Income Investor: a blue-chip stock for income and growth

These shares have outperformed the FTSE 100 this year and offer a higher yield. Analyst Robert Stephens thinks they’re one to own as returns on cash savings accounts decline.

19th November 2025 08:38

by Robert Stephens from interactive investor

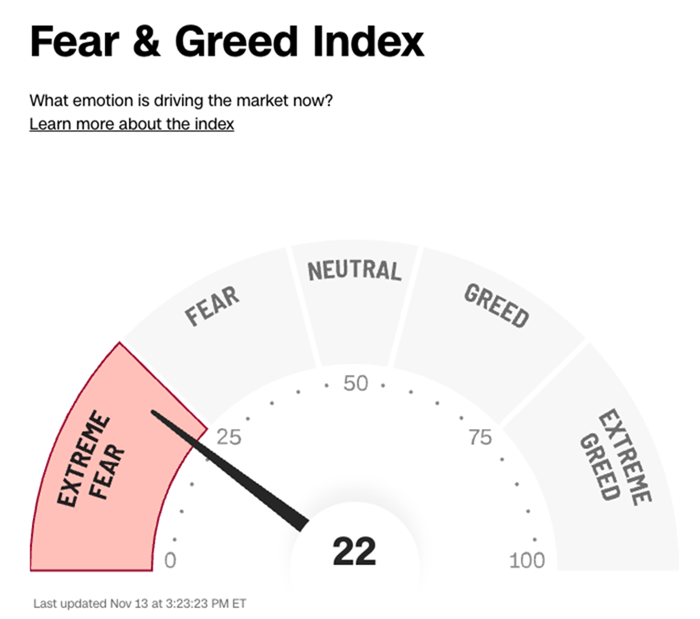

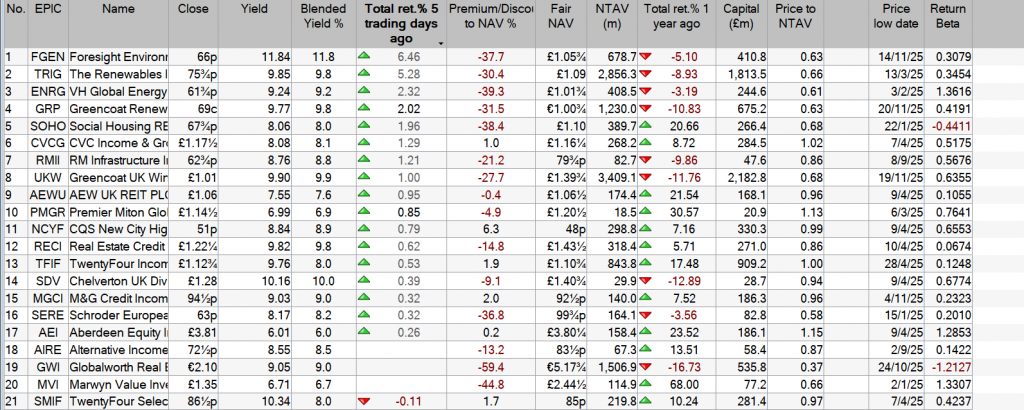

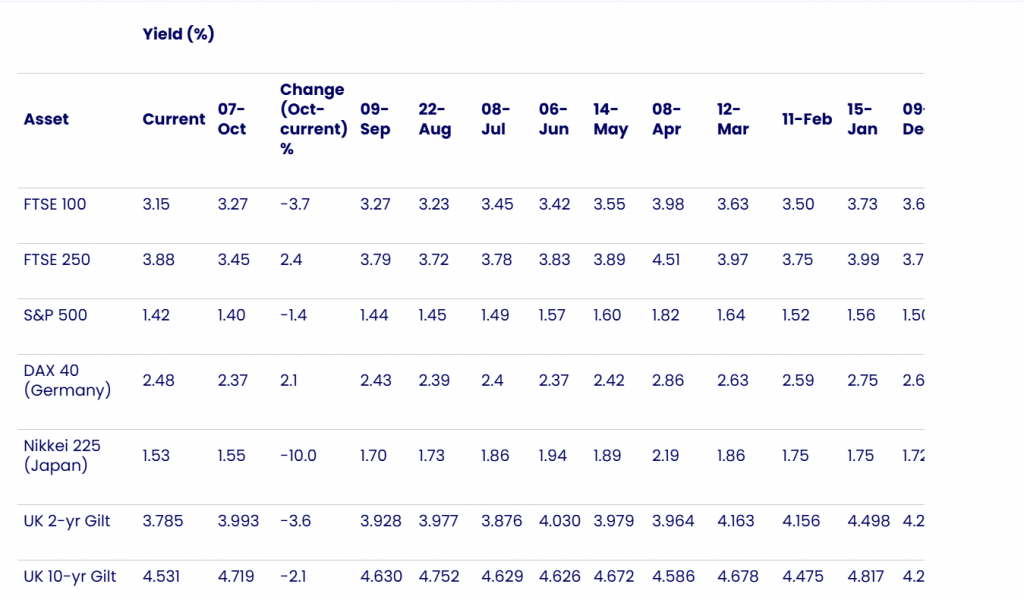

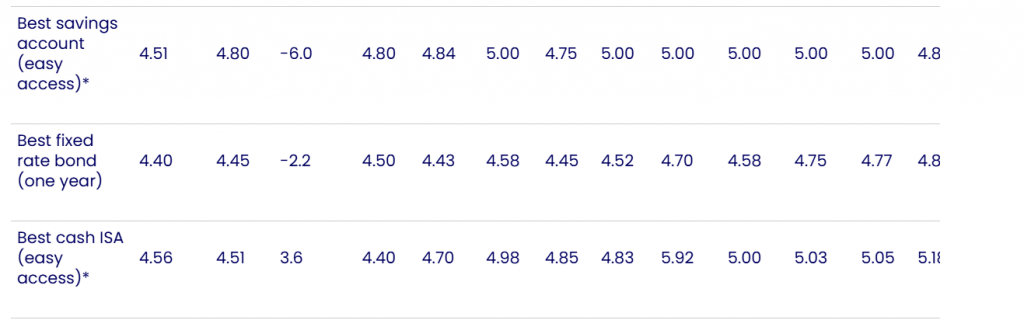

Yields across mainstream asset classes have declined over recent months. For example, easy-access savings accounts now offer little more than 4.0% excluding bonuses following a 75-basis point cut to the Bank Rate since the start of the year.

Similarly, falling interest rates have supported fixed-income prices. This has contributed to a fall in the yield on 10-year gilts, for example, which is down by around 20 basis points to 4.4% year to date.

Additionally, the FTSE 100 has surged by 15% since the start of the year. Its performance has been boosted by continued monetary policy easing not just in the UK, but across developed economies including the US and eurozone, given its overwhelming reliance on the global economy (over 80% of FTSE 100 members’ sales are generated from outside the UK). As a result of its recent surge, the UK’s large-cap index now yields just 3.2%.

Future prospects

The recent trend of falling yields is likely to continue in future. While UK inflation is currently 180 basis points in excess of the Bank of England’s 2% target, the central bank said in November that it believes the annual rate of price changes has now peaked. According to its forecasts, inflation will gradually fall to target during the first half of 2027.

When combined with an unemployment rate that currently stands at 5%, its highest since May 2021, and economic growth that amounted to just 0.1% in the third quarter of the year, this suggests further interest rate cuts are ahead.

Falling rates are likely to prompt continued decline in the income return of cash savings accounts. In theory, further monetary policy easing should also lead to a rise in government bond prices, which could prompt a continuation of falling gilt yields. And with lower interest rates likely to be implemented not just in the UK but also in the US, where the Federal Reserve expects inflation to fall to 2% by 2028, the outlook for the world economy is set to improve. This should support the FTSE 100’s future performance, thereby having the potential to further suppress its dividend yield.

Asset allocation

In terms of portfolio positioning, cash savings accounts are set to become an even less worthwhile means of generating an attractive income. Indeed, income investors who rely on them are likely to experience a substantial decline in their spending power even amid falling inflation.

While a looser monetary policy should boost bond prices, thereby providing scope for capital gains in the medium term, a heightened level of UK political and economic uncertainty could weigh on government bond prices. For instance, reaction to the upcoming Budget and any subsequent changes to fiscal policy remain a known unknown that may prompt heightened volatility in gilt prices.

As a result, income seekers may wish to continue to focus on dividend stocks rather than fixed income or cash alternatives. While the FTSE 100 index currently offers a yield that is around 120 basis points lower than that of 10-year gilts or easy-access cash savings accounts, its members provide scope for significant dividend growth amid falling interest rates and an increasingly upbeat global economic outlook.

Source: Refinitiv as at 18 November 2025. Bond yields are distribution yields of selected Royal London active bond funds (as at 30 September 2025), except global infrastructure bond which is 12-month trailing yield for iShares Global Infras ETF USD Dist as at 14 November. SONIA reflects the average of interest rates that banks pay to borrow sterling overnight from each other (14 November). Best accounts by moneyfactscompare.co.uk refer to Annual Equivalent Rate (AER) as at 18 November. *Includes introductory bonus.

An inflation-beating income?

Over the long run, it would be wholly unsurprising if a diverse portfolio of UK large-cap shares provides income seekers with a positive real-terms increase in their spending power. This contrasts with the fixed income offered by bonds, which is set to decline in real terms, and a likely fall in the income return from cash savings accounts.

Although the FTSE 100’s past performance suggests that its future returns could prove to be highly volatile, its earnings multiple of under 18, versus a figure of 27.6 for its US peer (S&P 500), suggests it is not yet overvalued. Alongside improving operating conditions for its members amid likely global interest rate cuts, this indicates that it could deliver further capital gains alongside inflation-beating income growth in the coming years.

Dividend growth potential

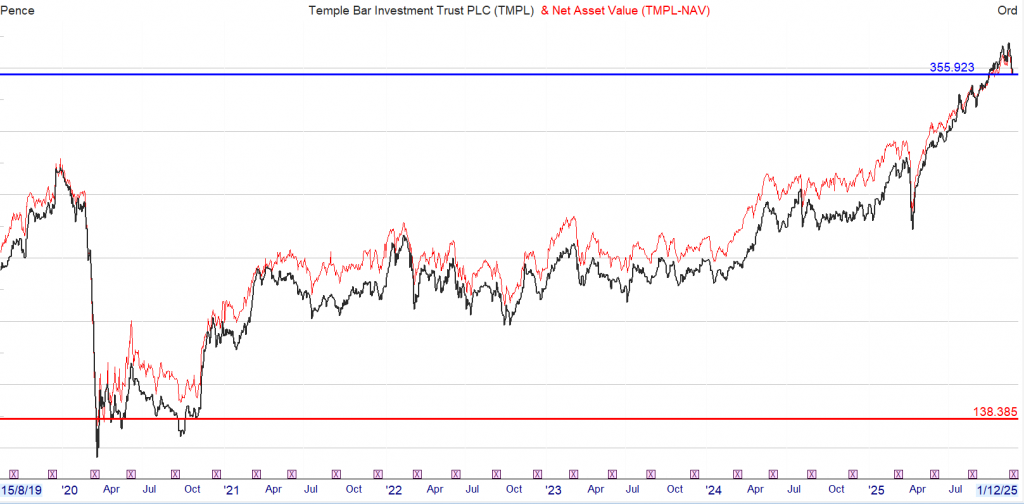

GSK’s 30% share price rise since the start of the year means it now has a yield of 3.6%. While the global pharmaceutical firm still has an income return which is 40 basis points greater than that of the FTSE 100 index, some income seekers may feel it now lacks dividend investing appeal having started 2025 with a yield of roughly 4.5%.

However, the company’s shareholder payouts are set to rise at a relatively fast pace over the coming years as a result of its improving financial performance. Recently released third-quarter results, for example, included an upgrade to profit guidance for the full year. GSK

GSK now expects to deliver earnings per share (EPS) growth of 10-12% versus a previous forecast of 6-8%.

Higher profits should ultimately translate into rising dividends, given that the firm aims to pay out between 40% and 60% of earnings to shareholders. Having already announced dividend payments for the first three quarters of the current year, shareholder payouts are on track to rise by 4.9% for the full year. This is 110 basis points ahead of an elevated inflation rate and gives a forward yield of 3.6%. A consensus forecast of a double-digit rise in profits next year is set to have a further positive impact on dividends.

Solid fundamentals

As with any pharmaceutical company, there are no guarantees that GSK’s product pipeline will deliver on its potential. However, the company is boosting the chances of it doing so by spending a larger proportion of revenue on research and development (R&D).

In the first three quarters of the current year, for instance, it spent 21.5% of total sales on R&D. This is up 2.5 percentage points on the same period of the previous year. When combined with the firm’s improving financial performance, it means that R&D spending was up 20% versus the same nine-month period from the previous year.

Given its solid financial position, the company is well placed to further invest for long-term growth. Although its net debt-to-equity ratio is relatively high at 92%, the firm’s defensive characteristics mean this figure is by no means excessive.

Meanwhile, net interest cover of 17.8 in the first nine months of the year suggests the company could overcome even a material fall in profits should it ultimately experience difficulties in replacing today’s top-selling drugs, for example.

Total return prospects

Clearly, an upcoming change in CEO and ongoing geopolitical risks, notably rumours regarding tariffs on pharmaceuticals, are uncertainties facing the business. They could weigh on investor sentiment and act as a drag on future share price performance.

However, even after its share price surge over recent months, GSK trades on an earnings multiple of just 11.2, and less than 11 on a forward basis. This is more than a third lower than the FTSE 100 index’s price/earnings (PE) ratio and indicates that there is a wide margin of safety present which provides scope for a further upwards rerating over the long run. This is especially the case given the company’s upbeat earnings profile and solid fundamentals.

As a result, GSK appears to offer long-term investment appeal. Its encouraging financial performance and strong earnings growth potential could equate to inflation-beating dividend growth that more than adequately compensates investors for a relatively modest yield. And with upward rerating potential and a rising bottom line, the stock’s total return prospects also appear to be relatively favourable.

Robert Stephens is a freelance contributor and not a direct employee of interactive investor.