The portfolio is not entitled to the dividend from Assura as the position was bought after the xd date.

Investment Trust Dividends

The portfolio is not entitled to the dividend from Assura as the position was bought after the xd date.

In the income portfolio, I’d highlight JPMorgan Global Growth and Income’s latest six- month numbers which showed NAV up 9.2% on a total return basis in Sterling, outperforming the 7.0% return from the MSCI AC World Index. Numis analysts noted that the “outperformance was particularly impressive in 2023 given market performance was driven by a small number of US tech stocks, and the approach (of the JPMorgan fund) seeks to combine ideas in both “growth” and “value” styles”.

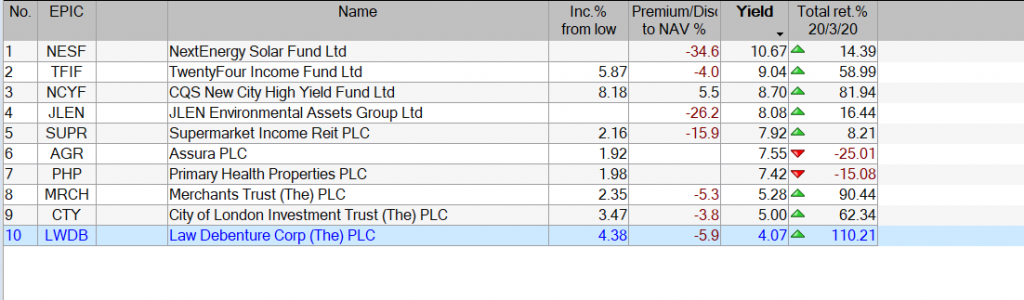

Some Trusts to research for when/if Mr. Market gives u the chance to buy.

A low risk portfolio for widows and orphans, u have to accept that the capital will be passed on, although in case of an unexpected emergency one of the positions could be sold, maybe the lowest yielder equivalent to taking dividends x amount of years in advance.

An equal weight portfolio would provide income of 7.3%, hopefully gradually increasing.

If u are re-investing the dividends, then hope for weak markets.

The difference between a yield of 7.3% and a tracker ? certainty that u can pay your electric bill.

The difference between a yield of 7.3% and a tracker ? u know that if u can compound at 7% your dividend stream will double in ten years better if u have longer.

No guarantees but to simplify your life, just check the Trust is going to pay its next dividend.

If u are going to take the risk of trading u may as well be rewarded for the risk.

I’ve bought some more shares for the portfolio, even though the price

could continue to fall as it’s xd next week. The portfolio has avoided the

worst of the Trust’s falls but as the price falls the yield rises and vice versa so it’s a risk on trade.

The Trust has a buy back programme in place which could help to arrest the the shares freefall.

Commenting on the results, Alexander Ohlsson, Chairman of Foresight Solar, said:

“Foresight Solar delivered resilient performance with record electricity production and cash distribution against a challenging market backdrop. Our operational strength, the powerhouse behind our progressive dividend, enabled us to comfortably meet our dividend target of 7.55p per share for 2023 and allows us to propose an above inflation increase of 6.0% for the 2024 target dividend of 8.0p per share.

Now the May dividends have been announced the income figure for the end of May should be £4,306.00. Ahead of plan.

The target for the half year period is £5,166.0.

I have bought for the portfolio 2410 shares in FSFL for 2k.

This should provide income to add to the Snowball this year of £135.00

and next year of £180.00.

A Message from WealthPress

Dividend stocks are possibly the only investment where you have the opportunity for capital growth as well as income.

It’s truly empowering once you see the impact that dividend stocks can make on any account size.

Imagine the peace of mind that could give you, knowing that your nest egg could be growing without having to make massive annual contributions.

Or slaving away at the computer screens trying to pick some miracle stock.

The key ingredient is DIVIDENDS.

And when you look at it over the scope of time, the difference dividends make is truly mind boggling.

Just visualize a $10k investment in the S&P 500 since 1960 with me.

Without the dividend payments…Your account would have grown to:

$641k

That’s not bad… But it’s certainly not enough to retire worry-free.

But during that SAME time period…With that SAME starting stake…

If you reinvested the DIVIDENDS:

$4 million

That means dividends were the ONLY difference between not having enough to make it through retirement.

Or retiring in the TOP 1% of all U.S. Households!

And the best part is, there’s no extra legwork on your end to collect these dividends – just sit back and watch.

As long as a company doesn’t cut its dividend, you’re guaranteed cash!

Invesco Bond Income Plus : BIPS (formerly City Merchants High Yield : CMHY until its merger with Invesco Leveraged High Yield) has an objective to seek to obtain both high income and capital growth from investment predominantly in high-yielding fixed-interest securities.

The trust seeks to provide a high level of dividend income relative to prevailing interest rates through investment in fixed-interest securities, various equity-like securities within fixed-income markets and equity-linked securities such as convertible bonds, and direct equities that have a high income yield. It seeks also to enhance total returns through capital appreciation generated by investments which have equity-related characteristics. Quoteddata

U are of the opinion that interest rates will fall, not a given and then your income deposit will fall. U also know that bonds rise when interest rates fall and vice versa when rates rise, which would have kept u well away from the recent blood bath in gilts/bonds.

U want to add a safety net to your portfolio, maybe a fund that pays interest to re-invest as u wait for the next market panic, when u may want to buy a dividend hero Trust, similar to LWDB.

The yield is 6.5%, the next xd date 18/04 but below the yield u need

to compound your dividends in ten years (7%) so u could pair trade it

with a higher yielder, plenty to choose from at present.

GRS

I guess we can all agree, the chart is not a buy at the present time.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑