It’s very unlikely you have a million in cash to invest and if you did have it’s doubtful you would take the risk on investing for dividends until you DYOR.

But the sooner you start, the sooner you will finish.

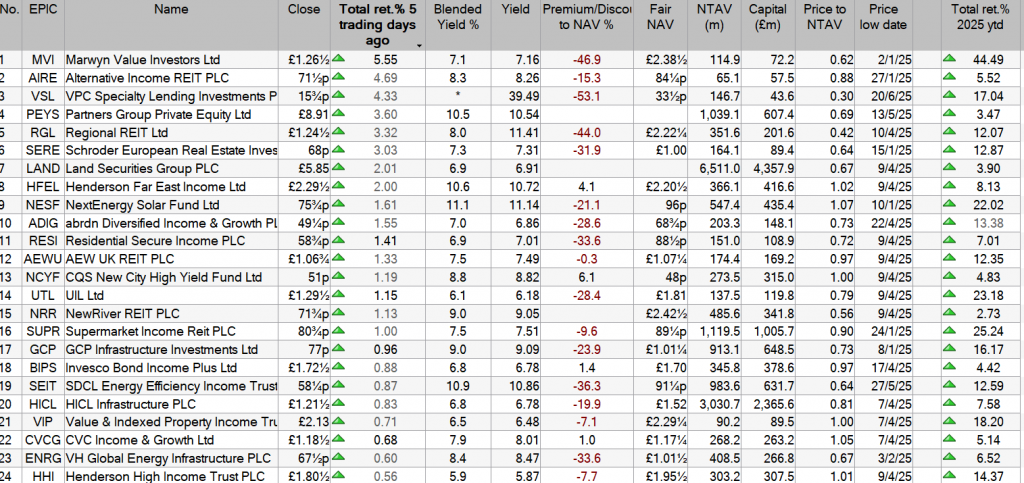

Investment Trust Dividends

It’s very unlikely you have a million in cash to invest and if you did have it’s doubtful you would take the risk on investing for dividends until you DYOR.

But the sooner you start, the sooner you will finish.

Story by Callum Mason

Investing can be the key to unlocking life milestones that allude so many younger people (Photo: Richard Drury/Getty)

My entry to the world of work in August 2016 coincided with the Bank of England lowering its base rate to 0.25 per cent – the lowest level on record (until 2020 at least).

Throughout the following seven years as the base rate – and therefore savings rates – fell further, these low-paying accounts were where I funnelled any hard-earned cash I had left over after paying my rent, bills and other costs each m

Inflation throughout that period regularly topped 2 per cent, and therefore in effect, I was haemorrhaging money left, right and centre.

In that period between 2016 and 2023, if I’d put my money in investments I could have had returns of more than 100 per cent on my original deposit, instead of the less than 15 per cent I made on cash.

That’s not the case. I could have had this return simply by putting the cash into a fund that tracked the performance of 500 of the biggest companies listed on stock markets in the US – an S&P 500 tracker – and forgetting about it for seven years.

Granted, US stock market performance has been particularly strong over the past decade – and I’d have had no way of knowing nine years ago that this would be the case – but it serves to illustrate how much harder your money can work in investments, as opposed to cash.

So why didn’t I make the move back in 2016? And what do I wish I’d have known back then, that I do now?

You don’t. If you’re not comfortable buying individual equities, a simple option is to invest in exchange-traded funds (ETFs). These expose your money to a basket of different investments, which could include stocks, but also currencies and other commodities like gold.

In the most simple case, you can invest in ETFs which simply passively track the performance of major stock markets. One option being the likes of an S&P 500 tracker or an All-World tracker – which exposes you to thousands of stocks in countries across the globe.

But if even doing this feels too much, an alternative option is to get a managed investment account, where someone manages your money for you.

Although this can be a good entry point into investing, remember that you will be charged a fee for this, and there’s no guarantee your return will actually be better than if you do it yourself.

The second point I wish I’d known is the level of risk you are encountering with investing. With cash, your money can of course only go upwards. When investing, there is a risk that you lose money, as well as gain it, we are often told.

Of course, though the above is true, it needs to be put into context. Though stock markets do dip from time to time – think the Covid pandemic or the aftermath of Donald Trump’s tariff blitz in April – they tend to recover and grow over the longer term.

Even the FTSE 100, which tracks the biggest UK stocks, has grown 30 per cent over the past decade despite multiple dips.

Your risk of losing money is also less if you put your money in a range of diverse investments, like an ETF, rather than buying large amounts of individual stocks.

Finally, I wish I’d better understood that having your money in cash is not risk-free.

Although you can’t lose money in cash terms – you’ll always end up with a higher total sum than you started with – if your savings are languishing in accounts that pay interest of below the inflation rate – currently 3.6 per cent – you are really losing money in real-terms.

If this happens repeatedly over time, you are compounding your losses, when an alternative exists.

Ultimately, more and more young people are starting to slowly learn that investing is the best way to grow their wealth.

Industry figures show that in February 2020, 19 per cent of 18- to 34-year-olds had investments, but by May 2022 this proportion had increased to 29 per cent.

Investing can be the key to unlocking life milestones that elude so many younger people.

It’s never too late, but the earlier you begin, the better.

Millions of us invest for passive income. Here, Dr James Fox explains how much money an investor would need in an ISA to make £120k a year.

Posted byDr. James Fox

Published 10 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Earning £10,000 a month in passive income is a financial milestone that many UK investors aspire to. Whether it’s to fund an early retirement, achieve financial independence, or simply provide peace of mind, reaching this level of income is possible.

However, it requires careful planning and a well executed strategy. And, of course, it makes sense to do this through a tax-efficient Stocks and Shares ISA.

With its exemption from income and capital gains tax, the ISA’s a powerful tool for UK investors. But generating £120,000 a year in passive income from an ISA alone is a tall order. To reach that level of cash flow without drawing down capital would need a substantial portfolio. What’s more, investors would need an asset allocation designed to yield reliably.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

So how much is “substantial”? The answer depends on several variables. Chief among them is the average yield of the investments held within the ISA.

A portfolio yielding 4% annually would require a value of £3m to produce £120,000 a year in income. At a 6% yield, the required capital falls to £2m. Of course, higher yields often come with greater risks, including income volatility as well as capital erosion.

Now, many readers may have zoned out at £2m or £3m. However, for those starting early enough, reaching these figures is very possible.

Take the case of investing £500 a month over 40 years with 10% annualised returns. In the first decade, progress can feel modest. After 10 years, the portfolio’s worth just over £100,000.

But compounding begins to accelerate. By year 20, the balance grows to around £380,000, and by year 30 it passes £1.1m. In the final 10 years, growth becomes dramatic: the portfolio adds over £2m, ending above £3.1m by year 40.

Despite contributing just £240,000 in total, over £2.9m comes purely from reinvested gains. This is the exponential nature of compounding. It starts slow, then surges.

Of course, it’s not all plain sailing. There are risks involved with investing, and we can lose as well as gain money. What’s more, 10% may prove to be a challenging target for some investors.

Investors typically want to strive for diversification. One way to do that is by investing in 20-30 individual stocks, another is to focus on in a handful of investment trusts or funds.

Scottish Mortgage Investment Trust (LSE:SMT) offers investors exposure to a high-conviction portfolio of innovative, growth-oriented global companies. Its top holdings include SpaceX (7.4%), Mercadolibre (6.5%), Amazon, Meta, and Nvidia.

These are firms at the forefront of e-commerce, artificial intelligence (AI), and digital infrastructure. The trust actively targets transformational businesses, often before they’re fully recognised by the wider market, and includes private companies such as Bytedance.

However, this strategy comes with risks. The trust employs gearing (borrowing) to enhance returns, which can magnify losses during market downturns. Moreover, its growth bias can lead to volatility, particularly in rising interest rate environments.

For long-term investors with a decent tolerance for risk, it remains an opportunity worth considering. It has a place across my own portfolios.

Should you invest, the value of your investment may rise or fall and your capital is at risk. Before investing, your individual circumstances should be assessed. Consider taking independent financial advice.

James Fox has positions in Nvidia and Scottish Mortgage Investment Trust Plc. The Motley Fool UK has recommended Amazon, MercadoLibre, Meta Platforms, and Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

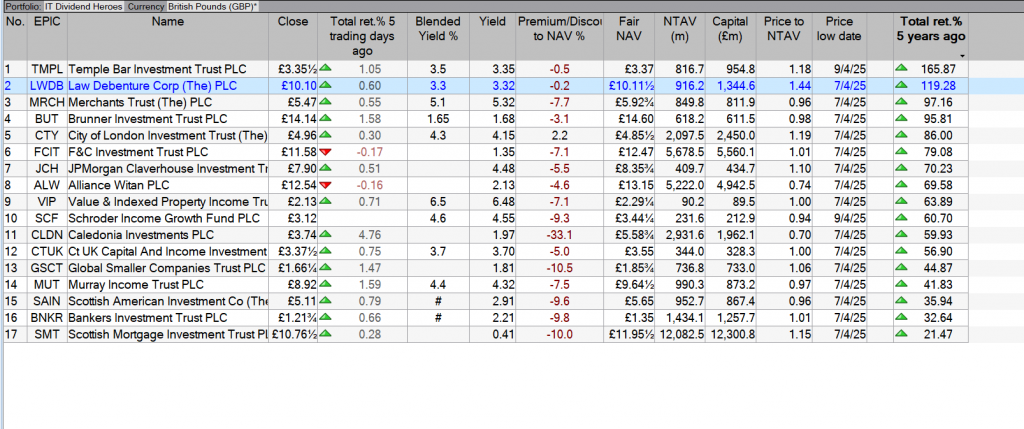

Interesting to note on the 5 year time scale, SMT which is a TR share with a tiny yield is the worst performing Trust.

GL

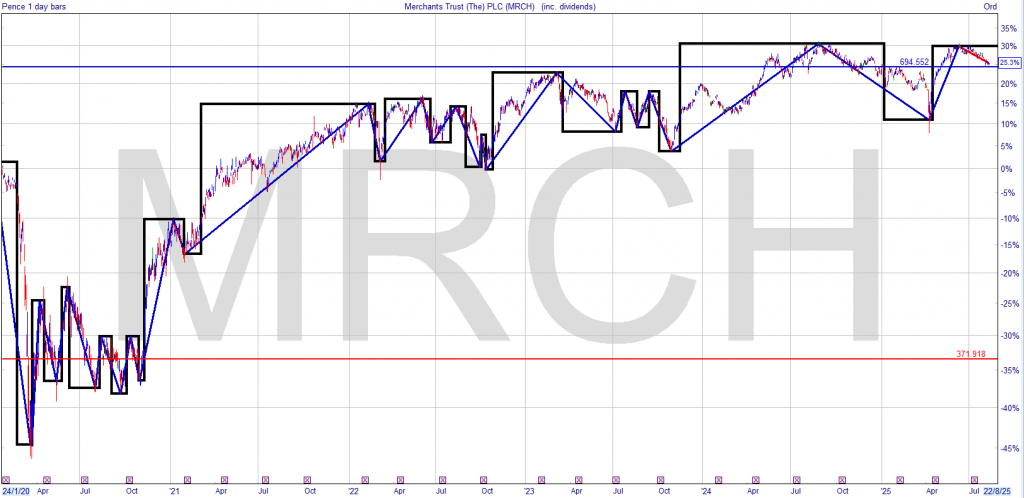

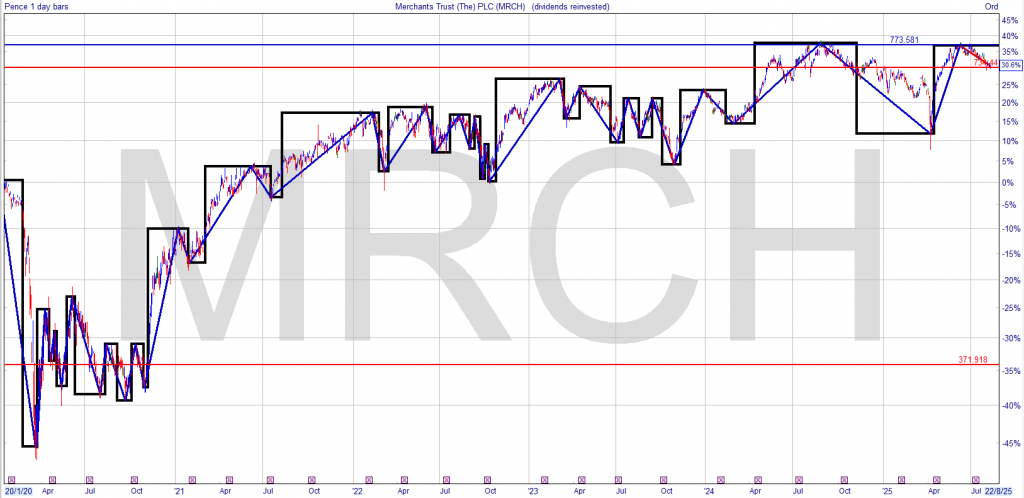

You do not need to take big risks with your Snowball to increase your income but it does help if you are ready to buy after a market downturn.

If you had just simply re-invested your dividends, you would have achieved the holy grail of investing in that you could take out your stake and MRCH would be producing income at a zero, zilch, nothing cost. If you had then re-invested the capital in a long term gilt you could achieve a blended yield of ten percent, with little or nor risk to your hard earned. You would then have 20k of capital invested producing around 1k of income to add to your Snowball.

A £10k lump sum in this dividend share portfolio could help Stocks and Shares ISA investors enjoy a large long-term income.

Posted by Royston Wild

Published 10 August

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Pleasingly for local income investors, the UK stock market has a strong culture when it comes to paying dividends. This means people holding products like a Stocks and Shares ISA have a wide range of shares to choose from when targeting a robust and reliable passive income.

The FTSE 100 and FTSE 250 are loaded with companies boasting market-leading positions, diverse revenue streams, and rich balance sheets. Many of these operate in mature industries with limited growth potential, too: this means they’re more likely to return surplus cash to shareholders than invest it for future growth.

This rich selection means investors can create income-generating portfolios that are closely tailored to their specific investment goals and appetite for risk. It also allows for terrific diversification that can generate a strong second income at all points of the economic cycle.

Here’s what a well-diversified ISA portfolio could look like today:

| Dividend share | Sector | Years of continued dividend growth | Forward dividend yield |

|---|---|---|---|

| BAE Systems | Defence | 21 | 1.8% |

| Legal & General Group | Financial services | 4 | 8.4% |

| Coca-Cola HBC | Consumer staples | 12 | 2.5% |

| Sirius Real Estate | Real estate | 11 | 5% |

| Rio Tinto | Mining | 0 | 6.2% |

| Bloomsbury Publishing | Media | 25+ | 3.3% |

| Merchants Trust (LSE:MRCH) | Investment trusts | 25+ | 5.3% |

| Foresight Solar Fund | Renewable energy | 10 | 9.3% |

| HSBC | Banking | 4 | 5.3% |

| Primary Health Properties | Real estate investment trusts (REITs) | 25+ | 7.4% |

As you can see, this selection of Footsie and FTSE 250 shares covers a range of cyclical and non-cyclical industries. It also includes companies with long records of annual dividend growth. These businesses have helped investors protect their income from inflation by providing consistent, growing payouts year after year.

Finally, many of the dividend stocks here have long histories of paying dividends above the UK share average. For this year, the average dividend yield for this grouping is 5.5%.

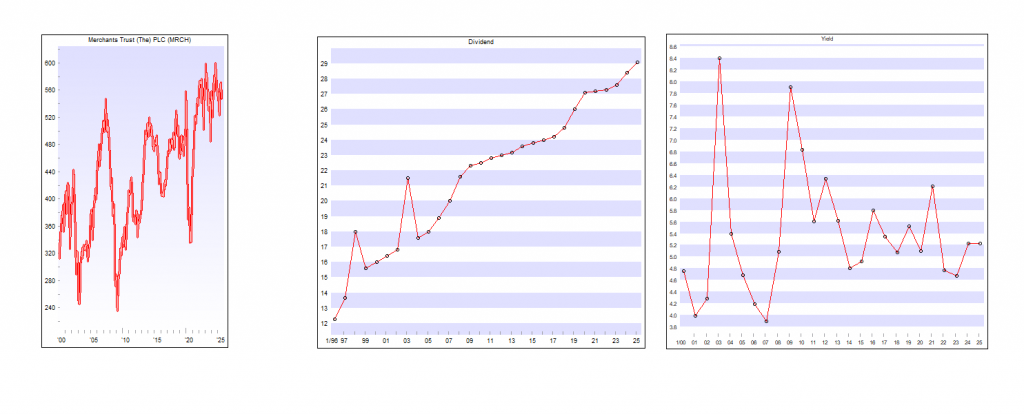

Let me explain why investment trusts like Merchants Trust can be powerful tools for targeting passive income. This particular one has grown annual payouts for 43 straight years, and provides a dividend yield far ahead of the FTSE 350 average of 3.3%.

These financial vehicles own a basket of assets, which provides investors’ portfolios with even better diversification. This Allianz-owned one holds shares in 52 different companies, ranging from banking stock Lloyds and pharmaceuticals developer GSK, through to utilities company National Grid.

Merchants Trust is also focused on the more robust companies found on the FTSE 100 and FTSE 250 as well. This provides it with added strength that supports strong and consistent dividend growth.

A focus on UK shares leaves the trust more exposed to regional difficulties than more geographically diversified ones. However, this could also pay off over time if the recent rotation into British stocks from US shares continues.

Based on this year’s 5.5% forward dividend yield, our mini ISA portfolio of shares could deliver a £1,100 passive income this year on a £20,000 lump sum investment.

What’s more, if their dividends grow by an average 5% a year over the next 25 years, it could provide a second income of £3,725 at the end of the period.

Dividends are never guaranteed, even with a diversified portfolio. But I’m confident this set of shares could deliver a robust long-term passive income.

Story by Royston Wild

House models and one with REIT – standing for real estate investment trust – written on it.© Provided by The Motley Fool

For my money, the best way to source a long-term second income is to invest in dividend-paying assets. I own a variety of stocks, investment trusts and exchange-traded funds (ETFs) that have a history of paying a large and growing income over time.

At 11%, Henderson Far East Income (LSE:HFEL) has one of the highest forward dividend yields on the London stock market. This reflects in large part significant share price weakness in recent years that’s inflated the yield.

As its name implies, it provides significant exposure to China and the surrounding regions. Around 27% of its capital is tied up in Chinese equities alone. So amid signs of severe economic cooling there, it’s no shock to see it fall in value.

The trust’s regained much ground in 2025, thanks to signs of improvement in China’s economy. Yet with trade tensions simmering, it’s possible the share price could turn lower again.

The make-up of its portfolio also allows it to weather individual dividend shocks and pay a large and growing dividend. As well

Source: Janus Henderson

As you can see, annual dividends have kept steadily rising, even in spite of troubles in the key Chinese market. In fact, they’ve grown for 17 years on the bounce.

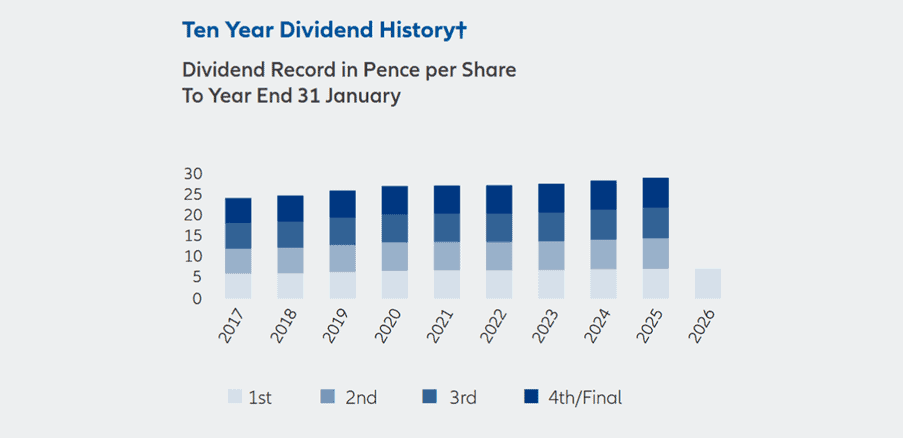

TR Property Investment Trust (LSE:TRY) doesn’t have such a knockout near-term dividend yield. For 2025, it sits at a still-market-beating (but not double-digit) figure of 5%.

What it does have however, is a similarly excellent record of unbroken dividend growth. Shareholder rewards have risen almost each year for around 20 years.

Source: TR Property

Many of these trusts focus on cyclical sectors like retail, leisure and industrials. And so rental collection and building occupancy are highly sensitive to economic conditions.

But strong diversification across sectors helps limit such damage on overall returns. Healthcare, residential and food retail are also among the industries it has exposure to through the 48 REITs it holds.

Today, the trust trades an a near-8% discount to its net asset value (NAV) per share of 352p. Combined with that large dividend yield, I think it’s a great value investment trust to consider.

The post 2 investment trusts I’d consider for long-term passive income appeared first on The Motley Fool UK.

Greencoat UK Wind on the rise as institutions clamour for renewables

Last updated: 02 Aug 2025

Greencoat UK Wind PLC is the leading listed renewable infrastructure fund, invested in operating UK wind farms.

The fund is a constituent of the FTSE 250 and has a market capitalisation of approximately c.£3.2bn.

02 Aug 2025

Greencoat UK Wind PLC’s (LSE:UKW) Matt Ridley talked with Proactive about the company’s interim results and strategic direction in a challenging macro environment.

Ridley highlighted that this marks the twelfth consecutive year of paying an RPI-linked progressive dividend, amounting to £1.3 billion in total distributions. “We generated about £1 billion of cash to reinvest in the business,” he noted, emphasising the importance of maintaining net asset value in real terms.

Despite facing some of the lowest wind speeds in the first half of the year, Greencoat UK Wind still achieved a 1.4x dividend cover. Ridley said this demonstrates the resilience of the portfolio. However, net asset value declined, impacted by lower-than-expected generation and softer power prices.

To support capital allocation efforts, the company has now completed £222 million in asset disposals over eight months, including four new disposals announced with the interim results. These were completed at prevailing NAV, reinforcing the disconnect between the share price and private market valuations.

Greencoat UK Wind PLC (LSE:UKW) has agreed to sell partial stakes in three of its wind farms, raising a total of £181 million and bringing its cumulative disposals over the past year to £222 million.

The London-listed renewables investment group said on Wednesday that it will dispose of 32.65% interests in each of the Andershaw and Bishopthorpe onshore wind farms for £42.6 million.

The income yield is 5.35%, the gross redemption yield is 5.42% but we will not dwell on that for long as the redemption date is 2056. Next income payment date 31 Jan.

If you have twenty years to retirement you will receive all you capital back as income. If you have thirty years to retirement you will achieve the holy grail of investing in that for ten years you will have in your Snowball a position that pays you income at zero, zilch, nothing cost.

Now 5.35% isn’t 7%, so you could pair trade it with a higher yielder.

If not, as you re-invest the income the blended yield will grow to above 7%.

On a 10k investment, after twenty years you will receive income of £535.00

The income re-invested at 7% would produce income of £700.00.

A blended yield of 12.35%

If you are lucky enough to have thirty years to invest, you can work out the return you will receive in the last ten years. Also if/when interest rates rise again you may be able to re-invest your income back into the gilt at a better rate. Income is taxable, so best if held in a tax free wrapper.

You have to allow for inflation and also that you could/will make a capital loss until the maturity date.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑