Investment Trust Dividends

These three bits of nonsense are often trotted out to investors aiming for passive income from an ISA. Now they’re all squashed.

Posted by

Alan Oscroft

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Passive income from stocks and shares sounds great, right? But so many naysayers trot out all the reasons why it will only ever be a pipe dream.

I can’t cover all their claims. But today I want to stomp on a few common ones.

Some passive income ideas might indeed cost big money to set up. Rental real estate is a common one, but that means having enough cash for a property or taking out a big mortgage. Actually, even that might not be true, and I’ll come back to it.

The stock market’s just for well-healed investors, yes ? Well, no. I’ve just done a quick online search. And I see with a Stocks and Shares ISA from AJ Bell, we can invest as little as £25 monthly or make a one-off £250 transfer. That’s not unusual and it’s not a recommendation, it’s just the very first one I found.

Other ISA platforms are similar. As well as costing very little to get started, they’re easy to open. The more we can invest, the better we’re likely to do. But we really can start with modest amounts of money.

The thought of putting our money into a company that goes bust is scary. It can happen, but we can greatly reduce the risk.

All we need to do is consider shares in a stock market tracker, like the iShares Core FTSE 100 UCITS ETF

Myth 3: It takes talent

Stock market investing has long been shrouded in mystery. We have to understand all sorts of big words and do complicated financial sums to have a clue, don’t we? Well, that myth has also been shattered these days. I think it’s pretty clear that investing in a simple tracker fund doesn’t require egg-head brains.

Considering investment trusts, which spread out cash using specified strategies is a common next move. Want income from UK dividend stocks? Look for one that does that. No genius required. Oh, remember that thing about real estate income? There are investment trusts that do that too.

And there’s a bonus — the more we widen our investing horizons, the smarter we can get at it.

Patria Private Equity and Foresight Solar have increased their dividends for 10 consecutive years.

News editor, Trustnet

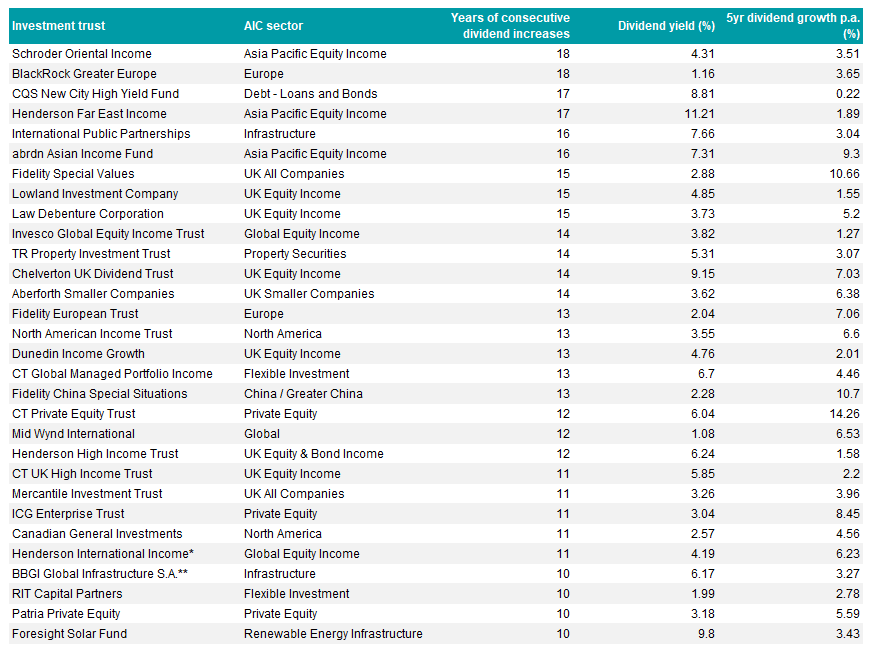

Patria Private Equity and Foresight Solar have joined the Association of Investment Companies’ (AIC) list of next generation dividend heroes – trusts that have grown their annual dividends for 10 or more consecutive years but fewer than 20.

Schroder Oriental Income and BlackRock Greater Europe lead the 30-strong list with 18 years of growing payouts. In two years’ time, they will qualify to join the ranks of the full-fledged dividend heroes.

Hot on their heels are CQS New City High Yield and Henderson Far East Income, with 17 years of unbroken dividend increases, followed by International Public Partnerships and abrdn Asian Income Fund, with 16 years.

The next generation of investment trust dividend heroes

Source: Association of Investment Companies, Morningstar. Data as at 20 Mar 2025. *A merger between Henderson International Income and JPMorgan Global Growth & Income has been proposed. **A cash offer for BBGI Global Infrastructure S.A has been proposed.

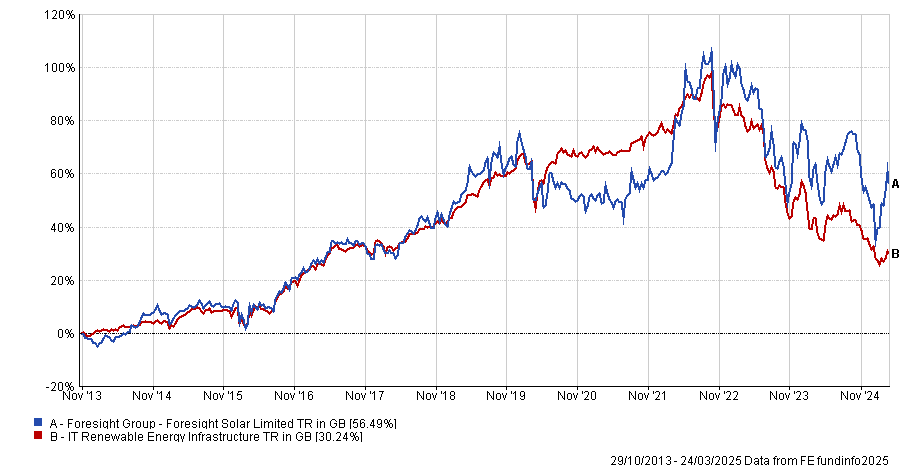

Foresight Solar has a 9.8% yield – the second-highest amongst the next generation dividend heroes – and over the past five years it has grown its dividend by an average 3.4% per annum. Since Foresight Solar listed in 2013, its dividend has grown by 35% (including the 2025 target).

Lead fund manager Ross Driver said: “Our operational portfolio will continue to produce steady, reliable income from the sale of electricity to the grid. We have a dedicated team to monitor and manage our solar farm assets and ensure they’re producing in the most efficient way.”

The trust has delivered solid long-term performance but made an 11.4% loss over three years to 24 March 2025 in total return terms. The whole IT Renewable Energy Infrastructure sector has struggled during the past three years due to higher interest rates and selling pressure, with an average loss of 28%.

Performance of trust vs sector since inception

Source: FE Analytics

“Our strategy has evolved to adjust to the new post-pandemic reality of higher interest rates,” Driver said.

“To amplify returns, we’re building a development pipeline of solar and battery storage projects that allows us to deliver an additional element of growth on top of the regular income provided by the operational portfolio – improving performance over time.”

Foresight Solar had a market capitalisation of £435m as at 31 December 2024 and was trading on a 31.4% discount to its net asset value of £634m.

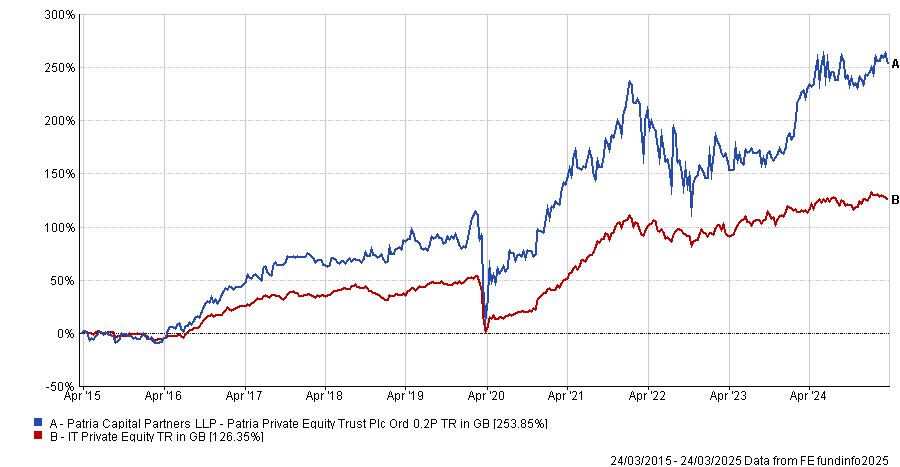

The other new entrant, Patria Private Equity Trust (PPET), was run by Aberdeen until it sold its European private equity business to Patria Investments last year. The trust allocates to mid-market private equity funds run by external managers and also invests directly in private companies, alongside these managers.

It has a market cap of £828m and a 3.2% dividend yield, and was trading on a discount of 29.9% as of 24 March 2025. PPET is the third-best performer in the IT Private Equity sector over 10 years.

Performance of trust vs sector over 10yrs

Source: FE Analytics

Lead fund manager Alan Gauld said: “Historically, there has been a debate over whether private equity trusts should be purely about capital growth or not. However, the board of PPET has consistently prioritised returning cash to shareholders. Having a consistent dividend policy has helped build trust with PPET’s shareholders.

“PPET’s portfolio is well diversified and generates a consistent cash yield, usually around 20% of opening NAV per year. As such, this allows PPET to comfortably support a growing dividend. The board’s strategy in recent times has been to at least maintain the value of the dividend in real terms. This has resulted in 5% growth in dividend in 2024 and 11% growth in 2023.”

More than half of the 30 next generation dividend heroes have yields above 4%, which illustrates the advantages of investment trusts for income seekers, said Annabel Brodie-Smith, communications director of the AIC.

“Investment trusts are able to smooth dividends over time because they can hold back income from their portfolio and use this to boost dividends in leaner years. They can also pay income out of their capital profits and their structure is particularly suitable for high yielding hard-to-sell assets, such as infrastructure and property,” she said.

Matt Ennion, head of investment fund research at Quilter Cheviot Investment Management, said the key thing for investors to watch out for is whether the dividend is a natural output of a trust’s investment strategy. A sustainable, growing dividend that is well covered is a good thing for investors, especially if the trust can maintain the dividend through downturns such as the Covid pandemic.

However, the potential problem with getting onto the dividend hero list is when a trust becomes desperate to keep growing its payout and potentially has to use capital to increase its dividend, he warned.

Story by Jon Smith

Fully using the £20k ISA allowance could make this much passive income© Provided by The Motley Fool

Before we get to the specific numbers, let’s run through the process of how this would all work. Cash gets moved to the ISA, where it then becomes available to invest. By selecting shares that pay out dividends, the investor can benefit from a source of income. Typically, these dividends get paid out a couple of times a year, in line with half-year or full-year accounts.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

To keep things easy, some might just buy a FTSE 100 fund that distributes the income, using the average dividend yield of 3.54%. This is an idea, but I feel that with more active stock-picking, a much higher yield can be achieved without taking on a huge amount of risk

For example, an investor could achieve an average yield of 7% by including a dozen shares from the FTSE 100 and FTSE 250. This would include stocks from a range of sectors, with different dividend payment dates throughout the year.

One example that might be considered for inclusion in such a portfolio could be Land Securities Group (LSE:LAND). The firm is one of the largest commercial property owners. This ranges from office spaces right through to shopping centres.

Over the past year, the share price has been down 13%. Part of this reflects the ongoing concern around commercial property, such as the continued desire for some to work from home. Another factor is the 34.9% loan-to-value ratio from the latest results. With interest rates staying higher than expected for longer, refinancing existing loans or taking on new loans is going to cost more than previously expected.

Even though these remain risks going forward, I think it’s a good stock for an income investor to consider. The current dividend yield is 7.11%, with a dividend cover of 1.27. Any coverage figure above 1 shows that the company can pay the dividend from the latest earnings, which is a good sign.

If someone were to invest £1666 a month (£20k a year) in a portfolio yielding 7%, the numbers could add up quickly. If this was kept up for seven years, then in year eight, it could make £1,154 a month in passive income.

The post Fully using the £20k ISA allowance could make this much passive income appeared first on The Motley Fool UK.

The Board intends to pursue a dividend policy with quarterly dividend distributions. The level of future payment of dividends will be determined by the Board having regard to, amongst other things, the financial position and performance of the Group at the relevant time, UK

REIT requirements, and the interest of Shareholders.

Thursday 27 March

Empiric Student Property PLC ex-dividend date

Fidelity European Trust PLC ex-dividend date

Primary Health Properties PLC ex-dividend date

Schroder Japan Trust PLC ex-dividend date

UIL Ltd ex-dividend date

Value & Indexed Property Income Trust PLC ex-dividend date

VH Global Energy Infrastructure PLC dividend payment date

The Snowball.

Buy Investment Trusts that pay a dividend and re-invest those dividends to buy more Investment Trusts that pay a dividend.

The current preferred yield for the Snowball is plus 7%. If u buy a Trust trading at discount to NAV, u could get a bid, if u are lucky, or as market sentiment improves the NAV gap could close. When you re-balance your portfolio any Trusts printing a profit, the profit could be crystallized and re-invested in the Snowball, subject to relative yields.

If an Investment Trusts radically changes it’s dividend policy, u need to sell even at a loss. You simply need to read the RNS when the dividend is anoucced.

Build your knowledge of Investment Trusts by Doing Your Own Research

If you invest 10k at a yield of 7%, and re-invest at 7%, better if higher. In 60 years that would equate to income of £46,844 pa which would have to be adjusted for inflation.

Better if you can add more funds to buy more Investment Trusts that pay a dividend. GL my friend.

Our writer learns a handful of lessons from the masterful investing career of Warren Buffett and his phenomenal long-term performance.

Posted by

Christopher Ruane

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Investing in some shares and seeing their value grow by 24,708% would be very rewarding. That is what happened to the US S&P 500 index between 1964 and 2022 (with dividends reinvested: compounding can really help build wealth!). Impressive though that is, Warren Buffett’s performance left it in the dust.

His company Berkshire Hathaway does not pay dividends. But during that period, its per-share market value grew 3,787,464%.

In other words (excluding currency movements), £100 put into Berkshire shares back in 1964 would have turned into almost £3.8m by the end of 2022.

Warren Buffett has learnt on the job. His strategy today is different to how it was in the 1960s (or even a few years ago).

But the broad principles have stayed the same: he has tried to accumulate wealth by paying less for stakes in businesses (or whole businesses) than he thinks they are worth.

Early on, Buffett saw value buying shares for less than their net asset value.

It used to be more common than now, but some shares do still trade below net asset value. FTSE 100 member Pershing Square Holdings had a net asset value of £59.70 per share on Tuesday (28 January), yet its shares could be picked up this week for around £42 apiece.

Warren Buffett moved from a focus on current net asset value to look instead at what assets a company had that might help it create recurring value in future.

An example is his stake in Coca-Cola

Thanks to its brands, proprietary formula, and distribution network, the drinks maker has been a massive cash generator over the decades. It faces risks like shifting tastes and health trends. But the cash has kept coming!

Berkshire bought shares between 1987 and 1994 and has simply held onto them.

It could have sold along the way for a quick buck. But buying to hold means that Warren Buffett now gets more than half as much as the stake originally cost every year in dividends – and the shares themselves have ballooned in value.

But, while he buys to hold, Buffett does sell on occasion. When an accounting scandal hit Tesco in 2014, he dumped his remaining shares in the supermarket at a sizeable loss.

Tesco was one of Buffett’s few forays into the UK market. His main focus has always been his native US – and industries he understands, like insurance and banking.

Warren Buffett is a firm believer in sticking to one’s own circle of competence, whatever it is.

Obvious as it may sound, to turn £100 into over £3.7m requires £100 in the first place!

Warren Buffett’s success shows that it is possible to start investing on a small budget: he began buying shares as a schoolboy. But, even if the budget is small, it needs to be something.

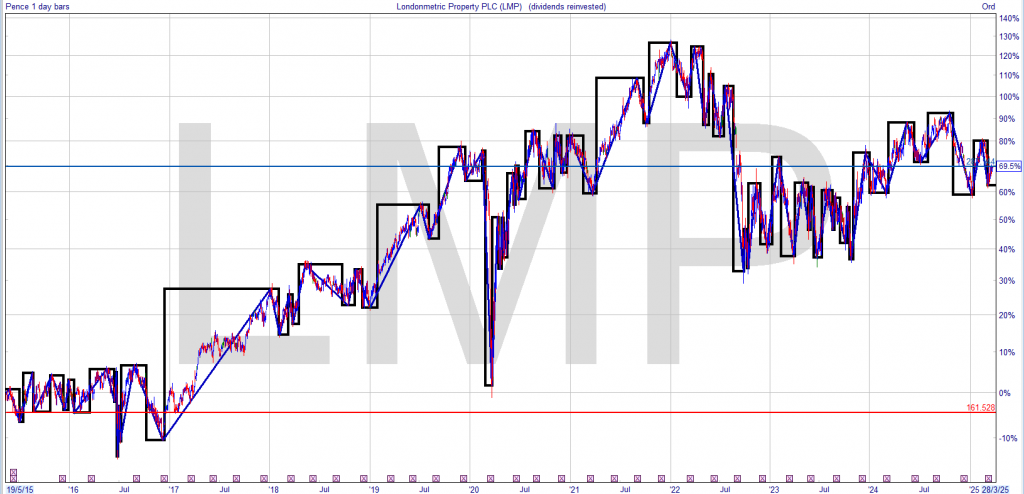

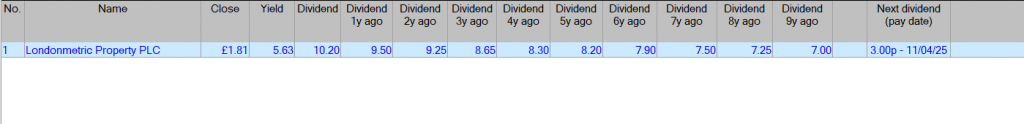

Not a Trust to re-invest the dividend in.

Current yield 5.63%. Trades just below it’s NTAV, so not a consideration for the Snowball.

Story by Zaven Boyrazian, MSc

Here’s how to start earning a second income with dividend shares

With the cost-of-living crisis increasing pressure on households, the importance of earning a second income’s rising rapidly. Luckily, dividend shares offer a potential solution to this problem, allowing focused investors to earn impressive long-term passive income.

Not all businesses are high-flying enterprises. The London Stock Exchange is to many mature businesses whose explosive growth days are now in the rear-view mirror. However, with the strong demand for their products and services, their cash flows remain robust. As such, with no other use of capital internally, management teams are returning a large chunk of this cash back to shareholders – the owners.

Typically, dividend payments come every quarter, although this frequency can be different depending on the business and its cash flow timings. However, most companies like to keep payment timing relatively consistent. And investors can leverage that to establish a reliable and predictable income stream.

If cash flows become disrupted, dividends can often find themselves under pressure. And if market conditions become too adverse, shareholders may see their payouts get cut or even outright cancelled. As such, the second income generated by an investment portfolio can take a hit on relatively short notice.

Luckily, such risks can be managed with prudent market monitoring and portfolio diversification.

There are a lot of UK dividend shares to pick from. However, not all of them offer the best value or long-term income potential. And depending on the risk tolerance and time horizon of an investor, the best dividend shares to buy can vary, depending on the individual

Higher interest rates have wreaked havoc on property prices, even in the commercial sector where LondonMetric operates. And with the book value of its assets marked down, shares are still trading at a forward price-to-earnings ratio of 13.9.

To be fair, weakened asset prices can be problematic. Suppose management suddenly needs to sell properties to raise capital. In that case, it will likely have to do it at a discount, given the weakness in the commercial real estate market. And the group’s £2.2bn of debt does add pressure to the bottom line, due to higher interest rates.

However, despite these handicaps, demand from tenants and occupancy remains strong, as do cash flows. That’s why LondonMetric Property’s already in my income portfolio, and I feel other investors may want to consider it for theirs.

The post Here’s how to start earning a second income with dividend shares appeared first on The Motley Fool UK.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑