Thursday 16 October

Invesco Bond Income Plus Ltd ex-dividend date

TwentyFour Income Fund Ltd ex-dividend date

TwentyFour Select Monthly Income Fund Ltd ex-dividend date

Investment Trust Dividends

Thursday 16 October

Invesco Bond Income Plus Ltd ex-dividend date

TwentyFour Income Fund Ltd ex-dividend date

TwentyFour Select Monthly Income Fund Ltd ex-dividend date

Highlights

· Net Asset Value (NAV) of £603.8 million and NAV per Ordinary Share of 108.5 pence (31 December 2024: £634.4 million and 112.3 pence), principally driven by lower power price forecasts.

· Plentiful solar resource contributed to better-than-expected production in the UK, Foresight Solar’s core market. Global generation was 4.0% above budget in the six months to June.

· Combined with an active power price hedging strategy, strong operational performance gives the board confidence in the 1.3x dividend cover target for the year.

· The buyback programme was increased to a total of up to £60 million. In the first half of 2025, Foresight Solar distributed £29 million to Shareholders between dividends and buybacks.

18 September 2025

A lump sum or regular investment in these UK dividend stocks could yield substantial passive income over time, predicts Royston Wild.

Posted by Royston Wild

Published 12 October

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.Read More

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

These dividend stocks offer enormous yields and long records of payout growth. Here’s why they demand serious attention right now.

Real estate investment trusts (REITs) can be great shares to target long-term passive income. Sector rules state at least 90% of annual rental earnings must be paid out in dividends. This can make the cash rewards they deliver less volatile than those from other dividend shares.

Unite (LSE:UTG) is one trust I feel demands close attention. It operates in the highly defensive student accommodation market, which gives profits protection from changing economic conditions. Following its acquisition of sector rival Empiric Student Property, it will be the UK’s largest operator with 75,000 beds, chiefly centred on the country’s strongest universities.

Unite has proven one of the UK’s most reliable dividend growth stocks, with payouts rising almost every year since 2011. The only exception came in 2019 when Covid-19 uncertainty forced a reduction.

For this year, the REIT’s dividend yield is a large 6.2%, which is almost double the FTSE 100 average of 3.2%. This figure has been boosted by a sharp fall in Unite’s shares on Wednesday (8 October) — then, the company said sales to date had delivered rental growth of 4%, down from 8.2% in the same 2024 period.

I think this represents an attractive dip-buying opportunity to consider.

Competition is tough, and Unite’s problems are being compounded by extra stress on students’ budgets right now. But the long-term sector outlook remains robust, and the company’s increased scale gives it a significant advantage. I expect dividends to continue rising over the next decade and beyond.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

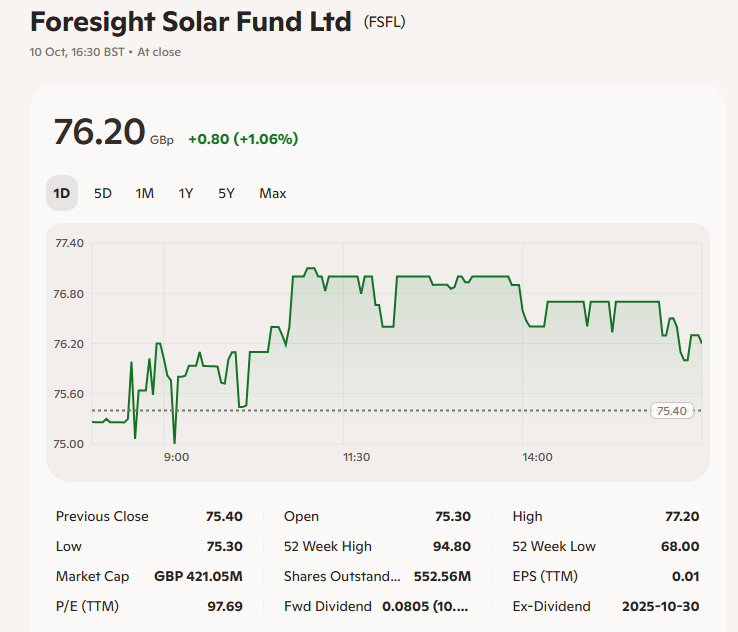

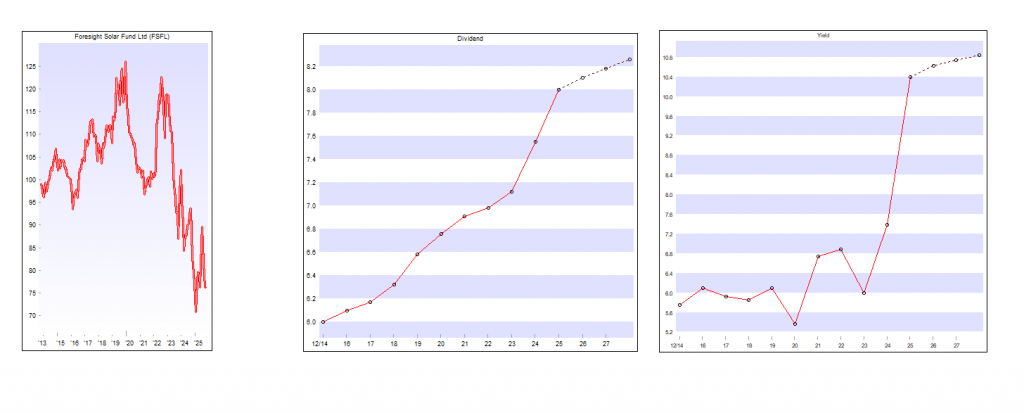

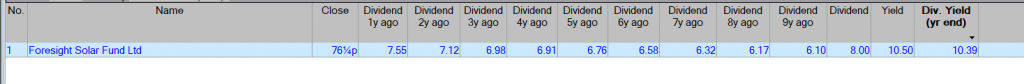

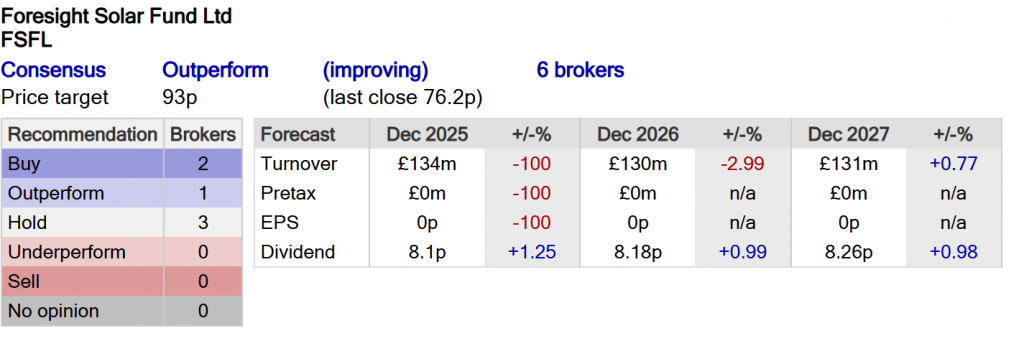

Foresight Solar Fund (LSE:FSFL) is another top dividend stock worth serious attention after recent price weakness.

It’s fallen in value as optimism over sustained interest rate cuts over the next year have declined. As with Unite, asset values come under pressure when rates are higher, and cost of borrowing pressures increase.

While this issue can be significant, the impact it’s had on Foresight’s dividend yield merits serious consideration. Its forward yield is now an enormous 10.7%.

Like any renewable energy stock, the company has significant long-term investment potential as the move from fossil fuels continues apace.

Foresight has ambitious plans to capitalise on the green transition — the business has 1 GW of capacity across its assets, and plans to treble its development pipeline to 3 GW from current levels, with growth focused on the UK and Europe where clean energy policy is especially favourable.

Investing in energy producers has another significant advantage for investors. Electricity demand is largely unchanged across the economic cycle, giving companies the financial strength and the confidence to steadily raise dividends.

In the case of Foresight, annual dividends have risen each year since it listed on the London stock market in 2013. It’s a theme I expect to continue long into the future.

Ben McPoland spotlights a trio of investment options from the London Stock Exchange. Collectively, they offer both growth and income potential.

Posted by Ben McPoland

Published 12 October

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

There are hundreds of different exchange-traded funds (ETFs) on the London Stock Exchange. They span everything from plain vanilla indexes to niche investing themes. Throw investment trusts into the mix, we’re talking thousands of different options!

Here are three that are worth exploring further.

Let’s start with the iShares UK Property ETF (LSE:IUKP), which holds 33 UK real estate investment trusts (REITs). These include LondonMetric Property (logistics and retail warehousing), Primary Health Properties (GP surgeries and health centres), Unite (student accommodation), and Big Yellow (self-storage).

This sector remains out of favour due to higher interest rates. Rising borrowing costs restrict portfolio expansion plans, while investors can now find attractive yields in perceived safer havens like government bonds.

The fact that this ETF is concentrated on one sector makes it higher risk. Were the UK property market to enter a prolonged slump, this product would carry on underperforming (it’s already down 20% in five years).

On the plus side, though, investors are being offered a 4.5% dividend yield while they wait for a potential recovery. This should materialise as interest rates slowly but surely come down over the next couple of years.

Many [UK REITs] are trading at significant discounts to their net asset value, offering investors the chance to acquire real estate below its true value.

Kenneth MacKenzie, CEO of Target Healthcare REIT

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

To diversify an income stream away from UK property, an investor might also look at the Schroder Oriental Income Fund (LSE:SOI). This FTSE 250 investment trust offers broad exposure to dividend-paying companies across the Asia Pacific region.

What I like here is the trust offers a healthy level of geographic diversification. Mainland China accounts for just over 18% of assets, with the bulk of the rest made up of Taiwan, Australia, South Korea, Hong Kong, Singapore, and India.

Holdings include Samsung Electronics and Singapore Telecommunications, as well as DBS Group (Singapore’s largest bank). But it does have an outsized position in Taiwan Semiconductor Manufacturing. Any weakness in the Taiwanese chipmaking giant’s share price could negatively affect performance.

The rest of the ETF looks well-diversified, though. And over the next decade, I expect institutional investors to start allocating more capital outside the S&P 500. Asia should be a natural beneficiary of this — it’s worth noting that the trust has returned more than 20% year to date.

Finally, while Schroder Oriental Income Fund is trading at a record high, it still carries a decent 3.7% trailing dividend yield.

Finishing with more of a growth angle, we have the iShares Digital Security ETF (LSE:LOCK). This one holds 111 stocks across cybersecurity, including leading players like Arista Networks, MongoDB, Datadog, and Cloudflare.

As we’ve seen recently with high-profile hacks at Jaguar Land Rover and Marks and Spencer, beefing up cybersecurity is becoming a key operational necessity. And this spending is sure to be benefitting many of the ETF’s top holdings.

One risk I would highlight here is valuation. The average trailing price-to-earnings multiple of the ETF’s holdings is around 30. Were tech stocks to tumble, this would hit the fund.

However, to my mind, the cybersecurity trend just has so much further to run, especially as AI rapidly develops. I think investors should consider getting some portfolio exposure.

Here’s the Time-Tested Way to Make

15% Per Year From Stocks

There’s an untapped portion of the market few people know about …

It’s filled with stocks that seem “boring” to the uninformed investor…

Companies that rarely get coverage from the mainstream media …

Contrarian investments that are hiding their true potential …

However, if you look below the surface and read between the lines, these “Hidden Yield Stocks” offer intelligent investors the opportunity to deliver 15% total returns per year—no matter what the wider market does.

How?

Well, the answer lies in what I call “The Three Pillars.”

Pillar #1 – Consistent Dividend Hikes

Pillar #2 – Lagging Stock Price

Pillar #3 – Stock Buybacks

Together, these three pillars allow us to identify the stocks that are undervalued … overlooked … recession-resistant … and primed for major growth.

And by investing exclusively in these “Hidden Yield Stocks,” we can enjoy massive upside with very little downside … plus collect regular, reliable income through healthy dividend payouts!

Contrarian Investor

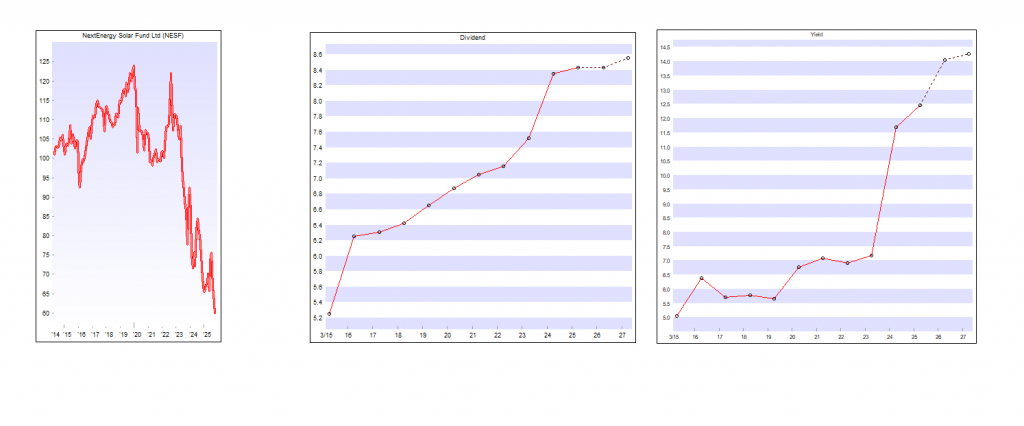

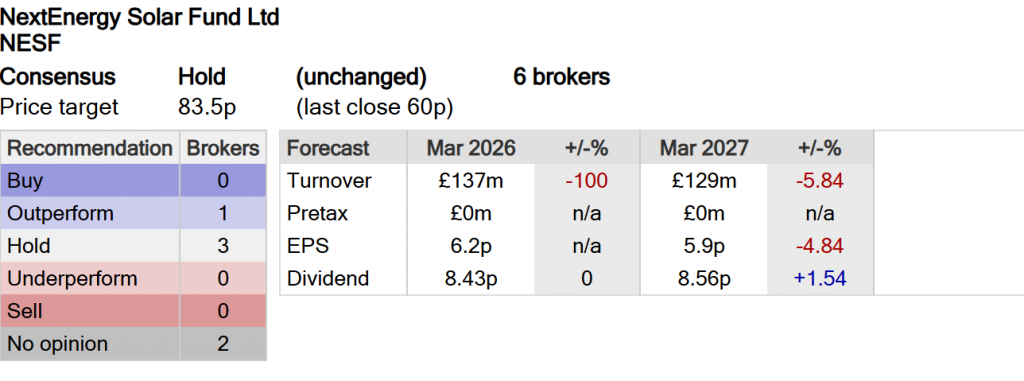

The current yield of NESF, is 14%. Is Mr Market flashing a warning sign, is Mr Market right ?

Sure, chasing high current yields will provide you with instant gratification, but it won’t give you the recession-resistant income … or the 15% year on year returns we want.

Instead, you need to focus on consistent dividend hikes.

In my opinion, selecting companies with a proven track of increasing their dividend payments is one of the safest, most reliable ways to get rich in the stock market. You see, every time a company raises its dividend, you start earning more from your original investment.

For example:

On a $1,000 initial investment, $30 in dividends equals a 3% return. Later, if the dividends go up to $40 a year, you are effectively earning 4% on your initial $1,000 investment.

As this trend continues, you could easily be earning 10%, 15%, even 20% per year just from rising dividends, as your initial investment never changes.

Contrarian Investor

Here’s a deeper look to help you decide:

📈 Current Price & Movement

Pillar #1 – Consistent Dividend Hikes

Pillar #2 – Lagging Stock Price

If you include dividends the NAV if flatlining, the worry is that it may eat it’s own tail with the dividend payments.

Dividend:

· Total dividends declared of 2.10p per Ordinary Share for the Q1 period ended 30 June 2025 (30 June 2024: 2.10p), in line with full-year dividend target.

· Full-year dividend target guidance for the year ending 31 March 2026 remains at 8.43p per Ordinary Share (31 March 2025: 8.43p).

· The full year dividend target per Ordinary Share is forecast to be covered in a range of 1.1x – 1.3x by earnings post-debt amortisation.

· Since inception the Company has declared total Ordinary Share dividends of £407m.

· As at 20 August 2025, the Company offers an attractive dividend yield of c.11%

NESF

Pillar #3 – Stock Buybacks

Share Buyback Programme:

· As at 30 June 2025, the Company had purchased 15,621,142 Ordinary Shares for a total consideration of

£11.5m through its up to £20m Share Buyback Programme, producing a total aggregate NAV uplift of 0.5p per Ordinary Share (0.0p during the period). All purchased Ordinary Shares are currently being held in the Company’s treasury account.

Solar investor NextEnergy Solar Fund will leave the 250 index. All changes will take effect from the start of trading on September 22.

IF the dividend isn’t increased or cut and NESF isn’t taken over, you should receive your capital back in around 5 years.

Richard Williams

08 October

The average real estate share price was flat in September, a welcome respite after a couple of bruising months of losses, although persistent inflation and high gilt yields continue to cloud the outlook. There were some big winners and losers in the month.

| (%) | |

| PRS REIT | 11.5 |

| Alternative Income REIT | 10.4 |

| International Workplace Group | 10.3 |

| AEW UK REIT | 6.9 |

| Big Yellow Group | 6.8 |

| First Property Group | 6.8 |

| Custodian Property Income REIT | 6.3 |

| Picton Property Income | 5.8 |

| Ceiba Investments | 5.8 |

| Land Securities | 5.1 |

Source: Bloomberg, Marten & Co

On the positive side, PRS REIT’s (PRSR) shares responded to a proposed sale of the company (although the deal would leave substantial value on the table, being at a 19% discount to NAV). Shares in Alternative Income REIT (AIRE) were also up double digits having fallen considerably over the previous two months weighed down by an impending debt refinancing. New bank facilities were agreed in September at an improved margin, although the overall higher debt costs saw it reduce its dividend target. Serviced office specialist International Workplace Group (IWG) was the other double-digit riser, with its share price rebounding strongly from an irrational 16% one-day drop following the release of half-year results in August.

| (%) | |

| Grit Real Estate Income Group | (16.2) |

| Globalworth Real Estate | (10.5) |

| Town Centre Securities | (8.3) |

| Ground Rents Income Fund | (7.1) |

| Henry Boot | (6.3) |

| Regional REIT | (4.5) |

| Life Science REIT | (3.9) |

| Sirius Real Estate | (3.8) |

| Macau Property Opportunities | (3.5) |

| Harworth Group | (3.4) |

Source: Bloomberg, Marten & Co

Investors seem to have given up on Grit Real Estate (GR1T) as it grapples with high debt costs, falling property income and challenged investment markets in Africa. With the disappointing news that Life Science REIT (LABS) had been unable to attract a bid for the company on acceptable terms, the share price dwindled as the board proposed that a drawn-out managed wind down was the best option for shareholders. Another notable name on the list was Regional REIT (RGL), which during the month reported another drop in NAV in interim results. The regional office landlord is progressing its strategy to sell non-core assets to reduce debt and invest in upgrading the remaining portfolio.

| Company | Sector | NAV move (%) | Period | Comments |

| Custodian Property Income REIT | Diversified | 0.6 | Quarter to 30 June 25 | Like-for-like portfolio valuation increase of 0.8% to £614.7m |

| Schroder European REIT | Europe | (0.2) | Quarter to 30 June 25 | Property portfolio valued at €193.9m, unchanged from the prior quarter |

| Harworth Group | Development | 0.8 | Half-year to 30 June 25 | Investment portfolio continues to grow as industrial developments complete |

| Real Estate Investors | Diversified | (1.4) | Half-year to 30 June 25 | Like-for-like, the portfolio valuation reduced by 0.6% to £119.4m |

| Phoenix Spree Deutschland | Europe | (1.7) | Half-year to 30 June 25 | Portfolio valued at €548.7m, a fall of 0.7% over the period |

| Social Housing REIT | Residential | (3.5) | Half-year to 30 June 25 | Portfolio valued at £611.8m, a 2.3% like-for-like reduction |

| Regional REIT | Offices | (3.6) | Half-year to 30 June 25 | Portfolio valuation of £608.3m, down 2.0% on a like-for-like basis |

| Life Science REIT | Labs/offices | (10.9) | Half-year to 30 June 25 | Value of portfolio fell 6.7% to £360.6m |

| Supermarket Income REIT | Retail | 0.1 | Full year to 30 June 25 | Portfolio valuation of £1,625m, which increased by 1.9% on a like-for-like basis |

Source: Marten & Co

Weak valuations in half-year results followed a slight outward movement in property investment yields across most sectors, with frustrating inflation data resulting in elevated gilt yields. Custodian Property Income REIT (CREI) was boasted by an uplift in the estimated rental value of its industrial portfolio, which makes up 43% of the wider portfolio by income. Social Housing REIT (SOHO) suffered a 20 basis point (the equivalent of 0.2%) yield expansion on its portfolio, mainly due to a group of properties let to troubled tenant My Space – the leases of which the manager is in the process of reassigning to another social housing provider. Supermarket Income REIT’s (SUPR) portfolio value was up almost 2% over 12 months, boosted by its inflation-linked leases to the largest grocery operators in the UK and France.

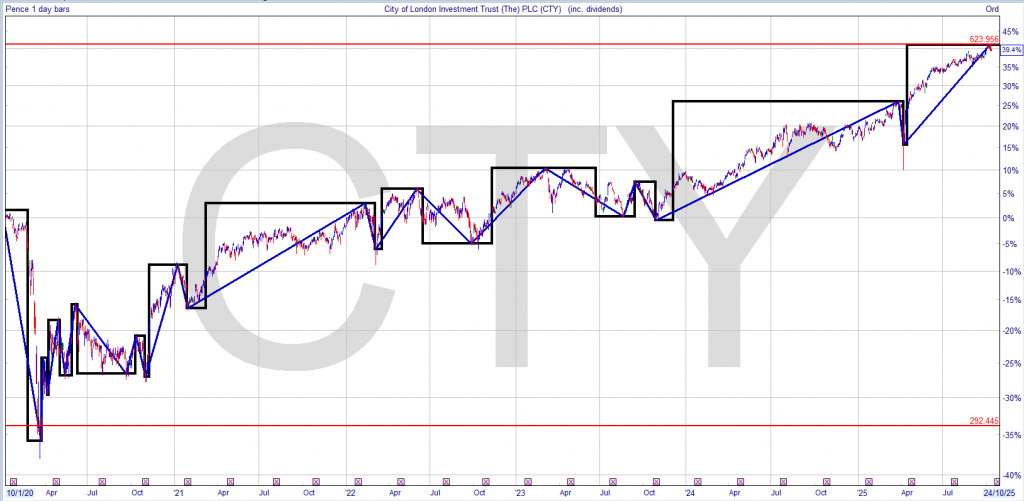

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by City of London Investment Trust (CTY). The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

A strong year of stock picking puts CTY well ahead of the benchmark.

Overview

City of London Investment Trust (CTY) aims to deliver income and capital growth. Job Curtis has an impressive tenure of 34 years managing the trust, giving him a depth of experience rarely matched. In particular, the last financial year illustrated the benefits of his active, stock-picking approach. That said, this is a cautious investment strategy that is arguably well suited to extending CTY’s unrivalled 59 year run of progressive dividend increases.

Job seeks to spread risks – both in terms of capital and income generation – across the portfolio. This has protected CTY against many sector-specific issues that have arisen over the years, but also in our view complements Job’s valuation-based investment framework, which favours quality companies, and sometimes has a contrarian tilt towards identifying new ideas. Job aims to balance any lower yielders in the portfolio by also investing in steady, highly resilient dividend payers with strong balance sheets. As we highlight in the Portfolio section, this means that CTY is exposed to a range of different types of companies, with varying growth and income characteristics.

Behind the headline-grabbing Dividend Hero moniker, CTY continues to deliver on a NAV total return basis too. CTY has delivered outperformance of the benchmark over one, three, five and ten years.

CTY’s dividend represents a yield of 4.25%. Whilst the dividend increase last year of 3.4% was a shade behind that of UK CPI at 3.6%, the board has stated that it understands the importance of growing the dividend in real terms through the economic cycle and long term. CTY has delivered real dividend growth over ten and twenty years, as we discuss in the Dividend section.

Analyst’s View

CTY has established itself as the leading trust in the UK Equity Income sector, a result not only of its long history of dividend increases over the past 59 years, but also because it has delivered good total returns to shareholders too. As a result, it has won investors’ confidence over time, issuing shares and growing organically so that it now dominates the UK Equity Income sector in terms of size, meaning good liquidity for investors and low Charges.

CTY’s 2025 dividend equates to a dividend yield of 4.25%. Not only is this attractive in absolute terms, so too is the fact that shareholders can derive an element of reassurance that comes with knowing CTY has a 59-year track record of delivering consecutive annual dividend increases. However, this is no UK domestic play – the majority of CTY’s portfolio revenues are derived overseas. Job sees the UK equities he owns as ‘global growth at a discount’. Job expects takeovers of UK companies to continue, highlighting the value available in the UK market.

CTY also provides reassurance in another way – the share price has tended to move in a relatively narrow band with regard to the NAV. As we discuss in the Discount section, a subtle change in wording means the board has underlined its commitment to try to protect shareholders from the discount widening out. As well as its other attractions, the tight discount has been fundamental to allowing CTY to grow organically in the past through share issuance. With this move, shareholders can continue to have confidence in continued good liquidity, and that the share price should follow the NAV. In our view, CTY appears well placed to continue its leadership within the UK Equity Income sector.

Portfolio

CTY’s investment objective is closely reflected by the investment process and attitude to risk of the managers, Job Curtis and David Smith. CTY is set up to deliver long term capital growth, and equally long-term growth in dividends. Now in his 35th year of managing CTY, Job has decades of experience to look back on to inform his investment decisions. Fundamentally, this is an active stock-picking approach, and Job has plenty of latitude to pick UK stocks across the market-capitalisation spectrum, as well as up to 20% overseas, in order to deliver on the trust’s objectives. As we discuss in the Performance section, Job and, since 2021, David, as deputy fund manager, have a good track record in delivering over and above the benchmark returns, whilst also building on CTY’s unrivalled 59 years of dividend growth. In particular, the last financial year to 30/06/25 (which CTY has recently reported on) saw Job and David deliver significant outperformance of the benchmark, largely driven by stock picking.

Job’s active approach is set within his philosophy, which sees him aiming to spread risks – both in terms of capital and income generation – across the portfolio. This has protected CTY against many sector-specific issues that have arisen over the years, but also in our view complements Job’s valuation-based investment framework, which favours quality companies, and sometimes has a contrarian tilt towards identifying new ideas. Of course, the prospective dividend yield and growth of that dividend is a key determinant for Job when selecting investments. Holding a company that doesn’t pay a dividend is relatively rare, but Job does hold a number of companies that pay a relatively low dividend yield but, in his view, have strong or resilient growth characteristics. Job aims to balance any lower yielders by also investing in steady, highly resilient dividend payers with strong balance sheets.

The managers break down the portfolio into companies with different features, which we show in the graph below, once again illustrating the fact that CTY is exposed to a range of different types of companies, with varying growth and income characteristics.

Source: Janus Henderson

Over the last few years, the number of individual stocks has been gently reducing (numbering 77 as at 31/08/25), with a greater proportion of stocks featuring from the FTSE 100. This is largely a result of valuations in the UK being at such a discount to international peers, which means that Job’s exposure to overseas stocks is relatively low by historical standards at c. 8% currently (a maximum of 20% is allowed). Job and David sit within Janus Henderson’s global equity income team, which, amongst other advantages, helps give them an understanding of relative valuations on an international basis. That said, far from being exposed to the UK domestic economy, the majority of CTY’s portfolio revenues are derived overseas. Job sees the UK equities he owns as ‘global growth at a discount’. Job expects takeovers of UK companies to continue, highlighting the value available in the UK market.

Job’s fundamental approach to stock picking has seen CTY benefit from the significant recovery in many UK bank share prices. Job has been focussed on the domestic deposit takers such as NatWest, Lloyds and Barclays. NatWest in particular has been a very strong contributor to returns, Job having recognised well before the wider market that it would have a very strong tailwind to returns from hedges taken out during the period of low interest rates rolling over at much higher interest rates. Away from the biggest stocks in the UK market, Job and David have also been active. An example is recent purchase and mid-cap stock TP ICAP, which is the world’s largest inter-dealer broker between investment banks on many products. Job and the team like the fact this world class group converts a high percentage of its profits into cash and is expected to be a good dividend payer. Harbour Energy is a small-cap, also recently purchased, which has increasingly diversified oil and gas production, with around one third in Norway, one third in the UK and one third spread across the rest of the world (including Latin America, North Africa and Germany). The team believe it has plenty of growth ahead of it, being a relatively nimble, independent energy company.

One to consider, the next time the market shakes out.

Brett Owens, Chief Investment Strategist

Updated: October 10, 2025

Closed-end funds (CEFs) are the last bargains left on the board. CEFs are often confused with mutual funds and ETFs, but they are different because they often trade at discounts to their net asset values (NAVs).

For contrarians like us looking for deals, this is key.

CEF trading is relatively thin. This created inefficiencies, such as select CEFs trading for as cheap as 95 or even 90 cents on the dollar.

Plus, some of them dish big dividends—like these five.

Eaton Vance Tax-Advantaged Dividend Income Fund (EVT)

Distribution Rate: 8.1%

Let’s start with the Eaton Vance Tax-Advantaged Dividend Income Fund (EVT)—a CEF that buys not just common stocks, but also preferred stocks, that distribute qualified dividends. Qualified dividends are taxed at the more favorable long-term capital gains tax rates; non-qualified dividends, like those paid by most real estate investment trusts (REITs), face less favorable short-term capital gains rates.

EVT’s four managers currently hold an 80/20 blend of common and preferred stocks, with the traditional equity “sleeve” made up of about 80 predominantly large-cap stocks. Names like JPMorgan Chase (JPM), Abbott Laboratories (ABT) and NextEra Energy (NEE) would be right at home in a bog-standard dividend fund.

But while that fund would likely pay 2% or so, EVT delivers 4x that number, at 8% currently. (And it’s a monthly dividend payer, no less.)

Part of that high yield we can chalk up to leverage—management borrows additional funds to invest even more money in their picks, which amplifies yields and gains if we’re fortunate, and amplifies losses if we’re not. Leverage currently sits at about 20% of assets.

But the other part of it is the nature of those distributions. When Eaton Vance’s fund sends out a monthly distribution, dividend income is only a (small) portion of that. The rest is capital gains, usually of the long-term variety. It’s a “managed” distribution, too—the typical dividend fund’s income will vary from one period to the next, but EVT’s monthly payout hasn’t changed since April 2024, when the CEF raised its distribution by about 11%.

The strategy doesn’t give us much of an edge over basic dividend funds, however—at least not longer-term.

EVT’s Leveraged Nature Is Good for Quicker Bouts of Outperformance

Right now, valuation is on EVT’s side, as the fund trades at a roughly 8% discount to NAV that’s wider than its longer-term 5% average.

Eaton Vance Tax-Managed Buy-Write Opportunities (ETV)

Dividend Yield: 8.3%

Options strategies are popular in CEFLand. Sometimes they’re complementary to the primary strategy, but sometimes they’re the whole point.

The latter is the case with the Eaton Vance Tax-Managed Buy-Write Opportunities (ETV). It holds a portfolio of 150, mostly large-cap stocks like Nvidia (NVDA), Microsoft (MSFT) and Apple (AAPL), then sells covered calls on a few major market indexes like the S&P 500 and Nasdaq Composite to generate income, which it distributes to its shareholders monthly.

Funds that sell covered calls—especially those where the strategy revolves around it—are designed to limit downside and provide income.

Covered Calls Cap Our Upside—But Limit Our Downside Too

On that front, actively managed covered-call strategies like ETV are better than comparable plain-vanilla index ETFs.

Better still? We can sometimes buy that protection on the cheap; while ETV tends to trade on par with its NAV, we can buy the fund and its monthly distributions at 94 cents on the dollar.

BlackRock Enhanced Global Dividend Trust (BOE)

Distribution Rate: 8.4%

BlackRock Enhanced Global Dividend Trust (BOE) is like a mix of ETV and EVT, with global exposure (read: U.S. and international stocks) mixed in.

Management has built a roughly 50-stock portfolio that’s currently split 65/35 across U.S. and international stocks, but that blend can and will change over time. When I’ve looked at this fund in past years, I’ve seen it hold as much as half of assets in international stocks, which is higher than the typical global fund.

But like ETV and EVT, everything revolves around blue chips. It holds U.S. mega-caps like Microsoft and Broadcom (AVGO), but also developed-market names like AstraZeneca (AZN) and even emerging-market giants like Taiwan Semiconductor (TSM) and Alibaba (BABA).

International stocks might pay more than domestics, but BOE still yields roughly 3x more than most global ETFs. It’s not leverage, which is vanishingly thin, but a covered call strategy—one that helps fund a monthly distribution north of 8%.

We’re not expecting to outperform a basic index over time, but we do expect less volatility and smaller drawdowns.

On That Front, BOE Is OK, But Hardly Great

An 8.7% discount to NAV would seem to give us an edge right now, but it’s a shallower markdown than its longer-term 11% average.

BlackRock Resources & Commodities Strategy Trust (BCX)

Distribution Rate: 8.1%

Many sector ETFs and mutual funds are usually faithful to one slice of the market. We buy technology funds for technology stocks, and bank funds for bank stocks.

But CEFs like the BlackRock Resources & Commodities Strategy Trust (BCX) aren’t afraid to “cross the streams.”

BCX primarily invests in stocks “issued by commodity or natural resources companies,” meaning that the portfolio straddles the energy and materials sectors. The management team has assembled a tight portfolio of just 45 companies including integrated energy majors like Shell (SHEL) and Exxon Mobil (XOM), but also metals and minerals specialists like Wheaton Precious Metals (WPM) and Freeport McMoRan (FCX). The fund also may invest in derivatives, and it also sells covered calls to enhance its dividend yield.

The result?

Sometimes, BCX Gives Us the Best of Both Worlds

It’s not always that way. Longer-term, BCX has struggled to capture some of the biggest moves in metals, at least in part because of its covered-call strategy.

Like with many CEFs, the best chance for success is buying while the fund is cheap. We can currently buy BlackRock’s fund for a 6% discount, but it’s not really a deal compared to its long-term average discount of 10%.

ClearBridge Energy Midstream Opportunity Fund (EMO)

Distribution Rate: 9.7%

We get a more targeted energy play (and the highest yield of the bunch, at nearly 10%) from the ClearBridge Energy Midstream Opportunity Fund (EMO).

Co-Managers Peter Vanderlee and Patrick McElroy own just 20 companies. But it’s a who’s who of midstream companies (firms that operate pipelines, storage, terminals and other energy assets), including regular stocks such as Targa Resources (TRGP) and ONEOK (OKE), as well as master limited partnerships (MLPs) such as Energy Transfer LP (ET) and Enterprise Products Partners LP (EPD).

Unlike with the other CEFs mentioned above, EMO’s holdings do a lot of the talking as it pertains to the monthly distribution. MLPs are among some of the highest-yielding securities in the stock market. But the fund still pays more than most MLP ETFs thanks to high leverage of nearly 30%.

EMO trails its benchmark, the Alerian MLP Index—represented in the chart below by the Alerian MLP ETF (AMLP)—by 30 percentage points since inception in 2011. But since 2023 EMO has nearly doubled the return of AMLP, thanks to its aggressive leverage.

EMO Outperforms in an Energy Bull Market

EMO has the deepest discount on this list—we currently can buy shares at 91 cents on the dollar. But thanks to its hot performance, it’s actually expensive in historical terms, trading well above its longer-term 15% average discount.

A Fully Paid Retirement on Just $500,000?!

Some of these CEFs aren’t as cheap as we might like, but they have two vital components we need if we plan to retire on income checks alone: 1.) yields of 8%+, and 2.) monthly distributions.

In fact, these two characteristics are the cornerstones of my 8% Monthly Payer Portfolio.

Why 8%? The math is easy to understand:

But what makes this portfolio really sing is the monthly frequency of dividends. That means we’re getting paid every bit as frequently as we’re paying the bills.

No complex accounting from one month to the next. No dividend “ladders.” Just money in our accounts every 30 days or so.

It’s like getting a regular salary—without the job!

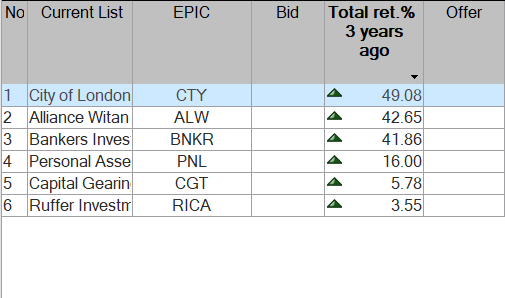

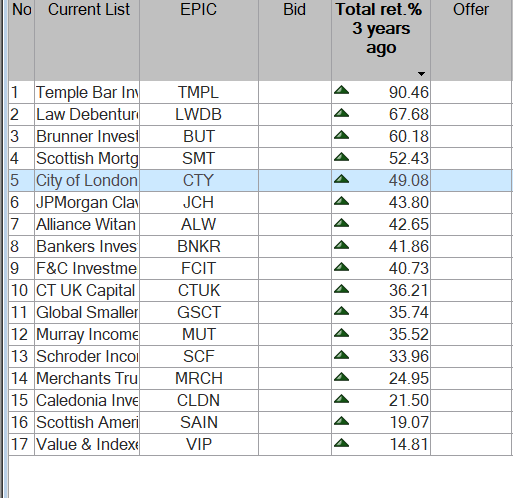

Here is the comparison for the recent article.

I’ve used 3 years as 5 years is a long time to wait to find out your analysis was faulty.

Remember if you invest, you need a decent return for the risk and along with the risk comes the chance that you will buy a clunker.

Its been a very positive time to own shares, which may change but LWDB/CTY show you do not need to take high risks to secure your retirement.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑