With yields currently above 7% and with a long term chart, it should be possible to make a capital gain of 3%, possible but not a certainty.

Investment Trust Dividends

With yields currently above 7% and with a long term chart, it should be possible to make a capital gain of 3%, possible but not a certainty.

A chart of Merchants Trust without dividends.

A chart of MRCH including dividends earned but not re-invested into the share as the Snowball’s intention is to re-invest all earned dividends into the higher yielding shares of the Snowball.

Remembering the ‘best laid plans of men and mice’ is to re-invest any capital gains into the higher yielding shares of the Snowball.

While history doesn’t always repeat but it often rhymes a long term hold for the Snowball.

Proactive Investors

Last updated: 15:00 17 Apr 2025 BST, First published: 13:59 02 Mar 2021 GMT

Supermarket Income REIT PLC is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the UK’s feed the nation infrastructure.

The company focuses on grocery stores which are omnichannel, fulfilling online and in-person sales.

Supermarket Income REIT provides investors with attractive, long-dated, secure, inflation-linked, growing income with the potential for capital appreciation over the longer term.

26 Mar 2025

Supermarket Income REIT PLC (LSE:SUPR, OTC:SUPIF) has completed the internalisation of its management function, as approved by shareholders last week, bringing its former external fund managers into the company as chief executive officer and chief financial officer.

The grocery property investment company previously reached an agreement with external manager Atrato for a consideration of £19.7 million.

Today, Rob Abraham has been appointed as CEO and Mike Perkins as CFO, with both joining the board with immediate effect.

Welcoming the pair, chair Nick Hewson said: “This represents a significant milestone for the company, as we continue to make progress on our key strategic initiatives, which are designed to enhance earnings and continue to reduce the discount to NAV.

14 Mar 2025

Supermarket Income REIT PLC (LSE:SUPR, OTC:SUPIF) managing director, Robert Abraham, and finance director, Michael Perkins, talked with Proactive about the company’s interim results for the six months to December 2024.

Abraham highlighted the company’s strategic progress, including cost reductions through internalisation, asset disposals, and lease renewals. He noted that a recent disposal to Tesco demonstrated the value of these assets, selling at a 7% premium to book value. The lease renewals extended three short-term leases to 15 years at significantly higher rental rates, reflecting the strong demand for top-performing supermarket assets.

11 Mar 2025

Stifel has reiterated its ‘buy’ rating on Supermarket Income REIT PLC (LSE:SUPR, OTC:SUPIF) following the company’s half-year results.

The real estate investment trust, which focuses on grocery store properties, delivered performance in line with expectations, but the real story is what happened after the period ended.

17 Apr 2025

In the face of the market persistently discounting their shares relative to net assets over the past couple of years, most self-respecting investment trust boards have tried various strategies to close the gap.

Supermarket Income REIT PLC (LSE:SUPR, OTC:SUPIF) has done what several others have discussed but rarely delivered – it has parted ways with its external investment manager and brought the team in-house.

27 Mar 2025

Supermarket Income REIT PLC (LSE:SUPR, OTC:SUPIF) received a reiterated ‘buy’ rating from analysts at Stifel, who raised their price target to 90p from 80p.

This followed a number of strategic changes over the past year, including the internalisation of its management function, which was completed this week.

Stifel said this move and associated reduction in costs “is unequivocally positive for the shares”

29 Apr 2024

Atrato Capital chief investment officer Steven Noble joins Proactive’s Stephen Gunnion with that Supermarket Income REIT PLC (LSE:SUPR, OTC:SUPIF) has a portfolio of 17 omnichannel supermarkets in France from Carrefour through a sale and leaseback transaction valued at €75 million.

The deal ensures a leaseback to Carrefour for 12 years, yielding an initial return of 6.3% with the advantage of annual uncapped inflation-linked rent reviews.

Noble emphasized that this move aligns with Atrato Capital’s ongoing strategy to focus on omnichannel stores, crucial for both online and in-store grocery sales. The acquisition not only fits its existing investment strategy but also expands its addressable market to the French grocery sector, valued at €284 billion. France was specifically chosen due to its significant online growth potential and Carrefour’s strong market position and omnichannel capabilities.

Stephen Wright has been taking advantage of a volatile stock market to buy shares in two UK companies that have interesting dividend prospects.

Posted by

Stephen Wright

Published 16 April, 7:48 am BST

BNZL

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

The recent stock market volatility has offered investors the chance to give their dividend income a boost. And I’ve been taking advantage with my own portfolio.

I see dividends as part of a bigger picture, rather than the sole focus of my investing. But, it hasn’t escaped my attention that my passive income is set for a boost.

Shares in FTSE 100 distribution firm Bunzl (LSE:BNZL) have a dividend yield of around 2.5%. That doesn’t sound like much, but I’ve got an eye on the long term.

Between now and 2027, Bunzl is set to invest £700m a year into growing via acquisitions. If it can’t do this, the firm is to use the cash for dividends and share buybacks.

At today’s prices, that’s 7% of the firm’s market value. So I’m expecting at least that in terms of annual growth for the next few years – and I think it could well be much more.

Growing through acquisitions can be a risky business and making a mistake can set a company back years. Rentokil, for example, is still working through an acquisition from 2022.

In general though, buying businesses is riskier when they’re either large in size or involve the acquirer taking on significant debt. But I think Bunzl should be able to avoid this.

The FTSE 100 firm operates in an industry where competition is mostly fragmented. This should give it the chance to make relatively small acquisitions using its cash rather than debt.

Bunzl consistently achieves returns on invested capital of around 15%, which is a strong result. And I think the fragmented nature of the market means there’s a good chance this continues.

I’ve also been adding to my investment in Tristel (LSE:TSTL). With a market cap of £153m, this one is at the other end of the scale to Bunzl, but I think it also has some impressive prospects.

The company makes chlorine dioxide wipes and foams for medical settings (equipment and surfaces). These are quicker and more effective than other decontamination methods.

Tristel is currently looking at US expansion. The firm has approval for its ultrasound wipes and is expecting to achieve the same for its ophthalmic product this year.

That could be a huge opportunity. But the biggest risk for investors might not be the inherent uncertainty in getting the product signed off by regulators.

Tristel’s products are very good, but they’re also expensive and it’s looking to break into a market that has some well-entrenched practices. This won’t be straightforward, by any means.

Right now, however, the stock has a dividend yield of 4.5%. And the company has committed to growing this by 5% each year in the near term – regardless of what happens with the business.

I take that as a sign that – unlike Bunzl – Tristel doesn’t need to use its cash to finance its growth prospects. That makes it very attractive from my perspective.

When it comes to investing, the thing to do is to focus on the underlying business first and foremost. Get that bit right and the dividends will follow.

Bunzl and Tristel are very different companies. But I’m optimistic about strong returns from both and I think their dividends will grow.

The very same morning.

| 16/04/2025 |

Bunzl PLC’s soft trading update is likely to prompt earnings downgrades of as much as 10%, analysts on Wednesday said, with risks the shares could de-rate further.

Shares in London-based distribution and outsourcing company plunged 27% to 2,258.00 pence each in London on Wednesday. They had earlier hit an intra-day low of 2,252.00p and languish well below the 52-week high of 3,732.00p

In a trading update, Bunzl lowered guidance and paused its share buyback programme amid weaker than expected trading.

RBC Capital Markets said the unscheduled update is likely to be “very poorly received” by the market with potential high single digit earnings downgrades at constant currency.

That’s just one reason the Snowball only invests in collectives.

A great way to invest in supermarket safe havens

Experts reckon we could survive three days or nine meals with empty supermarket shelves before a full-blown societal collapse. That’s how vital supermarkets are to our everyday existence. So, invest in shares of Tesco (TSCO), Sainsbury’s (SBRY) or Marks & Spencer (MKS) during times of market turbulence?

That is a possible option, but Shares thinks there’s a more interesting way to play the theme – Supermarket Income REIT

As the name suggests, this is a real estate investment trust that makes money by leasing retail space to supermarkets. It has a portfolio of 82 properties worth an estimated £1.8 billion, scattered across the UK and France. These include Morrisons, Asda, Waitrose and Carrefour (France) stores, but roughly three quarters of the rent roll comes from Tesco and Sainsbury’s outlets.

You might argue that this represents considerable concentration risk, but we believe this is not a major concern given the blue-chip status of both. Tellingly the trust has never failed to collect 100% of rents since floating on the stock market in 2017.

NOT RUN-OF-THE-MILL STORES

These are not run-of-the-mill stores, but omni-channel grocery pitches that are dominant in their area, providing the full range of in-store, click and collect and online shopping. That means net rental yields of 6%, higher than real estate sector averages below 5%, with in-built inflation-linked reviews.

They are also long-term contracts, lending that income streams a high level of security. The portfolio has an average term to expiry of 12 years. In short, long-run rental agreements with blue-chip clients that won’t expire for years, resulting in an income stream which should be predictable and durable.

Dividends are paid quarterly and have incrementally increased since the 2017 IPO. A 6.12p per share dividend is expected for the full year to end June 2025, rising to 6.24p in 2026, and presumably, up again thereafter.

If that doesn’t sound like much, it represents a near 8% dividend yield at the current 77.1p share price, which has struggled against higher interest rates like the rest of the sector. That makes now a great time to invest, not only locking in a very attractive yield, but at a near 14% discount to net assets to boot.

Why such a wide discount? We previously mentioned that higher base rates reduce the attractiveness of income assets, but that should reverse once rates start to come down. The other issue of costs has recently been addressed – the trust bringing the portfolio management team in-house. This function was previously outsourced to Atrato, but Supermarket Income REIT has reached the scale to do this internally.

This saw Atrato’s Rob Abraham and Mike Perkins, both crucial to the REIT’s progress in recent years, join Supermarket Income REIT as chief executive and finance chief respectively, solving any issues around long-term leadership. Supermarket Income REIT estimates that these steps will save it around £4 million.

WHY RECYCLING ASSETS COULD HELP

Something else that could improve the market’s mood towards the trust is its recent pledge at capital recycling, which sounds to us like it means to take a more proactive approach to asset trading. Earlier this year Supermarket Income REIT sold a Tesco store in Newmarket to the chain for £63.5 million, 7.4% above its estimated value in June 2024.

Future proceeds might be reinvested back into the portfolio or perhaps returned to shareholders through share buybacks or even special dividends, time will tell. These deals should also help address the discount as they demonstrate the true value in the portfolio.

With the UK big-four supermarkets (Tesco, Sainsburys, Morrisons and Asda) increasingly under pressure from retailers like Aldi and Lidl, owning their own real estate to make operating cost savings that can be funnelled into product price cuts may become an increasingly attractive lever to pull, which should help Supermarket Income REIT secure other stores sales at higher than book value.

Investors may need to be patient. Getting the market to re-evaluate Supermarket Income REIT stock is likely to be a slow process. But, in the interim, investors will be getting paid an 8% yield for their patience, a very attractive low-risk return. Ongoing charges are 1.36% according to industry body the Association of Investment Companies.

| Alfun adam unissula.ac.idx alfunadam@unissula.ac.id 103.28.223.1 | In essence, the article presents a case for investing in specific high-yield CEFs as a strategy to generate significant and stable income (10%+) even during market uncertainty, drawing lessons from the 2022 experience and analyzing the current market dynamics related to tariffs and interest rates. The author emphasizes the potential for these discounted funds to provide both income and capital appreciation upon market recovery.Good Information |

It’s very important that anyone carries out their own research as the Snowball owns no CEF’S and has no intention of doing so in the near future.

| Alfun adam unissula.ac.idx alfunadam@unissula.ac.id 103.28.223.1 | In summary, your purchase of 1798 shares in MRCH for £9,000 provides a buying yield of 5.8%. While you won’t receive the immediate upcoming final dividend due to the ex-dividend date, you are now positioned to receive future dividends from this holding, which has a strong track record of consistent growth.\Good Information Regards |

Tks for taking the time to comment but MRCH goes xd today for 7.3p payable of the 29/05/25.

The plan is to re-invest all dividends from MRCH into the higher yielding shares in the Snowball, along with any ‘profits’ when they are available.

Brett Owens, Chief Investment Strategist

Updated: April 16, 2025

Are we having fun yet, my fellow income investor?

We’re now in a bear market, whether the financial media or our intrepid politicians admit it or not. Peak to trough the S&P 500 dropped 21% intraday. Based on closing prices the decline was “only” 18%, however—not quite the technical 20% drop that defines a bear market.

Regardless, let’s not split hairs and call this what it is—the third bear market of the 2020s. Three bears. And it’s only 2025!

You may be wondering, as I was, if this is normal. It is not, my friend. Since 1900 we have averaged 1.77 bear markets per decade. So yeah, three in six years sure is yet another stomach punch:

Last time around, in 2022, we sold early and often and hunkered down in cash. Stocks and bonds were pummeled for nine straight months. There was no point in trying heroics—Benjamins under the mattress outperformed active portfolios. So, we went with the “doomsday” allocation and put many of our payouts on pause for a few months.

It was the most difficult bear market a dividend investor will ever face. Normally we turn to bonds when stocks are uncertain. But that did not work in 2022, because bond prices were dropping faster than their payouts.

Our mission, when we retire on dividends, is to leave our principal intact. But in 2022 both stocks and bonds jeopardized our underlying nest egg, so cash was the only choice.

Fortunately, bear markets tend to last less than a year. Stocks take the stairs up but the elevator down and, on cue, the 2022 bear market ended after nine months. And we went back to a regular dividend-paying portfolio. We made up for our time in cash with price gains, which often follow bear market lows.

Return of capital trumps return on capital when the bear—and Trump tariffs (ha!)—growl.

We have a better landscape to work with here in 2025 because we can buy bonds. Not only do they pay more today than they did three years ago, but these higher interest rates provide us with price “cushions.” If yields come down, we’ll enjoy price gains.

Of course, yields don’t have to come down. The total China tariff rate is currently 145%. This will put upward pressure on imported goods—with the potential for sustained higher prices—over the next six months.

And just last week, as I was putting my kids to bed, I noticed the bond market melting down in the Asia session. The 10-year Treasury rate jumped 12 basis points, over 4.5%. Japan was rumored to be the seller, dumping its sizeable holdings to protest tariffs. The bond meltdown got President Trump’s attention—he announced the 90-day pause on most tariffs the following day.

I don’t blame you for not wanting to stay up at night babysitting bonds through Asia trading windows. China—ye of 145% levies—owns $760 billion in long-term Treasuries. Think they may be looking to sell?

China dumping bonds would obviously put pressure on long rates. This, in fact, may be the reason why long-dated yields are not lower in the face of slowing economic data.

The “short end” of the yield curve, on the other hand, is insulated from overseas sales. It follows the Fed, which is still relatively high, at least for the time being. When the Fed begins to cut again, these divvies will compress, so this may be the best time to find safety and yields between 4.3% and 5%.

These low-duration bonds are not at risk when a trade war adversary begins to sell. Here are five of the safest, most liquid short-term bond funds on the market today:

SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) invests in ultra-short-term US Treasury bills. It is plenty liquid and will protect our capital. BIL yields 4.3%.

The downside with BIL is that its yield may not last. When the Fed cuts rates, BIL’s yield will decrease, too. But this “dividend cut” will not eat into the price, so your principal will remain intact. (The same caveat and logic follow for our four other funds.)

PIMCO Enhanced Short Maturity Active ETF (MINT) pays 4.8%. This fund is actively managed by “blue blood” fixed-income leader PIMCO. Dan “The Beast” Ivascyn and his team buy high-quality, short-duration assets. Thanks to their expertise, MINT benefits with a bit of extra yield beyond what short-term US Treasuries pay.

JPMorgan Ultra-Short Income ETF (JPST) yields 4.6% and owns short-term investment grade bonds, both fixed and floating rate.

iShares Floating Rate Bond ETF (FLOT) pays the most at 5.0%, but it is down 1% month-to-date. FLOT buys investment-grade floating-rate bonds, and its “floaters” are a bit shaky as rates drop. Sock FLOT away on the watch list. We’ll revisit it on the other side of the upcoming economic downturn, when stagflation becomes a theme.

Finally PGIM Ultra Short Bond ETF (PULS) pays 4.7%. PGIM is another top name in Bondland. PULS buys ultra-short duration bonds with higher yields than BIL.

Of course it is difficult to retire on dividends using funds that only pay 4% or 5%. This requires $2 to $3 million in capital—we don’t all have piles of cash like this lying around.

Fortunately there are safe, simple monthly dividend payers dishing up to 10% right now. Ten percent on a million dollars is $100,000 per year in dividend income. We bank this without touching principal. Now we’re talking.

These funds are secure and built to handle recessions. The steady every-30-day payments help smooth out the stock market’s daily—ahem—gyrations these days.

The dividend earning Trusts will provide income thru thick and thin, I expect there will be plenty of thin.

The TR shares could provide profits to be re-invested into the dividend earning shares when markets are powering ahead.

When they fall the dividend income could be diverted into the TR holdings, subject to relative values.

Why revisit it today?

Let’s introduce the ETF first. The idea is simple. Invest in a passive tracker of the 100 international ideas that yield the highest dividend. The highest dividends are found in Financials firms, Energy and Mining with Real Estate and Industrials comprising nearly 90% of the index.

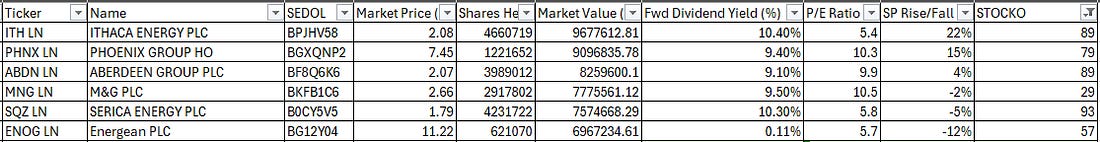

I’ve sampled through a number of the holdings, and also focused on the UK names, and as you can see some good names in there where Serica has its temporary Triton disruption, where Energean had its Italy assets deal with Carlyle fall through, M&G is perhaps the weakest given its outflows which hopefully cease before it (and the UK) bleed out with outflows. These six give a decent flavour of what you are buying into.

I’m struck by the fact that there are ideas which I’d otherwise not be able to easily access. Companies like shipping co Zim, or Norwegian Oily DNO.

I’m struck by a -0.84% capital loss in a pretty volatile quarter is not bad either.

I get to a 12.64% average yield and a 8.7X p/e as the average of the 100 holdings.

A ~1% yield per month is quite appealing as a place to hide, and where the index rebalances jettisoning those too weak to sufficiently pay dividends replacing them with the highest dividend out of the top #200 not in the index.

Is it wise to buy into this as the world faces potential recession? Some ideas are cyclical but not all. Besides I’m not wholly convinced yet that the forecast doom and gloom will happen. I see countries accelerating trade deals on the back of Lib Day (not with the US), although maybe the UK and Japan may get a US free trade deal. US tax cuts and strong momentum could surprise us with the US. I see myself watching this until August, and then re-evaluating (prior to the August rebalance)

I pounced on this given its 15% fall from the Lib Day sell off I’ve got a fair bit of margin of safety and where the capital returns are broadly zero and where I get over 12% yield to park some money.

For non-UK folks there’s a US SDIV, a Euro UDIV (that ticker would be considered very rude in the UK!) listed in Germany, Italy and Switzerland.

There is a 0.45% management charge plus trading costs (quarterly) which I expect aren’t awfully high, but I couldn’t find what they were (the TER).

Regards

The Oak Bloke

Disclaimers:

This is not advice – make your own investment decisions.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑