ISA fund and trust picks for every type of investor – which could work for you?

Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

By Laura Miller

ISA fund and trust picks for every type of investor – which could work for you?

(Image credit: Getty Images)Share

With the end of the 2025/26 tax year approaching on 5 April, now is the time to make full use of your current £20,000 ISA allowance and start thinking about what to do with the next allowance when it resets on 6 April.

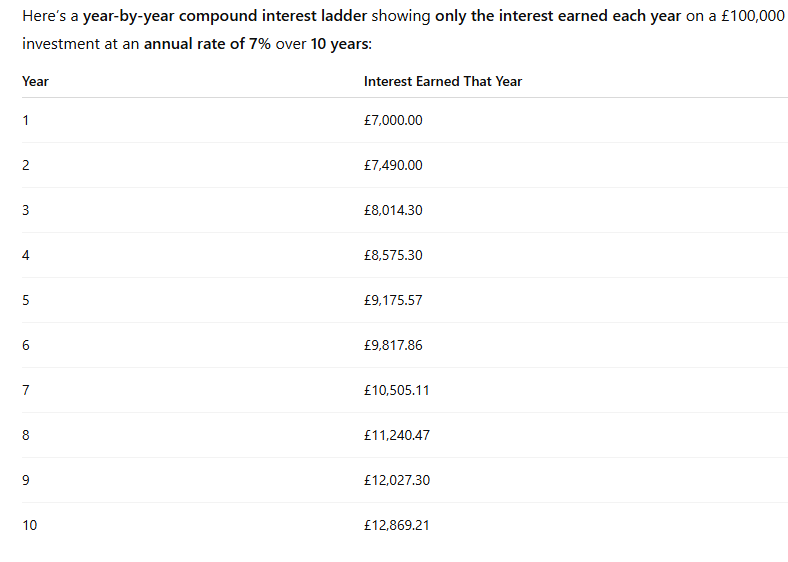

Stocks and shares ISAs provide investors with a home to grow money free of any tax on the gains, which can be significant. Those who invested the full ISA allowance every year into the FTSE All-Share Index from when ISAs launched in April 1999, for example, would have a portfolio worth £665,696 over the 26 years to April 2025, according to calculations by Interactive Investor (having contributed £326,560).

Picking the right investments for your stocks and shares ISA portfolio is key – ideally you should balance your attitude to risk, the types of investments you already hold and where you are in your investment learning curve.

Get 6 free issues +

a free water bottle

Stay ahead of the curve with MoneyWeek magazine and enjoy the latest financial news and expert analysis, plus 58% off after your trial.

MoneyWeek asked investment experts at fund platforms Fidelity International and Interactive Investor for their top ISA fund and ISA investment trust picks, to suit different types of investors.

Reliable returns

Stocks and shares ISA investors seeking a reliable return might look at global equity income funds. Investing in dividend-paying companies across the globe, they have the potential for a growing income stream alongside long-term capital growth.

Global equity income funds often lean towards financially robust, well-managed businesses, a great match for anyone who loves the idea of steady earnings but still wants exposure to global markets.

Dzmitry Lipski, head of funds research at Interactive Investor, suggested the Fidelity Global Dividend fund, which has been managed by Dan Roberts since its 2012 launch, drawing on more than two decades of dividend-investing experience.

“It invests in companies globally that offer a healthy dividend yield and the potential for capital growth and aims to generate roughly 25% more income than its benchmark,” said Lipski.

The portfolio holds around 46 large, resilient companies, with Europe representing roughly 48%, North America 26% and the UK 15%, and no Chinese exposure. Lipski said: “Sector allocations are deliberately defensive, led by financials, industrials and consumer staples.”

Alternatively, Jemma Slingo, pensions and investment specialist at Fidelity International, said she likes Pyrford Global Total Return – about two thirds of the portfolio is in high quality bonds, and a third is in equities.

“It tries to keep volatility low, while providing a stable stream of inflation-beating returns,” she said. Slingo said that, while at first glance at the fund’s performance chart reveals few serious falls, “on the flip side, growth has been fairly muted particularly when inflation is accounted for”.

Pyrford has turned an initial investment of £1,000 into £1,440 over the course of the decade. If you want a ‘sleep at night’ option, however, this might be a trade off you’re willing to make.

Adventurous diversification

With global stock markets becoming increasingly concentrated and growing fears of the AI theme potentially being overheated, those wanting to spice up their stocks and shares ISA portfolio with some interesting diversification could take a look at investment trust Murray International.

Kyle Caldwell, funds and investment education editor at interactive investor, said he likes the trust because he is “looking more towards those investment trusts that use their full global remit in having a good chunk of exposure to Asia Pacific and Latin America – Murray International ticks this box”.

The portfolio is very different from the wider market, it has a value investment style, and it offers an above average dividend yield of around 4%, Caldwell pointed out.

Fidelity’s Slingo is also concerned about the stock market being dominated by a handful of US technology stocks – and also likes Latin America and Asia, but this time in the form of the Lazard Emerging Markets fund.

“The fund seeks out companies that are cheaper than the market but that have better fundamental prospects,” she said, adding emerging markets were among the best performing equity assets last year and the outlook remains positive.

“Strong earnings growth, a weak US dollar and a rotation out of the US could all boost performance this year,” Slingo said.

Newer investors

For newer investors who would like something a little more interesting than a global tracker fund and who are nervous about jumpy markets, the Fidelity Global Dividend fund could be a good option.

“It invests in companies from around the world; offers a combination of growth and income; and aims to keep volatility lower than the wider market. The fund has delivered steady gains over the past 10 years,” Slingo said.

The fund contains some well-known names like Unilever and National Grid, Slingo added, so “new investors will know that buying the fund means buying real businesses that impact them”.

Alternatively Lipski at Interactive Investor highlights a managed solution, like Interactive Investor’s Managed ISA, might be a good place to start, where the investments are chosen for you.

Investors fill out a questionnaire and are matched with one of 10 portfolios – in two styles (index investment style and sustainable investment style) and five different levels of risk. Once invested, the portfolio is periodically rebalanced – in line with the risk level you signed up for.

The fund fees are low, and there is no separate management fee as it sits within Interactive Investor’s existing flat-fee subscription-based charging model.

A less experienced investor may also want to look at absolute return or capital preservation funds. They use a mix of strategies to limit volatility and help protect against big downturns.

Lipski suggested looking at the Trojan Fund: “Managed by Sebastian Lyon, Trojan Fund takes a conservative, disciplined approach focused on preserving capital and delivering long-term real returns,” he said.

Lyon invests across a broad range of asset classes. The equity portion is focused on large, financially robust companies in developed markets, particularly the UK and US. The fund also holds high-quality sovereign and inflation-linked bonds as defensive assets, alongside a strategic allocation to gold. Cash is also used meaningfully to protect capital and allow swift investment when opportunities arise.

“The fund offers a steady, defensive option for investors seeking long-term real returns with controlled risk,” said Lipski.

Experienced investors

More experienced investors may want to consider smaller companies for their stocks and shares ISA. “These can be significantly riskier than large ones,” Fidelity’s Slingo pointed out, “however, experienced investors with long time horizons might want some exposure to this part of the market”.

Slingo suggested the Brown Advisory US Smaller Companies fund. “It deploys a big team of researchers to find the most promising smaller companies listed in the US. Their strategy is based on the belief that good fundamental research coupled with a long-term approach can generate attractive outperformance,” she said.

The fund is a higher risk option, and its performance has lagged the benchmark in recent years. “However, it may appeal to experienced investors who are concerned about the dominance of huge US tech stocks in their portfolios,” said Slingo.

Finally, according to Dave Baxter, senior fund content specialist at Interactive Investor, another good option for the more seasoned investor is the Marlborough Special Situations fund.

It invests in the dynamic growth potential of the UK’s innovative and agile smaller companies. Its sector bets are markedly different with big weightings to industrials, consumer discretionary shares and technology. Top holdings include Zegona Communications, Boku and SCA Investments.

Baxter said: “Marlborough Special Situations has been poor in 2025, and in recent years. The fund has more than 150 holdings and small position sizes, with its top holding making up only 2.6% of the portfolio.

“However, the fund has a good long-term record, and good exposure to micro caps, small caps and mid caps. It should in theory do better when interest rates fall in earnest.”