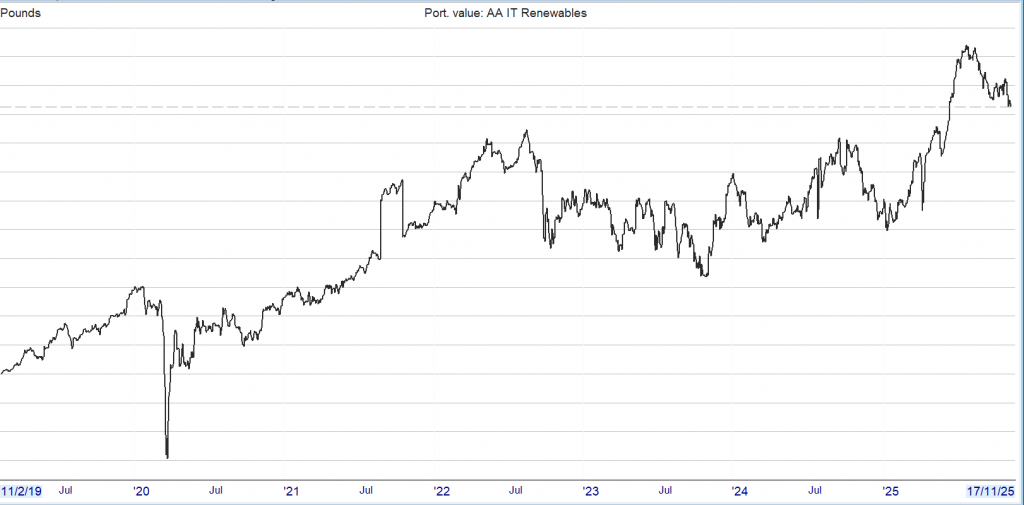

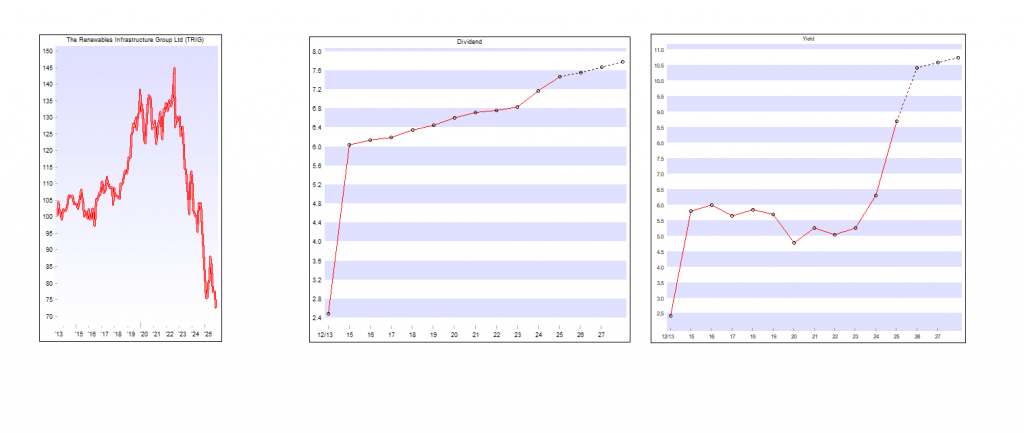

The Renewables Infrastructure Group (TRIG)

27 June 2025

Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by The Renewables Infrastructure Group (TRIG). The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

TRIG’s managers position for growth.

Overview

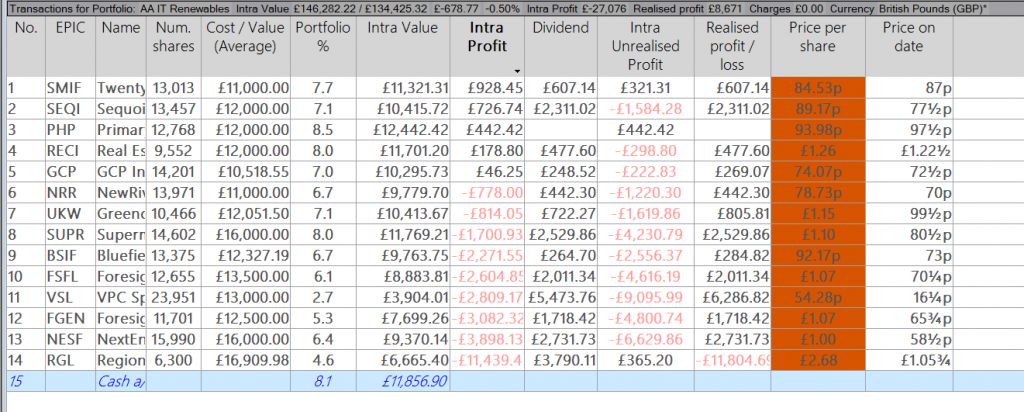

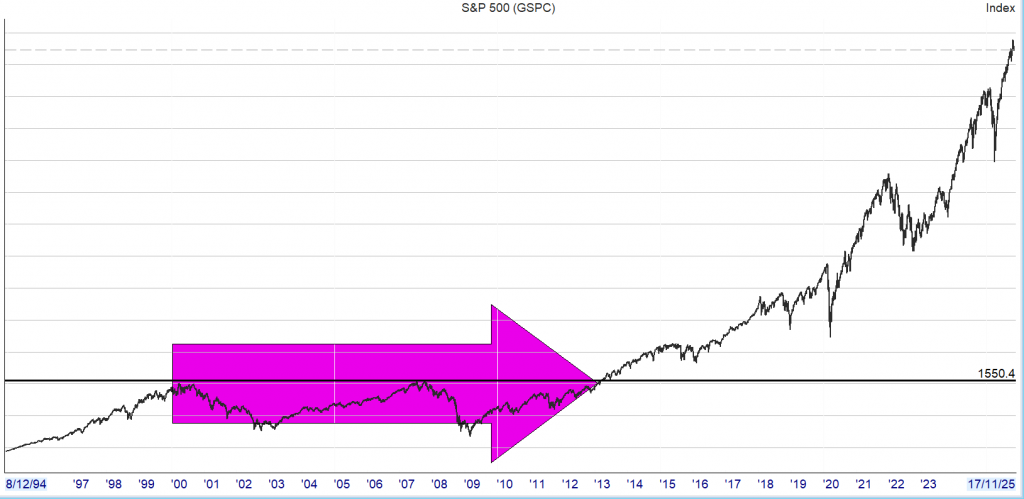

The Renewables Infrastructure Group (TRIG) is one of the leading trusts in the renewable energy infrastructure sector, having a large portfolio of institutional quality assets of significant size and scale, which is diversified geographically and by technology. The renewables sector, of which TRIG is a large constituent, has been facing a challenging backdrop for sentiment, with the significant rise in interest rates around the world the main culprit. Despite progress on sales of assets since 2022, with c. 10% of the portfolio sold at prices above or in line with NAV, TRIG has not yet been able to reduce its short-term borrowings as much as planned. Further transaction activity would also serve to usefully validate TRIG’s NAV.

As we discuss in the Gearing section, TRIG has announced that for the first time it is in the process of arranging longer-term corporate-level debt, which will mean it can pay back the majority of the short-term debt, as well as give it more flexibility to deploy capital in the future—either re-investing in the existing portfolio to boost returns, investing in the development pipeline, or further share buybacks. The board is carefully monitoring the respective attractions of each, focussed on making the trust’s capital work hard and generate value for shareholders.

As we discuss in the Portfolio section, drawing down this debt will also enable the team to bring forward investment to accelerate growth in capital and income. TRIG has a significant development pipeline that could take the proportion invested in battery assets up to c. 10% – 15% if fully built out. Battery assets complement wind and solar assets in that their revenues benefit from the price volatility of intermittent generation, and so as the portfolio mix changes, the portfolio can potentially receive higher returns on invested capital.

Analyst’s View

With scale and a strong balance sheet, TRIG is in a good position to continue to provide a resilient income stream. The company recently held a capital markets event, which demonstrated that the combined expertise of InfraRed and RES working together on the trust is a clear advantage, with the breadth and depth of resources working to maximise returns for shareholders clearly evident.

Drawing down structural company-level debt is a new step for TRIG. As well as enabling the repayment of some of the short-term borrowing facility, it will also enable the team to bring forward investment to accelerate growth in capital and income. This should result in higher revenues and higher NAV over the long term than would otherwise be the case. Buybacks clearly help address the discount and are accretive over the short term, but on their own, do not help the long-term trajectory of the company.

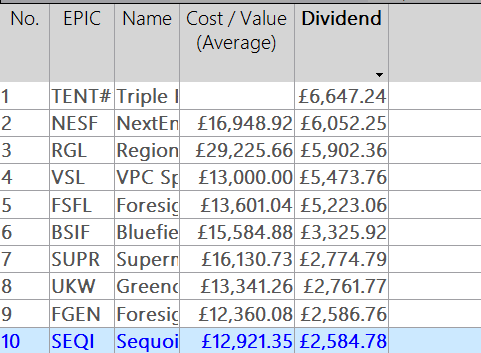

There are other benefits too. TRIG has a real opportunity to enhance diversification and earnings by building out a bigger portfolio of battery projects through its in-house developer, Fig Power. The first of TRIG’s battery development projects is due to energise this year. If further assets are successfully developed, they will increasingly complement the cashflows from TRIG’s wind and solar assets, meaning an enhanced revenue stream from the portfolio as a whole. These factors, and others that we discuss in the Portfolio section, mean that TRIG remains amongst the highest quality offerings in its sector, offering an attractive and resilient dividend yield of 8.5%, currently trading on a significant discount to NAV.

Bull

- A high yield of 8.5% from a cash-covered dividend, with the potential for NAV growth

- High-quality diversified portfolio, bolstered by proprietary development pipeline and RES’ operational enhancements

- Discount may provide an accelerant to NAV returns, if appetites return to the sector

Bear

- Discount to NAV may persist for some time

- Dividend cover not as high as that of funds that are not amortising, i.e. paying down debt

- Macro and political factors outside the managers’ control have at times provided a headwind to the NAV

Net Asset Value update – Q2 2025

TRIG announces an estimated unaudited Net Asset Value as at 30 June 2025 of 108.2 pence per share, a decrease of 4.5 pence per share in the quarter principally due to a reduction in revenue forecasts (-4.4p).

Dividend cover for H1 2025 was 2.2x gross or 1.0x net after the repayment of £105m portfolio-level debt across the Group. A further c. £85m portfolio-level debt is scheduled to be repaid in H2 2025.

The Board reaffirms the dividend target for 2025 of 7.55p per share for FY 20251. Low generation as a result of particularly poor wind speeds in H1 can be expected to impact H2 cash flows meaning that covering the FY 2025 dividend may be tight.

01/08/25