed last week. And on a price basis, ADX returned 15.5% in 2025, just less than the 16.4% of an S&P 500 index fund. But add reinvested dividends and you’ll see that ADX (in purple below) easily beat the market. … And the Short Term, Too  CEFs like ADX are nicely set to keep outrunning a rising stock market. Anyone who’s letting bubble fears keep them out of the market (and this great fund) are missing out – on both the income and the capital gains side. |

The portfolio is called the Snowball because as a snowball rolls down a hill it gathers more and more snow and grows bigger until it stops rolling.

Or your Snowball, which should be different to the blog portfolio, the yield will grow as you buy more shares with the earned dividends, until you want to spend the same dividends, either when you retire or if you need to boost your income.

2026 Income £943.00

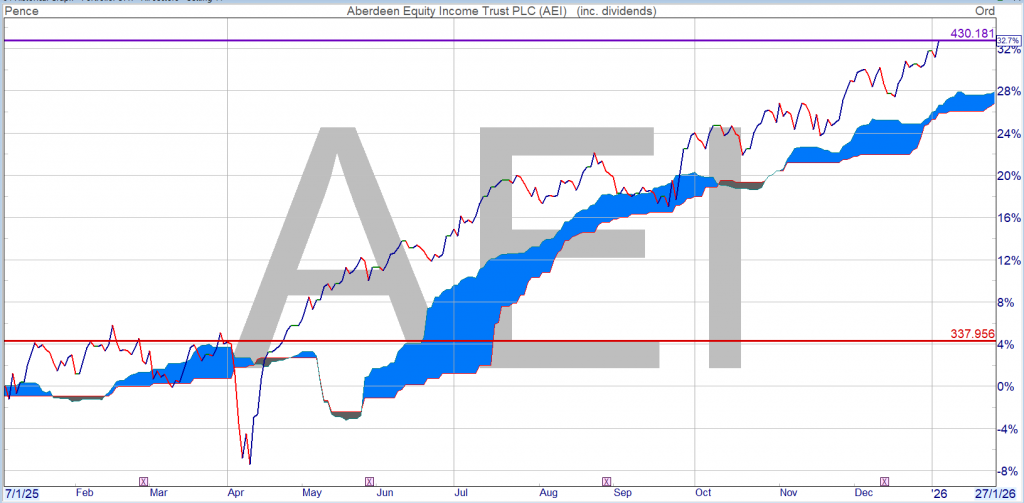

The Boards of Aberdeen Equity Income Trust plc (“AEI“) and Shires Income PLC (“SHRS)”) are pleased to announce that heads of terms have been agreed for a combination of AEI and SHRS (the “Combination“), bringing together two successful in

The combined yield will most probably fall and the Trust will leave the Watch List.

SUPERMARKET INCOME REIT PLC

DIVIDEND DECLARATION

Supermarket Income REIT plc (LSE: SUPR, JSE: SRI) has today declared an interim dividend in respect of the period from 1 October 2025 to 31 December 2025 of 1.545 pence per ordinary share (the “Second Quarterly Dividend”).

The Second Quarterly Dividend will be paid on or around 27 February 2026 as a Property Income Distribution (“PID”) in respect of the Company’s tax-exempt property rental business to shareholders on the register as at 30 January 2026. The ex-dividend date will be 29 January 2026.

Please note that there is no scrip dividend alternative available for the Second Quarterly Dividend and it will be paid in full as cash. The Board will keep under consideration the offer of a scrip dividend alternative in respect of future quarterly dividends.

Dividends £755.00

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑