Investment Trust Dividends

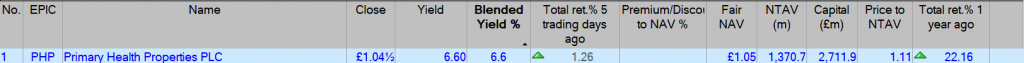

Copied from the Watch List Below.

The yield is a blend of the future fcast yield and the historical yield. Here because of the takeover of Assura the yield may change.

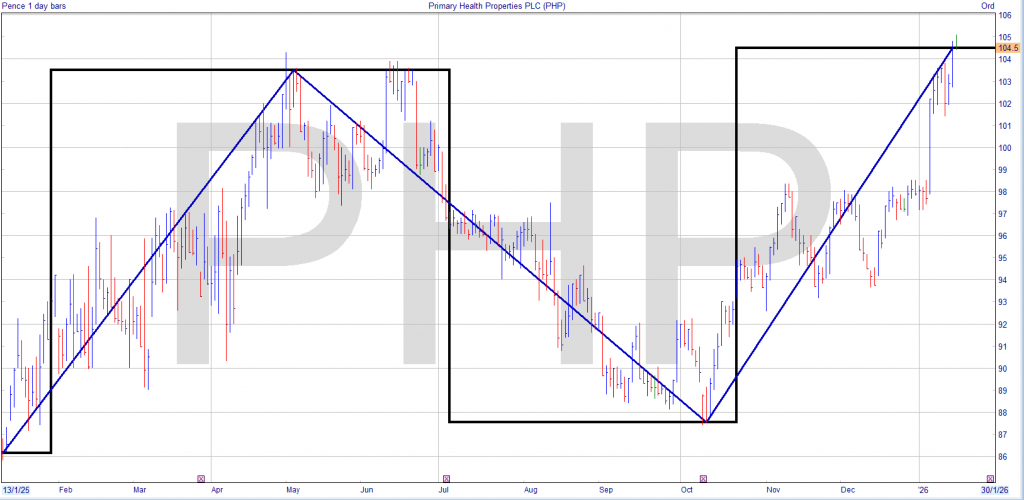

Notice of interim dividend

The Company announces the first quarterly interim dividend in 2026 of 1.825 pence per ordinary share, equivalent to 7.3 pence on an annualised basis, which represents an increase of 2.8% over the dividend per share distributed in 2025 of 7.1 pence and will mark the 30th year of consecutive dividend growth for PHP.

The 1.825 pence dividend will be paid by way of a Property Income Distribution (“PID”) of 1.325 pence and an ordinary dividend of 0.500 pence on 13 March 2026 to shareholders on the register on 30 January 2026.

The Company intends to maintain its strategy of paying a progressive dividend, paid in equal quarterly instalments, that is covered by adjusted earnings in each financial year. Further dividend payments are planned to be made on a quarterly basis in May, August and November 2026 which are expected to comprise a mixture of both PID and normal dividend.

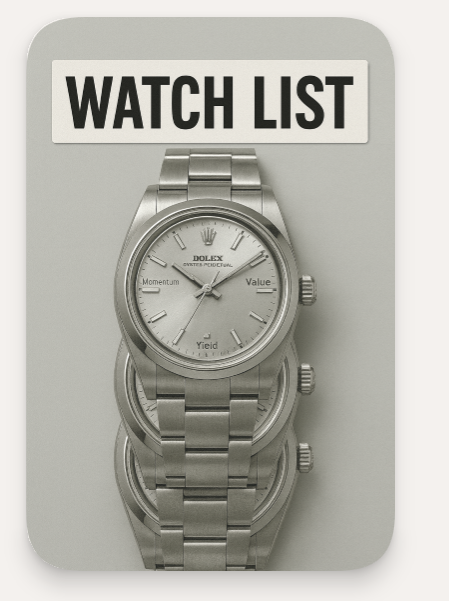

Share price £1.04 dividend 7.3p Yield 7%

You can only base your decisions on the statement from the company and take action if the future dividend changes.

There is no premium/discount to NAV as although the share is a REIT it’s an Investment Company, so you need to look at the Fair Value, which isn’t as reliable as a company’s NAV RNS.

NTAV is the capital minus any outstanding loans.

Trading Tip

Looking at the loans figure you can understand why REIT’s fall in value when interest rates rise and vice versa when they fall.

If you were lucky with your timing or new that REIT’s prices rise when interest rates fall, not all REIT’s so better to be lucky than clever, you would have made a TR return of 22%.

Which you may decide to take some or all of your profit and re-invest in another share, with a higher yield and discount to NAV.

Or maintain the holding and use the ‘secure’ dividend, no dividend is 100% secure

and re-invest the dividends in a higher yielder.

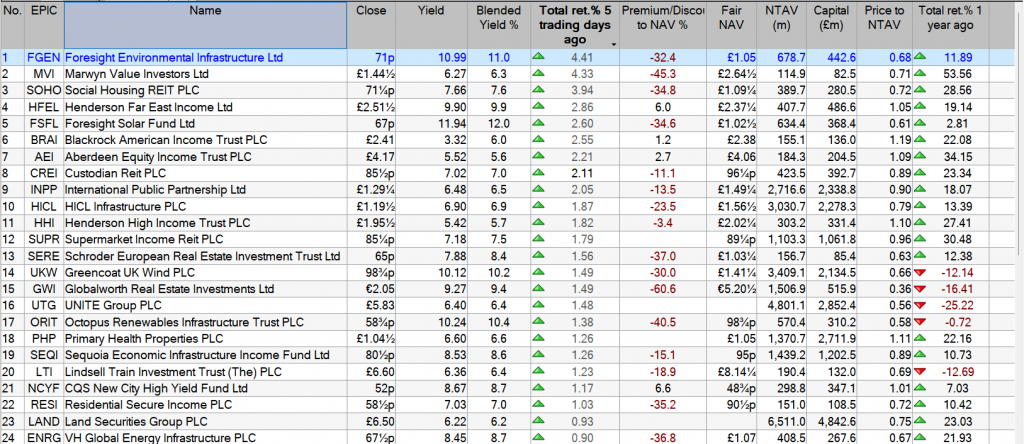

The Watch List will be reviewed at the end of the month and any shares that yield less than 5% will be deleted.

I’ve bought for the Snowball a further 1486 shares in FSFL for 1k.

I wanted to open a new position in the Snowball but that will have to wait, until later when markets flip over, until then

I’ve bought 1275 shares in DIG for 4k, completing the Snowball’s position in the share.

Cash for re-investment £3,532.00

I’ve sold the Snowball’s shares in BRAI for a short term profit of £302.00, mainly because I never managed to buy a full position before the share price rose.

A share I will most probably come back to.

Brett Owens, Chief Investment Strategist

Updated: January 14, 2026

Wall Street, please. Enough with the narratives.

CNBC and Bloomberg have become the ESPN and Fox Sports of the financial world. Stories are simplified, spun and spoon-fed to the audience.

We thoughtful contrarians can’t stomach this junk any longer!

These “experts” have vanilla investors sweating every headline. The always-impending recession. Job losses. Trade wars. Geopolitical battles. Domestic political dysfunction.

Sure, there’s a kernel of truth to every story. But investors who ride this roller coaster suffer heart palpitations and (worse!) retirement portfolio underperformance. They get scared stiff by the media coverage, sell stocks at the wrong time (near lows) and stay on the sidelines for too long.

Most investors are terrified of a recession because they own things people stop buying when times get tough. We own the things people literally cannot live without—like lunch.

Regardless of what awaits in 2026, people are going to eat. In my Hidden Yields, we played this “three meals a day” trend exactly one year ago and bought the company that processes the corn that goes into everything in the grocery store, Archer-Daniels Midland (ADM).

ADM is a “boring” company that prints cash in any economy. As the broader market chopped and churned over the past 12 months, this underappreciated food trade delivered 26% total returns to HY subscribers. No heart palpitations, just dividends (including one raise!) and price gains:

People Keep Eating, ADM Returns 26%

If you missed that run, I’ll share some good news—you have a second chance. ADM has pulled back in recent months, presenting us with a sweet opportunity to reload for 2026.

The stock topped out in late summer because Wall Street was concerned about low “crush margins,” industry jargon for the profit ADM makes from processing soybeans into meal and oil. Vanilla investors incorrectly saw this as a negative trend and sold the stock.

We careful contrarians know better. Agricultural markets move in predictable cycles. When corn prices are high, farmers plant more acres to chase the profit. That new supply floods the market, prices drop and farmers then plant less or switch crops (to cotton, for example).

Corn and soybean prices have come down in recent years, and the “dumb money” is fleeing the sector. This is exactly when we buy—at a cyclical low, with catalysts lining up to send related plays like ADM higher again.

Because recession or not, people keep eating. The global population is still climbing, adding millions of new mouths to feed every year. Developing nations are becoming wealthier and, with their money, people demand protein.

Raising chickens, pigs and cattle requires massive amounts of feed—mostly corn and soy meal. It takes about six pounds of feed to produce one pound of beef. This “multiplier effect” sets a floor on the corn and soybean fee inputs going forward and, guess what? They’re already about as low as they’re likely to go. It’s not a matter of if grain prices turn higher. It’s when.

Two previous worries for ADM are likely to turn into catalysts. First, policy. The EPA proposed a new Renewable Fuel Standard rule that includes higher biomass-based diesel targets. If approved, this will boost demand for corn and soybeans—and quickly improve those crush spreads. More profit for ADM.

Second, the business is getting leaner, cutting $500 to $700 million in annual costs over the next three to five years. While we wait, this “shareholder yield” monster is maximizing our future profit per share. Management’s aggressive share repurchases power a higher stock price. Over the last five years, ADM has reduced its share count by a fantastic 14%.

These “disappearances” are the quiet driver of total returns. They are the reason we earned 26% in a quiet year for crops. When ADM buys back its own stock, it reduces the number of shares outstanding. Every remaining share then owns a larger slice of the profit pie. This is how earnings per share (EPS) can increase, even if total earnings stay flat.

As we speak, ADM is using this “mini dip” in the stock price to buy back even more stock on the cheap. These smart shoppers know their stock is cheap and they are gobbling it up before crop prices rally.

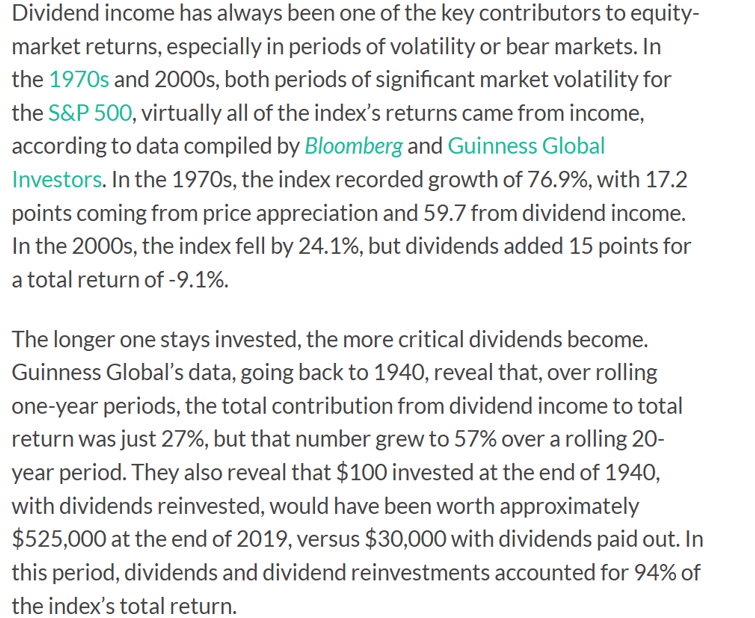

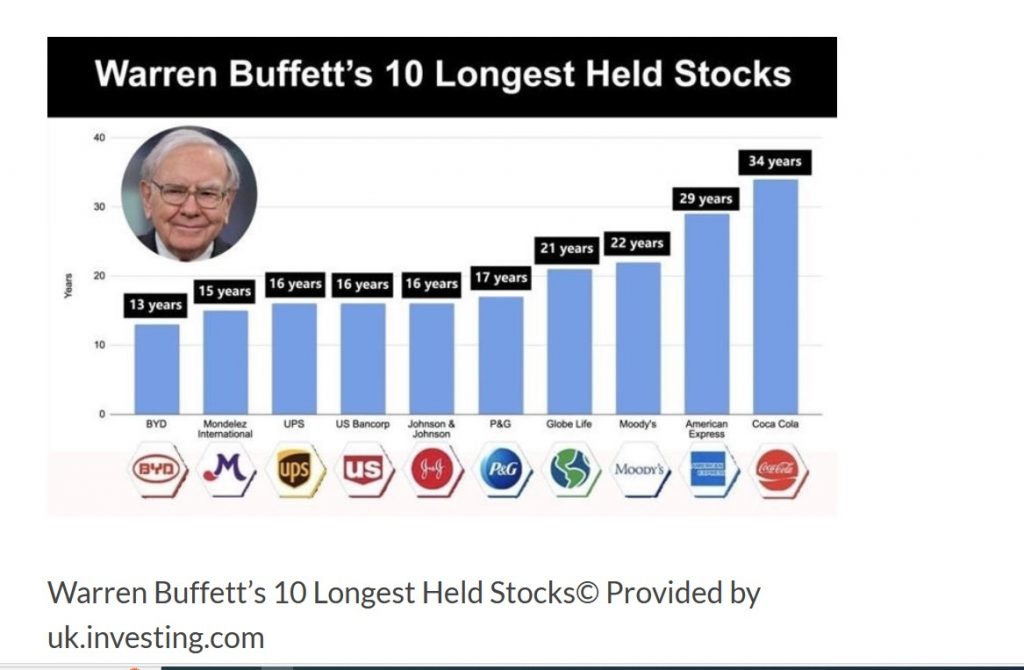

Finally, there’s the dividend. ADM is a “Dividend King,” meaning it has raised its payout for more than 50 years in a row. Which means that through the inflation of the 1970s, the dot-com bubble, the Great Recession and COVID, ADM never missed a raise.

Last 20 Years of Dividend Kingpinning

I imagine it’ll do just fine through ’26, too—bull or bear!

ADM checks all the boxes we look for in Hidden Yields. Its products are essential. It’s boring. It’s bulletproof. It has plenty of upside and it generously pays us a 3.5% yield while we wait. And by the way, ADM is due to hike its dividend in the weeks ahead, making this is our last chance to “front run” the raise. Let’s not dilly-dally!

And ADM isn’t alone. I have identified five more “essential” stocks that are trading at similar valuations to where ADM was last January. These are recession-resistant dividend growers that are positioned to return 15% (or more) in the year ahead, regardless of what the economy does.

These are not the stocks you’ll see discussed on CNBC. They are too boring for TV! But they are exactly the kind of stocks that build real retirement wealth.

The AI Bubble Is Overblown (But This 10.6% Dividend Wins Either Way)

by Michael Foster, Investment Strategist

Is 2026 going to be the year the AI “bubble” finally bursts?

Maybe my use of quotes there tipped you off to my true opinion: Worries about an AI bubble are vastly overdone.

And today we’re going to grab a 10.6%-paying closed-end fund (CEF) that wins either way: If I’m wrong and there is an AI bubble (that pops), cash will flow into it. If not, that’s fine: We’ll happily collect its growing 10.6% payout.

From Silicon Valley to Wall Street

Of course, the AI CEOs agree with me that there is no AI bubble: Sam Altman, Elon Musk and the heads of Microsoft (MSFT), Meta Platforms (META), Alphabet (GOOGL) and Oracle (ORCL) are all bullish and willing to spend trillions on the tech.

But another group also agrees that AI-bubble fears are overdone: a cadre of hedge funds and institutional investors that regularly hold tech titans like Musk, Zuckerberg and friends accountable – and know the “plumbing” of the tech world even better than the billionaire set does.

You can see what I’m talking about here in the fight between Elon Musk and institutional investors over the latter group short-selling stocks like Tesla (TSLA). Musk has complained about this repeatedly, but this short selling does give companies an incentive to do better, so their stocks don’t end up shorted. A kind of accountability emerges as a result.

Coatue and the Tech Hedge Fund World

All of this brings me to Coatue Management. It’s a tech hedge fund that began during the dot-com bubble and not only survived but grew from $45 million in assets at its launch to about $70 billion today.

Over that time, Coatue has shorted many tech stocks, so it has experience in keeping corporate managers from getting tied up in indulgent behaviors that lose money for investors. Coatue also has plenty of experience with bubbles.

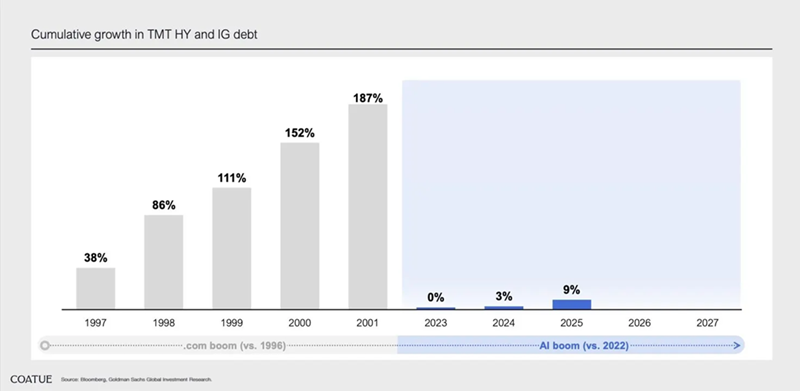

So when Coatue dismisses talk of an AI bubble, we should listen. And that’s exactly what it did late last month, when it posted this chart:

Here we see that over the last three years, there has been surprisingly little growth in the amount of money invested in corporate bonds issued to fund the tech, media and telecom sectors. (That’s the “TMT” in the title – those are the companies like Google, Microsoft, Meta and Oracle.)

The 0%, 3% and 9% gain in total debt issuances from 2023 to 2025 in these sectors suggest the bond market is not overly exposed to AI, and that there’s still a lot of room for debt to grow. Also, the comparison with the dot-com boom’s surging debt growth (on the left side of the chart) tells us the current situation is likely not a bubble – at least not yet.

To be sure, private debt and creative financing of some AI projects means a lot of AI borrowing isn’t shown on this chart. But that was also true of the dot-com era. And estimates of both again show we’re far from a bubble today.

But even if we were, the fact remains that corporate bonds are not overly exposed to AI. Moreover, bond holders tend to demand more discipline around costs.

The AI Hedge Move

If the corporate-bond market isn’t overly exposed to AI, then any volatility prompted by AI-bubble worries will likely drive cash from stocks to corporate bonds. That makes the corporate-bond market the perfect hedge for anyone worried about a selloff.

There’s just one thing: AI bubble fears are fading and have been since they peaked in November, at least according to internet search traffic.

AI Bubble Fears on the Backburner – for Now

I know what you’re thinking. “Markets are calm. AI bubble fears are fading, so why worry about this now?” The low fear means the market is not pricing in the potential of investors looking to hedge against AI in the future. That’s left corporate bonds cheaper than they should be.

In other words, we can buy into bonds now that the market isn’t hedging, wait for any stock volatility to boost demand for said bonds, then sell those bonds to investors.

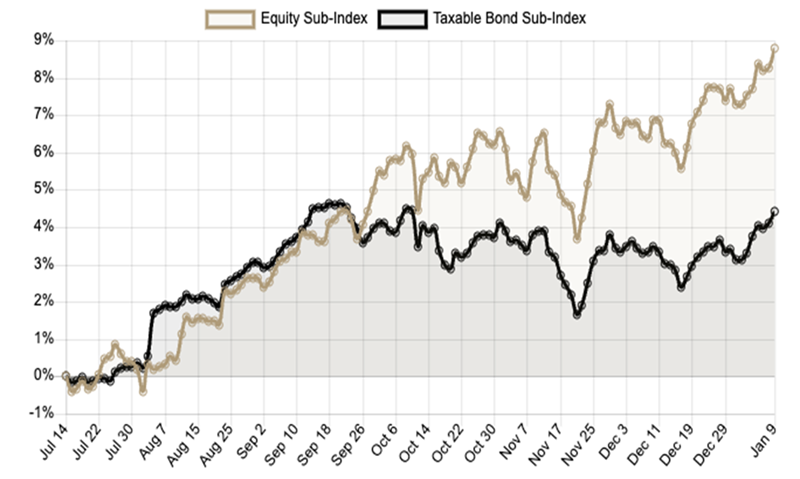

Take a look at this chart.

Bond CEF Underperformance Highlights Our Opportunity

Source: CEF Insider

I started 2025 bullish on corporate bond CEFs until September, when we sold three of these funds from our CEF Insider portfolio.

The reason is in the chart above: September was when CEF Insider‘s corporate-bond-fund subindex (in black) began lagging its equity-fund subindex (in brown). So CEF Insider focused more on equity funds, which have outperformed since.

Now that bond funds are on sale, and stand to gain on any short-term worries over an AI bubble, it’s time to cycle back to some of them. But how? Through a CEF, of course!

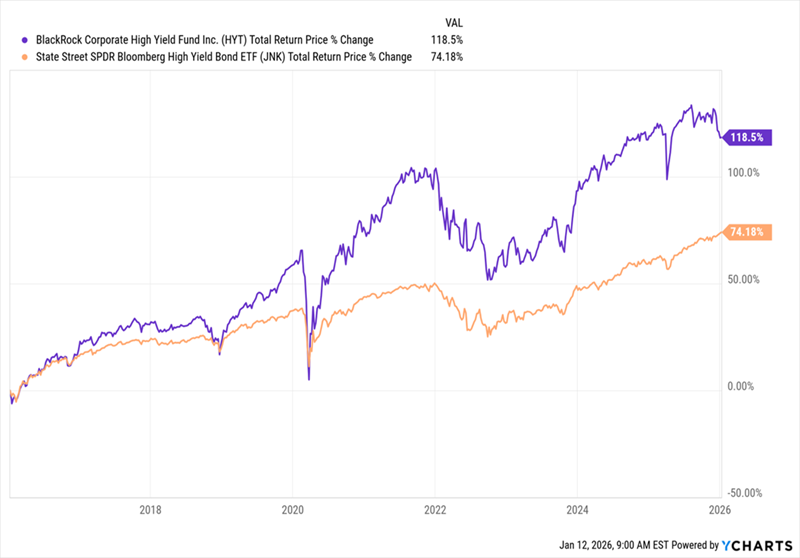

Buying corporate bonds individually is difficult, and bond ETFs typically underperform. But a CEF like the BlackRock Corporate High Yield Fund (HYT) is a great way to buy in, both now and over the next few weeks.

HYT Clobbers Its Benchmark

HYT yields 10.6% today and has raised its payout around 11% in the last decade. That’s in contrast to the corporate-bond benchmark SPDR Bloomberg High Yield Bond ETF (JNK), which has actually seen payouts fall a bit. Even better, HYT (in purple above) has outperformed JNK (in orange).

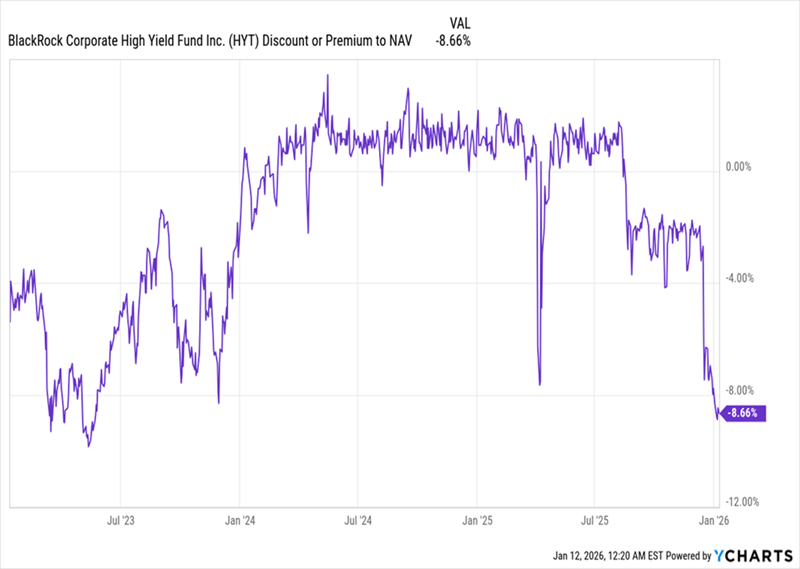

An even better reason to buy HYT is that today’s low bond demand means the CEF is especially cheap:

A Sudden Discount Appears

In the last six months, HYT’s discount to net asset value (NAV) has dropped to levels not seen since 2022 and 2023, after a long period of trading around par. This is an opportunity for us, putting short-term upside on the table if the fund’s discount evaporates again, like it did at the end of 2023.

With that in mind, buying HYT now is a solid value play, with demand for a hedge against an AI bubble waiting in the wings. And then, of course, there’s the 10.6% dividend.

HYT Is Just the Start. Here Are My Top “AI Bubble” Plays (Yielding up to 8.7%)

The bond market is far from the only place we’re investing to play overhyped fears of an AI bubble.

Another place? AI stocks themselves! But of course, careful contrarians we are, we’re taking two key precautions to safeguard the gains (and dividends) we get from these plays:

I know, I know. The big-name AI stocks are all pricey now, and offer low (or no) dividends. So how are we going to pull this off?

Through CEFs, of course! I’m pounding the table on 5 CEFs holding shares of companies that not only provide AI, but those that stand to gain the most by using it, too.

The time to buy these 5 high-yielding CEFs is now.

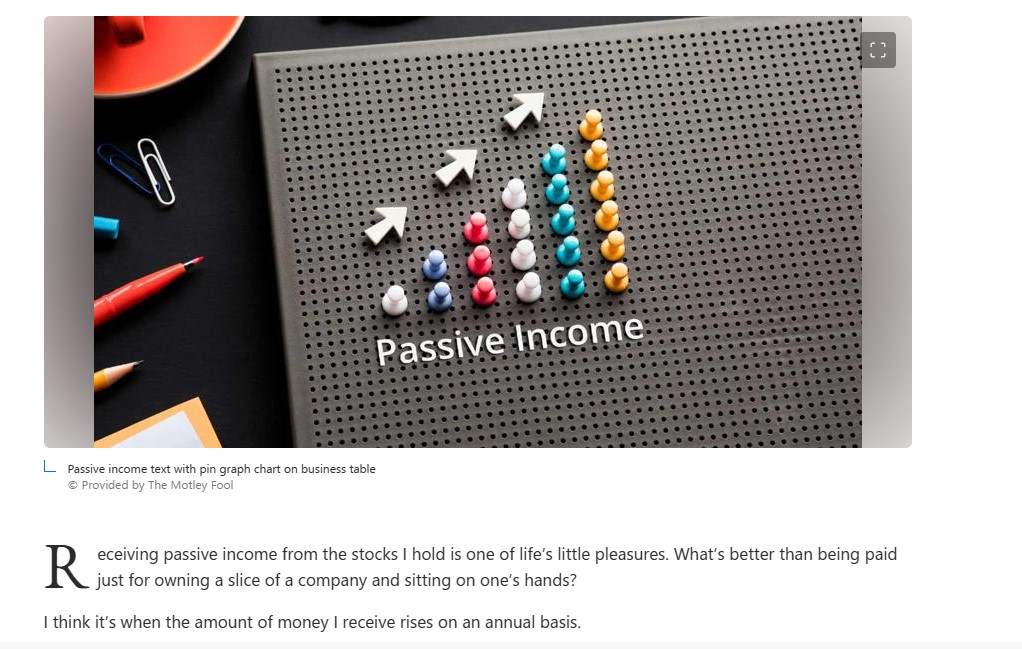

Drip-feeding money into growth and dividend shares can eventually deliver a stunning second income in retirement. Royston Wild explains how.

Posted by Royston Wild

Published 16 January

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services

Looking to build a life-changing second income? For me, the best way to chase a strong and sustained income — and one that requires considerably less effort than most popular side hustles — is to invest in the stock market.

Last year, the FTSE 100 delivered an enormous 25% total return to investors. For the S&P 500 index of US shares, the figure was 18%. Those buying stocks at the start of 2025 could have supercharged their portfolios, then, boosting their chances of eventually enjoying a large passive income.

Returns were larger than usual, sure. But even at typical rates, a small investment can generate considerable wealth over time. The FTSE All-World Index of large- and mid-cap shares has delivered an average annual return of roughly 12% over the last five years.

Here’s how investing just £100 in global stocks could eventually produce a £23,455 second income with minimal effort.

One of the simplest ways to invest in stocks is with an index tracker fund. They allow individuals to own a slice of many different companies, spreading risk and providing exposure to a broad selection of growth and income opportunities. And all at relatively little cost, too.

The Vanguard FTSE All-World ETF, for instance, tracks the performance of 3,657 stocks across regions and industries. And it has an ongoing charge of just 0.19%. If it can continue delivering the 12% annual return of recent years, a £100 monthly investment over 30 years will eventually turn into £335,074.

If then invested in 7%-yielding dividend stocks, a portfolio of this size would generate a £23,455 passive income a year.

Rather than gaining broad stock market exposure with a fund, investors can also choose to invest directly in companies. This requires a lot more effort than simply sticking your cash in an index tracker. However, it can also lead to far better results.

I think a portfolio of 15-20 stocks offers excellent diversification to spread risk and aim for big returns. Games Workshop (LSE:GAW) is one of the FTSE 100’s finest growth stocks I’ve bought for my own portfolio.

Thanks to its leading role in a rapidly growing market, the tabletop gaming specialist continues to enjoy booming profits even as the broader retail sector struggles. Last year it delivered a total return of 47%, smashing the broader FTSE index’s performance.

Further price gains in 2026 mean the average annual return over the last decade is 45%. If you’d drip fed £100 each month into Games Workshop shares since then, you’d now be sitting on a cool £218,409 (assuming dividends were reinvested).

If then invested in 7%-yielding dividend stocks, a portfolio of this size would generate a £23,455 passive income a year.

The big risk is that even if you achieve the target, there will be enough shares yielding 7% for a diversified portfolio.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑