Compound Interest.

The interesting thing about compound interest is that you stand to make more in compound interest in the later years of your Snowball than in all the early years.

Good news if you only have a modest amount in savings but intend to add to your Snowball when you can.

“The true investor… will do better if he forgets about the stock market and pays attention to his dividend returns.” – Benjamin Graham

How to harness the power of dividends

Dividends went out of style in the pandemic. It’s great to see them back, says Rupert Hargreaves

Dividend income has always been one of the key contributors to equity-market returns, especially in periods of volatility or bear markets. In the 1970s and 2000s, both periods of significant market volatility for the S&P 500, virtually all of the index’s returns came from income, according to data compiled by Bloomberg and Guinness Global Investors. In the 1970s, the index recorded growth of 76.9%, with 17.2 points coming from price appreciation and 59.7 from dividend income. In the 2000s, the index fell by 24.1%, but dividends added 15 points for a total return of -9.1%.

The longer one stays invested, the more critical dividends become. Guinness Global’s data, going back to 1940, reveal that, over rolling one-year periods, the total contribution from dividend income to total return was just 27%, but that number grew to 57% over a rolling 20-year period. They also reveal that $100 invested at the end of 1940, with dividends reinvested, would have been worth approximately $525,000 at the end of 2019, versus $30,000 with dividends paid out. In this period, dividends and dividend reinvestments accounted for 94% of the index’s total return.

If you want to be a Warren Buffett mini me.

Warren Buffett just collected another $204 million from Coca-Cola — a reminder that some of the most powerful returns on Wall Street come from patience, dividends, and owning the right business for decades.

Here’s how that payout breaks down, why Coca-Cola keeps funding Berkshire’s war chest, and what this kind of compounding looks like in real dollars.

Coca-Cola has been one of Warren Buffett’s signature bets since the late 1980s, and it’s still paying like clockwork.

Berkshire Hathaway owns 400 million shares, and Coca-Cola’s $0.51 quarterly dividend just delivered a $204 million payout. Sometimes the biggest wins aren’t dramatic. They’re automatic.

Coca-Cola dividends now bring Berkshire over $800 million a year, far beyond the original $1.3 billion cost. Coca-Cola may have its “secret” headlines, but Buffett only cares about one secret: the dividend arriving every quarter.

Why Coca-Cola Still Matters

Coca-Cola isn’t just a dividend machine, it’s still a modern profit engine.

With a market cap around $289 billion and gross margins above 61%, the company keeps doing what it does best: defend pricing power, stay everywhere, and find small ways to sell more. Mini cans. Convenience-store pushes. Product tweaks that look boring up close, but scale fast when you’re global.

That durability is why some Wall Street analysts still see upside, with price targets reaching $80. This implies that Coca-Cola is still being priced as a cash machine with staying power. And for Berkshire, that’s the whole point. No hype. No chasing trends. Just owning a durable cash machine, year after year, and letting dividends and compounding do the heavy lifting.

This is where most investors get caught. They chase the hot stock, the pop, the quick win, and end up trading emotions instead of building wealth.

Buffett plays a different game. He doesn’t need to react to every headline. He owns businesses that pay him, then lets time and dividends do the work.

The difference isn’t access to information. It’s behavior, and the traders who last tend to rely on rules, not emotion, like stop-loss and take-profit orders

Why This Dividend Story Matters

That $204 million payout is more than a headline number. It’s what long-term investing looks like when the business is durable and the cash flow is real.

While plenty of investors chase the next spike, Buffett’s Coca-Cola stake shows the quieter path: own a high-quality company, let the dividend stack up, and give compounding time to do its job. You don’t need to love soda to take the point, you just need to respect what consistent payouts can build over decades.

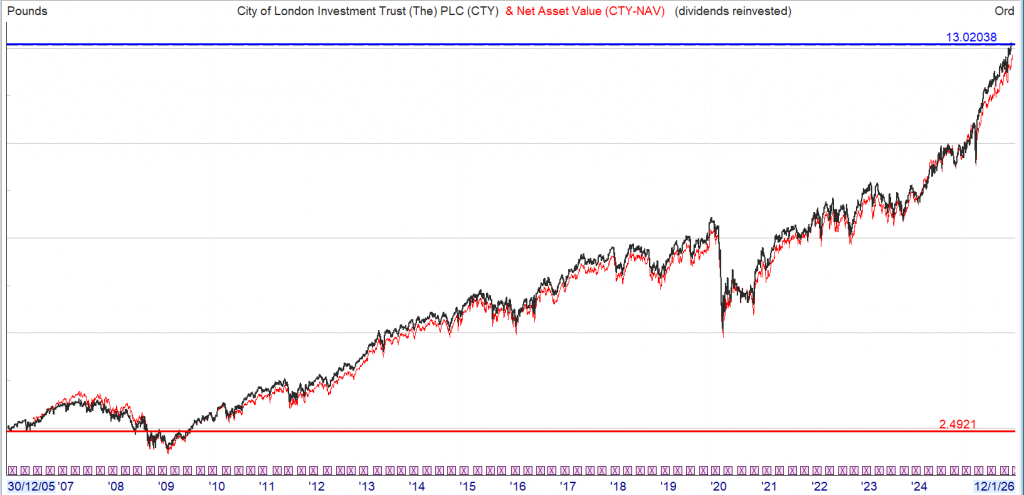

You do not need to take high risks with your hard earned, above the dividends have been re-invested, where because of the lower yield you might have re-invested elsewhere in your Snowball.

If you had bought at £2.50 the yield was around 4% and the current yield on buying price is 8.5%

An option for your Snowball might be to squirrel away some of your dividends, especially if you have a long time before you want to spend your dividends, in a quasi tracker as markets will always go higher because of inflation although near the end of a bull run, maybe is not the best time to start a position.

Finally the rules for the Snowball for any new readers. There are only 3.

Rule one. Buy shares that pay a ‘secure’ dividend and use those dividends to buy more shares that pay a ‘secure’ dividend.

Rule two. Any share that drastically changes its dividend policy mist be sold, even at a loss.

Rule three. Remember the Rules.

This topic really needed to be talked about. Thank you.