Comments are now open for moderation, the 1,801 unmoderated comments have been deleted. An update tomorrow.

Category: Uncategorized (Page 78 of 362)

Thursday 4 September

Derwent London PLC ex-dividend date

Empiric Student Property PLC ex-dividend date

European Assets Trust PLC ex-dividend date

Foresight Environmental Infrastructure Ltd ex-dividend date

Globalworth Real Estate Investments Ltd ex-dividend date

Hammerson PLC ex-dividend date

Henderson European Trust PLC ex-dividend date

Utilico Emerging Markets Trust PLC ex-dividend date

The above xd dates have been published early as I will be on holiday until September the 11th.

Please do not make any comments as all comments will be deleted on my return.

It could be a good time to review your plan to see if it will meet your end destination. GL until then.

The proof of the pudding is in the eaten.

2025 Update.

Dividends received plus dividends currently xd

£7,910.00

Do not scale to reach the figure for the year as the amount includes a special dividend from VPC.

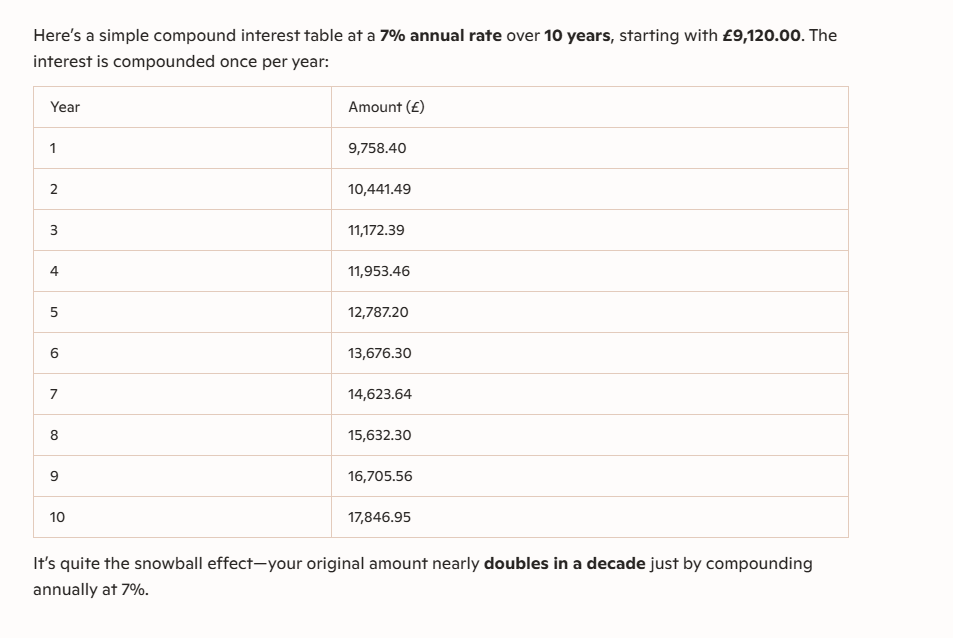

The figures in the table compound annually, whereas the Snowball received income monthly and is re-invested back into the market when around 1k has been received, which gives the Snowball a small edge.

Current cash for re-investment £1,437.00

For any new readers, welcome. There are only three rules.

Rule 1.

Buy Investment Trusts/ETF’s that pay a high dividend and re-invest those dividends into Investment Trusts/ETF’s that pay a high dividend.

Rule 2.

Rule 3.

Remember the rules. GL

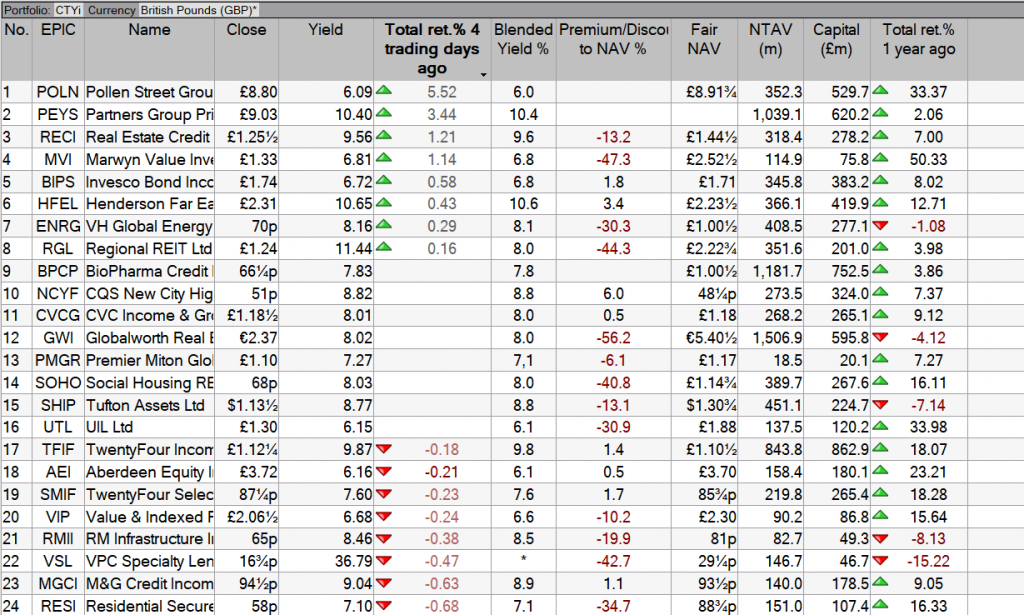

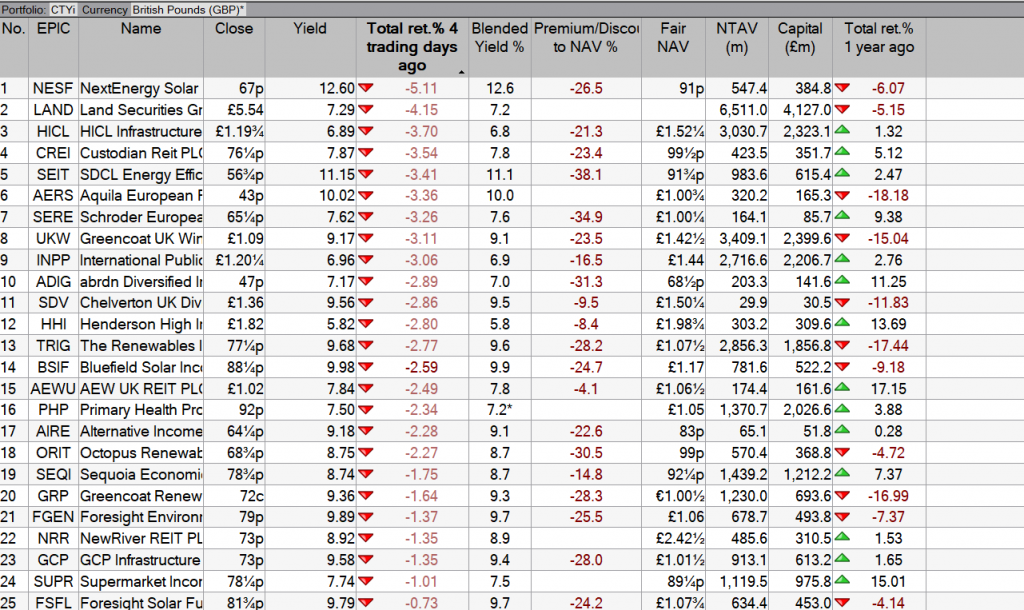

Not a good week for the Watch List shares, unless you are a dividend hunter when it’s good news week.

The current ten year plan.

Option one.

The retirement plan is to have a Snowball providing income of £20,000, a yield on seed capital of 20%.

Option two.

Using the control share VWRP and compounding at 7%

£284,000 and using the 4% rule that would provide income of £11,360

but you would retain your capital, which could be higher or lower.

Option three.

Use the capital which could be higher or could be lower, that’s the gamble you would take with your retirement an buy annuity increasing by 3% a year.

Let’s use a figure of 5%: £14,200 but you have to surrender your capital and live around eighteen years just to receive your cash back on an 100k annuity.

The gamble is the annuity is based on the current interest rate when you retire so could be

Canada Life figures show the 65-year-old with a £100,000 pension pot could buy an annuity linked to the retail price index (RPI) that would generate a starting annual income of £3,896. That’s up from £2,195 in the New Year following a 77% spike in rates this year.

Oct 22

Control, what you can control unless you are a gambler. GL

The pros and cons of ‘natural income’ investing

Never selling assets to fund your retirement solves some problems, but can create others

Published on August 26, 2025

by Val Cipriani

How to best draw income from a portfolio may well be the trickiest question in financial planning. That income is money you need to live on, and ideally you want it to be regular, reliable and non-volatile – all things that the stock market is not. So how do you square the circle?

There are different schools of thought. One interesting solution, which has the advantage of being more intuitive than many of the alternatives, is relying on a ‘natural income’ strategy. This means living off the income (dividends and interest) paid out by your assets, without ever selling any.

The main benefit of this approach is that it eliminates the so-called sequencing risk. If you have to sell investments during a market downturn to fund your lifestyle, your portfolio will take much longer to recover and may not last you through to the end of your retirement. But if you completely remove the need to sell assets by only taking the income, you get rid of sequencing risk.

This also removes the downsides of buying an annuity. Annuitising is the only way to turn a pension pot into income that is both regular and guaranteed. But doing so means you lose access to your capital, which makes this an inflexible option. You don’t necessarily get a good rate if you are relatively young. And if you die prematurely, the money is not passed on to your beneficiaries.

On top of this, when you retire, you need your income to increase every year to keep up with inflation. Otherwise, your living standards will slowly but surely be eroded over time – potentially by a significant amount, considering that most people spend multiple decades in retirement.

You can buy an ‘escalating’ annuity, but they are more expensive, meaning you start on a lower income than you otherwise would with a level annuity, and you have to live to a certain age to make it worth it. The alternative is investing part of your portfolio in growth assets, to make sure it keeps pace with inflation; if you draw down from the portfolio, you will periodically sell some of those assets to maintain your asset allocation of choice, and to fund your lifestyle.

It is possible to invest in assets that generate an escalating income as part of a natural income strategy, minimising investment sales and reducing sequencing risk. But you have to build the portfolio carefully – not all income-generating assets are created equal, as we explain below.

Downsides

A natural income strategy can be a sort of middle ground between buying an annuity and drawdown. But it does present some challenges.

Unquestionably, dividends and interest fluctuate a lot less than share prices. “The income has about one-tenth of the volatility of the underlying capital,” says Doug Brodie, founder of Chancery Lane Income Planners. However, this doesn’t mean that they do not fluctuate at all, or that dividends cannot be cancelled, particularly if there is a major global crisis such as the Covid-19 pandemic.

So, unlike with an annuity, the income generated by your portfolio is not guaranteed. What you need, argues Brodie, is a range of investments that have proved their ability to generate income at times of crisis, so that there is a high likelihood they will continue paying out that income throughout your retirement.

A natural income strategy can also force you to focus more on income assets, which can impact your overall returns. “The approach can be restrictive in terms of both diversification and maximising returns,” explains Rob Morgan, chief analyst at Charles Stanley. “This is because non-yielding or low-yielding areas might perform better overall, or else perform differently and thereby keep volatility lower at a portfolio level. A case in point is the sell-off in bonds from 2022, which spilled over into many income-producing areas such as infrastructure and property that were also exposed to the risks of escalating inflation and interest rates.”

In theory, a natural income strategy means you do not need a cash buffer, aside from the usual emergency fund of three to six months’ worth of expenses, and you can put your entire portfolio to work. But in practice, this depends on how confident you are in your portfolio’s ability to maintain income generation in a difficult environment.

Assets

A natural income strategy will best suit an expert investor who does not want to fiddle too much with their portfolio, is prepared to potentially sacrifice some returns in exchange for simplicity and peace of mind, and/or has a large portfolio to begin with.

As Morgan puts it: “Ideally, with this strategy you’ll have a pot big enough not to have to compromise on asset allocation – in other words, maintain a very diversified portfolio that has both growth and income-producing assets.” This kind of asset mix will not offer a very high yield, so the portfolio needs to be large enough for that yield to fund your lifestyle.

Alternatively, you can aim for a higher yield but sacrifice more returns in the long term. Only later will you need to worry about portfolio longevity. “It can work well as a top-up to guaranteed income from annuities or defined-benefit pensions, when any capital erosion is less of an issue,” Morgan adds.

If you want to give this strategy a go, the next step is thinking about what assets will go into your income portfolio.

Perhaps counter-intuitively, you do not need a lot of bonds. “I’m a big fan of taking natural income, with a few caveats,” says Ben Yearsley, investment director at Fairview Investing. “If your portfolio is made up entirely of bonds and you take the natural income, there isn’t any room for growth and your buying power erodes over time. But those with primarily equity portfolios can potentially see income growth as well as capital growth.”

To build a natural income portfolio, he suggests a core of UK and global equity income investments, with other assets such as infrastructure to complement it. “I wouldn’t ignore bonds, but I would predominantly have equities,” he stresses.

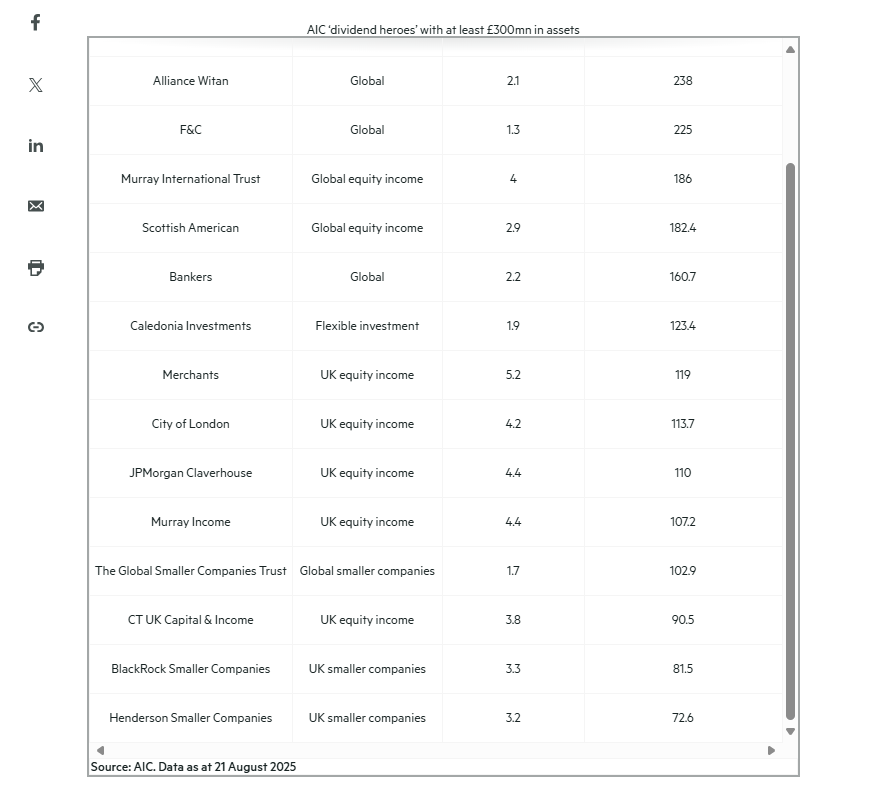

Brodie argues for investment trusts with a proven record of paying dividends for decades. Because investment trusts can build cash reserves and use them to pay dividends in difficult years, they can be incredibly reliable income sources; at the same time, they invest in a range of markets and types of assets, so you can achieve diversification. They are more volatile than open-ended funds, but then, if you don’t intend to sell, you don’t need to worry about this too much.

The Association of Investment Companies’ dividend hero list, which ranks trusts that have consistently increased their dividends for 20 or more years in a row, is one place to start looking for ideas. However, many dividend heroes have fairly low yields; those at the top end tend to invest in UK equities and their long-term total returns are lower. This perfectly illustrates how a natural income strategy is all about finding the right balance between income and growth.

Remember if you buy an annuity, you have to surrender your capital and if an unexpected emergency happens you have burnt all your bridges.

The gamble is: when you want to retire on your annuity you may be offered the following annuity rate:

Canada Life figures show the 65-year-old with a £100,000 pension pot could buy an annuity linked to the retail price index (RPI) that would generate a starting annual income of £3,896. That’s up from £2,195 in the New Year following a 77% spike in rates this year.

Oct 22

3 Big Dividends About to Crash (One Is 89% Overvalued!)

by Michael Foster, Investment Strategist

I’m sure you’ve noticed that the media has been fretting about a selloff in the last few weeks. But the S&P 500 is still up a lot on the year.

Even so, there is cause for concern about overvaluation, as the market’s current gain is equal to a whole year’s worth of historical returns, on average. But the softness we’ve seen lately, combined with the deep April selloff, do suggest that while stock valuations are high, we’re not in a bubble – at least not yet.

In light of the market’s strong run, there are many more overbought CEFs than usual. It’s critical that we do not let these paupers’ high yields distract us from this.

Below we’ll look at three CEFs with way overinflated premiums to net asset value (NAV, or the value of their underlying portfolios). All three need to be sold now, if you hold them, or avoided if you don’t.

Keep in mind, though, that these aren’t bad funds – in fact, they’re all worth putting on your watch list. It’s just that their prices are way too high right now.

“Overcooked” CEF No. 1: Gabelli Utility Trust (GUT)

You might recognize the Gabelli Utility Trust (GUT), as we discussed this fund’s absurd premium in an August 4, 2025, Contrarian Outlook article. Then, it had a 96.2% premium. So investors were paying 2X GUT’s assets just to get in!

They essentially still are. As I write, the premium has “narrowed” to 89.6%, but that’s still ridiculous. The fund’s market pricebased return has also slipped slightly since then, while the S&P 500 gained.

This suggests more investors are realizing that GUT, which holds major US utility stocks, like Duke Energy (DUK), NextEra Energy (NEE) and Wisconsin-based WEC Energy (WEC), would drop if its premium vanishes.

Could that happen?

Well, utilities are getting a lot of attention as a way to play AI’s voracious appetite for electricity. That makes them a crowded trade, so any softness in the AI story (even temporarily) could see them – and GUT’s lofty premium – tumble.

That’s too much risk for us to take, even with GUT’s steady, and monthly paid, 10% dividend. Let’s hold off on this one until after its stratospheric premium returns to earth.

“Overcooked” CEF No. 2: PIMCO Strategic Income Fund (RCS)

Another corner of the market that’s gotten more attention is non-sovereign debt, such as corporate bonds. This explains why the PIMCO Strategic Income Fund (RCS) has seen its market pricebased return soar in the last four months, boosting its premium.

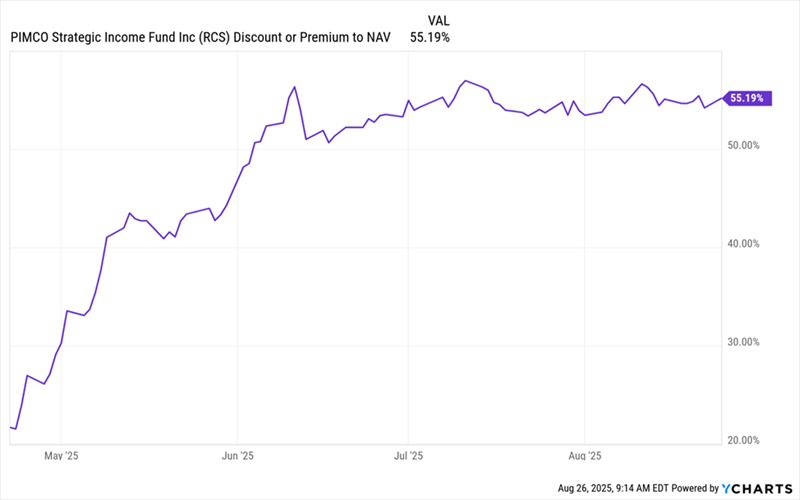

RCS’s Premium Soars – Then Levels Off

During the April selloff, RCS was trading at a bit above a 20% premium. That’s very pricey for a bond fund, but this 7.3% yielder now trades at a premium that’s more than double that! Note also how its premium has not widened since June.

That’s a sign that RCS’s premium might drop, taking unrealized investor profits with it. It wouldn’t be the first time: Look at what happened to the premium at the start of 2025.

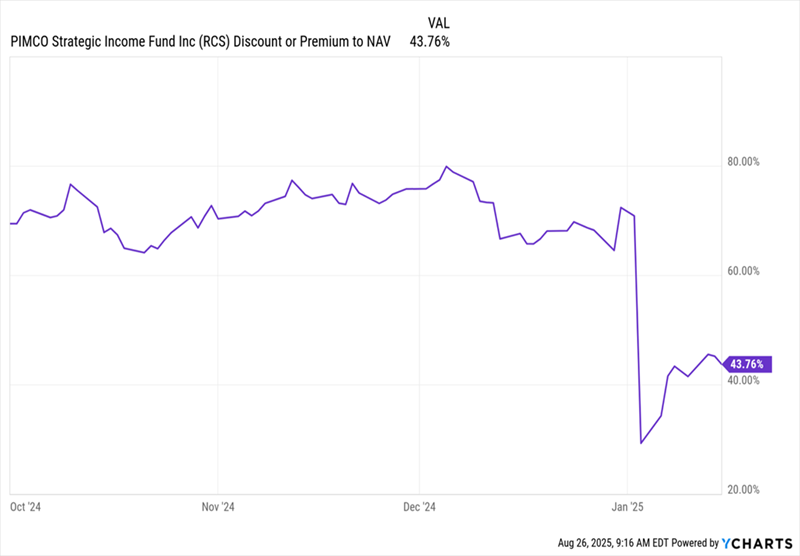

Investors Hit the “Reset” Button on RCS’s Premium …

After months of moving in a narrow range, the fund’s premium tanked, turning what was a tidy profit into a sudden loss:

… Wiping Out Months of Profits

This kind of move is likely to reoccur when investors realize this fund, at a still-absurd 55% premium, remains a “mini-bubble” all its own.

“Overcooked” CEF No. 3: Guggenheim Strategic Opportunities Fund (GOF)

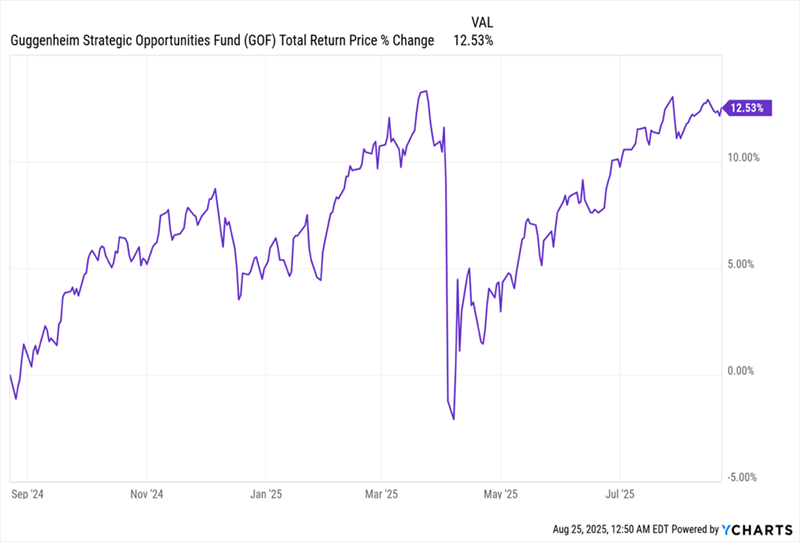

Finally, there’s the Guggenheim Strategic Opportunities Fund (GOF), a corporate-bond fund that’s had an eventful 2025, with big gains, losses, and big gains again.

GOF’s Window of Opportunity Is Gone

Buying this fund during the April selloff made sense, but a lot of funds made sense during the selloff! Now, GOF’s 29.1% premium, while smaller than some extreme mispricings we’ve seen in 2025 (it was above 40% in March) is cause for worry. This chart explains why.

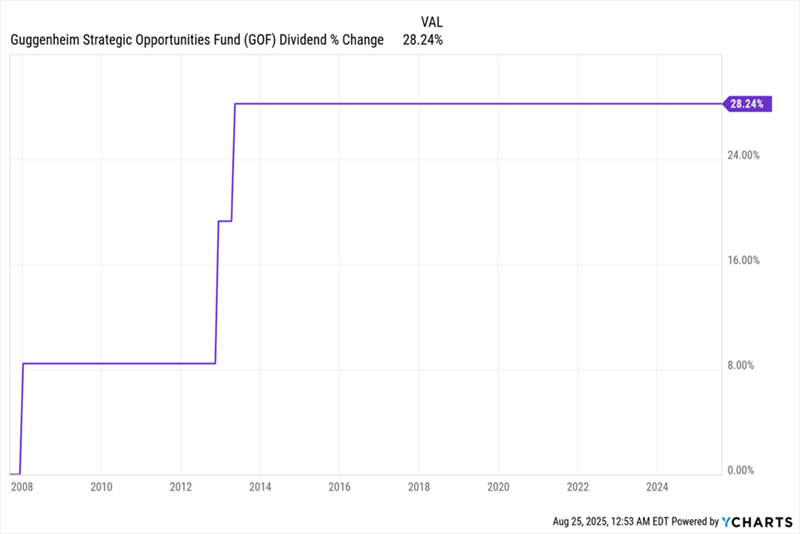

Big Payout Gains Then = Risk Now

GOF has raised payouts three times in its history, impressively doing so during the Great Recession of 2007 to 2009 and twice again in the mid-2010s. The market expects GOF to keep – and indeed grow – that high payout.

After all, that’s what GOF has done for its entire history. Plus, its total NAV return over the last year is 15.5% – surely more than enough to maintain payouts.

Except it isn’t. With a 14.7% yield, it looks like GOF is paying out less than its profits to shareholders. But that 14.7% is based on its market price. What matters is the yield on NAV, since how much management needs from its portfolio to sustain its payout.

And with the fund’s big premium, GOF is paying out a 19% yield on NAV. So even with a 15.5% return over the last year, the fund isn’t earning enough to cover its dividend.

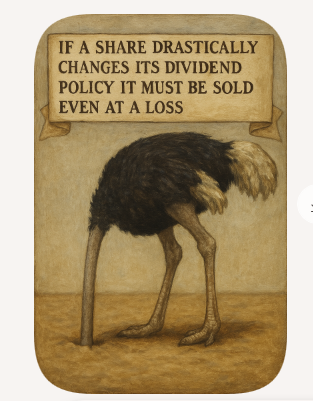

In other words, a cut is likely. And while that wouldn’t be the end of the world (a lot of CEFs make minor payout cuts here and there), there is a risk that GOF shareholders aren’t pricing that in. The result could be a big selloff when it arrives.

Stock pickers strike back as value investing returns

Do value stocks in the UK, Europe and Asia offer better returns over the long term than growth shares in America? Analyst John Ficenec discusses the merits of value investing right now.

28th August 2025

by John Ficenec from interactive investor

Stock pickers who follow value investing principles are beating the market this year as volatility returns and higher interest rates put pressure on debt-laden companies. And despite expectations that rates in the US and the UK will fall in the coming months, hopes of a growth rally look overdone and there is every reason why value and stock picking will continue to shine.

Value back in fashion

This year has shown the strongest signs yet of a long-awaited return of value investing. Value-focused funds have almost doubled the returns on the wider market this year, and stock pickers who follow the same principles have enjoyed equally strong returns.

The iShares Edge MSCI Wld Val Fctr ETF $Acc GBP

, which looks for undervalued companies around the world, has jumped 24% so far this year, and the iShares Edge MSCI USA Val Fac ETF $ Acc

0.05%, which does the same for American companies, has risen 12%, outpacing the US tech index the Nasdaq, which is up 9%, and the wider S&P 500, up 8% so far in 2025.

Source: TradingView. Past performance is not a guide to future performance.

Funds run by investors who follow similar value principles have also done well. Sir Chris Hohn’s hedge fund, The Children’s Investment Fund (TCI), has reported gains of 21% to the end of July, a strong comeback having spent the past three years struggling to beat the index.

Debt bites

The reason value is back in fashion has to do with higher interest rates and political instability from tariff policy, which have all given rise to market volatility and risk aversion. When the future is uncertain investors are less willing to hand over their cash on the promise of future returns. Under these market conditions investors want companies with strong balance sheets and regular dividend income now, rather than debt and the promise of growth.

This is a marked change from the status quo after the 2008 financial crisis when rates were cut to the floor and a huge money printing programme lifted all boats. This wave of monetary stimulus crushed all before it, and the most profitable strategy in the face of such action was to follow the momentum and “buy the dip” any time that share prices corrected even slightly.

Growth stocks soared as the borrowing needed to fuel growth cost almost nothing, and any companies in financial trouble were encouraged to “pretend and extend” by lenders who didn’t want to recognise losses. The fundamentals of stock valuation didn’t matter as the wall of money looked for a home.

This put pressure on the true value investor who was becoming an endangered species. Value fund managers were left in the wake of growth, and any underperformance from the index would be severely punished as a proliferation of exchange-traded funds (ETFs) offered easy access to follow the momentum crowd. Fund managers who pursued value or contrarian strategies, such as Hugh Hendry who famously made strong returns during the 2008 crisis, shuttered his fund by 2017 and went surfing and skateboarding in the Caribbean.

What next, value or growth?

The latest statements from Jerome Powell, chair of the Federal Reserve, at the Jackson Hole economic conference, took a more doveish tone and hinted that rates would be cut if the labour market remained weak. Markets cheered and the probability of a rate cut soared, with expectations of up to 100 basis points, or 1%, of cuts within the next 12 months. However, his ability to cut rates is hamstrung by persistently high inflation and a resilient US economy that doesn’t warrant drastic action.

The other element is how far rates would fall. The US rate is currently in the range 4.25 to 4.5%, and a 1% cut would take that down to 3.25 to 3.5%, which is still a long way above the 0.1% level of rates between 2008 and 2016, and the 0.05% rates were cut to in 2020 to 2022. So, the level of support for debt that fuelled the boom in growth between 2010 and 2020 would not be the same.

Value over growth

Given that rates don’t have as much room to fall, and the money supply is still lower than it was at the end of 2023, according to the latest figures from the St. Louis Federal Reserve tracking of US Monetary Base, then it seems there isn’t the explicit support present for a strong growth rally that we saw post 2008 and 2020.

Investor caution is also worth considering as an indicator of risk appetite. Using the gold price as a rough proxy for investors looking for security, it has remained elevated at around $3,373 an ounce, just off from the all-time high of $3,500 an ounce in April 2025 during the tariff turmoil.

Against this backdrop, even if rates fall in the US next month and in the UK again later this year, it looks like value would be the beneficiary rather than another strong growth rally.

What is the meaning of value?

This isn’t a philosophical question; value investing is all about looking at the fundamentals of a company, its earnings, share price and balance sheet to try and identify opportunities.

Two of the key metrics to start with are the price/earnings (PE) ratio and the price-to-book (PB) ratio. The PE is calculated by dividing the share price by the earnings per share (EPS). A high PE indicates a potentially overvalued, or high growth company, whereas a low PE can suggest an undervalued or low growth company.

The PB ratio is reached by dividing the share price by the net assets per share on the balance sheet. A high PB ratio indicates either high growth or overvalued, whereas a lower PB ratio can suggest an undervalued share. The PB ratio also gives you an idea of the level of safety in the share price, as the closer it is to 1 means that in theory if the business closed tomorrow and all the assets were sold they’d equal the share price.

One of the most famous exponents of the art has been Warren Buffett who has followed the principles of value investing with his Berkshire Hathaway Inc fund. He himself was taught by the godfather of value investing Benjamin Graham at Columbia University.

Is anything good value?

With US and UK markets at all-time highs, it’s worth asking the question if you should even be investing at the top; surely the only way is down? But Henry Allen, macro strategist at Deutsche Bank, thinks there are reasons to be optimistic: “It’s understandable why many are saying that markets are ‘priced for perfection’, given the strength across risk assets with further cuts already priced in. But the reality is we’ve heard a similar narrative at several points in this cycle, even as markets have continued to post further gains.”

Mr Allen outlines how two important drivers could give markets the impetus they need in the second half of the year. The US economy could surprise investors again with its resilience after a wobble following the latest US jobs report for July. The second is if inflation fears begin to ease, it would clear the way for more interest rate cuts. So, while it is right to be cautious, there is also every reason to look for returns in good value sectors and regions.

History is on the side of value. While growth may have held sway from 2010 to 2020, over the long term value investing has been the most profitable strategy. Growth has only delivered during exceptional market conditions with near-zero interest rates and huge monetary stimulus. A return to historical norms of rates, inflation and money supply should see value win out.

Where in the world is value?

The regions of the world economy that look attractive right now are Europe, the UK and Asia. Purely on a valuation basis the UK FTSE 100 forward PE ratio is currently around 12 times, below its long-term average of 15, while in Europe the EuroStoxx 600 index of blue-chip continental companies is at around 14 times and below its long-term average of 17. Meanwhile, in the US the S&P 500 is trading at 22 times and above its long-term average of 17 times.

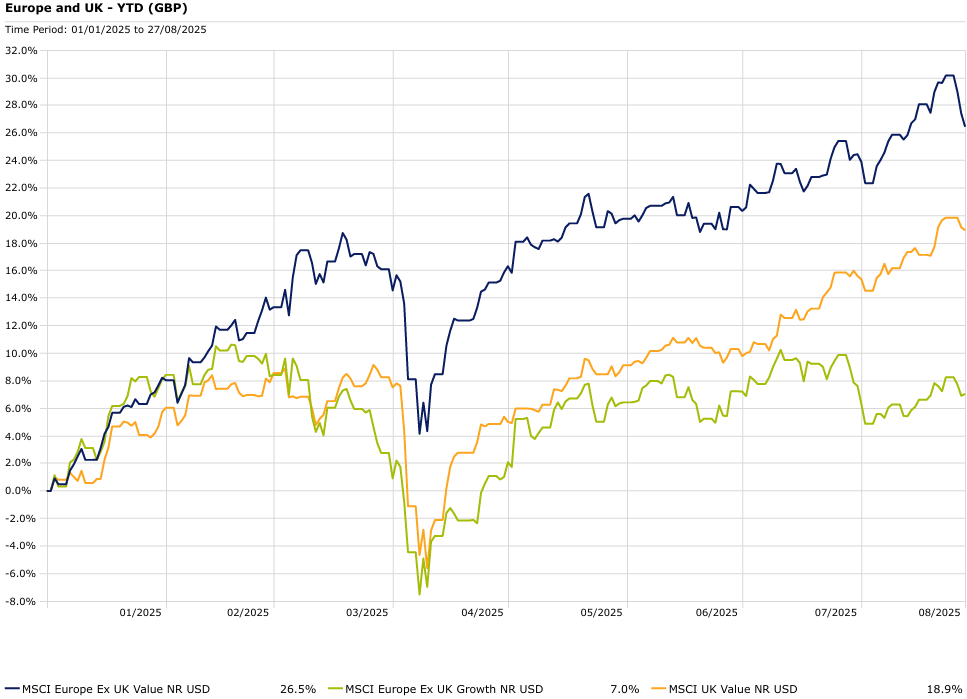

The index performance so far this year also shows how value principles have benefited. The MSCI Europe Ex UK Value index is up 24%, well ahead of its growth partner up 6%, while not far behind is the MSCI UK Value up 15%, ahead again of its growth version up 12%.

Source: Morningstar. Past performance is not a guide to future performance.

Long-term value ideas

While I’m not advocating dumping US and tech stocks, it looks sensible that when funds become available then allocation towards value in UK, Europe and Asia could potentially offer better returns over the long term than growth shares in America.

There are a few different ways to access this theme. There are ETFs that focus on large and mid-cap companies which look undervalued based on measures such as PE and PB.

Options include iShares Edge MSCI Wld Val Fctr ETF $Acc , which is weighted 37% US, 23% Japan, 10% UK and 20% Europe, or something more Europe-focused such as the iShares Edge MSCI Eurp Val Fctr ETF €Acc weighted 25% UK, 22% Germany, 20% France, 6% in both Spain and Italy, and the balance the rest of Europe.