Remember your Snowball should be different to the

as it should reflect the years you have before retirement.

Investment Trust Dividends

Remember your Snowball should be different to the

as it should reflect the years you have before retirement.

SNOWBALL SHARE NESF. Not buy advice DYOR

Have we seen

Picking high-income stocks in an ISA can be a route to securing long-term passive income.

Posted by Alan Oscroft

Published 5 February

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

The ability to invest up to £20,000 per year in an ISA and not pay a penny tax on the passive income it can generate can be life-changing.

In the 2023/24 financial year, the latest for which we have the numbers, UK adults held 15m ISA accounts. And the total cash invested in those ISA accounts came to £103bn ! So we’re a nation of canny savers and investors, right ? Well, we need to dig a bit deeper.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Of those 15m ISA accounts, 9.9m were Cash ISAs — and only 4.1m were Stocks and Shares ISAs. Cash ISAs held £69.5bn, but only £31.1bn — less than half that amount — went into Stocks and Shares ISAs.

Cash ISAs can be a great way to protect some emergency cash or short-term savings. And for folks who really don’t want any stock market risk at all, the guaranteed returns offer a safer option. But over the long term, Stocks and Shares ISAs have wiped the floor with the Cash ISA alternative.

The top Cash ISA interest rates are currently a bit above 4%. And that’s actually not bad at all. But over the past 10 years, the average annual Stocks and Shares ISA return has come in at a whopping 9.6%.

The total sum we’d need to build up depends on the rate of return we can achieve.

From that 9.6% Stocks and Shares ISA return, around £132,000 should generate enough passive income to cover our target £1,000 per month. And investing £500 per month with all dividends reinvested, we could get there in 12 years.

To get the same from a 4% Cash ISA return, we’d need more than £320,000. And at that interest rate, it should take 29 years to build that up.

To be fair, that 9.6% from shares has been above average for shares in general. But the 4% from cash can’t be maintained when Bank of England (BoE) rates come down. I can easily see Cash ISA interest getting down below the BoE’s 2% inflation target. To take home £1,000 per month from a 2% return, we’d need more than £600,000 — and 56 years to get there.

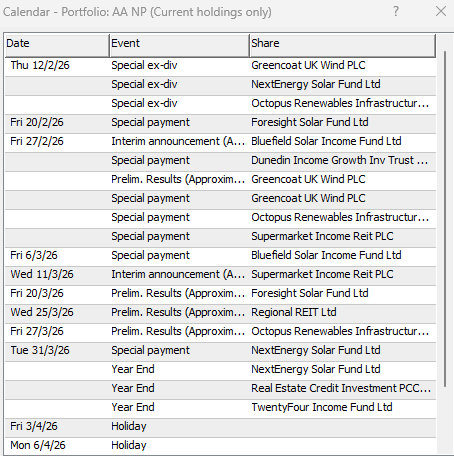

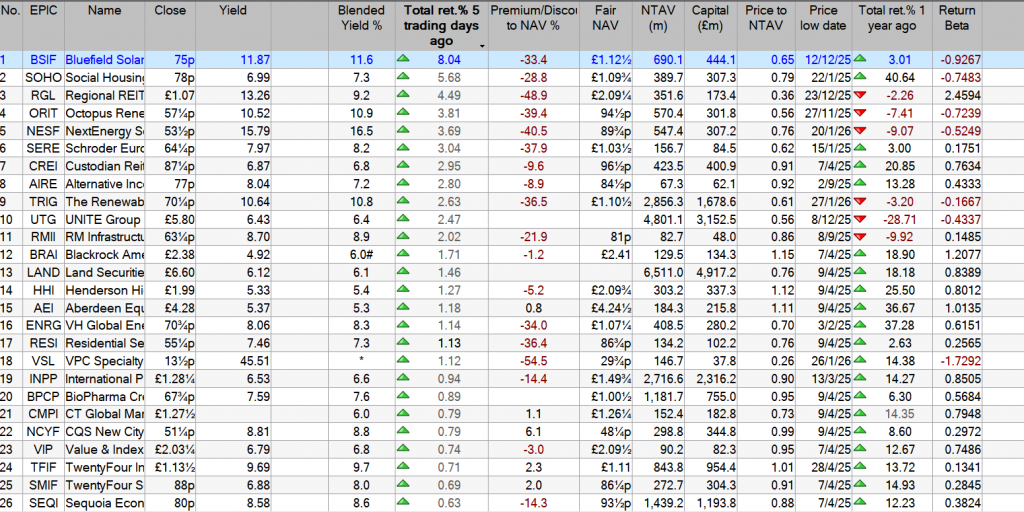

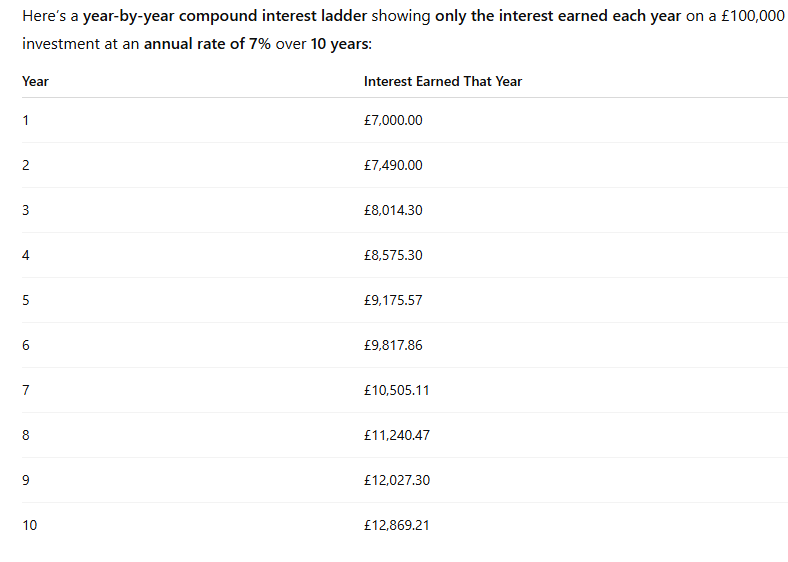

The target for the SNOBWALL is a return of 10% on seed capital of 100k. Hopefully in 2 years time it will earn income of 1k per month.

Your Snowball should be different to mine, to reflect you risk profile and how many years before you want to spend your dividends instead of re-investing them. Depending on how many years you have to re-invest your dividends there may be surplus income that you could continue to re-invest with.

Monthly Dividend Superstars:

11% Average Annual Yields

Most investors with $600,000 in their portfolios think they don’t have enough money to retire on.

They do – they just need to do two things with their “buy and hope” portfolios to turn them into $5,000+ monthly income streams:

The result? More than $5,000 in monthly income (from an average annual yield just over 11%, paid about every 30 days). With potential upside on your initial $600,000 to boot!

And this strategy isn’t capped at $600,000. If you’ve saved a million (or even two), you can just buy more of these elite monthly payers and boost your passive income to $9,166 or even $18,333 per month.

Now we’re talking!

But if you’re a billionaire, sorry, you are out of luck. These Goldilocks payers won’t be able to absorb all of your cash. With total market caps around $1 billion or $2 billion, these vehicles are too small for institutional money.

Which is perfect for humble contrarians like you and me. This ceiling has created inefficiencies that we can take advantage of. After all, in a completely efficient market, we’d have to make a choice between dividends and upside. Here, though, we get both.

Inefficient Markets Help Us

Bank $100,000 Annually (per Million)

Fortunately for you and me, the financial markets aren’t 100% efficient. And some corners are even less mature and less combed through than others.

These corners provide us contrarians with stable income opportunities that are both safe and lucrative.

There are anomalies in high yield. In an efficient market, you wouldn’t expect funds that pay big dividends today to also put up solid price gains, too.

We’re taught that it’s an either/or relationship between yield and upside – we can either collect dividends today or enjoy upside tomorrow, but not both.

But that’s simply not true in real life. Otherwise, why would these monthly payers put up serious annualized returns in the last 10 years while boasting outsized dividend yields?

For example, take a look at these 5 incredible funds that pay monthly and soar:

This is the key to a true “Monthly Payer Portfolio” – banking enough yields to live on while steadily growing your capital. It’s literally the difference between dying broke and never running out of money!

But I’m NOT suggesting you run out and buy these funds.

Some have been on my watchlist and in our premium portfolios over the years, but I mention them only as examples of the potential ahead.

And get paid every month, too.

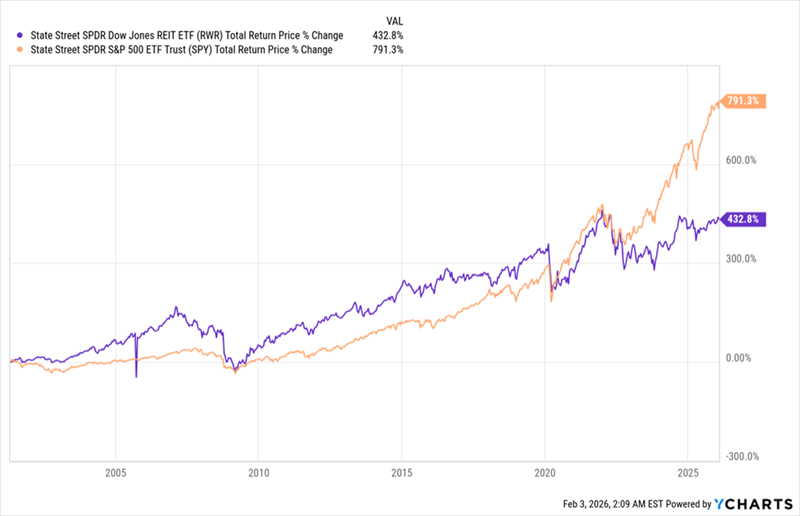

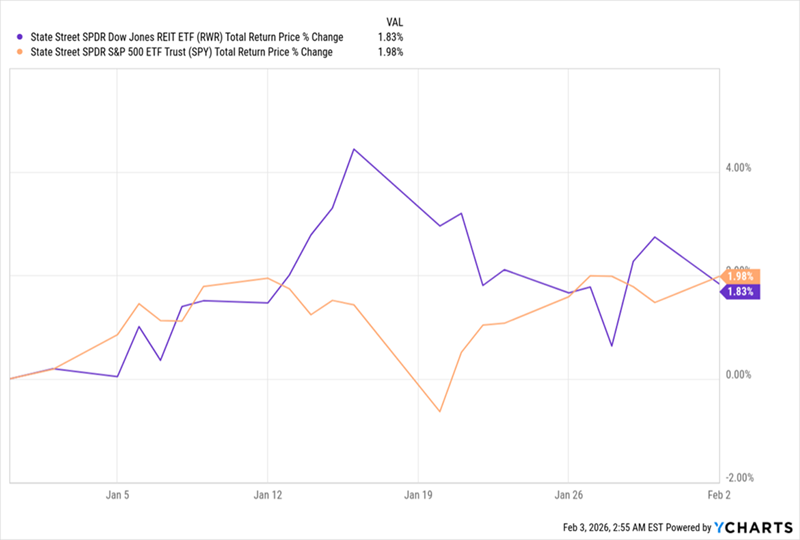

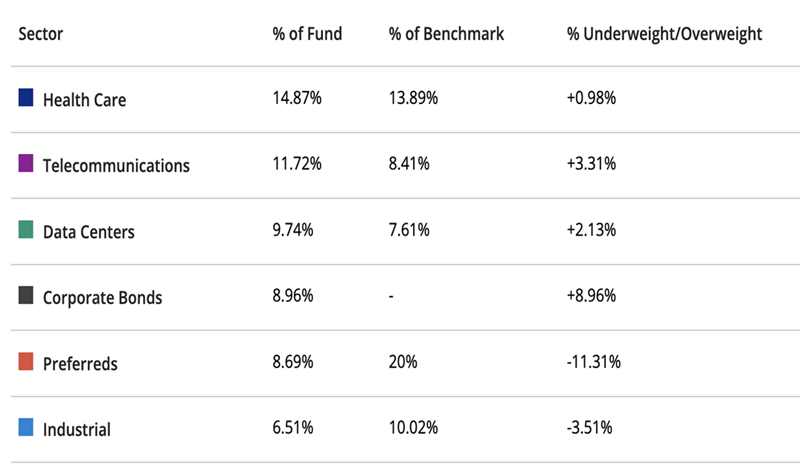

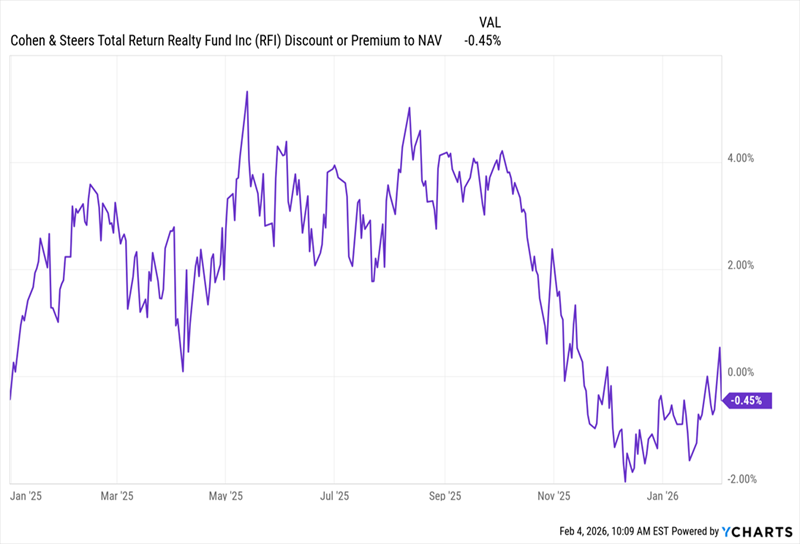

Our 8.6% Dividend Play on a “REIT Revival” by Michael Foster, Investment Strategist A multi-year disconnect in high-yielding REITs is about to turn on its head. When it does, these solid income plays are poised to shoot ahead of stocks. I’m talking about a quick reversal of pretty well everything investors thought had REITs left for dead, interest rate trends and the work-from-home shift among them. Now is the time to buy. And we contrarian income investors know the play: At times like these, we look to 8%+ paying closed-end funds (CEFs) to reap the strongest dividends and potential upside. I say this as REITs, long-time market outperformers, have been stuck in an unusually long slump. Remember when stocks ricocheted hard after the early days of the pandemic? REITs (with their benchmark ETF shown in purple below, compared to the main S&P 500 ETF, in orange) rebounded, too. But not nearly as much. REITs’ Slow Recovery  Why REIT Headwinds Are Diminishingand Setting Up to Reverse There are lots of reasons why REITs have lagged in the last six years, and none of them are really secrets: Work-from-home hit office demand. Interest rates jumped, hitting REITs’ bottom lines, as these companies borrow heavily to invest in their properties. Lower immigration into the US also had an effect on both housing and workspace demand. That last point – immigration into America – still applies. But both of those other barriers, which are far more meaningful, have either flipped or are in the process of doing so. Work-from-home? It’s largely been replaced by either a full-time return to the office or hybrid work. Interest rates? This is where things get intriguing. Rates Fall, REITs Start to Respond  REITs, as mentioned, borrow to invest in real estate, so rate cuts go straight to their bottom lines. The cuts the Federal Reserve has delivered since mid-2024 (in orange above) have come more slowly than markets expected. So it follows that the boost to REIT profits, and therefore their share prices, is real (purple line), but smaller than investors hoped. That leaves REITs in a strong position – still underpriced, but starting to show momentum. And with the first month of 2026 now behind us, we can see the current state of play here: REITs Nearly Reeled In Stocks in January  As you can see, in January, REITs (again with their benchmark in purple above) almost met the stock market’s returns. Now, one month does not make a trend, but that’s a switch from what we saw in 2025, when the S&P 500 gained over 17% and RWR returned a mere 3.2%. The takeaway: The lead stocks have held over REITs is finally starting to fade. And if interest rates fall faster than the market expects – quite possible if President Trump’s nominee for Fed chair, Kevin Warsh, is confirmed – REITs could not just match the S&P 500 but beat it this year. That would finally end REITs’ six-year lag. Let’s buy in before that happens. How? My favorite avenue is through those aforementioned CEFs. Consider, for example, the Cohen & Steers Total Return Realty Fund (RFI), a holding in my CEF Insider service that yields 8.6% as I write this. The fund is a solid play here, thanks to that 8.6% dividend, which has been rock-steady for years. The fund pays that dividend monthly, to boot. Source: Income Calendar RFI is also nicely diversified, boasting a portfolio that gives us exposure to AI’s infrastructure needs, with significant weightings in data center and communications (think cell-tower) REITs.  Source: Cohen & Steers Source: Cohen & SteersIt also holds industrial REITs, giving us broad exposure to both the reshoring and automation of factories. That top allocation to healthcare is also a plus, letting us tap into the aging of the US populations – a trend that still has decades to run. Finally, its allocations to bonds and preferred shares add stability. The fund is cheap, too. As I write this, we can buy RFI at a 0.5% discount to net asset value (NAV, or the value of the fund’s portfolio). I know that doesn’t sound like much of a deal, but it’s far below the premiums at which RFI traded for most of last year:  The kicker? That “small” discount is also well below RFI’s average premium of 3.7% over the last five years. That makes now a good time to buy this overlooked bargain, before other investors pick up on the many tailwinds shifting in RFI’s favor. 5 More “Built-for-2026” Income Plays You’re Not Too Late On (Yields Up to 10.7%) CEFs are, hands-down, the top plays on disconnects like the one we’re seeing shape up with REITs today, for three reasons:CEFs pay us (mostly) in cash, thanks to their rich dividends (around 8% on average).CEFs give us a double discount – on both washed-out stocks (or in this case REITs) themselves and on the fund itself through its discount to NAV.CEFs put our investments in the hands of a professional who knows their asset class inside and out. |

Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

By Laura Miller

ISA fund and trust picks for every type of investor – which could work for you?

(Image credit: Getty Images)Share

With the end of the 2025/26 tax year approaching on 5 April, now is the time to make full use of your current £20,000 ISA allowance and start thinking about what to do with the next allowance when it resets on 6 April.

Stocks and shares ISAs provide investors with a home to grow money free of any tax on the gains, which can be significant. Those who invested the full ISA allowance every year into the FTSE All-Share Index from when ISAs launched in April 1999, for example, would have a portfolio worth £665,696 over the 26 years to April 2025, according to calculations by Interactive Investor (having contributed £326,560).

Picking the right investments for your stocks and shares ISA portfolio is key – ideally you should balance your attitude to risk, the types of investments you already hold and where you are in your investment learning curve.

Stay ahead of the curve with MoneyWeek magazine and enjoy the latest financial news and expert analysis, plus 58% off after your trial.

MoneyWeek asked investment experts at fund platforms Fidelity International and Interactive Investor for their top ISA fund and ISA investment trust picks, to suit different types of investors.

Stocks and shares ISA investors seeking a reliable return might look at global equity income funds. Investing in dividend-paying companies across the globe, they have the potential for a growing income stream alongside long-term capital growth.

Global equity income funds often lean towards financially robust, well-managed businesses, a great match for anyone who loves the idea of steady earnings but still wants exposure to global markets.

Dzmitry Lipski, head of funds research at Interactive Investor, suggested the Fidelity Global Dividend fund, which has been managed by Dan Roberts since its 2012 launch, drawing on more than two decades of dividend-investing experience.

“It invests in companies globally that offer a healthy dividend yield and the potential for capital growth and aims to generate roughly 25% more income than its benchmark,” said Lipski.

The portfolio holds around 46 large, resilient companies, with Europe representing roughly 48%, North America 26% and the UK 15%, and no Chinese exposure. Lipski said: “Sector allocations are deliberately defensive, led by financials, industrials and consumer staples.”

Alternatively, Jemma Slingo, pensions and investment specialist at Fidelity International, said she likes Pyrford Global Total Return – about two thirds of the portfolio is in high quality bonds, and a third is in equities.

“It tries to keep volatility low, while providing a stable stream of inflation-beating returns,” she said. Slingo said that, while at first glance at the fund’s performance chart reveals few serious falls, “on the flip side, growth has been fairly muted particularly when inflation is accounted for”.

Pyrford has turned an initial investment of £1,000 into £1,440 over the course of the decade. If you want a ‘sleep at night’ option, however, this might be a trade off you’re willing to make.

With global stock markets becoming increasingly concentrated and growing fears of the AI theme potentially being overheated, those wanting to spice up their stocks and shares ISA portfolio with some interesting diversification could take a look at investment trust Murray International.

Kyle Caldwell, funds and investment education editor at interactive investor, said he likes the trust because he is “looking more towards those investment trusts that use their full global remit in having a good chunk of exposure to Asia Pacific and Latin America – Murray International ticks this box”.

The portfolio is very different from the wider market, it has a value investment style, and it offers an above average dividend yield of around 4%, Caldwell pointed out.

Fidelity’s Slingo is also concerned about the stock market being dominated by a handful of US technology stocks – and also likes Latin America and Asia, but this time in the form of the Lazard Emerging Markets fund.

“The fund seeks out companies that are cheaper than the market but that have better fundamental prospects,” she said, adding emerging markets were among the best performing equity assets last year and the outlook remains positive.

“Strong earnings growth, a weak US dollar and a rotation out of the US could all boost performance this year,” Slingo said.

For newer investors who would like something a little more interesting than a global tracker fund and who are nervous about jumpy markets, the Fidelity Global Dividend fund could be a good option.

“It invests in companies from around the world; offers a combination of growth and income; and aims to keep volatility lower than the wider market. The fund has delivered steady gains over the past 10 years,” Slingo said.

The fund contains some well-known names like Unilever and National Grid, Slingo added, so “new investors will know that buying the fund means buying real businesses that impact them”.

Alternatively Lipski at Interactive Investor highlights a managed solution, like Interactive Investor’s Managed ISA, might be a good place to start, where the investments are chosen for you.

Investors fill out a questionnaire and are matched with one of 10 portfolios – in two styles (index investment style and sustainable investment style) and five different levels of risk. Once invested, the portfolio is periodically rebalanced – in line with the risk level you signed up for.

The fund fees are low, and there is no separate management fee as it sits within Interactive Investor’s existing flat-fee subscription-based charging model.

A less experienced investor may also want to look at absolute return or capital preservation funds. They use a mix of strategies to limit volatility and help protect against big downturns.

Lipski suggested looking at the Trojan Fund: “Managed by Sebastian Lyon, Trojan Fund takes a conservative, disciplined approach focused on preserving capital and delivering long-term real returns,” he said.

Lyon invests across a broad range of asset classes. The equity portion is focused on large, financially robust companies in developed markets, particularly the UK and US. The fund also holds high-quality sovereign and inflation-linked bonds as defensive assets, alongside a strategic allocation to gold. Cash is also used meaningfully to protect capital and allow swift investment when opportunities arise.

“The fund offers a steady, defensive option for investors seeking long-term real returns with controlled risk,” said Lipski.

More experienced investors may want to consider smaller companies for their stocks and shares ISA. “These can be significantly riskier than large ones,” Fidelity’s Slingo pointed out, “however, experienced investors with long time horizons might want some exposure to this part of the market”.

Slingo suggested the Brown Advisory US Smaller Companies fund. “It deploys a big team of researchers to find the most promising smaller companies listed in the US. Their strategy is based on the belief that good fundamental research coupled with a long-term approach can generate attractive outperformance,” she said.

The fund is a higher risk option, and its performance has lagged the benchmark in recent years. “However, it may appeal to experienced investors who are concerned about the dominance of huge US tech stocks in their portfolios,” said Slingo.

Finally, according to Dave Baxter, senior fund content specialist at Interactive Investor, another good option for the more seasoned investor is the Marlborough Special Situations fund.

It invests in the dynamic growth potential of the UK’s innovative and agile smaller companies. Its sector bets are markedly different with big weightings to industrials, consumer discretionary shares and technology. Top holdings include Zegona Communications, Boku and SCA Investments.

Baxter said: “Marlborough Special Situations has been poor in 2025, and in recent years. The fund has more than 150 holdings and small position sizes, with its top holding making up only 2.6% of the portfolio.

“However, the fund has a good long-term record, and good exposure to micro caps, small caps and mid caps. It should in theory do better when interest rates fall in earnest.”

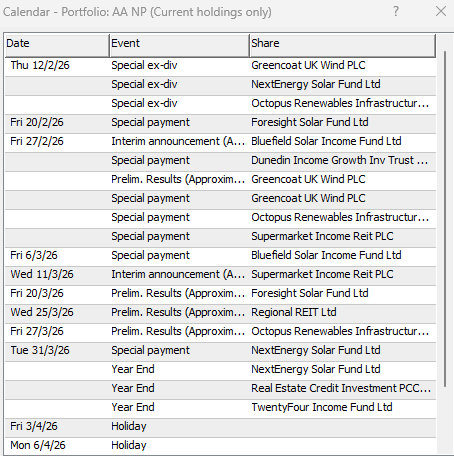

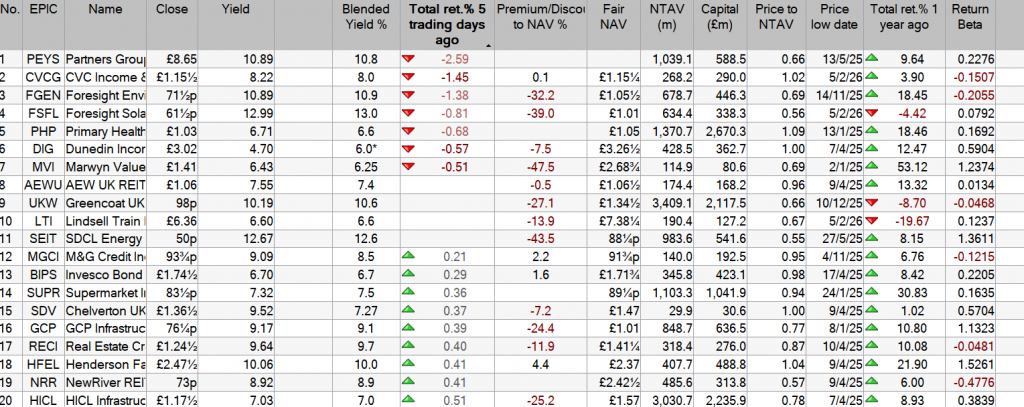

Now the NESF dividend has been announced the income earned for the first quarter of 2026 should be £3,641.00

The total for the year should be around £10,769.00.

There should be income from the dividends, as they are re-invested and also a contribution from VPC, which is a known unknown and should act as a buffer for the 2026 target of 10k.

IF the snowball earns £10,505.11, it will put the SNOWBALL several years ahead of the plan.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑