Investment Trust Dividends

In his final Big Picture column, David Stevenson considers the next steps for investors deploying capital into investment trusts. As discussed last week, diversifying US equity exposure is key. Now may be the time to focus on income-generating funds, with our model income portfolio offering further ideas. Equity income funds could also play a significant role in a balanced strategy.

By David Stevenson

This is our last Big Picture column, and it might be worth ending with some practical ideas for investors in investment trusts. My advice is to keep it simple and not be swayed too much by the fashionable ideas kicking around the investment commentariat. Stick to monthly pound cost averaging into your favourite diversified equity and bond funds, and generate the wealth that funds these regular plans. Frankly, the best idea for most investors I talk to is to build a core portfolio with the broadest exposure to the widest range of financial assets (equities, bonds and other structures), keep costs to a minimum and then just forget about it.

But I’m also aware that many investors have more idiosyncratic, short-term objectives: they might have a large capital sum to invest or be older and more worried about equity market volatility. Alternatively, they might need more income for retirement. In these circumstances, the idea of finding a very diversified fund, such as the Alliance Witan Trust or a broad MSCI World ETF, and then sticking with it doesn’t quite work. These investors are forced to take a view, so I’d offer the following three observations.

The first echoes last week’s article: diversify and ensure you are not overly exposed to US tech stocks. This is not to say that US tech stocks aren’t an excellent investment – they have been and may continue to be. It’s just that most globally diversified equity funds, be they active investment trusts or passive index trackers, have a very high exposure to a handful of tech names, notably the Mag7. In the very broad MSCI World index, for instance, these seven stocks plus another tech giant called Broadcom currently account for over 24% of the value of the index – and that’s for an index that has 1396 stocks and currently comprises just under 75% of its market value in US equities.

What might the alternatives be? The first area worth exploring is to shift some of your focus away from US tech stocks and think about having a bit more exposure to equity income funds: the UK investment trust market has lots of these funds out there at the moment, and I’d probably focus most attention on globally diversified equity income trusts. You’re spoilt for choice in this space, but I’d probably highlight JPMorgan’s very successful Global Growth and Income fund, yielding 3.7%, and Murray International, yielding 4.3%.

The next area worth exploring is to think local: I argue that the UK economy is slowly on the mend. Although there are some headwinds, the UK market is cheap, still produces decent earnings growth and contains pockets of enormous value. I prefer to overweight UK small-cap stocks, which, although volatile, do present huge opportunities. If that strikes the reader as too risky, I’d consider investigating UK equity income as a sweet spot, with funds like Law Debenture and City of London Investment Trust topping the list.

Next, I’d point to our model Income portfolio as a source of great income stories. It’s packed with a combination of global and alternative income trusts such as BioPharma Credit or TwentyFour Monthly Income, TFIF. This model also includes one of the few bond investment trusts in the UK market, Invesco Bond Income Plus, which currently offers a dividend income of 7.1% and trades at a small premium of 0.6%.

Sticking with the theme of UK equities, I’ll finish with one last thought: cheap alternative income funds. Last week brought the news of the first fund IPO for nearly two years: the Achilles Investment Company, which raised just over £50m to shake up the alternative funds segment. I think it’s an excellent idea, although it will have its work cut out, finding the right funds to target and change. The successful launch nevertheless underscores a considerable opportunity set: many funds are trading at huge discounts that are still churning out decent yields, but the market has chosen to undervalue. Something needs to give, and Achilles might be the catalyst that makes investors rethink their exposure to the space. As James Carthew over at Citywire points out, the team behind Achilles “cites a £39bn valuation gap between market caps and asset values in these [alternative assets] sectors. It will seek to ‘maximise value for shareholders through constructive activism’”. This isn’t Saba but more an assertive, constructive catalyst to get share prices moving in the right direction. Its timing is spot on, and I think investors might want to look at the funds Achilles might target carefully.

With two shares to declare their dividends for March, the first quarter income should equal £2,369.00 which would be just ahead of the year end fcast of £9,120.00

The comparison share is VWRP which would be valued at £132.5k and using the 4% rule at todays price an income of £5.3k.

Cash for re-investment £847.00

10 year chart with dividends re-invested back into the Trust.

Current yield 1.29%

Current discount to NAV 7%

GOLD MEDAL

The UK’s biggest investment trust, Baillie Gifford-managed Scottish Mortgage, is the clear winner over 20 years, generating a total share price return of 1,978%, equivalent to an annualised return of 16.4% a year.

The bulk of the gains (76%) have come from capital gains, with just 24% coming from reinvested dividends, whereas the average split across the illustrious group of dividend heroes is 60% from income and 40% from capital.

This split isn’t too surprising given SMT’s investment philosophy, which is to own ‘the world’s most exceptional growth companies’.

These types of companies tend to be leaders in their fields and at the cutting edge of new industries, meaning they prioritise investing in growth over paying out dividends.

Fund managers Tom Slater and Lawrence Burns believe share prices follow business fundamentals over the long-term, while short-term price movements are overwhelmingly driven by other factors.

During 2022, rising interest rates impacted growth companies disproportionately, leading to underperformance of the trust, but the managers believe part of their edge is the ability to look through such ‘noise’ and focus on long-term business performance.

Arguably, the trust’s long-term success reflects the managers’ good judgement in backing the best growth companies which is then reflected in higher share prices.

Looking outside the publicly-quoted holdings, around a quarter of the fund is invested in private companies.

Scottish Mortgage owns stakes in half the world’s top 10 unicorns (private companies valued at more than $1 billion), including SpaceX, the fund’s largest position, Chinese social media group and Tik-Tok owner ByteDance, online payment processing group Stripe and video games maker Epic Games.

Some of the private companies the trust originally invested in have become publicly traded and still remain in the fund, such as music streaming firm Spotify (SPOT:NYSE) and Chinese shopping platform Meituan (3690:HKG).

The top 30 positions in the fund represent 79% of the portfolio and three have been held for more than a decade, including Amazon (AMZN:NASDAQ), Tesla (TLSA:NASDAQ) and Dutch semiconductor equipment maker ASML (ASML:AMS).

Over the last decade, the trust’s top five performing holdings have contributed nearly 60% of the fund’s total returns, with Amazon contributing the most in terms of absolute percentage points, while AI darling Nvidia (NVDA:NASDAQ) is the fund’s best performing holding, rising an incredible 10,188% over that timeframe.

Looking forward, it seems a fair bet the proven investment skills of Slater and Burns should continue to deliver strong investment returns, although, as they themselves acknowledge, returns are often accompanied by high volatility. [MG]https://datawrapper.dwcdn.net/vEGri/1/

SILVER MEDAL

Launched back in 1868, F&C (FCIT) has the distinction of being the world’s oldest collective investment trust.

Although it is a Dividend Hero, with more than 50 years of consecutive increases, it has always focused more on growth investing than income.

In the late 19th century, it owned government bonds in countries which today we might think of as emerging markets like Brazil, Egypt and Turkey, as well as US railroad company bonds just as investment in the railways boomed.

In the 1920s, the trust diversified into stocks, and since the early 2000s it has invested in private equity, both as a way of diversifying risk and creating potential for large capital gains.

Until 2013, much of the trust’s equity holdings were in UK-listed companies, but since then it has renewed its original focus of investing overseas and today less than 10% of its assets are in UK-listed stocks.

A look at the top holdings shows the focus on growth and foreign markets, with the six of the ‘Magnificent Seven’ in the top six positions by weight.

Speaking to the AIC (Association of Investment Companies) in December on the outlook for markets in 2025, manager Paul Niven said he was ‘relatively constructive on equities,’ in particular US tech stocks, where he argued earnings growth outweighed any valuation concerns.

‘Valuations are high, though this tends to be concentrated in the US and in the obvious names such as the Magnificent Seven. Although the premium levels of growth which are expected from this area look set to diminish, their earnings delivery should still comfortably outstrip that of the wider market. While numerous other areas and markets are trading at lower levels of valuation, growth prospects in these areas typically still appear far more fragile or anaemic.’

However, it would be wrong to assume US tech stocks have driven the trust’s performance – if we rewind to 2014, the 10-year total return was 173%, yet there was just one tech stock in the top 10 holdings, Alphabet (GOOG:NASDAQ), or Google as it was called back then, while the rest were mainly US and European health care companies plus BP (BP.A) and HSBC (HSBA).

There are a number of stocks in the portfolio today which were in the portfolio 20 years ago, including Shell (SHEL), which was one of the trust’s first ever equity purchases in 1925, and has returned around 300% over the past 20 years.

Other names which the trust owned 20 years ago, and which are still in the portfolio today, include AstraZeneca (AZN) (total return 1,110%), Elevance Health (ELV:NYSE) (1,080%), RELX (REL) (1,200%), SAP (SAP:ETR) (1,370%) and TSMC (2330:TPE) (7,000%).

BRONZE MEDAL

Less well-known than the other podium-placed names in our list of dividend heroes measured by 20-year total return, BlackRock Smaller Companies has found the going a little more tough in recent times.

This, and the trust’s near 13% discount to net asset value, is a reflection of the relatively weak sentiment towards the small-cap space.

Nonetheless, it’s not a huge surprise to see a smaller companies trust score well over the long term given small-caps have more scope to grow than their larger listed counterparts.

Run by Roland Arnold for nearly seven of the past 20 years, the trust is almost exclusively UK-focused and as its strong total return record would imply it has consistently beaten the benchmark.

These are ‘smaller’ rather than small companies – the top 10 holdings have an average market cap of roughly £950 million.

Some names have been in the portfolio for some time: flexible office space provider Workspace (WKP), for example, was a holding 10 years ago.

Other names in the top 10 are publishing outfit Bloomsbury (BMY), engineering and infrastructure firm Hill & Smith (HILS) and mobile payments company Boku (BOKU:AIM).

House broker Shore Capital outlines the trust’s investment process: ‘Through bottom-up stock selection, the manager seeks quality companies with the potential to grow significantly. Typical attributes include competent management teams, attractive growth prospects irrespective of market conditions, good cash generation and strong balance sheets.

To identify these opportunities, the BlackRock team spends a considerable amount of time with company management teams, often attending over 700 company meetings a year.

As Shore notes, the focus is on capital appreciation but it is the bias towards cash-generative companies which has supported the trust’s ability to keep raising the dividend for 21 years and counting.

The financial discipline required to pay a regular dividend can be a good marker of quality in a universe where corporate failures are more commonplace.

In his most recent commentary on the trust’s performance, manager Arnold notes the valuation of UK small- and mid-cap companies is ‘attractive on an historic basis’.

‘As we move through this near-term noise, the opportunity presented by UK small- and mid-caps will present itself, and maybe we will finally see investors looking to allocate back to what has historically been a profitable asset class,’ adds Arnold.

The ongoing charge is 0.8%, which is fairly competitive compared with other trusts in the Association of Investment Companies UK Smaller Companies sector.

The names which have delivered the most to investors

Thursday 27 Feb 2025

Hotter-than expected UK inflation for January, with headline CPI up 3% year-on-year versus the 2.8% expected, combined with a volatile geopolitical backdrop, means investors should be seeking ways to protect their income.

Shares has long championed the unique advantage investment trusts have when it comes to paying regular and progressive dividends, since these funds are able to hold back up to 15% of the income they receive from their investments in their revenue reserves.

They can use these reserves to boost dividends during lean spells when businesses may be cutting their payouts. This structural benefit has enabled many investment companies to pay consistently rising dividends through both good and bad years for many decades, a record unrivaled by other funds such as unit trusts.

You may have heard of the AIC’s (Association of Investment Companies) ‘Dividend Heroes’, classified as trusts which have increased their dividends for 20 or more years in a row – impressively, 10 of these dividend heroes have over half a century of unbroken annual increases under their belts.

The AIC’s well-followed list helps you spot products with lengthy dividend growth streaks, but you’ll need to do some digging to discover which ‘heroes’ have consistently delivered the best total returns, or for that matter, whether those returns have predominantly come from capital growth or income.

Fear not, however, as care of our friends at the AIC, Shares has crunched the numbers going back 20 years to see which dividend heroes have made the most money for shareholders.

Read on for a run-through of the heroes which have consistently delivered for shareholders and for detailed profiles of the top three performers, who take their place on our winners’ podium adorned with gold, silver and bronze

HOLDING OUT FOR SOME HEROES

In recent years, the concept of dividend heroes has really taken off with qualifying investment trusts eager to hold on to their position within the AIC’s index. After all, dividend hero status is a valuable marketing tool.

At the time of writing, there are 19 investment trusts qualifying for dividend hero status, with City of London (CTY), Bankers (BNKR) and Alliance Witan (ALW) sporting 58 consecutive years of dividend hikes apiece; these three trusts started paying their shareholders higher dividends in the same year England won the World Cup, and they’ve not stopped since!

Hot on their heels is the Cayzer family-controlled Caledonia Investments (CLDN) with 57 years of consecutive payout growth to crow about, followed by The Global Smaller Companies Trust (GSCT) on 54 years, with F&C (FCIT) and Brunner (BUT) tied on 53 years apiece.

A simple re-invest the dividend strategy back into the share, using good ole hindsight it would have been better to re-invest in another high yielding Trust but for better or worse etc.,

As always timing and then timein is important.

Results analysis from Kepler Trust Intelligence

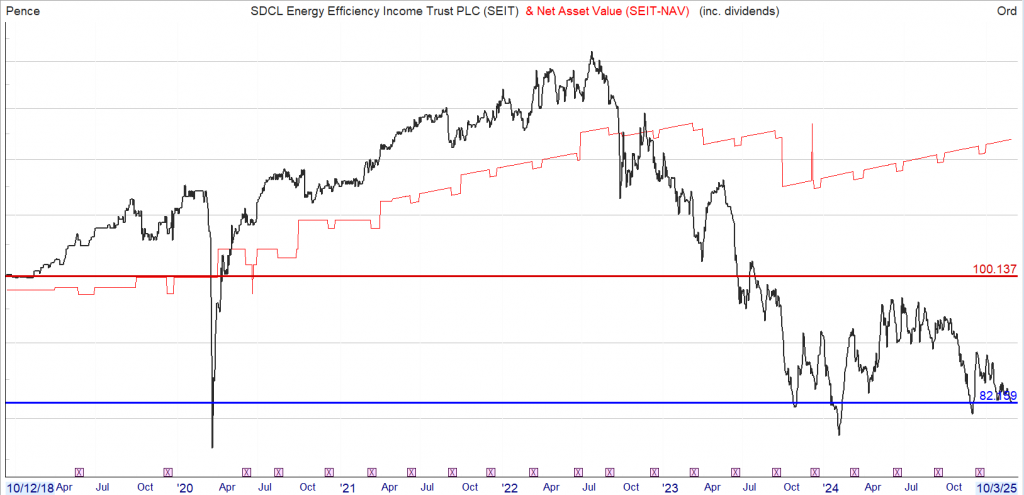

SDCL Energy Efficiency Income (SEIT) has reported its interim results to 30/09/2024, with the NAV stable at 90.6p (31/03/2024: 90.5p) and aggregate dividends of 3.16p compared to 3.12p for the same period last year. SEIT made a profit before tax of £35 million (2023 equivalent period: Loss of £89m). At the current share price, SEIT yields c. 11%. First half dividends were covered 1.1x by cash and the board reaffirmed its dividend guidance for the year ending 31/03/2025 of 6.32p (2024: 6.24p). SEIT’s portfolio valuation was £1,103m compared to £1,117m at 31/03/2023, with the main difference being the sale of UU Solar for £90m in May 2024.

SEIT’s gearing was 35% LTV, with 11% at a fund level through the trust’s revolving credit facility (RCF) and 24% at a project level. The same figures calculated as a percentage of NAV were 54%, split 17% at the trust level and 37% at a project level. The average interest rate was 5.6% and the average remaining life 4.1 years. Over 80% of debt at a project level is amortising, meaning it will naturally run off over time. SEIT’s discount at the half year end was c. 30% and is currently c. 36%. The Morningstar Renewable Energy Infrastructure peer group average was c. 20% and is currently c. 28%. The board and manager set out a plan to address the discount in the final results to 31/03/2024, the main points focusing on disposals, NAV return, capital allocation and reducing short term borrowings.

Kepler View

In the weeks before SDCL Energy Efficiency Income’s (SEIT) results announcement, the Morningstar Renewable Energy Infrastructure peer group in which it sits experienced significant discount widening, seemingly a result of the US election and investor worries about the different approach the new administration is expected to take to renewable energy. Share prices of other renewable energy companies were similarly hit. While it’s quite likely in our view that this is a sector-wide over-reaction, SEIT has some specific differences in its business model compared to the peer group.

First, the vast majority of SEIT’s revenues do not rely on any form of subsidy or incentive, and its projects are primarily rooted in their commercial attractions. Second, SEIT has very limited merchant exposure, with most of its long-term revenues contracted, and low direct exposure to power prices. SEIT is really an equity investor in platforms that provide corporate customers with efficiency solutions, so it participates not only in the contracted revenues that come from these solutions, but in the growth of the platforms themselves. Third, SEIT’s project-level debt is mostly amortising and so is repaid over a period of time, with many of its assets and investments extending well beyond the life of the debt, giving the trust different options in the future to enhance earnings. The team also point out one of the first moves made by the new US administration was the formation of a new Department of Government Efficiency, so ‘efficiency’ appears to be a positive theme in the US, which SDCL counts as its single largest country exposure at 67%.

Without getting into the flamboyant rhetoric, it is fair to say that the incoming US administration has an agenda much less focused on ‘energy transition’ and whatever the practical realities that unfold over the next few years, this is a negative for investor sentiment right now. We think SEIT’s business model, while aligned with energy transition, is relevant to customers with concerns about energy security, either more locally due to extreme weather events, or more widely due to geopolitical instability, as well as more straightforwardly simply helping customers to reduce costs. Thus, in our view, SEIT’s business model doesn’t really align with the main negatives of investor sentiment, and as the board’s plan to address the discount unfolds, the current discount could prove to be a significant opportunity.

09/12/2024

Current yield 12.5%

Current discount to NAV 46%

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑