4 REITs. 4 Monthly Dividend Programs. 4 Massive Yields of Up to 11.7%

Brett Owens, Chief Investment Strategist

Updated: January 30, 2026

Quarterly-paying dividend stocks? Ha!

We save those for the poor vanilla investors. Give us the monthly payers—those that dish divvies every 30 days.

Today we’ll discuss four monthly payers yielding between 5% and 11% per year. An average yield of 7.9%.

This means a $500,000 investment portfolio can buy this four-pack, earn $39,500 per year in dividend income alone and keep principal intact.

Better yet, the payments show up in neat monthly installments. No need to wait 90 days to get paid. The “checks” show up every 30!

Let’s contrast our monthly dividend strategy with the tried, true and (let’s be blunt) inferior techniques employed by unimaginative Wall Street suits who jam their clients into standard broad-based bond funds (or worse, a cheesy 60/40 portfolio):

The advantages of monthly payers are many:

- We cut down on “lumpy” portfolio income. Investors who insist on owning nothing but mega-caps and plain ETFs (which usually pay quarterly) must deal with uneven cash flow. A portfolio of monthly dividend stocks pays us the same month in and month out.

- Dividends compound faster. The quicker the payouts hit our pockets, the quicker we can put that money back to work.

Do we jump out and buy any monthly dividend payers, however? NO! Remember, our goal is to (at minimum) keep our principal intact. Which means we need to find stocks that are at least likely to grind sideways as they pay their divvies.

With this “price stability” requirement in mind, let’s review these four monthly payers.

Realty Income (O)

Dividend Yield: 5.3%

Realty Income (O) is a $55 billion net-lease real estate investment trust (REIT) with 15,500 commercial properties leased out to more than 1,600 clients in more than 90 industries. The vast majority of those properties are leased here in the U.S., but a few hundred of those buildings are scattered across eight European nations.

Realty Income is also a dividend juggernaut, so much so that it calls itself the “Monthly Dividend Company.” It’s a self-given nickname, but it is legit. This REIT has declared 667 consecutive monthly dividends and 113 consecutive quarterly dividend increases; indeed, at more than 30 years of consecutive dividend hikes, it’s a Dividend Aristocrat—and the only monthly payer to enjoy that honor.

Those are some impressive accolades. Too bad they’ve meant nothing to shareholders over the past few years.

Realty Income: Dead Money Since 2023

The comparisons look a little better since O’s late 2023 low, but the point still stands: Real estate generally has been a lackluster sector, and Realty Income hasn’t differentiated itself. What we need to know is whether that’s primed to change.

Realty Income’s size is a double-edged sword at this point. On the one hand, its broad diversity and long-term leases (its average remaining lease is over nine years!) gives us plenty of reason to believe the dividend will keep inching higher for the foreseeable future. But external growth is increasingly difficult to come by. And as far as its existing properties go: Realty Income is exposed to several industries, including restaurants and health/fitness, that could struggle in a soft economy.

Valuation isn’t helping us either. O trades at about 14 times adjusted funds from operations (AFFO) estimates; it’s not expensive, but it’s hardly a springboard for shares, either.

SL Green Realty (SLG)

Dividend Yield: 6.7%

SL Green Realty (SLG), “Manhattan’s largest landlord,” is a much more specialized REIT that deals in commercial real estate in New York City. Its portfolio currently consists of interest in 53 buildings representing nearly 31 million square feet.

The good news? SL Green Realty is one of the biggest landlords in one of the biggest cities on the planet, and its portfolio is stuffed with high-quality and well-located buildings. It also has an extremely well-covered dividend, which currently represents only two-thirds of 2026 FFO estimates.

The bad news? SLG is one of the most highly leveraged companies in its category, FFO estimates for 2026 are 19% lower than they are for the yet-to-be released full-year 2025, and SLG’s dividend seems to go whichever way the wind is blowing.

This Is the Opposite of a Dependable Dividend

If there’s any reason to be optimistic, it’s that New York offices have mounted a strong recovery. The stock is also decently priced at 10 times those lower 2026 estimates.

Apple Hospitality REIT (APLE)

Dividend Yield: 7.8%

Another monthly payer from the real estate sector is hotel property owner Apple Hospitality REIT (APLE).

Apple Hospitality’s portfolio is predominantly made up of upscale, “rooms-focused” hotels in the U.S. It currently boasts 217 hotels accounting for about 29,600 guest rooms in 84 markets in 37 states and D.C. The portfolio is largely split between Hilton (HLT, 115 hotels) and Marriott (MAR, 96 hotels), though it also has a single Hyatt (H) branded hotel.

Apple Hospitality’s hotels, on average, are on the younger side, they’re well-maintained, and they enjoy some of the best EBITDA margins in the industry. That’s in part because of the “rooms-focused” or “select service” nature of the hotels, which means they focus only on essential amenities such as gyms, business centers, small convenience stores and limited dining. Geographic diversification is a plus. This is a truly inexpensive REIT, to boot, trading at just 8 times 2026’s FFO estimates.

However, APLE doesn’t have much room to broaden margins further. It’s also in the precarious position of being strongly tethered to World Cup 2026 demand—a big showing could drive growth in this hotel name, but concerns over the administration’s immigration policies could dampen demand.

The monthly dividend is a mixed bag, too. It’s extremely well covered at less than two-thirds FFO estimates. But it has never recovered to its post-COVID levels; APLE was paying 10 cents per share, but suspended the dividend in 2020, brought it back in 2021 at a penny per share, and has since raised it to 8 cents per share. It also has been paying small specials at the start of the past three years but didn’t authorize one for 2026.

APLE’s Dividend Growth Has Flattened, And Shares Have Reflected That

Ellington Financial (EFC)

Dividend Yield: 11.7%

No surprise at all the highest yielder on the list, Ellington Financial (EFC), is a small-cap mortgage REIT (mREIT). It primarily deals in credit such as residential transition loans, residential and commercial mortgage loans, CMBSs and collateralized loan obligations (CLOs), but it also has lesser (and shrinking) dealings in agency MBSs.

All of that is “paper” real estate, not physical properties. Mortgage REITs like EFC borrow money at short-term rates to buy mortgages and other assets that pay income tied to long-term rates, and they profit off the difference. Naturally, then, management wants short-term rates to be lower than long-term ones, which they typically are.

These loans are helped by short-term rates declining while long-term rates hold steady or move lower (because lower rates mean mREITs’ mortgages—issued when rates were higher—yield more than newly issued ones, so they’re worth more). Importantly, the 30-year rate has drifted lower, which is good, but it hasn’t plunged quickly enough to trigger a wave of refinancing or prepayments.

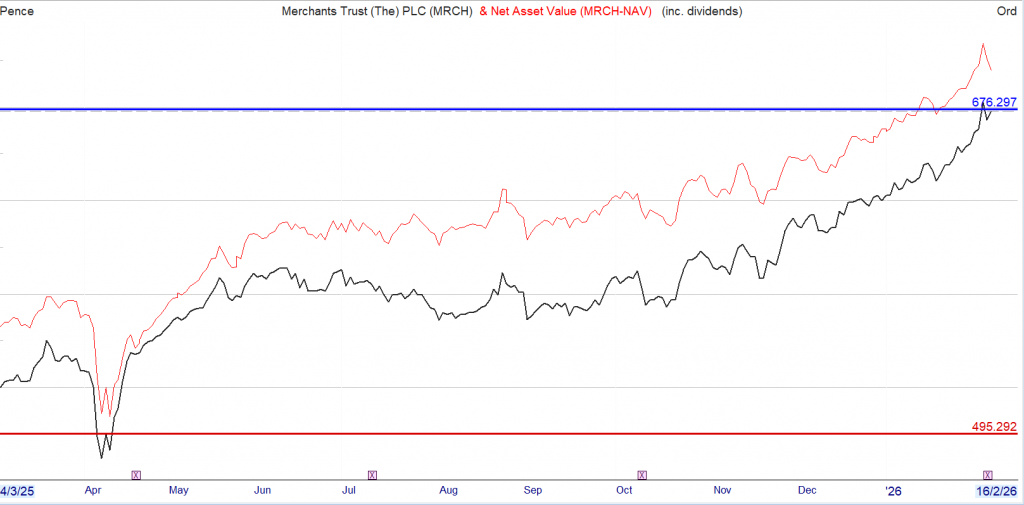

EFC’s Relationship With Long-Term Mortgage Rates Was Pretty Straightforward in 2025

2025’s run in EFC (and other mREITs) could very well continue into 2026 if the Federal Reserve adds a couple more rate cuts this year. Ellington also stands to benefit from government-sponsored enterprise (GSE) reform, with the Trump administration looking at releasing the likes of Fannie Mae and Freddie Mac from government conservatorship.

The mammoth yield on EFC’s monthly dividend grew a little bit more a couple days ago: The company announced an 8.77 million-share secondary offering, with the option to sell up to another 1.32 million shares, to help redeem all of its Series A Preferred Stock. The resulting decline in shares bumped the yield from just above 11% to nearly 12%.

On a nominal basis, Ellington pays out$1.56 per share annually, which is about 86% of 2026 estimates for $1.82 in earnings per share (EPS). Not a ton of breathing room, but not panic territory, either. The stock also trades at less than 8 times those earnings.