There are two conflicting views of markets.

How Does the Stock Market React to Interest Rate Cuts?

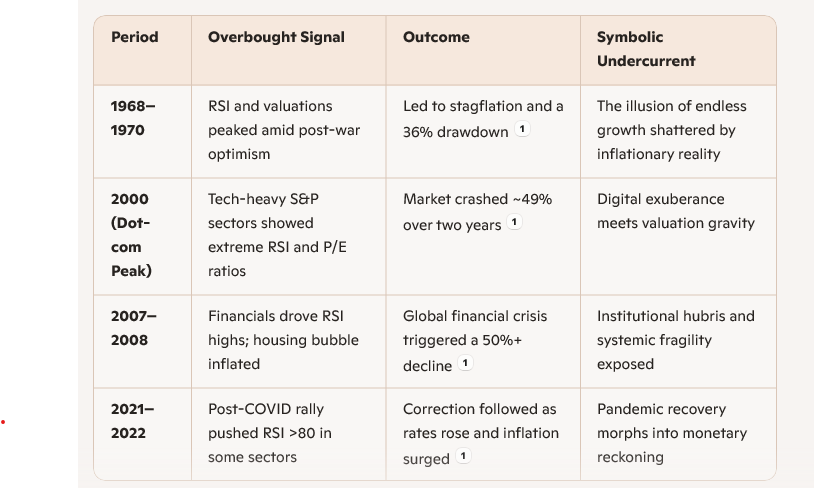

Below, we show how the S&P 500 has performed after the first rate cut over the last five decades:

| Year of first rate cut | Three months | Six months | One year after |

|---|---|---|---|

| 1973 | -10.2% | -6.2% | -36.0% |

| 1974 | -14.7% | -15.3% | +7.5% |

| 1980 | +15.0% | +28.9% | +30.3% |

| 1981 | -11.0% | -7.9% | -17.8% |

| 1982 | -4.8% | +17.4% | +36.5% |

| 1984 | -1.2% | +7.2% | +10.5% |

| 1987 | +0.1% | +1.7% | +7.5% |

| 1989 | +7.4% | +7.5% | +11.9% |

| 1995 | +5.1% | +8.0% | +13.4% |

| 1998 | +17.2% | +26.5% | +27.3% |

| 2001 | -16.3% | -12.4% | -14.9% |

| 2007 | -4.4% | -11.8% | -27.2% |

| 2019 | +3.8% | +13.3% | +14.5% |

| Average | -1.1% | +4.4% | +4.9% |

Historically, the S&P 500 returns 4.9% on average one year after the first interest rate cut, seeing positive returns nearly 70% of the time.

In the three months following a rate cut, the market often dips, but typically rebounds by the six-month mark. This aligns with conventional wisdom that lower interest rates stimulate economic activity by reducing borrowing costs for businesses and consumers, which tends to benefit the stock market.

However, S&P 500 performance following rate cut cycles can vary significantly. For instance, U.S. equities saw double-digit declines after the first rate cuts in 1973, 1981, 2001, and 2007. On the other hand, the S&P 500 surged 36.5% one year after the 1982 rate cut cycle. In the most recent rate cut cycle, the S&P 500 jumped by 14.5% in the following year.

In this way, interest rate cuts don’t show the whole picture. Instead, positive earnings growth may offer a more reliable indicator of S&P 500 performance in the following year. When earnings growth is positive, the market averages 14% returns one year after. In contrast, when earnings decline during periods of falling interest rates, the S&P 500 increased by 7%, on average.

Veroni App

📈 Yes, the S&P 500 is showing signs of being overbought as of mid-September 2025.

Here’s what’s happening:

- 14-day RSI peaked at 76 in July, which is well above the typical overbought threshold of 70.

- Market breadth is narrowing—only a small group of large-cap stocks (especially the “Magnificent Seven”) are driving the rally, while broader participation has faded.

- Volatility risks are rising, with technical analysts warning of a potential correction due to systemic overvaluation and divergence from equal-weighted indices.

Even though the index is hovering near all-time highs, the underlying structure looks fragile. It’s a classic setup where enthusiasm can quickly flip to caution. If you’re tracking this for historical parallels or symbolic storytelling, it’s a textbook case of exuberance masking imbalance.

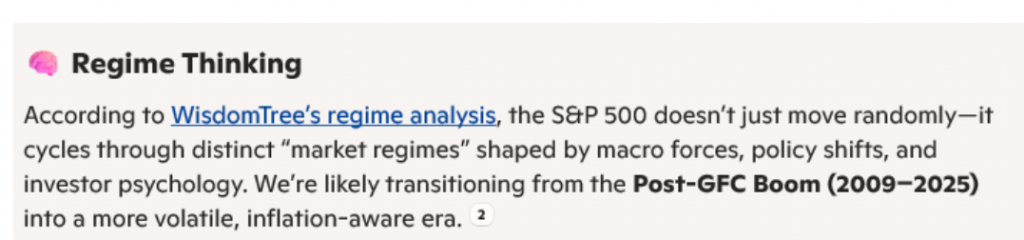

Narrowing Market Breadth and Rising Overbought Conditions in the S&P 500: A Warning Signal for Investors?

Henry RiversTuesday, Sep 9, 2025

– S&P 500’s recent gains show growing divergence from broader market breadth, with 80% of stocks above 50-day averages in May 2025 but narrowing participation by September.

– Overbought conditions intensified as 20% of S&P 500 stocks entered overbought territory, with RSI peaking at 76 and WealthUmbrella Margin Risk hitting extreme 13-level readings.

– Persistent divergence between index performance and equal-weighted indices/small-cap laggards signals structural fragility, historically preceding market corrections.

– Magnificent Seven dominance and systemic overvaluation create volatility risks, urging investors to adopt defensive strategies amid mixed economic signals and Fed policy uncertainty.

The S&P 500 has long been a barometer of U.S. equity health, but recent data suggests a growing disconnect between the index’s performance and the broader market. Investors are increasingly scrutinizing narrowing market breadth and systemic overbought conditions, which together may signal a heightened risk of a near-term correction.

Market Breadth: A Tale of Two Rallies

Market breadth, as measured by the Advance/Decline Line (AD Line), has been a mixed bag in 2025. In late 2024, the AD Line plummeted despite the S&P 500’s resilience, a classic bearish divergence that signalled weak participation and reliance on a narrow group of large-cap stocks, particularly the “Magnificent Seven” S&P 500 Forecast: Correction Signs & 2025 Buy Levels[2]. This trend persisted into early 2025, with high uncertainty over policy shifts like tariffs exacerbating the imbalance S&P 500 Forecast: Correction Signs & 2025 Buy Levels[2].

However, a more recent rebound in mid-2025 offered a glimmer of hope. By April–June 2025, the AD Line surged to a 2-year high, outpacing the S&P 500’s recovery and suggesting broader participation as stocks rebounded from oversold conditions S&P 500 Nears Record Highs: Key Market Drivers Explained[3]. By late May, 80% of S&P 500 stocks were trading above their 50-day moving averages, a robust sign of sector-wide strength US Stocks Watchlist – 5 September 2025[4]. Yet, this optimism has since dimmed. As of September 2025, the AD Line has flattened while the S&P 500 continues to climb, raising concerns about sustainability S&P 500 Forecast: Correction Signs & 2025 Buy Levels[2].

Overbought Conditions: A Volatility Time Bomb

The S&P 500’s recent rally has pushed it into overbought territory, with its 14-day RSI peaking at 76 in July 2025 US Stocks Watchlist – 5 September 2025[4]. While the index has since retreated slightly, technical analysts warn that the market remains vulnerable. The WealthUmbrella Margin Risk Indicator, a rare tool for gauging systemic overbought/oversold levels, hit an extreme reading of 13 in late 2025—a level historically associated with trend reversals Is the S&P 500 Overdue for a Correction? 2025 Forecast & …[1].

Compounding the risk is the fact that one in five S&P 500 stocks has entered overbought territory, with financials and industrials joining the tech sector in this precarious position S&P 500 Nears Record Highs: Key Market Drivers Explained[3]. This widespread overbought condition, combined with valuations at “nosebleed” levels, creates a volatile backdrop S&P 500 Nears Record Highs: Key Market Drivers Explained[3].

Divergence and the Path to a Correction

The most alarming signal is the persistent divergence between the S&P 500 and breadth indicators. While the index hit record highs in September 2025, the Equal-Weighted S&P 500, small-cap indices, and semiconductors lagged behind Is the S&P 500 Overdue for a Correction? 2025 Forecast & …[6]. This lack of confirmation from key sectors is statistically rare and historically precedes corrections S&P 500 Forecast: Correction Signs & 2025 Buy Levels[2].

Moreover, the AD Line’s recent bearish tendencies—despite a brief rally in Q2—suggest fragility. If the AD Line continues to decline while the S&P 500 rises, it could signal a loss of momentum Market Breadth: What it is, why it matters, common …[5]. Conversely, if the index experiences new lows while breadth metrics improve, it might hint at a reversal Is the S&P 500 Overdue for a Correction? 2025 Forecast & …[1].

Conclusion: Caution in a Narrowing Market

The S&P 500’s current trajectory is a double-edged sword. On one hand, the mid-2025 rally demonstrated broad-based strength, with 67.87% of stocks trading above their 50-day averages in September US Stocks Watchlist – 5 September 2025[4]. On the other, the reliance on a handful of mega-cap stocks and systemic overbought conditions paints a cautionary picture.

Investors should remain vigilant. While the market’s technical setup does not guarantee a correction, the combination of narrowing breadth, overbought momentum, and divergent sector performance warrants a defensive stance. As the Federal Reserve pauses monetary policy and economic signals remain mixed, the coming months will test whether this rally is a durable recovery or a prelude to a pullback.

Leave a Reply