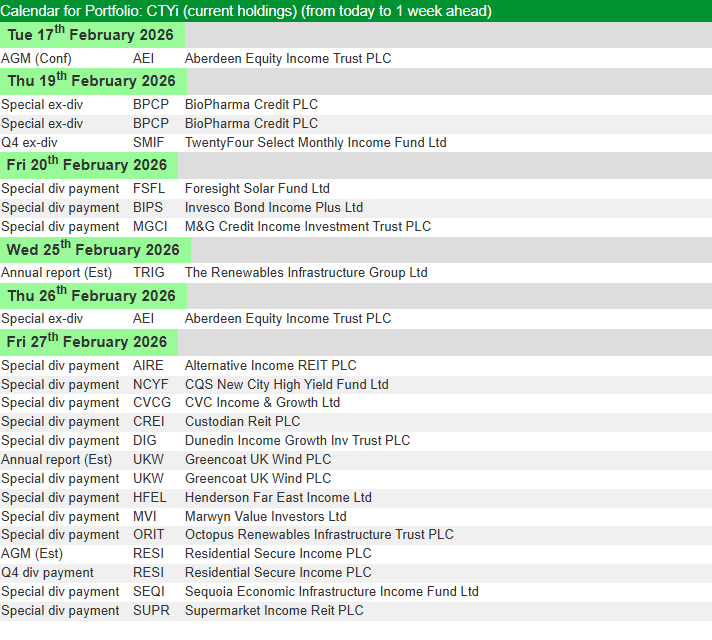

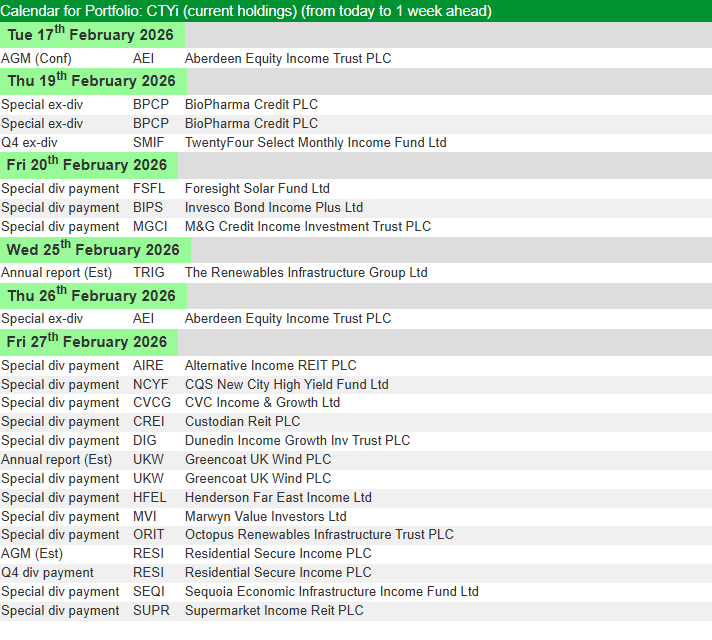

Investment Trust Dividends

Thursday 19 February

BioPharma Credit PLC ex-dividend date

Greencoat Renewables PLC ex-dividend date

Impax Asset Management Group PLC ex-dividend date

Mountview Estates PLC ex-dividend date

Shires Income PLC ex-dividend date

I’m hunting for enormous dividend yields for my income portfolio and this FTSE industry leader could be a massive opportunity right now!

Posted by Zaven Boyrazian

Published 16 February

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Even with the UK stock market reaching new record highs lately, there are still plenty of FTSE shares offering generous dividend yields. And if these payouts can be maintained, investors could go on to earn an absurd amount of passive income.

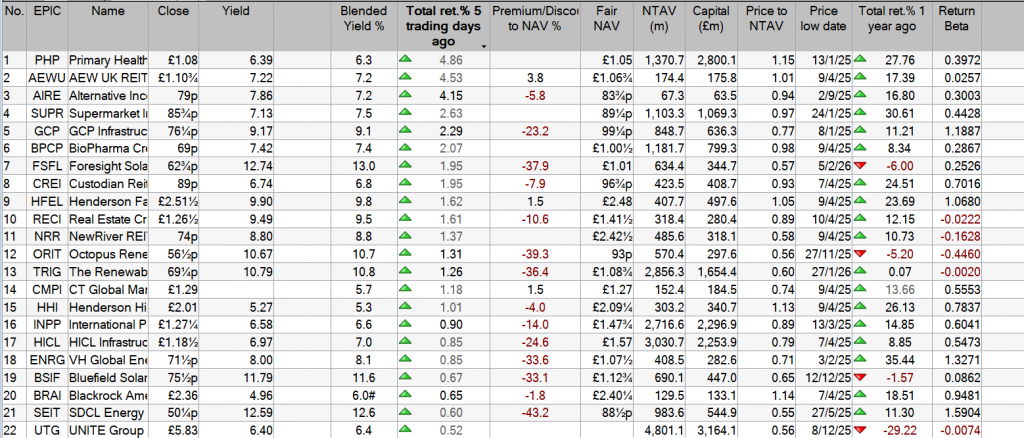

That’s what’s brought Greencoat UK Wind (LSE:UKW) back in my sights. Renewable energy stocks continue to be unpopular in 2026. But new evidence is emerging that Greencoat shares could be a phenomenal long-term opportunity. And if that’s the case, its 10.6% payout could pave the way to exceptionally lucrative results.

So, is now the right time to go against the crowd and aim to earn a massive passive income?

Despite hiking its dividend by more than 130% since its IPO, Greencoat’s double-digit dividend yield stems from a painful fall in Greencoat’s share price.

Down around 35% since the start of 2023, the shares now trade at a 26.6% discount to net asset value (NAV). And to be fair, there are some valid concerns to justify this large discount.

In April this year, the Renewable Obligations (RO) scheme will be switching its inflation index from the retail price index (RPI) to the consumer price index (CPI). While CPI is a generally more accurate measure, it’s also often 1% to 2% lower than RPI, resulting in a significant reduction in long-term subsidy revenue for green energy generators.

At the same time, with more energy capacity being added to the national grid, long-term power price forecasts have been steadily dropping, placing further pressure on Greencoat’s projected cash flow. Combining all that with some fairly weak wind speeds over the last few years, it’s not surprising to see investor sentiment sour.

Despite some valid criticisms, investor pessimism looks like it could be overblown.

The near-30% discount to NAV doesn’t align with what’s happening in the private markets. The fact that Greencoat’s recent asset sales have occurred at NAV is evidence of that. And it shows there is a real disconnect between perceived value and actual value.

This valuation gap is something management has already been taking advantage of. By systematically buying its own stock at a substantial discount, not only is the firm boosting the NAV per share, but it’s also opening the door to a higher dividend per share simultaneously.

What’s more, policy uncertainty surrounding the RO scheme is now resolved. Meanwhile, looking at the group’s performance in the final quarter of 2025, even wind speeds have also started picking up again, with energy generation coming in just 1.6% below budget versus 14% across the first half of the year.

So, where does that leave investors?

Fluctuations in wind speeds remain a persistent threat. And prolonged periods of calm weather could be catastrophic for Greencoat, particularly given its fairly leveraged balance sheet.

However, with the share price barely moving despite substantial policy uncertainty being removed from the equation, it’s hard not to be tempted by the double-digit yield. Even more so, given that dividends are still entirely covered by cash flow.

So, with a favourable risk-to-reward ratio, Greencoat shares could be worth mulling over. But it’s not the only high-yield opportunity on my radar today.

Thursday, February 12

Director of Personal Finance

When people think of investors they may imagine people with private yachts or thousands of pounds in the bank, but investing doesn’t have to mean big sums or expert timing to deliver decent results.

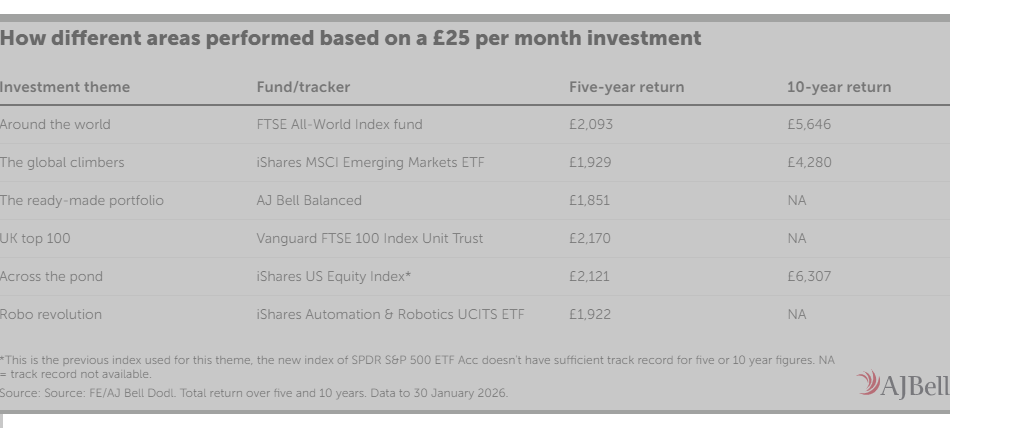

Putting away just £25 a month could grow into a sizeable investment pot over time, and the figures highlight the powerful impact of investing little and often. Over the past decade, even modest monthly contributions to global and US markets could have turned spare change into more than £6,000, underlining how time in the market can matter far more than the amount you start with.

If you put away just £25 a month, less than £1 a day, you could build up a tidy pot after a few years. Assuming 6% a year investment growth after charges, you’d have £1,793 after five years and £4,191 after 10 years. If you kept up the trend for 15 years, assuming those same 6% a year investment returns, you’d have just over £7,400 in your investment pot, or almost £11,700 after 20 years. The figures show how investing little and often can really add up.

Often when people start investing they start small and set up a direct debit with the money invested automatically every month, making the process hassle free. This is a great way to reduce the time it takes to invest and means you don’t have to worry about trying to time the market. But the danger is that you start at £25 and never increase that amount, even when your earnings grow.

Typically, people’s wages grow over time, so you could also increase your contributions over your investment journey, to boost your investment pot over the long term. You could give your investment contributions a 5% pay rise every year, meaning they’d rise to £26.25 in the second year, up to around £38.75 a month by year 10. If you do this your portfolio benefits from a pay rise boost. If we assume the same 6% a year investment returns, you’d have £1,970 in your investment pot after five years, or £5,150 after 10 years. After 15 years that pot would have risen to £10,101 before hitting £17,612 after 20 years – almost £6,000 more than if you left the monthly savings at a static £25 a month.

If you want to start investing little and often you may find a simple tracker fund a good option, with many investment providers, like AJ Bell’s Dodl app, making it easy to choose from a range of funds and ETFs tracking a basket of assets.

Investing £25 a month into the FTSE All World Index Acc fund, Dodl’s global tracker of choice, 10 years ago would have left you with £5,646 today. Even if you’d only started five years ago, you’d be sitting on £2,093 today.

If you’d opted for a US focus, with the iShares US Equity Index, and invested £25 a month over the past 10 years you’d be sitting on £6,307 in your investment pot, or £2,121 if you’d invested over the past five years.

Before investing you’ll want to make sure that you’ve paid down any pricey debt, otherwise the interest you’re racking up on your credit card or overdraft will probably more than wipe out the gains you make investing.

Investing is also generally only suitable for money that you don’t plan to spend for five years or more. So, make sure that you’ve got your emergency savings in cash, as well as any money you’ll need in five years – for a big holiday, a new car or your first home, for example. Any savings goal that’s further out than five years could be ideal for investing.

Investing for the first time can feel daunting. If you don’t feel confident picking which countries or sectors to invest in you can defer asset allocation decisions to a professional. You can buy so-called ‘all in one’ or multi-asset funds that spread your money between different regions and across various asset classes, with an option of having more or less in stock markets versus bonds, gold and cash, depending on your risk appetite. Alternatively, first-timers could buy a cheap ‘tracker’ fund, which mimics the performance of a broad global index, such as the MSCI World.

Investors also need to make sure they understand what they’re buying, and why they think it will make money – whether it’s a fund or a share. All too often investors are lured in by the promise of high returns or invest because a friend has recommended it, but you need to make sure you understand how the investment works and all the risks before you commit your money.

Zaven Boyrazian explores two REITs with dividend yields of up to 7% that experts have highlighted as top long-term passive income picks.

Posted by Zaven Boyrazian, CFA

Published 15 February

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Real estate investment trusts (REITs) are notorious for offering high dividend yields and generating chunky passive incomes. Sadly, with higher interest rates throwing a spanner into their debt-heavy balance sheets, many of these enterprises have struggled in recent years… but not all of them.

Several REITs remain in strong financial form and are favourites among some expert analysts in 2026. So for investors seeking to unlock a reliable long-term passive income, which REITs should they be considering right now?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

A top pick from both Berenberg Bank and Jefferies is Primary Health Properties (LSE:PHP). After completing its takeover of Assura in 2025, the REIT’s become the UK’s largest healthcare landlord with a portfolio of 1,142 properties spanning local surgeries, medical centres, private practices, and even a few hospitals.

With healthcare in continuous demand, the company’s had little trouble finding tenants or securing long-term leases.

As such, the average duration of its rental contracts currently spans 11 years, with occupancy standing at 99.1%. And since close to 90% of the group’s rent is paid by the NHS, the company essentially earns government-guaranteed income.

Few REITs enjoy this level of revenue visibility. And as a result, management’s been able to consistently and intelligently allocate capital, ensuring steady growth, and 28 years of continuous dividend hikes – a pattern that experts believe will continue far into the future.

What could possibly go wrong? Having the NHS as a top tenant is a bit of a double-edged sword. While it ensures reliable and timely rent payments, it also means Primary Health Properties is at the mercy of government spending and political priorities.

If the NHS budget’s cut or efficiency initiatives reduce the required real estate footprint for healthcare, the group’s impressive occupancy could come under pressure. Similarly, it gives the NHS far more power when negotiating lease renewals that limit the group’s future cash flow growth.

These risks are something investors will need to consider carefully before adding this business to their income portfolio.

With e-commerce volumes continuing to expand worldwide, demand for well-positioned logistics facilities continues to rise. And another top REIT from Berenberg to profit from this trend is Segro (LSE:SGRO).

As one of the largest commercial landlords in Europe, businesses such as Amazon, Deutsche Post DHL, and Tesco all rent from Segro to run their expansive operations. And with an impressive undeveloped landbank, this scale advantage is only becoming more prominent.

Occupancy stands at 94.3% with an average lease duration of 8.2 years as of June 2025. And just like Primary Health Properties, this long-term revenue visibility has enabled 11 years of continuous payout hikes.

However, unlike Primary Health Properties, Segro is more exposed to cyclical risks. Downturns in consumer spending directly impact demand for renewing old leases or signing new ones.

At the same time, if the wider market overdevelops new e-commerce capacity prior to a downturn, it could result in oversupply, putting downward pressure on rental rates. Nevertheless, Segro’s demonstrated a knack for navigating such environments in the past.

So once again, it might be a risk worth taking. But these aren’t the only REITs on my radar right now.

Dr James Fox explores whether it would could be possible to generate enough dividend income to live comfortably and stop working.

Posted by Dr. James Fox

Published 30 May, 2023

The content of this article was relevant at the time of publishing. Circumstances change continuously and caution should therefore be exercised when relying upon any content contained within this article.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing

Like many investors, I receive dividend income from the stocks I own. In my case, dividend-paying stocks represent the core part of my portfolio. But just how much would I need to earn from dividends to live off this income alone? And would it be possible?

Let’s take a close look.

Well, I’d want to build a portfolio of dividend stocks that collectively pay me enough money to live from. Let’s say this is £30,000, but I appreciate this might not be possible in London.

And I’d want to be doing this within an ISA wrapper. That’s because any capital gains, dividends, or interest earned within the ISA portfolio is tax-free.

So, if I was earning £30,000 from dividends, I’d actually be taking home more money than someone on a £45,000 salary — including student loan repayments.

Of course, unless I picked specific stocks, I wouldn’t expect this income to be spread evenly across the year. At this moment, the majority of my portfolio’s income comes around April and May, shortly after the end of the financial year. So that’s something to bear in mind.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Well, to earn £30,000, I’d need to have at least £375,000 invested in stocks. That’s because I believe the best dividend I can achieve is around 8%. This would involve investing in companies, like Legal & General, that don’t offer much in the way of share price gains.

But what if we don’t have £375,000? And let’s face it, the majority of us don’t.

Well, I’d need to build a portfolio over time. And I could do that using a compound returns strategy. This involves reinvesting my dividends and earning interest on my interest. It’s very much like a snowball effect.

Naturally, there are several key variables here. The starting figure, the yield I can achieve, and the amount of money I contribute from my salary every month.

If I started with £10,000 and stocks yielding 8%, in theory I could reach £375,000 in 19 years. But this would require me to contribute £400 a month and increased this contribution by 5% annually throughout those 19 years.

And by contributing £400 a month, I’d fall way under the maximum annual ISA contribution of £20,000.

Compound returns isn’t a perfect science, and as with any investment, I could lose money. But it’s certainly safer than investing in growth stocks.

Of course, the above is great in theory, but I’d need to pick the right stocks. I’m looking for stocks with strong dividend yields, but I also need to be wary. Big dividend yields can be a warning sign, and the dividend coverage ratio is a good place to start.

View over Old Man Of Storr, Isle Of Skye, Scotland

Story by Zaven Boyrazian, CFA

Few investors come close to matching the exceptional track record of billionaire Warren Buffett. The ‘Oracle of Omaha’ has steered his investment firm to generate close to a 20% average annualised return since the 1960s. So it’s no surprise that when Buffett gives advice, investors listen… carefully.

And with the cost of living continuing to rise, his previous tips about the need to earn passive income are now more relevant than ever. After all, “If you don’t find a way to make money while you sleep, you will work until you die”, he famously said.

With that in mind, here’s how any investor can immediately start earning a passive income overnight.

While many investment portfolios tend to be geared towards growth, it’s easy to overlook mature, boring dividend-paying stocks. After all, why would you invest in a dull self-storage enterprise when there are bleeding-edge biotechs curing cancer?

So how do investors tap into all this passive income potential? It’s simple. All they need to do is buy shares in a dividend-paying company, and wait for the money to come rolling in, usually once every quarter.

But is it really that simple?

The most lucrative dividend stocks over the long run aren’t necessarily the ones with the highest yields today. Instead, it’s the businesses that generate exorbitant volumes of consistent free cash flow that not only fund shareholder payouts but also enable them to grow over time.

That’s a lesson Buffett has learned firsthand with his investment in Coca-Cola (NYSE:KO). The soft drinks giant has used its consistent and steady cash flows to increase dividends every year for 63 years in a row. And consequently, Buffett’s now earning more than a 60% yield on his original investment in the late 1980s.

Sadly, past performance doesn’t guarantee future results. And if investors blindly buy previously successful income stocks without investigating the underlying risks or potential rewards, their passive income could quickly disappoint.

So let’s take a closer look at Coca-Cola.

Starting with the positives, Coca-Cola’s latest results show that the company continues to expand sales organically at impressive profit margins. And even after another round of price increases, thanks to the group’s brand driving pricing power, sales volumes have remained robust, indicating that customers are happy to pay a premium.

That all translates into yet more free cash flow, paving the way for its 64th consecutive dividend hike. However, there are some brewing headwinds to keep a close eye on. Rising global sugar taxes and rising economic constraints in key emerging markets undermine the group’s long-term momentum.

As such, even if dividends continue to rise, future payout hikes might be far less impressive. Put simply, there may be other better dividend growth opportunities to explore right now. Nevertheless, for investors seeking reliable passive income, this Buffett-style stock might be worth a closer look.

The post Warren Buffett says you need to make passive income while sleeping! appeared first on The Motley Fool UK.

Feb. 13, 2026 BIZD, MAIN, CSWC, ARCC, HTGC, GBDC, BXSL, OBDC, VNQ, O, NNN, MAA, CPT, AMH, INVH, GLD, XLB, XLE, AMLP, KMI, WMB, EPD, ET, MPLX, PAGP

Samuel Smith Investing Group

When looking to retire on passive income, I look to build a portfolio diversified by sector that is filled with high-yielding, high-quality businesses that have durable defensive business models, strong balance sheets, high and sustainable yields that are well-covered by underlying cash flows, and have the potential to either grow at a rate that meets or beats inflation or generate excess income that can be reinvested to generate growing income to offset the corrosive impacts of inflation.

While diversification is a sacred pillar of my investment strategy, at the same time, as a value investor, I do tend to overweight sectors that are opportunistically valued at the time. This is how I’ve been able to generate outsized total returns with below-market beta over time. With that in view, in this article, I’m going to detail what I think are three of the most undervalued, attractive, retirement-friendly income machines right now.

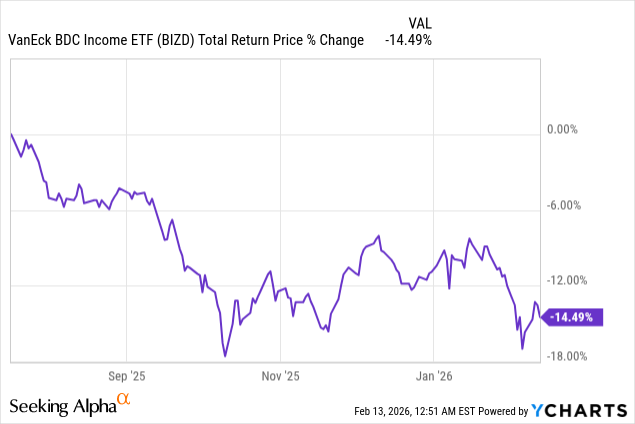

The most undervalued high-yield sector right now is the business development company sector (BIZD), as it has sold off pretty aggressively since last July:

While there certainly are concerns about private credit in general due to the influx of capital into this space in recent years, the compressing spreads, the muted M&A activity, and, most recently, concerns about AI disruption of software, which does have a substantial place in many BDCs’ lending portfolios, I think that overall these concerns are largely overblown. This is especially true in the leading quality underwriters, as their portfolios continue to deliver strong underwriting performance and their internal risk metrics are not showing any material signs of growing weakness and potential credit defaults.

Within the BDC space, there are quite a few opportunities right now that offer attractive and sustainable yields that I would have no issues buying if I were an income-focused retiree as part of a well-diversified portfolio. If you want to go with the bluest of the blue chips, Main Street Capital Corporation (MAIN), Capital Southwest (CSWC), and Ares Capital (ARCC) are three great names to choose from, though I do not view them as being particularly cheap at the moment. If you want to move further into tech, you can go with the leading blue-chip Hercules Capital, Inc. (HTGC), which is a solid opportunity, albeit trading near fair value, in my view.

However, if you want to go after more undervalued names while still insisting on quality, I think names like Golub Capital BDC (GBDC), Blackstone Secured Lending Fund (BXSL), Blue Owl Capital Corporation (OBDC), and several others offer an attractive combination of yields and value right now. While it is entirely possible that some of these BDCs – such as BXSL and OBDC – will cut their dividends in the coming quarters, it is also important to keep in mind that their current yields are high enough that even a 10-20% cut in their dividend would still leave them yielding over 10%. This is similar to how GBDC recently cut its dividend by 15%, yet still yields over 10%. This reduced dividend rate would then be quite sustainable, barring a very aggressive pace of rate cuts from the Fed and/or a material economic downturn. Meanwhile, their substantial discounts to net asset value, strong underlying balance sheets, and defensive portfolio posture, along with strong underlying performance, set them up to be dependable and relatively defensive income machines.

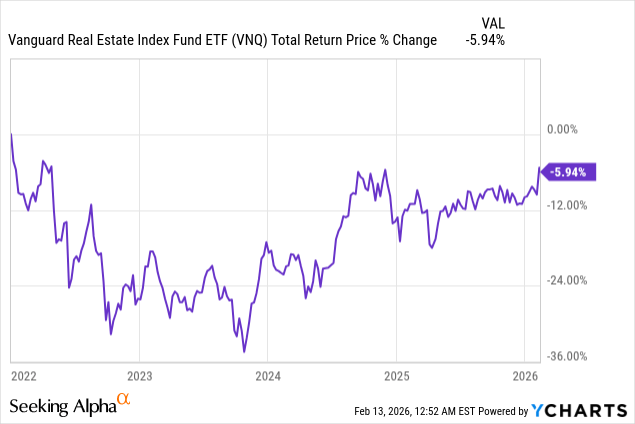

The second most undervalued high-yield income machine right now, in my view, can be found in the real estate investment trust space (VNQ), as it has been in the doldrums ever since interest rates began rising aggressively in 2022.

While triple-net lease is typically the bastion of sustainable income, with names like Realty Income Corporation (O) and NNN REIT, Inc. (NNN) headlining that space with fairly attractive yields, one of my favorite places to invest in the real estate sector right now is the residential space.

This is because there continues to be a general housing shortage in many markets in the United States, and rental rate dynamics in key Sunbelt markets are about to hit an inflection point where I think they will likely increase materially later this year and into 2027, as new supply is expected to be weak moving forward while demand continues to grow due to strong in-migration into these markets. Some of the most attractive ways to play it right now are Mid-America Apartment Communities, Inc. (MAA) for multifamily, along with Camden Property Trust (CPT) as another attractive option, and then in the single-family space, American Homes 4 Rent (AMH) and Invitation Homes Inc. (INVH) are both deeply undervalued as well.

All four of these REITs offer pretty solid dividend yields with strong dividend growth track records backed by rock-solid balance sheets, diversified portfolios of quality residential real estate in good markets, and yet all four of them trade at deep discounts to net asset value. Between their essential nature, attractive long-term growth prospects, status as a real asset inflation hedge, and deep value, I think these make for a very compelling place to allocate capital right now, especially in an environment where many other real asset investments, especially in the precious metals space (GLD) and commodity materials space (XLB), as well as increasingly the energy sector (XLE), have recently undergone strong rallies, making this one of the few real asset value plays remaining.

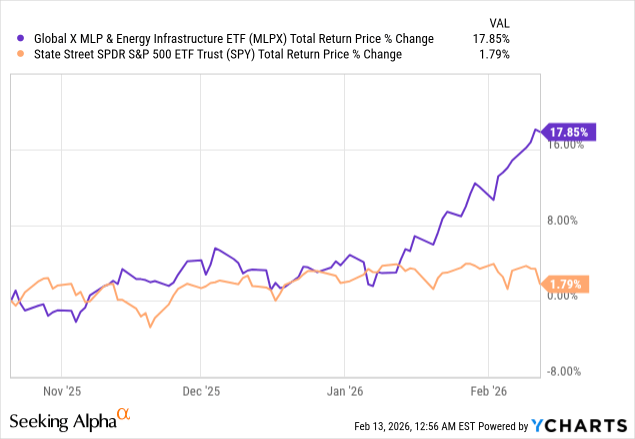

The third most undervalued high-yielding retirement income machine right now is midstream infrastructure (AMLP). Now, some midstream infrastructure is not discounted at all, such as Kinder Morgan, Inc. (KMI) and The Williams Companies, Inc. (WMB), which are quite richly priced after strong recent rallies. However, there are some attractive opportunities in this space yet that combine high yield with inflation-beating growth, very strong balance sheets, well-diversified and high-quality asset bases, and good management teams.

In particular, Enterprise Products Partners L.P. (EPD), Energy Transfer LP (ET), MPLX LP (MPLX), and several other K-1-issuing MLPs look very attractive right now, and in the 1099-issuing midstream side of things, there are also a few attractive opportunities, such as Plains GP Holdings, L.P. (PAGP). While they’re not as cheap as they were this past October, when I was pounding the table on them as my highest conviction pick at the moment, they still offer very attractive combinations of yield and inflation-resistant growth, as well as defensiveness thanks to their longer-duration, highly contracted cash flow profiles.

As a result, I think they still are a must-own as a substantial allocation in any income-focused retirement portfolio.

While I’m very bullish on select undervalued high-quality BDCs, REITs, and midstream companies right now, none of them is risk-free. As already mentioned, BDCs are facing a plethora of headline and fundamental headwinds, whereas REITs remain highly interest rate sensitive, and residential REITs in particular need to work through some oversupply conditions in certain markets, which I think will happen soon. Finally, midstream infrastructure companies are mostly prone to commodity price volatility, impacting their equity valuations, even if their underlying cash flows are fairly resistant to it. Additionally, they have operational risk as they end up investing in growth projects that need to be executed on time and within budget to generate attractive returns.

Thanks to the attractive income yields and risk-reward profiles, these are three sectors where I currently have substantial allocations and very likely will continue to allocate capital to in the coming months, as long as they remain undervalued high-quality sources of attractive income and growth at High Yield Investor.

By Brett Eversole, Daily Wealth

Since the pandemic, we’ve seen two separate economies emerge. They’re moving in different directions. One is thriving… while the other is struggling.

We call this the “K-shaped economy.” And it was one of the biggest topics in finance and economics last year…

Folks in the higher-income portion of the economy are doing incredibly well. They’ve seen their wages rise. And more important, their assets have grown. These folks are much better off today than they were five years ago.

Lower-income Americans have experienced the opposite. Their wages haven’t grown as fast. They haven’t benefited from the stock market boom. And inflation crushed them during the post-pandemic era.

Most people believe the K-shaped economy is an income-disparity problem… They say that some people make a lot while others don’t make enough. That’s a compelling idea politically – but it doesn’t explain what’s happening.

In America, we’re seeing a K-shaped economy for a single reason…

One group of Americans owns assets… and the other group doesn’t.

Now, there’s a way to ensure your kids and grandkids belong to the asset-owning portion. And acting on it is the most important thing you can do for them this year…

It’s not politics. It’s economics. This divide is all about owning assets and having them work for you – or not.

If you’re in the asset-owning category, chances are you’ve done darn well over the past five years. And that’s almost regardless of your personal income or employment situation. Asset growth has been so strong that it has dwarfed the pain of inflation.

It’s another story for those who don’t own assets. For them, it’s almost impossible to get ahead.

The simplest way to fix this problem isn’t through political jockeying. We just need to move more folks into the asset-owning category.

And now, thanks to one piece of legislation, there’s a new opportunity to jump-start asset ownership for members of your family.

It’s called the Invest America Act. It became law as part of the One Big Beautiful Bill Act last year – and it went into effect on January 1.

The Invest America Act allows you to open a tax-deferred investment account for anyone under the age of 18.

For the pilot portion of the program, the government will also fund accounts belonging to children born between January 1, 2025 and December 31, 2028 with $1,000.

These accounts are a type of individual retirement account (“IRA”). The difference is that traditional IRAs are mostly off-limits for minors, since you must have income to fund one.

By contrast, these accounts are open to all children. And just about anyone can fund them up to the $5,000 annual limit. They’re the perfect way to make your child or grandchild an asset owner right now… and help them join the upper portion of the K-shaped economy.

I’m sharing this because I believe setting up your children and grandchildren for long-term financial success is one of the most important gifts you can give them…

Investing is all about putting your money to work for you. The longer you’re able to do that, the better off you’ll be. You want compounding to work in your favor… And that means starting early.

Everyone’s situation is different. But here’s what I plan to do for my two young daughters, aged 8 and 4…

I’m going to prioritize maxing out each of these accounts ($5,000 a year) for at least the next 10 years. Assuming an 8% annual return, they’ll each have about $72,000 saved a decade from now.

That might not sound like much… I’ll have contributed $50,000 to each account. The funds will have grown by less than 50%. But compounding will have only begun to work in our favor.

From there, my girls will have roughly 45 years until retirement. And that’s where the magic happens…

Over that time, those $72,000 accounts will compound to roughly $2.3 million.

For just $5,000 a year for a decade, I can effectively fund each of my children’s retirements. That’s incredible.

Again, each situation is different. But if you’re reading this, you’re likely an investor who wants to make your money work for you. And if you’ve got children in your life, you probably want to see them in the upper part of the “K.”

That means taking advantage of these new accounts is the most important thing you can do for your children and grandchildren in 2026.

While you can open one right now, funding doesn’t begin until later this year. In the meantime, figure out your contribution plan… Maybe you can’t max out multiple accounts each year, but even small contributions will grow dramatically over decades.

If you can only contribute $2,500 a year for the next decade, the account should grow to nearly $1.2 million. Even investing just $1,000 per year for the next 10 years would mean a final balance of nearly half a million dollars.

The point is, a small investment now will lead to life-changing returns in the future. Invest now so your children will be able to thrive in the future.

This simple step is how you ensure your kids or grandkids are in the upper part of the K. And I urge you to take advantage of it.

Again, each situation is different. But if you’re reading this, you’re likely an investor who wants to make your money work for you. And if you’ve got children in your life, you probably want to see them in the upper part of the “K.”

If you have a dividend re-investment plan, you should be able to live off the natural income and leave your capital, to whoever you wish.

恭喜发财 Gōng xǐ fā cái

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑