With UK income stocks dominating for the first time in a decade last year, could 2026 be the perfect time to load up on dividend shares?

Posted by Zaven Boyrazian, CFA

Published 24 January,

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

British income stocks’ performance has been rather underwhelming over the last 10 years. Between 2016 and 2024, the FTSE UK Dividend+ index lagged the wider stock market, generating only a 48.6% total return compared to the 79.6% of the FTSE 350.

In other words, most British income stock investors have missed out on some substantial gains. However, that all changed in 2025, when the FTSE UK Dividend+ index charged ahead by a massive 33% versus the FTSE 350’s 24.2%.

So with dividend stocks now roaring back into life, are investors looking at a once-in-a-decade chance to lock in phenomenal long-term passive income?

Surging passive income

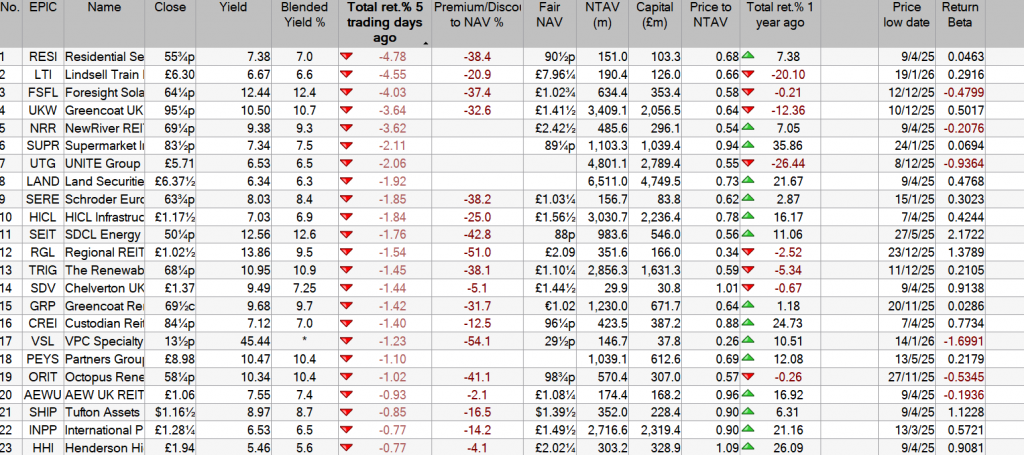

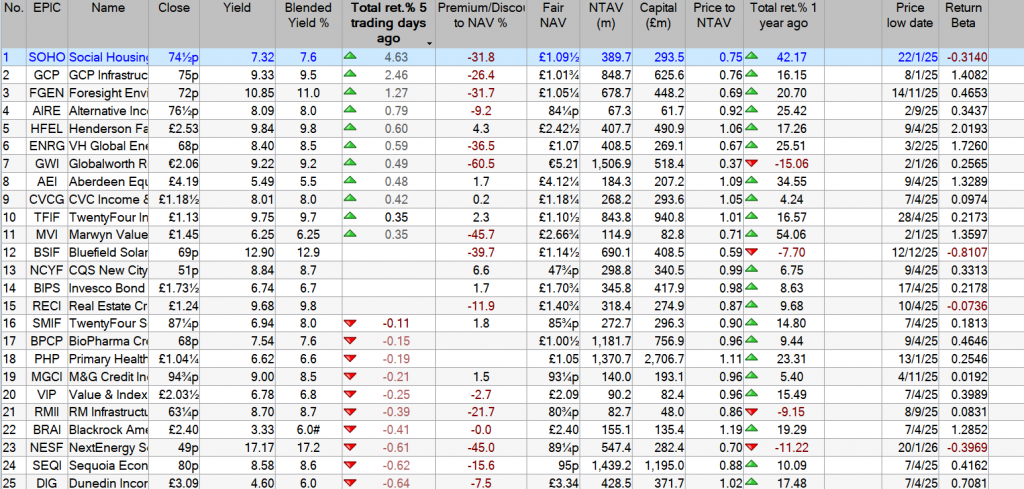

As a market-cap-weighted index, roughly 23% of last year’s gains came from its top-five constituents:

- Rio Tinto (LSE:RIO)

- Legal & General

- HSBC Holdings

- NatWest Group

- British American Tobacco

Since the mining and financial sectors vastly outperformed last year, it isn’t surprising the dividend index did as well when looking at this list. And as 2026 progresses, these stocks continue to drive the bulk of returns. But can the giants outperform again?

Looking at the macroeconomic environment, there’s room for optimism. Rising commodity prices are serving as a powerful tailwind for Rio Tinto.

Meanwhile, structural hedges and robust demand within the pension risk transfer markets bode well for the financial stocks on this list. And even British American Tobacco’s getting a little boost from the regulatory intervention against single-use vapes, driving up demand for its own non-combustible brands.

But with any stock, it’s critical to look at each underlying business. After all, even with favourable macroeconomics, structural operational issues can still lead to lacklustre results. So let’s take a closer look at the biggest company on this list.Zoom1M3M6MYTD1Y5Y10YALL

Is Rio Tinto a good investment in 2026?

One of the biggest headlines within the mining sector this year is the proposed merger of Rio Tinto and Glencore.

If successful, the deal would instantly provide Rio Tinto with new copper assets to capitalise on the electrification trends of global infrastructure while making it the largest diversified mining enterprise worldwide. And it would nicely complement its existing portfolio of iron, aluminium, and lithium projects.

Providing that commodity prices don’t suddenly drop off a cliff (which has happened in the past), this surge in production capacity could pave the way for substantially higher dividends moving forward.

Of course, that’s not guaranteed. Given the size of these businesses, regulators from multiple jurisdictions will undoubtedly demand concessions. And that could translate into forced asset sales, with some analysts already anticipating necessary divestments in China.

Even if that doesn’t happen, mergers of this size are enormously complicated and will most likely encounter unforeseen challenges. That could translate into a sharp rise in one-time expenses that might actually pressure dividends instead of supporting them.

Nevertheless, with an experienced management team at the helm, and the mining sector seemingly well-positioned for a cyclical rebound, Rio Tinto shares could be worth investigating further.

And with more tailwinds supporting the other UK income stocks in the FTSE Dividend+ index, 2026 could be another phenomenal year for dividend investors.