Investment Trust Dividends

I’ve sold the Snowball shares in SOHO for a total profit of £4,698.64.

I will most probably buy back some shares next week starting with a clean slate and a stop loss, as I don’t want to give back most of the profit in case of bad news.

Michelle Lewis

Donald Trump will push fossil fuels and undo renewable energy policies, but it ultimately won’t stop clean energy’s momentum.

Trump has always pushed for more oil drilling and fewer regulations, left the Paris Agreement in his first term as president, says he hates “windmills,” promised to scrap offshore wind on “day one” if he won the 2024 election, and calls climate change a “scam.” And now that he’s won, this is a direct threat to the US’s pledge to reach net zero by 2050. After all, federal policy directly impacts the pace of renewable energy growth, especially when it comes to incentives and research funding.

The Biden administration’s ground breaking Inflation Reduction Act (IRA), which has spurred a clean energy boom, will be challenged under Trump. use Republican states have received 80% of the IRA’s money with which they’ve built factories and created thousands of jobs, a complete IRA repeal is unlikely. What’s more probable is that the Republicans phase out tax credits earlier than planned or cap overall funding.

Federal financial support for innovative technologies and projects could also take a hit. Brendan Bell, COO of Aligned Climate Capital, who formerly led the US Department of Energy’s Loan Programs Office, told Electrek:

My partner Peter and I led the DOE Loan Program Office under President Obama. We supported the first utility-scale solar and storage projects, as well as early EV investments – including the first loan to Tesla.

Today, these technologies are commercialized and are propelling the clean energy transition. None of it would have been possible if these programs had been cut off 10 years ago.

Put simply, Trump can’t turn back the tide of clean energy – but he could delay tomorrow’s solutions and the birth of new industries.

BloombergNEF’s “2H 2024 US Clean Energy Market Outlook,” released at the end of October, examined the worst-case scenario, where control of both the Senate and the House leads to a full repeal of the IRA tax credits:

The wind, solar, and energy storage sectors jointly see a 17% drop in total new capacity additions over 2025-2035, with 927 gigawatts (GW) of cumulative build compared to 1,118GW in BNEF’s base case forecast. Wind sees the greatest fall in activity in this scenario with a 35% drop, followed by energy storage at 15% and solar at 13% relative to BNEF’s base case.

That’s a blow we can’t afford at a time when we need to reduce emissions by 50% from 2005 levels by 2030 to avoid climate disasters becoming even worse than they already are.

But all is not lost. The clean energy market isn’t solely driven by federal policy. Over the last decade, solar, wind, and EVs have become more cost-competitive and popular. State policies play a huge role too, and many states are committed to their own clean energy goals regardless of who sits in the White House. States like California, New York, and Washington have ambitious targets to combat climate change, and deep red Texas is No. 1 in the US for both solar and wind.

Corporations are also key players. Companies like Amazon, Google, and Walmart have committed to going 100% renewable, and they’re not about to reverse course. This demand keeps the market for renewables strong. Plus, there’s significant public support for clean energy jobs, and renewables create more employment opportunities than fossil fuels in many regions of the country.

JD Dillon, chief marketing officer of California-based solar tech m (Nasdaq: TYGO), said to Electrek, “The march toward renewable clean energy is both inevitable and the right thing to do. In a perfect world, we would eliminate partisanship from the renewable energy conversation because everyone benefits from a cleaner environment and affordable energy. Unfortunately, none of us live in said perfect world.”

££££££££££££££

Renewable share prices generally have been very week since the American election, which may be bad news but for the Snowball it’s good news as we should be able to re-invest the earned dividends at a better yield for longer. Remember the rules.

Foresight Environmental Infrastructure Limited

(“FGEN” or the “Company”)

Portfolio Update – HH2E Administration

FGEN made an initial investment into the green hydrogen sector in January 2023 and has since been working with management at its partner, HH2E AG (“HH2E“), to progress the development of several green hydrogen production sites across Germany.

The Company has invested a total of €22.3 million into HH2E (£19.3 million) representing 2.6% of net asset value as at 30 June 2024. The investment into HH2E to date has principally been used to secure orders for long lead time equipment and develop HH2E’s first two green hydrogen sites at Lubmin and Thierbach, which are now both at a stage of requiring further capital to fund construction in line with the development consortium’s original business plan.

HH2E has recently undertaken a process to source additional third-party funding for ongoing development of the pipeline and construction of Lubmin, the most progressed of the sites. However, due to the nascency of the green hydrogen sector and challenging current global funding environment, the process has not led to a financing partner being secured within the required timeframe and at the required scale, and there is now material uncertainty over whether adequate funding will be achieved.

FGEN, along with its investment manager, Foresight Group (the “Investment Manager”), has given consideration to providing further funding to HH2E to allow it to continue to meet its commitments and requirements under German law. However, the Board does not believe that it is appropriate to do so at this time, reflecting the Company’s approach to portfolio construction, risk and capital allocation in the context of the current market environment.

Therefore, without the guarantee of third-party funding and as required by German insolvency law, HH2E management are expected to take the decision to file a petition for insolvency and enter administration. The Board and the Investment Manager are disappointed by this development, particularly given the potential for green hydrogen to play an important role in decarbonising heavy transport, industry, and other hard-to-abate sectors of the economy and the opportunity that remains at Lubmin and Thierbach.

HH2E’s administration process will focus on an outcome in the interests of all creditors. FGEN is an indirect creditor via its shareholding in Foresight Hydrogen HoldCo GmbH, which has provided shareholder loans to HH2E. Under German insolvency law, shareholder loans are subordinated to other creditors and as such it is expected that there will be no recovery of the invested amount.

The outcome of the administration process is not yet known, but the Company will update the market at the appropriate time.

The investment in HH2E is the only development-stage investment in the FGEN portfolio. FGEN’s dividend target for FY 2024/25 is 7.80p per share and the Board reassert that target with expected dividend cover in the range 1.2-1.3x. The Company will publish its interim results for the six months ended 30 September 2024, on Thursday 21 November 2024.

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by Greencoat UK Wind. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research. Overview Analyst’s View Portfolio Gearing Performance Dividend Management Discount Charges ESG. Kepler.

UKW in a good position to continue to deliver attractive returns…

Overview

UKW is the fifth largest owner of wind farms in the UK and is in a strong and unique position to help the UK’s transition to a low-carbon economy through its simple business model. By investing in wind farms, UKW aims to provide a comfortably covered dividend. Each year it should be in a position to reinvest surplus cash flows to grow NAV; the managers see their role as stewards of shareholders’ capital, determining the most accretive use of these surplus cash flows.

The recent Q3 NAV announcement offers an insight into how the board and manager are thinking about capital deployment. With the discount relatively wide, cash was used to progress the previously announced buyback programme. As the discount narrowed, the relative attractions of an incremental investment in the Kype Muir Extension wind farm came to the fore. We understand that the investment opportunity came through the exercise of UKW’s shareholder rights in the project, and was on highly attractive terms. The worth of this transaction is shown in the NAV accretion from the £14.25m deal, which exceeded the accretion from the £16.8m worth of buybacks also made over the quarter. In our view, this shows the benefit of UKW’s cash generative model, which gives the trust flexibility to take advantage of opportunities.

The recent NAV announcement also included news that UKW’s shorter-term debt has been successfully refinanced and UKW has no further need to repay any debt for a further two years. The overall weighted average interest rate has risen by an immaterial amount (4.68% as at 30/09/2024 vs 4.63% as at 30/06/2024). We understand that the board sees the current level of long-term gearing as attractive and sustainable, though it has been noted that proceeds from any disposals would likely be used to reduce gearing.

Analyst’s View

The recent NAV announcement provided some interesting information on the board and managers’ thoughts in the current environment. But with UKW trading on a discount to NAV, and further equity raises therefore off the table, the team are optimising returns for shareholders on a dynamic basis. Key to their ability to do this effectively is UKW’s impressive surplus cash flows, over and above that required to pay and increase the dividend in line with inflation. As at 30/06/2024, UKW has paid £1,074m in dividends and generated (and reinvested) £935m of excess cash flow.

The attractive terms achieved in the recent refinancing show that borrowing even in the current environment is not blunting shareholder returns, with the weighted average interest rate effectively unchanged. In terms of outlook, UKW seems well positioned to continue to deliver strong total returns to shareholders with the majority of returns coming in the form of an attractive dividend that yields well in excess of government bonds.

As we have discussed, that UKW currently trades at a discount has not impacted the manager’s ability to allocate capital and generate NAV accretion, as the most recent quarter illustrates. With the dividend yielding 7.5%, UKW’s shares are an interesting proposition for investors wishing to take advantage of the potential for rates to fall. Should the ten-year yield fall back once again, UKW may benefit from the discount narrowing, providing outsized returns to shareholders who bought shares at a wider discount to NAV.

55KBET Slot

55kbet4.com

claricemckelvy@yahoo.de

49.68.107.187

I’m really enjoying the theme/design of your website. Do you

ever run into any internet browser compatibility issues? A handful of my blog visitors have complained about my website not operating correctly in Explorer but looks great in Chrome. Do you have any advice to help fix this problem?

I have received similar comments but about Chrome. Sorry I can’t offer any advice.

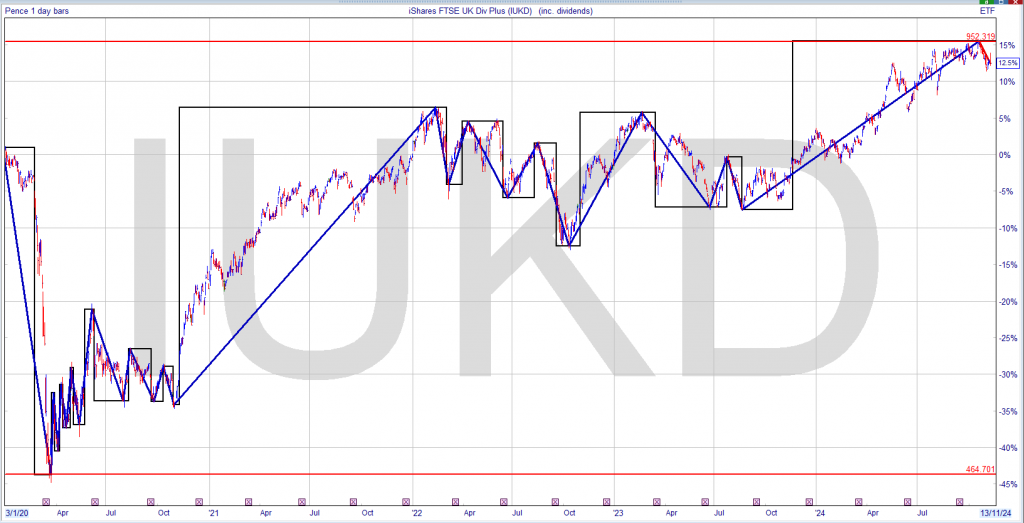

An ETF, so no discount to NAV to ponder. The holy grail of investing a position in your Snowball where u could withdraw your stake to re-invest in another high yielder, whilst still receiving income, forever, with the chance of some capital growth.

The Renewables Infrastructure Group Limited

Interim Dividend

The Renewables Infrastructure Group Limited (the “Company”) is pleased to announce the third quarterly interim dividend in respect of the three month period to 30 September 2024 of 1.8675 pence per ordinary share (the “Q3 Dividend”). The shares will go ex-dividend on 14 November 2024 and the Q3 Dividend will be paid on 31 December 2024 to shareholders on the register as at the close of business on 15 November 2024.

Dividend

I am pleased to report that we have once again maintained the Company’s 17-year track record of increasing dividends. A total dividend of 24.60p has been paid in respect of the year ended 31 August 2024, representing a 1.7% increase over the prior year.

It is also particularly pleasing to confirm that our dividend has been fully covered by portfolio revenues during the financial year as we witnessed a strong resurgence of dividend growth in line with longer term trends. We will, as we always do in years of surplus, be adding a considerable amount to the revenue reserve which we seek to strengthen when we can. The revenue reserve can be used to smooth dividends through periods of revenue shortfall. This reserve now stands at £29.9m.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑