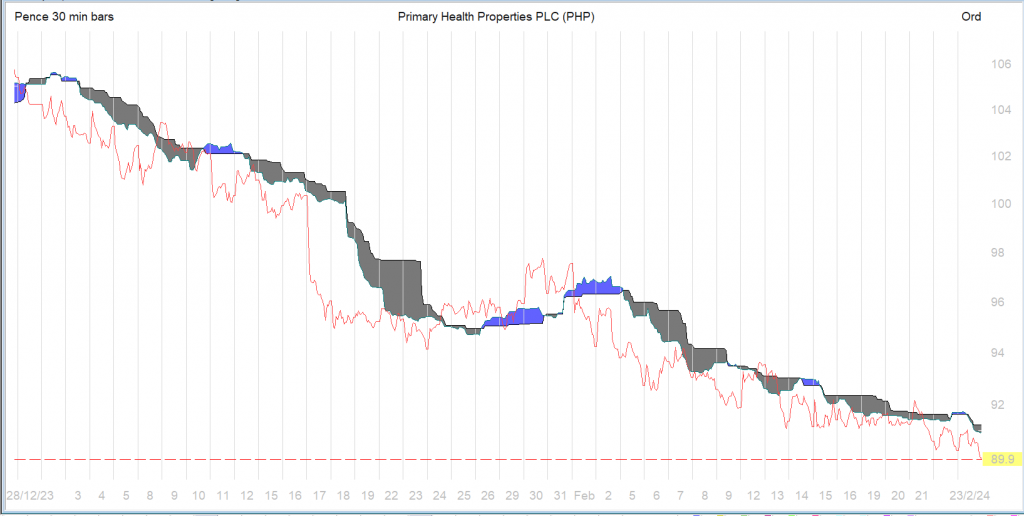

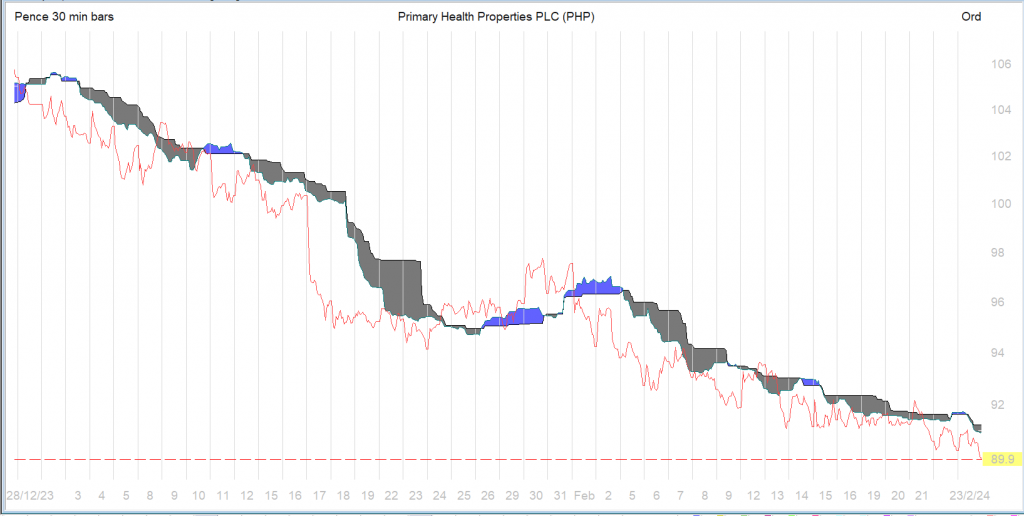

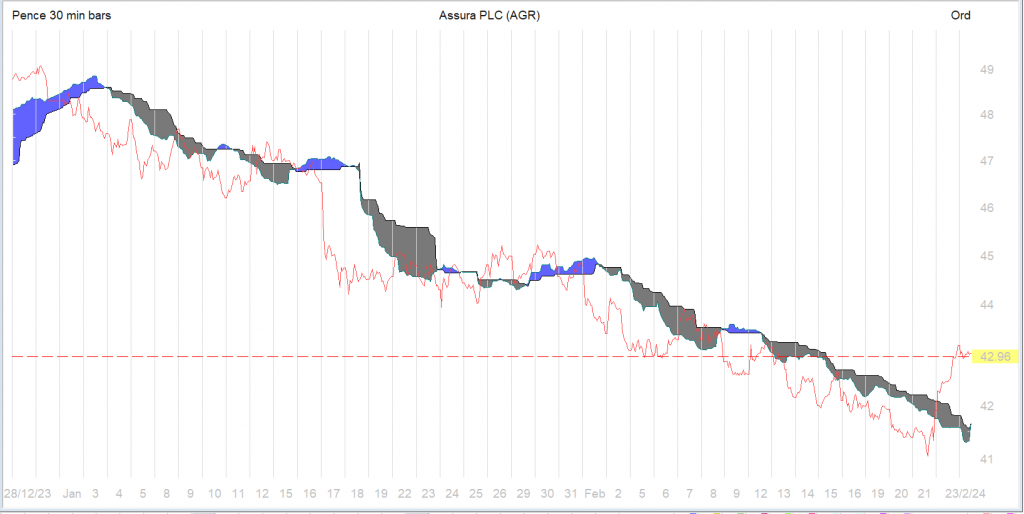

Not a chart buy, yet.

Investment Trust Dividends

Not a chart buy, yet.

All articles are to inform your thinking, not lead it. Only you can decide the best place for your money and any decision you make will put your money at risk. Information or data included below may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Some Trusts to build a portfolio on sound foundations.

The intention is to never sell the Trusts in the portfolio *

but to use the dividends to buy more Trusts that pay a dividend

and repeat. *If/when a Trust rises in value and the yield falls

u could sell, crystallizing the capital gain and re-invest in

a higher yielding Trust.

If u buy a buy to let house and intend to use the rent to pay

for your retirement, the value of the house is unimportant

if u want to keep receiving the rent to pay your bills.

LWDB could be a buy if/when the next time the market crashes.

Tks to Mr. Market, then look for the next market opportunity.

I’ve added to the Snowball by buying 2855 shares in AEI

for 8k

xd next week for £162.00 payable in March.

Currently £112,628.00 invested in the market.

This is not the value of the portfolio as it will take a while

for markets to improve and more dividends earned.

It makes no difference because as the price of a Trust rises

the yield falls, so when u are re-investing lower for longer

is best.

Stick to your plan until it sticks to u.

I am going to buy a position in AEI as the shares they hold

are of interest to me and looking well ahead for when the FTSE100

trades higher.

ACTIVITY BREAKDOWN

Top 10 Holdings

Name Holdings

BP PLC 4.8%

Shell PLC 4.3%

National Grid PLC 4.3%

Imperial Brands PLC 3.8%

SSE PLC 3.8%

DS Smith PLC 3.7%

Barclays PLC 3.1%

NatWest Group PLC 3.1%

BHP Group Ltd 3.0%

OSB Group PLC 3.0%

Currently yielding 8.2% trading at a discount to NAV of 5.9%

There are only two.

I’ve sold 12264 shares in GRID for a loss of £1,175.00

after they cancelled their next dividend.

Cash to re-invest £8,139.00

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑