Investment Trust Dividends

We outline the basics about dividends from what they actually are to how they can provide a regular income

A dividend is quite simply a portion of a company’s earnings distributed to its investors.

In the UK most companies pay two ordinary dividends per year, one at the half-way stage (the interim or first-half dividend) and one at the end of the year (the final dividend). Some UK firms pay quarterly dividends.

Sometimes, companies will decide to pay a special dividend on a one-off basis if their earnings have been particularly strong or they have sold a business and have no use for the cash themselves.

Investment trusts and funds also pay dividends to investors and they can be half-yearly, quarterly or even in some cases every month.

HOW DO YOU RECEIVE AN ORDINARY DIVIDEND?

To receive a dividend, you need to have a holding in a company, fund or investment trust that pays a dividend to its shareholders.

There are four important dates to keep in mind:

In the days leading up to the ex-dividend date, the price of your shares might go up as other investors decide to buy because they also want the dividend.

On the day the stock goes ex-dividend, the share price usually drops by the same amount in order to compensate for the fact that if you buy the shares now you have no right to the dividend (they are ‘ex-rights’, in market parlance).

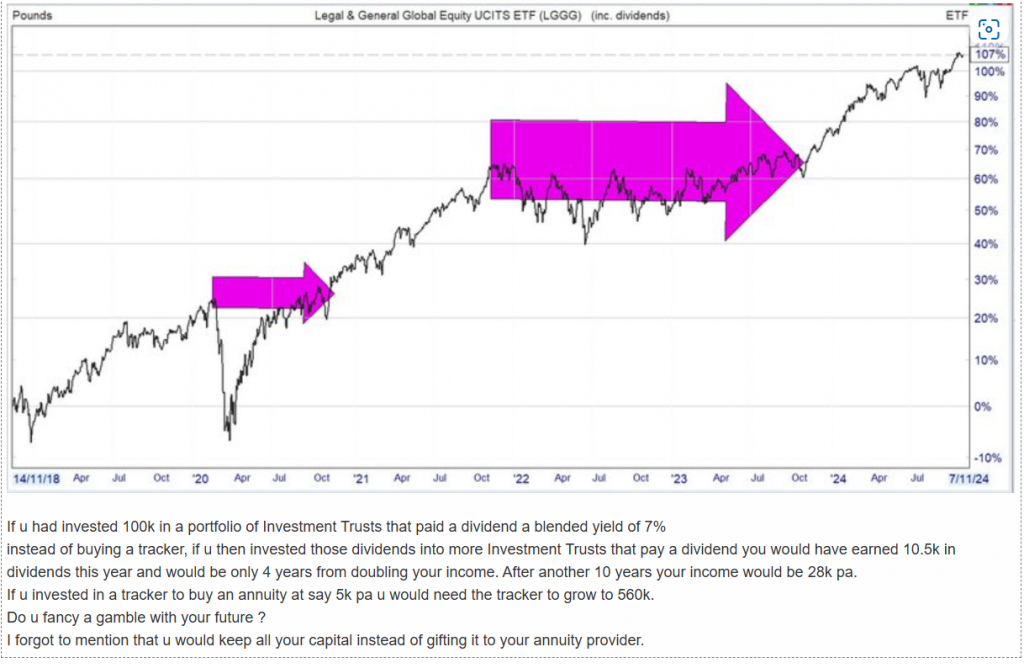

KISS. For any new readers there are only 3.

One. Invest in a portfolio of Investment Trusts* that pay a secure** dividend and use those dividends to buy more Trusts that pay a secure dividend.

Two. Any Trust that drastically alters their dividend pay out, must be sold even at a loss.

Three. Remember the rules.

*The Snowball invests only in Investment Trusts as they have reserves to pay dividends in time of market stress.

**No dividend is 100% secure although some dividends are more secure than others.

No savings? I’d put £100 a month into this sleepy giant to generate passive income of £7,772 a year.

Story by James Beard

by The Motley Fool

I recently read that “passive income is the fuel that powers your dreams, giving you the freedom to pursue your passions and live your life on your own terms”. I have no idea who came up with this quote, but I hope they dream well and are in a position to spend their time doing something fulfilling.

Another investing concept that gets a good press is compounding. In the case of income stocks, this is the act of reinvesting dividends to buy more shares, generating an ever increasing level of return. This has been described as the eighth wonder of the world.

Just imagine how happy we could be by combining the two! Well, that’s what I try and do.

Now, I must be honest. I still have to work for a living and I’d love to have more freedom to do what I want. But I do have a steady stream of passive income that I’m reinvesting with a view to having a more comfortable retirement.

Take two

If I were to start my investing journey all over again, I’d put a relatively modest amount (say £100) into UK income stocks. If I then received dividend payouts of 5.9% a year — payable two-thirds/one-third in January and July, respectively — my hypothetical sum would grow to £67,248 after 25 years.

At this point, my shareholding would be generating income of £3,967 a year.

Readers may be wondering why I’ve chosen such specific numbers. Well, that’s because National Grid (LSE:NG.) presently offers a 5.9% yield and pays a dividend twice a year.

And it’s a share that has a long track record of increasing its payout.

My example assumes zero growth in its dividend. However, factoring in an increase of 3.6% a year — the company’s average annual increase over the past five years — would increase my investment pot to £131,731. This could give me an annual passive income of £7,772.

Remember, there could be some capital growth too.

Caution

Of course, the stock price could fall. And dividends are never guaranteed. But this example highlights the potential long-term gains achievable from picking a steady and reliable income stock.

National Grid is able to pay a generous dividend because its earnings are reasonably secure. It operates in a regulated industry, which means as long as it keeps the lights on (literally), it will be able to achieve a pre-agreed level of return.

Because of this its share price performance tends to be unspectacular. This — along with the fact that it’s the UK’s 13th-largest listed company — is why I describe it as a sleepy giant. I think there’s always room for this type of stock in a well-balanced portfolio.

But there are a couple of things that could threaten its ability to maintain its healthy dividend.

Although it doesn’t face any competition it must meet its regulatory obligations. This requires huge capital expenditure.

It surprised shareholders in May by asking them for more money. Due to the company’s large borrowings, perhaps its directors felt they had no alternative other than to approach its owners for additional cash. I wonder if the terms offered by lenders were unfavourable.

However, despite these challenges, the next time I’m in a position to invest I’m going to seriously consider taking a stake.

The post No savings? I’d put £100 a month into this sleepy giant to generate passive income of £7,772 a year! appeared first on The Motley Fool UK.

I’ve sold the shares in M&G credit for a loss of £8.00 including the earned dividend but not yet received. The funds to be re-invested in Private Equity.

True diversification in a concentrated market

Diversification has always been a foundational principle of smart investing. You’ve likely heard the adage “don’t put all your eggs in one basket.” Diversification is an investment technique that aims to increase returns and decrease overall risk by allocating across different investment types and industries.

Over the years, public markets have become more concentrated. In 1996, the number of U.S. publicly traded companies peaked at 8,134 before dropping to less than 4,300 in 2018. The decrease in publicly traded companies increases the challenge of achieving true diversification through traditional equity investing. Consider this: The top 10 companies in the S&P 500 now account for roughly one-third of the entire index. What’s more, most of these companies are in the tech sector.

Private equity, on the other hand, provides an opportunity to achieve deeper diversification. By investing in private markets, you can gain exposure to thousands of companies across a wide range of sectors and industries. Several of these sectors are underrepresented or entirely absent in public markets. For example, there are nearly 200,000 midsize companies in the United States, the vast majority of which are private. Midsize businesses account for one-third of private sector output and are predominantly private and not accessible through public markets. Investments into these companies can be accessed only through PE.

By including private equity in your portfolio, you gain access to different industries, market segments and business models that aren’t as susceptible to the concentration risks seen in market-weighted public indexes today, such as the S&P 500. Private equity investment is a way to broaden your exposure beyond the mega-cap, tech-heavy giants and reach into the broader economic landscape.

Alignment of interests for long-term success

One of the most beneficial aspects of private equity is the alignment of interests between investors and the management teams of private companies. Liquidity, a readily tradeable market and accessible information are strong benefits for publicly traded companies.

However, in public markets, companies are often pressured to prioritize short-term earnings to satisfy shareholders and analysts. This pressure can lead to decisions that undermine long-term growth.

In contrast, private equity is not under the same rigor. Often, private equity aligns management goals with long-term performance metrics. Compensation packages in PE-backed companies are often tied to the successful growth and operational efficiency of the business over a period of five to seven years and are typically aligned with a successful exit.

Private equity’s structure encourages strategic thinking and operational stability that benefits both the companies and the investors. Compared to public companies, board members of private companies typically have a significant investment in the company, prioritize previous experience and meet more frequently and often prioritize long-term value over short-term accounting profits.

Proven superior performance

How did your investment perform? What was the rate of return? Did it make money? Investment performance is an investor’s scorecard. Past performance is no indication of future performance. However, when evaluating investment options, historical performance is an important aspect of decision making.

Ares Wealth Management Solutions, a leading global alternative investment manager, conducted research on the performance of private equity compared to public markets over the past three decades. Overall, the research illustrates private equity’s long track record of delivering superior, more durable returns compared to public markets.

For instance, their report highlighted how if you had invested $100,000 in private equity (buyout market, the largest and most mature private equity market) in 1992, today you’d be looking at an approximate value of $6 million 30 years later. This is significantly superior to the approximate $1.1 million value that the same $100,000 would have generated in public markets (represented by the MSCI World Index). This kind of outperformance should not be overlooked.

In addition to superior performance, private equity has also proven to provide better downside protection, thus less pronounced declines during market downturns and faster recoveries afterward, according to the Ares Wealth Management Solutions research. During the 2008 global financial crisis, for example, private equity experienced smaller declines and quicker recoveries compared to the broader public markets. The same downside protection and quicker recovery was also evident during the COVID-19 pandemic.

Know the risks

Private equity does come with risks; reduced liquidity and the need for a longer time horizon are certainly important factors in determining whether private equity is an appropriate investment. Investments are not listed on any securities exchange and may not be readily liquidated.

An additional risk that can adversely affect the performance of private companies is their reporting requirements. Private companies are generally not subject to SEC reporting requirements, are not required to maintain accounting records in accordance with generally accepted accounting principles and are not required to maintain effective internal controls over financial reporting. Due to the lack of reporting requirements, there is the risk that investors may invest based on incomplete or inaccurate information.

A powerful tool

Due to the ever-changing economic landscape, private equity’s potential benefits in terms of diversification, alignment of investor interests and historically superior performance make it an investment category worth considering. Private equity can give you opportunities that you would otherwise not have access to through public markets — potentially helping you find the right balance between risk and reward

Marwyn Value Investors Limited

(the “Company”)

INTERIM DIVIDEND TO ORDINARY SHAREHOLDERS

The Company is pleased to announce that an interim dividend of 2.265p per Ordinary Share will be paid on 29 November 2024, pursuant to the Company’s ordinary share distribution policy.

The payment of the interim dividend to eligible holders of Ordinary Shares will be effected through CREST or by BACS in the case of holders of depository interests relating to the Ordinary Shares, or by BACS in the case of Ordinary Shares held in certificated form.

Timetable for November Interim Dividend

| Ex-date | 7 November 2024 |

| Record date | 8 November 2024 |

| Payment of the interim dividend | 29 November 2024 |

The Company expects to make a quarterly dividend payment of 2.265p per share in February 2025, details of which will be confirmed in January 2025.

As set out in the Company’s interim results, the Board and the Manager expect to continue to consult with shareholders in relation to the ongoing operation of the distribution policy, assessing the prevailing share price, net asset value and cash flow requirements of the Company and underlying portfolio and will make an announcement to shareholders should there be proposed changes to the distribution policy.

Alternative Income REIT PLC

(the “Company” or “Group” or “AIRE“)

NET ASSET VALUE, DIVIDEND DECLARATION AND PORTFOLIO VALUATION UPDATE

TO 30 SEPTEMBER 2024

New target annual dividend of 6.2 pence per share (“pps”) for the year ending 30 June 2025†,

an increase of 5.1% on the prior year target of 5.9pps

Unaudited NAV total return for the quarter of 2.5%

Resilient portfolio well-placed to continue to provide secure, index-linked income with the potential for capital growth

The Board of Directors of Alternative Income REIT PLC (ticker: AIRE), the owner of a diversified portfolio of UK commercial property assets, predominantly let on long leases with index-linked rent reviews, provides a trading and business update and declares an interim dividend for the quarter ended 30 September 2024.

Simon Bennett, Non-Executive Chair of Alternative Income REIT plc, comments:

“Having achieved the Company’s target dividend of 5.9pps last year, subject to the continued collection of rent from the Group’s portfolio as it falls due, the Board has set a new dividend target of 6.2pps for the year ending 30 June 2025†, which represents an increase of 5.1% over the previous year.

At 30 September 2024, the Group’s unaudited NAV was £65.4 million, 81.3pps, representing a 0.5% increase over the previous quarter. When combined with the 1.625pps dividend paid in the quarter, this produces an unaudited NAV total return for the quarter of 2.5%.

The Group’s portfolio remains relatively insulated from market fluctuations, benefiting from being 100% let, achieving 100% collection of rent due, and a 95.9% index-linked rent review profile. The Board continues to actively seek properties to invest the remaining proceeds from the sale of the hotel in Glasgow which amounts to £2.2 million, which has taken longer than originally anticipated.

The Group produces a secure and increasing income stream and this is the second quarter where the valuation of the portfolio has risen, albeit modestly, and the Group will continue to benefit from low borrowing costs until October 2025. I look forward to reporting on AIRE’s continued progress in the coming months.”

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑