After slipping below £1, is this FTSE 250 REIT an unmissable passive income opportunity?

This FTSE 250 income stock has fallen below £1, pushing the dividend yield to a whopping 7.95%! Is this a rare opportunity to grow investment income?

Posted by Zaven Boyrazian, CFA

Published 20 October

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing, which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

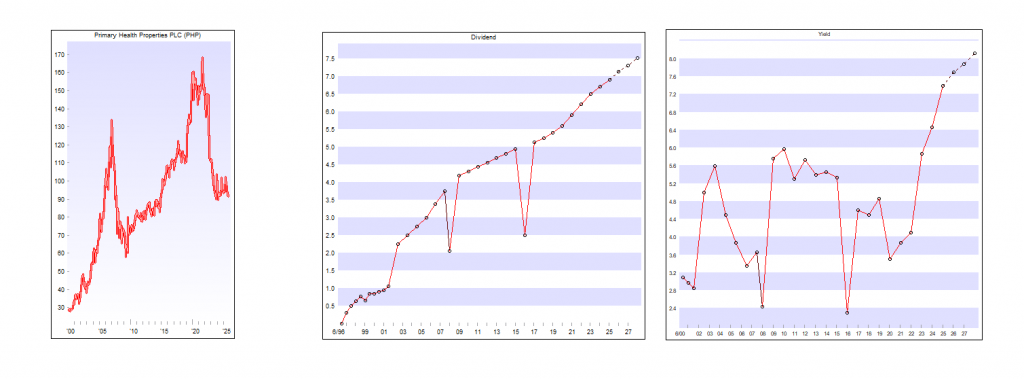

Over the last six months, the FTSE 250 has enjoyed some strong performance, climbing by more than 14%. However, not all of its constituents have been so fortunate, such as Primary Health Properties (LSE:PHP).

Like many other businesses in the real estate sector, the healthcare-focused landlord has suffered from generally weak investor sentiment, resulting in the share price slipping back below £1. Yet despite this, dividends have continued to flow. And as a result, the REIT now offers a tasty-looking 8% dividend yield.

Should you buy Primary Health Properties Plc shares today?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Impressive dividends

As a quick crash course, Primary Health Properties is one of the biggest healthcare landlords in the UK. It owns and leases a diversified portfolio of GP surgeries, pharmacies, and dental clinics primarily to the NHS.

With a government entity being one of its largest tenants, the company has enjoyed fairly resilient and predictable cash flows over the years. And it’s one of the main reasons why, despite the challenges within the real estate sector, the group has continued to reward shareholders with ever-increasing dividends for more than 25 years in a row.

But if that’s the case, why are investors seemingly not rushing to capitalise on the stock’s impressive yield?

Headwinds and challenges

Even with a resilient business model, the group has encountered several challenges both internally and externally. It’s no secret that higher interest rates have created numerous headaches for property owners, especially REITs that often carry significant debt burdens.

In the case of Primary Health, the group’s rental cash flows have continued to grow steadily, but rising debt costs have increased the pressure on net earnings.

At the same time, management’s contending with some protracted rent increase negotiations with the NHS. Should these talks fail, its currently impressive 99.1% occupancy might start to slip alongside its net rental income. After all, finding new tenants in the healthcare niche can be a bit trickier compared to the residential sector.

With that in mind, it’s not surprising that investors aren’t as keen to buy shares while the macro environment remains unfavourable.

Still worth considering?

The continued pressure of financing costs and delays in rent revaluations indicates that margins are at risk of being squeezed. This could also hinder rental income growth, squeezing the coverage of existing dividends and any potential future growth.

Nevertheless, the business continues to have an ace up its sleeve. Primary Health ultimately benefits from structural long-term demand for primary healthcare infrastructure. And that’s an advantage that doesn’t change even during economic downturns.

The balance sheet does carry a large chunk of debt. But it appears to remain manageable. And with interest rate cuts steadily emerging, the pressure from its outstanding loans should slowly alleviate over time while simultaneously helping boost the value of its property portfolio.

That’s why, despite the risks, I think this FTSE 250 REIT’s worth a closer look.

Very good post. I absolutely appreciate this website. Keep it

up! https://canadatonybet.wordpress.com/

Very good post. I absolutely appreciate this website.

Keep it up! https://canadatonybet.wordpress.com/

Hi there, its pleasant post about media print, we all be familiar with media is a great source of information. https://Hellspinuk.wordpress.com/