Gold Just Got Cheaper and It’s Jet Fuel for This 8.3% Dividend

Brett Owens, Chief Investment Strategist

Updated: June 3, 2025

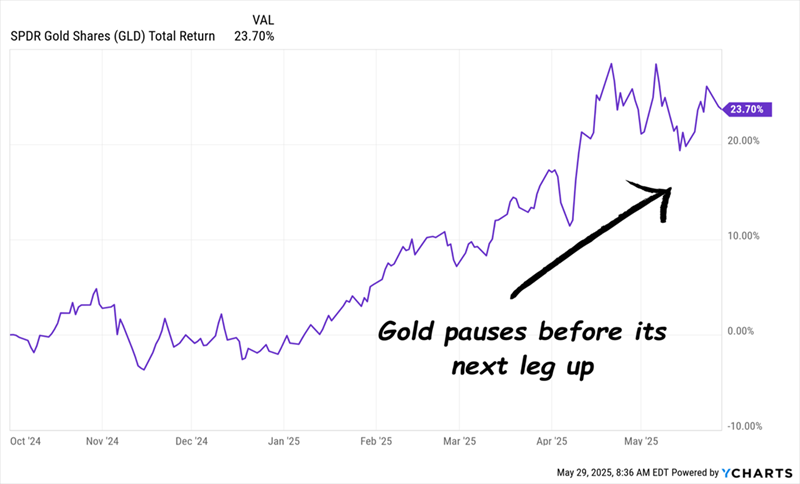

Gold prices have taken a breather—and we’re getting a rare opportunity to snag two shimmering dividend plays paying up to 8.3%.

Here’s why this setup is on the table: While recession worries are still valid, they’re overblown. Plus, the doomsayers are missing critical details set to kick gold higher. Let’s break all of this down, then get into the 8.3% (and growing) payouts the archaic metal is poised to deliver.

The “No-Landing” Economy: Alive, Well—and Bullish for Gold

Last fall, we talked about a “no-landing” economy in the US, where growth ticks along, but inflation sticks around, too. Fast-forward to today, and that’s pretty much how things have played out.

“But wait,” the first-level thinkers cry. “Didn’t the economy shrink in the first quarter?”

Sure, GDP growth did slow in Q1. But the underlying numbers were more bullish than the headlines suggested.

The drop mainly came from a surge in imports ahead of tariffs—and imports are calculated as a drag on GDP. Government spending also fell in light of DOGE cuts, while consumer spending held up.

In other words, this wasn’t real weakness. It was a data blip. And we’ll happily take it!

“No-Landing” Becomes Reality, Gold Takes Off

Consecutive negative quarters would signal an “official” recession, but President Trump and Treasury Secretary Scott Bessent do not want this scarlet letter heading toward the midterms. Jay Powell wants nothing to do with it, either.

So we can expect the government and the Fed to continue their (quiet) interplay to keep rates down and growth ticking along. Inflation—or just the fear of inflation, which is all we need to spur gold—will likely come along with it, prompting higher gold prices.

Bessent and Powell Team Up to Spur Gold

Let’s start with the “One Big, Beautiful Bill,” which is nothing if not stimulative (even though it adds to the $2-trillion-and-growing deficit abyss Uncle Sam is staring into), with its broad array of tax cuts.

Consider, for example, the potential elimination of taxes on tips and overtime. According to the House Ways and Means Committee, this could put $1,700 in the pockets of individual taxpayers who collect either one.

These folks, who lean toward the lower end of the income scale, tend to spend their earnings in the real economy, driving growth (and potentially inflation). Wealthier taxpayers, on the other hand, are more likely to pump any tax savings into investments.

The bill has passed the House, and we have to see what happens with it in the Senate. But with both parties broadly supporting the tip/overtime measure, it’ll likely survive.

Next up we have Jay Powell, who, despite his tough talk, recently stepped up the Fed’s bond buying by an extra $20 billion a month!

Finally we have Treasury Secretary Scott Bessent, who’s likely to stick with a tactic used by former Treasury Secretary Janet Yellen: Leaning more on short-term Treasuries to finance the government’s needs, thereby reducing issuance—and increasing demand—for longer-term Treasuries.

Without this shift toward shorter-term borrowing, the 10-year Treasury yield would be 30 to 50 basis points higher, according to a 2024 paper by economist Nouriel Roubini. In other words, the 10-year yield would top 5% today. And the cost of borrowing for business (lending rates) and individuals (mortgage rates) would be notably higher along with it.

The bottom line? These measures (and more) are likely to keep inflation worries alive, even if they keep long rates capped and slow economic growth. That makes today’s pullback in gold worth buying. Here are two ways to do it, for either high income now or dividend growth (and price gains) later. Or both!

Gold Play No. 1: An 8.3%-Paying Fund With a Discount “Kick”

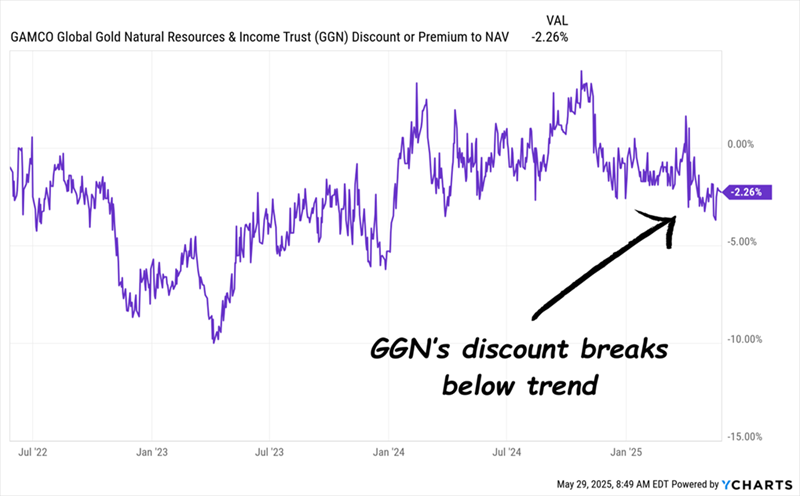

I’ve been critical of the GAMCO Global Gold, Natural Resources & Income Trust (GGN) in the past, because its discount to net asset value (NAV) never seems to drop to a level that catches our interest.

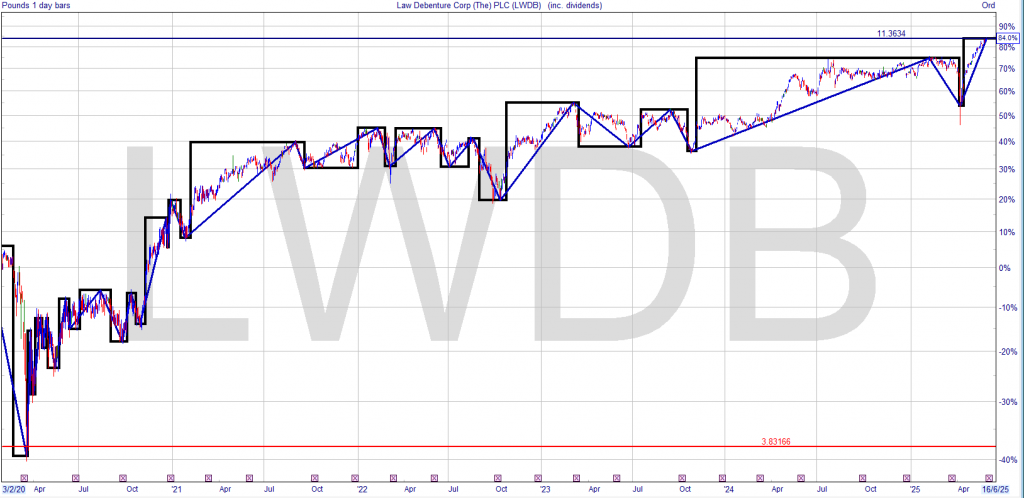

That, in turn, has been part of the reason why GGN typically trails gold prices. But that discount story is starting to change (As a CEF, GGN regularly trades at a different level than its portfolio value, or NAV).

GGN’s “Hidden” Discount

CEF discounts like these quietly drive price gains as they flip to premiums. And while GGN’s 2.3% discount isn’t huge, it’s a far cry from the premiums we saw late last year. That suggests this trade is much less crowded now, even as gold’s outlook improves.

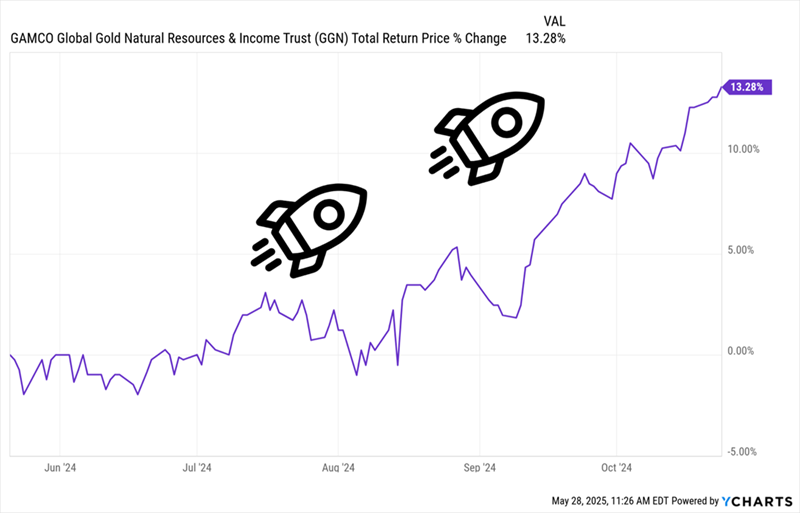

Moreover, that 2.3% markdown is right around where it was a year ago. Here’s how buyers did back then, as that discount shot to a 4% premium over the following five months (note that about a third of this gain came in the form of dividends):

GGN’s Last “Disappearing Discount” Drove a Fast 13% Gain

Another premium could be ahead, sparked by those moves by the Fed and the Trump administration we just talked about.

Now there is something we need to keep in mind with GGN: It isn’t a “pure” gold play. As the “Natural Resources” in the name suggests, about 60% of the portfolio is in mining stocks—including some non-gold names like Freeport McMoRan (FCX), which focuses mainly on copper.

Another third or so is in energy stocks, with Exxon Mobil Corp. (XOM) the fund’s top holding. That may be okay if you’re bullish on oil. But with another part of Bessent’s economic strategy being, quite literally, “drill, baby, drill,” we think shares of gold mining companies offer better, er, “prospects” now, especially if you’re less focused on current income.

Which brings me to …

Gold Play No. 2: A Way to Profit From Cheap Energy, Soaring Gold

Imagine for a second you’re an exec at a gold miner like Newmont Corp. (NEM), the biggest of the bunch. As I write this, the WTI crude price is around $62, not far off lows last seen in 2021. That’s huge, with energy being a major input cost for any miner.

At the same time, the selling price of your main output, gold, is around $3,300. That’s still near historic highs, even with the modest pullback we’ve seen.

I think you’ll agree that this is a very good setup for a gold miner—maybe as good as it gets! No wonder Newmont’s revenue shot up 25% year over year in Q1, while EPS soared to $1.68 from $0.14 a year earlier. Fourteen cents!

And yet—as I write this, shares trade at just 12-times forward earnings, far below the five-year average of 19.3.

NEM yields 1.9% now and pays a base plus variable dividend that fluctuates with gold prices. But the dividend clocks in at just 27% of NEM’s last 12 months of free cash flow, so it’s safe and primed to rise if gold keeps climbing.

The Last Word: GGN for Income, NEM for Gains (and Payout Growth)

Here’s where that leaves us with gold miners like NEM: Gold is likely to move higher, and energy prices are likely to remain low—both thanks to Bessent and Powell.

That makes NEM worth a look, especially if you’re okay with a bit of movement in the dividend. Higher gold also helps strengthen GGN’s 8.3% payout, even with the prospect of continued lower energy prices. That payout comes in monthly and has held steady since mid-2020.