AI Is Driving Huge Profits, These Are Best Dividends up to 13%

Michael Foster, Investment Strategist

Updated: July 31, 2025

By now you’ve no doubt heard the argument that AI is a bubble, and there’s no way Big Tech will make a significant profit from it, given the massive amounts of cash they’ve already piled in.

That take is just plain wrong—truth is, the tech giants are already booking profits from AI. And we closed-end fund (CEF) investors can grab our share at a discount—and at dividend rates running all the way up to 13%, too.

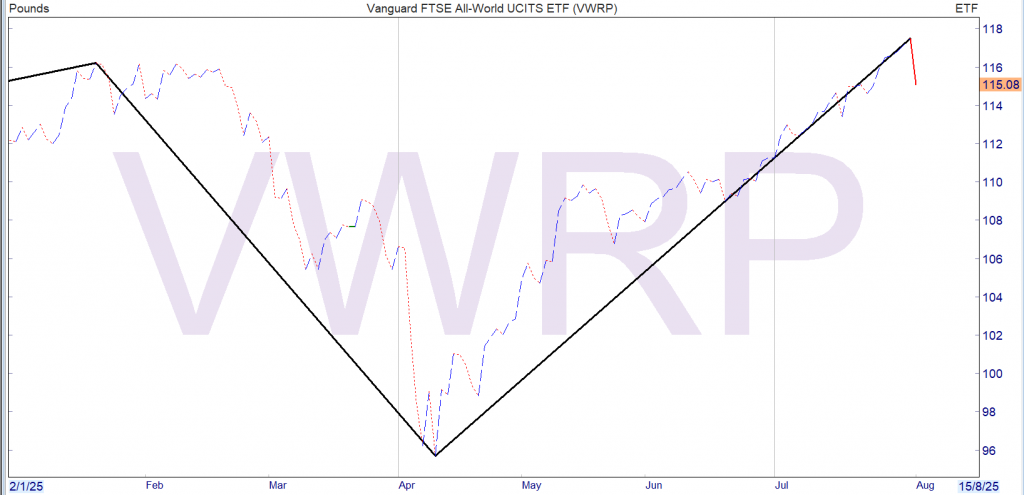

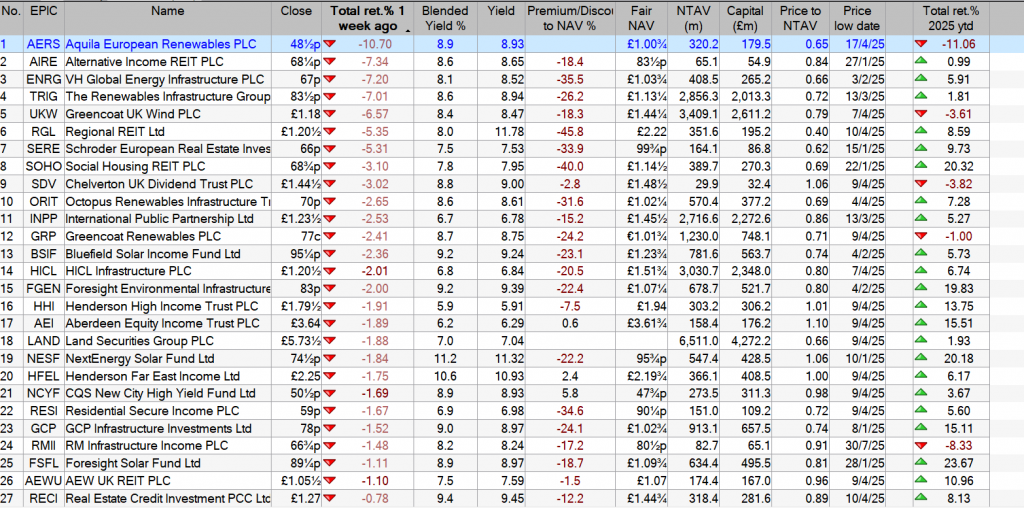

This next chart tells us straight-up why the “AI-is-unprofitable” theory is off the mark.

Look at the far left of this chart and you see that communication-services stocks led in profit growth in the second quarter of 2025.

Alphabet (GOOGL) and Meta Platforms (META) are both titans of that sector, and both have invested billions in AI. They’ve largely done it by buying chips and other hardware, as well as software, from IT firms like NVIDIA (NVDA).

That pop in communication-services earnings proves that these companies are profiting from AI. Similarly, the second-highest earnings gains in the chart above, in IT, confirms that AI actually does make money for Big Tech.

Tech-Focused CEFs Go on a Tear

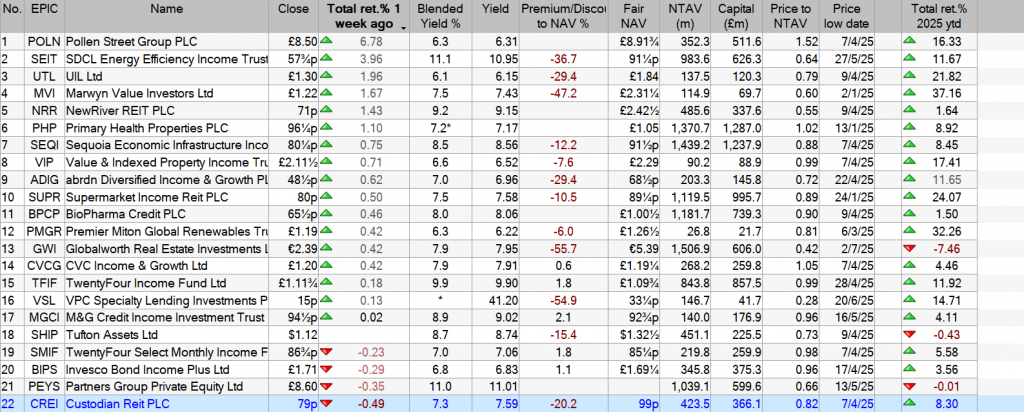

When it comes to high-yielding, tech-focused CEFs, there are basically four tickers that income investors look to. Let’s check in on those now.

As you can see in the chart below, all four of these funds’ net asset values have been roaring higher, with the 12.3%-yielding BlackRock Science and Technology Term Trust (BSTZ), in green, leading by a small amount over the last three months. It’s followed closely by its sister fund, the 7.7%-yielding BlackRock Science and Technology Trust (BST), in purple.

The BlackRock Technology and Private Equity Term Trust (BTX), with its huge 13% yield (in blue), and the Columbia Seligman Premium Technology Growth Fund (STK), (in orange and paying 6%) bring up the rear.

Tech CEFs Rise Across the Board

The Best Tech CEFs Are Still Great Bargains

The interesting thing, however, is the fact that these funds still trade at discounts to net asset value (NAV). The best values are the three BlackRock funds (again in green, blue and purple):

Tech CEFs Get Cheaper, Led By BlackRock Funds

We’ve seen BSTZ’s discount remain basically where it was three months ago, despite its strong NAV return in that time, while BST’s discount has widened slightly, despite its strong performance.

The third BlackRock tech CEF, the BlackRock Technology and Private Equity Term Trust (BTX), has seen its discount narrow slightly (April was a great time to buy BTX). The Columbia Seligman Premium Technology Growth Fund (STK) is the priciest of our quartet, but context matters here, as its premium to NAV, which it has held for much of the last decade, suddenly disappeared.

Let’s stick with STK for a bit. Despite that fund’s smaller discount, is it still worth our time? I’d say yes, given the next chart. But there is a caveat that we’ll get into shortly.

STK Tracks the NASDAQ Higher, Pays a Bigger Dividend

Before we get to that, we see that STK, whose NAV (in purple above) has closely matched the NASDAQ 100 (whose benchmark index fund is shown in orange) over the last decade. That makes STK a good way to get tech exposure, plus the index’s diversification.

I mention that diversification because STK is tech-heavy, with core names like Microsoft (MSFT), NVIDIA and Apple (AAPL). But like the NASDAQ, it also branches out a bit, with holdings in companies like Visa (V) and Bloom Energy (BE), which focuses on products that help customers generate power on-site.

On the dividend side, STK’s 6% yield far outruns the NASDAQ’s 0.5%, and the CEF has also never cut its payouts. However, STK is contending with funds yielding a lot more—up to 13% in the case of the highest-paying BlackRock fund, BTX.

That’s the real reason for STK’s growing discount: Even though it was swept up in the tech rally, its lower payouts aren’t enough for many income investors, now that there’s more competition, plus dividends that nearly double STK’s 6% yield, among tech CEFs.

This is why the bigger discounts offered by the BlackRock funds are the better deals here, and why STK’s discount isn’t yet big enough to warrant our attention.

These Tech CEFs Are Just the Start. Here Are the Real AI “Dividend Winners”

We’re still in the early stages of AI’s stunning growth. As this breakthrough tech embeds itself across the economy, it’ll drive massive productivity gains—fattening the profits of AI providers and AI users alike.